Key Takeaways

💸 Hubbell offers a forward dividend yield of 1.50% with a consistent track record of annual increases and a conservative 34% payout ratio, supporting sustainable long-term income.

💵 The company generated $936 million in operating cash flow and $770 million in free cash flow over the trailing 12 months, comfortably covering dividend payments and supporting reinvestment.

📊 Analyst ratings are mixed with a consensus “Hold” and a median price target of $449.38, reflecting both caution on near-term performance and confidence in long-term potential.

Updated 5/13/25

Hubbell Incorporated is a well-established industrial manufacturer serving the electrical and utility infrastructure sectors. With over a century of operational history, it provides essential components used in commercial, industrial, and residential applications, along with advanced solutions supporting grid modernization and electrification. The company’s dual-segment model—Electrical Solutions and Utility Solutions—positions it to benefit from long-term infrastructure investments.

The leadership team, headed by Gerben Bakker, continues to focus on operational execution, strategic pricing, and innovation. Backed by strong margins, consistent free cash flow, and a growing dividend, Hubbell has maintained a disciplined approach to capital allocation. Recent analyst sentiment is mixed, but consensus remains constructive, with steady earnings guidance and a focus on long-term growth.

Recent Events

In the latest quarter, Hubbell posted strong earnings per share growth—up nearly 15% year over year—even as revenue slipped slightly. That kind of margin expansion in the face of softer sales tells you a lot about how efficiently this company is run. It’s a strong sign for investors who care about profitability more than headline revenue numbers.

Despite being down around 13% over the past year, the stock has recently shown signs of life. Today’s nearly 3% bounce puts shares at $388.55, part of a broader move upward after a rough stretch. The long-term outlook appears to be stabilizing as the company continues to show strength in margins and capital returns.

Hubbell’s profitability metrics remain impressive. With an operating margin north of 17% and return on equity at nearly 26%, this isn’t a business that wastes resources. Those numbers speak to a culture of disciplined execution—exactly what income-focused investors want to see when evaluating dividend safety.

Key Dividend Metrics

💰 Forward Dividend Yield: 1.50%

📈 5-Year Average Dividend Yield: 1.80%

🧾 Payout Ratio: 34.35%

🔁 Dividend Growth Rate (5-Year): Steady annual increases

📅 Next Ex-Dividend Date: May 30, 2025

💵 Next Payout Date: June 16, 2025

💸 Forward Annual Dividend: $5.28 per share

The numbers might not scream high yield, but they tell a different story—one of sustainability, consistency, and room to grow.

Dividend Overview

At a current yield of 1.50%, HUBB doesn’t top any income charts. But peel back the surface and you’ll find a conservative payout strategy that leaves plenty of flexibility. The payout ratio sits at just over 34%, signaling that the company isn’t stretching itself to pay out dividends—it’s doing so comfortably.

This leaves Hubbell with ample financial room to continue raising the dividend or reinvest in future growth. It’s the kind of conservative structure that appeals to investors looking for reliability rather than a short-term spike in yield.

What supports this even further is the company’s cash position. With over $936 million in operating cash flow and $640 million in levered free cash flow, Hubbell has plenty of coverage for its dividend payments, which currently total a little over $280 million annually. That’s the kind of cushion that lets you hold onto a stock through ups and downs without worrying about your income stream.

Dividend Growth and Safety

What makes Hubbell really shine for dividend investors is its approach to raising payouts. The company has consistently increased its dividend for well over a decade, doing so methodically without making a show of it. The growth isn’t explosive—but it’s solid and dependable, typically landing in the high single-digit range annually.

More importantly, that growth is built on a stable financial foundation. Debt levels are reasonable, with a debt-to-equity ratio around 61%. And the return on assets—a measure of how efficiently it turns investments into profits—sits just above 10%. These metrics point to a business that isn’t overleveraged and knows how to put capital to work.

Hubbell also maintains a modest liquidity profile. Its current ratio stands at 1.17, reflecting tight but controlled working capital management. Combine that with nearly $360 million in cash on the balance sheet, and you’ve got a buffer that helps ensure dividend payments won’t be at risk, even in leaner periods.

Another reassuring signal comes from who’s holding the stock. Over 94% of shares are owned by institutions. That level of institutional confidence suggests that major players believe in the company’s ability to deliver over the long haul—including its dividend performance.

At the end of the day, Hubbell offers more than just a yield. It offers peace of mind. Its dividend policy is thoughtful, its financials are solid, and its cash generation is strong. For investors building an income-focused portfolio, this kind of dependable compounder can quietly do a lot of heavy lifting.

Cash Flow Statement

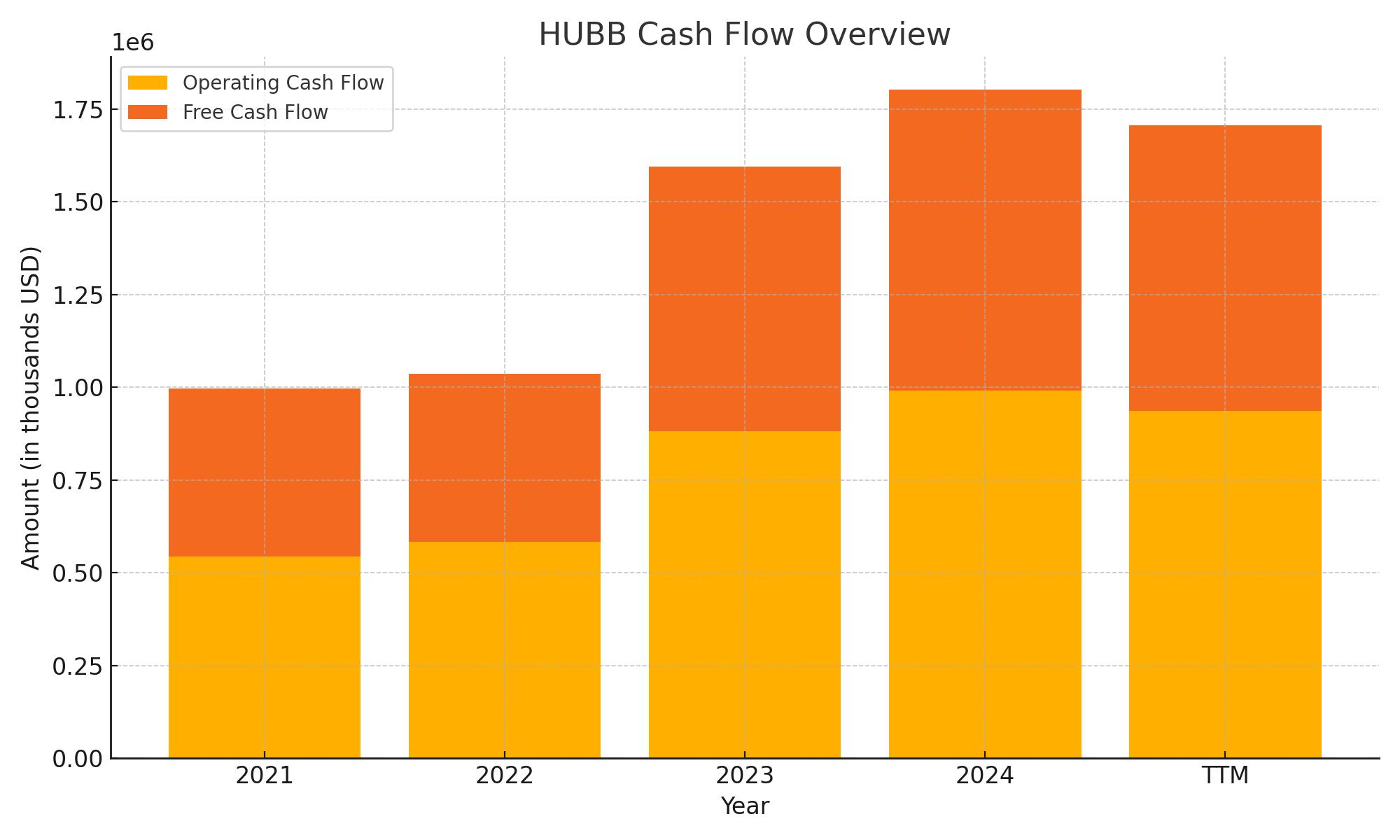

Hubbell’s cash flow statement tells a story of steady financial discipline and strong operational performance. Over the trailing twelve months (TTM), the company generated $936 million in operating cash flow—down slightly from the previous year but still well above pre-2023 levels. This is a reflection of the company’s ability to convert profits into actual cash, and it’s been trending in the right direction for several years now. Capital expenditures have remained relatively stable, coming in at $166 million for the TTM, leaving Hubbell with a robust $770 million in free cash flow.

On the financing side, cash outflows were significant, with $723 million used, mainly for debt repayment and share repurchases. The company paid down $475 million in debt over the past year and also repurchased $155 million worth of stock. This underscores a capital return strategy balanced between deleveraging and rewarding shareholders. While cash used in investing activities widened to $247 million in the TTM, the company still ended the period with over $354 million in cash on hand, providing a healthy cushion for both operations and continued dividend payouts.

Analyst Ratings

📉 Hubbell Incorporated (NYSE: HUBB) has recently seen a shift in sentiment from the analyst community, with a mix of cautious and optimistic views reflected in their latest calls. The overall consensus stands at a “Hold,” signaling a more measured approach to the stock in the short term.

🏷️ In April 2025, one major firm trimmed its price target on HUBB from $430 to $352, keeping a neutral stance. The revision followed a quarterly report where earnings beat expectations, but revenue came in slightly below estimates. That slight miss raised concerns about potential demand softness or margin pressures ahead.

📉 Another firm lowered its target from $422 to $400 in March 2025, citing broader macroeconomic challenges and competitive pressures that could weigh on Hubbell’s growth, particularly in its Utility Solutions segment. These adjustments reflect growing caution amid an uncertain economic backdrop.

📈 Not all views are bearish, though. One firm recently initiated coverage with an “Outperform” rating and a price target of $535. They highlighted Hubbell’s steady cash flow generation and positioning within the power and utility infrastructure space as reasons for long-term confidence. Meanwhile, another large bank slightly adjusted its target from $455 to $450 in January, while maintaining an “Equal Weight” rating, seeing limited near-term upside but acknowledging solid fundamentals.

🎯 The average consensus price target is currently around $449.38. With the stock trading near $386, that leaves room for potential upside of roughly 16%, depending on how market and business conditions evolve.

Earning Report Summary

A Mixed Start to the Year

Hubbell’s first-quarter results for 2025 came in a bit lighter than what some expected, but they still held their ground on full-year goals. Earnings per share landed at $3.50, just shy of the forecast, while revenue dipped slightly year-over-year to $1.37 billion. It wasn’t a blowout quarter, but management isn’t hitting the brakes either. They’re sticking to their adjusted EPS guidance for the full year, which remains in the $17.35 to $17.85 range.

Segment Performance Tells Two Different Stories

Electrical Solutions held up nicely. Sales came in at $508 million, nudging higher than last year. That strength was driven by continued demand in areas like data centers and some solid execution across the board. Operating income rose to $79 million, helped by pricing discipline and cost efficiencies.

The Utility Solutions side, though, hit a few bumps. Sales dropped 4% to $857 million. The real drag came from Grid Automation, which saw a 15% drop compared to last year. On the flip side, Grid Infrastructure sales held their own with a modest 1% increase. So while not everything fired on all cylinders, there are pockets of resilience.

Leadership’s Take and Outlook

CEO Gerben Bakker acknowledged the headwinds, calling out inflation and tariffs as two key pressures. Still, he sounded confident about the bigger picture. He pointed to long-term tailwinds like grid modernization and electrification trends as reasons to stay optimistic. Management also highlighted pricing strategies and productivity efforts as key tools they’re using to keep margins in check.

Cash Flow and 2025 Expectations

Cash flow from operations came in at $37 million, down from last year’s $92 million, and free cash flow slipped to $11 million. These early numbers aren’t out of line given typical first-quarter seasonality, and the company still expects to hit a 90% or better free cash flow conversion for the year.

Looking forward, Hubbell expects total and organic net sales to grow between 6% and 8% for 2025. They’ve baked in some pricing adjustments to keep up with cost increases and continue investing in the core areas that are driving future growth. The message from leadership is pretty clear: stay the course, stay efficient, and let the long-term trends play out.

Management Team

Hubbell Incorporated is led by Gerben W. Bakker, who has been Chairman, President, and CEO since May 2021. He brings more than two decades of experience with the company, having worked his way up through various leadership roles. Under his guidance, the focus has been on driving operational efficiency and pursuing strategic growth opportunities across both core and emerging markets.

Supporting Bakker is William R. Sperry, the Executive Vice President and Chief Financial Officer. Together with the broader leadership team, they’ve established a track record of reliable execution and prudent financial management. Their combined industry knowledge and internal experience provide Hubbell with a stable leadership base capable of navigating market cycles and executing long-term strategic plans.

Valuation and Stock Performance

As of mid-May 2025, Hubbell’s stock trades at $386.66, posting a notable daily gain of over 2%. The stock has been gaining momentum recently, notching several consecutive days of positive performance. Despite this short-term rally, shares remain nearly 20% off their 52-week high of $481.35 reached last November.

From a valuation standpoint, the stock trades at around 22.3 times earnings, which is relatively aligned with peers in the industrial sector. Its EV/EBITDA ratio is approximately 14.5, a level that suggests investors see balanced growth potential without extreme premium pricing. Analysts covering the stock have issued a range of price targets, with a median estimate of $363.80 and a spread from $250 to $450. This wide band reflects a mix of views on execution risk and upside potential over the next 12 months.

Risks and Considerations

There are a number of considerations for investors looking at Hubbell today. One of the primary concerns is the volatility in raw material costs—especially copper and steel—which are central to many of Hubbell’s products. Significant price swings can compress margins and impact profitability if not offset through pricing or supply chain strategies.

Regulatory compliance presents another layer of risk. As Hubbell operates in sectors influenced by safety, environmental, and energy regulations, any changes in policy or increased compliance demands could require capital outlays or strategic adjustments. These factors can add cost pressure or limit flexibility in certain areas.

Cybersecurity is an increasing focus, particularly as Hubbell expands its footprint in grid automation and smart infrastructure. With more digital integration, the risk of system breaches and data vulnerabilities rises. The company continues to invest in digital defenses, but it remains a dynamic risk area to watch.

Economic sensitivity is always part of the picture for a company like Hubbell. A slowdown in construction or infrastructure spending, or broader industrial pullbacks, could affect sales volumes. On top of that, competition within the sector remains strong, and aggressive pricing from rivals could influence market dynamics over time.

Final Thoughts

Hubbell remains a solid, disciplined player in the electrical and utility infrastructure space. The leadership team’s long tenure and strategic clarity give the company a clear direction, with a focus on markets tied to modernization and electrification. While no business is immune to risk, Hubbell’s consistent cash generation, careful capital allocation, and operational strength create a foundation that dividend and long-term investors can appreciate.

With a fair valuation, a dependable track record, and growing exposure to future-focused sectors, Hubbell continues to hold relevance in portfolios built for durability and income.