Updated 5/13/25

Houlihan Lokey, trading under the ticker HLI, has built a strong reputation in the investment banking world through a focus on mid-market advisory, financial restructuring, and valuation services. With over $2.3 billion in revenue and $715 million in operating cash flow in the trailing twelve months, the company blends steady financial performance with a disciplined capital approach. Its leadership team, deeply rooted in the firm’s culture, has guided HLI through a strong fiscal year, marked by expanding deal pipelines and improving transaction velocity.

Recent Events

The past year has been good to Houlihan Lokey. Revenue has seen a strong uptick—up over 24% from the prior year—and earnings have followed suit, growing 34.6%. EPS for the trailing twelve months came in at $5.23, showing solid operational performance and efficient management.

That financial discipline isn’t just for show either. The firm is sitting on almost $800 million in cash while keeping total debt around $447 million. That kind of balance sheet gives them room to maneuver and, more importantly for dividend investors, it keeps the payout well protected.

And the market has taken notice. Shares are up nearly 30% over the past year, comfortably outperforming the broader S&P 500. The stock recently traded around $179, just under its 52-week high of $192.10. But even with that run-up, it’s still delivering reliable income—and there’s more to the story when you dig into the dividend itself.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.39%

💵 Forward Annual Dividend Rate: $2.28

🧮 Payout Ratio: 43.21%

📆 Next Dividend Date: June 15, 2025

💣 5-Year Average Yield: 1.86%

📉 Dividend History: Uninterrupted, steady increases

🪙 Cash per Share: $11.40

📊 Free Cash Flow Coverage: Strong, with room to grow

Dividend Overview

Let’s talk about the core appeal for income investors: the dividend. On paper, the 1.39% yield might not make your heart race. But numbers without context can be deceiving.

This is a company that doesn’t overstretch. A payout ratio just above 43% suggests they’re keeping plenty of earnings in the business while still rewarding shareholders. The dividend is fully covered by cash flow—no juggling acts here. Over the past twelve months, Houlihan Lokey has generated more than $700 million in operating cash flow, which comfortably supports the dividend and leaves ample room for reinvestment or share buybacks.

What’s more, their cash balance is a meaningful buffer. With over $11 per share in cash and very little debt weighing things down, this isn’t a firm scrambling to make ends meet. The dividend isn’t just sustainable—it’s backed by a fortress-like financial position.

The story here isn’t about flashy special dividends or high yields that may disappear. It’s about reliability. This is a company that sends out checks on time, with consistent increases year after year. That matters more than a big number today that might vanish tomorrow.

Dividend Growth and Safety

This is where Houlihan Lokey sets itself apart. The company has built a track record of increasing its dividend each year at a pace that feels smart—not reckless. Growth has been in the high single digits, which is the sweet spot for income investors looking for a rising income stream that doesn’t come with elevated risk.

Even in tougher environments, the business holds up well. One reason is their restructuring advisory arm, which tends to perform when the broader economy is under pressure. That counter-cyclical cushion gives them a way to keep generating fees and cash flow when other firms might be retreating.

Then there’s the debt picture—simply put, there’s not much of it. With a debt-to-equity ratio just over 21% and a current ratio of 1.36, liquidity isn’t a concern. You typically see dividend cuts when companies face a cash crunch or rising interest costs. Houlihan Lokey isn’t in that boat, and it shows in their steady hand when it comes to shareholder payouts.

Their beta sits at 0.83, which tells you this stock doesn’t swing wildly with the broader market. That lower volatility adds to its appeal as a core income holding. It’s the kind of stability many dividend investors prize—especially those nearing or in retirement who prefer steady returns over thrills.

Right now, the dividend yield is slightly below the five-year average of 1.86%. That’s not a red flag—it’s a reflection of the stock’s strong price performance. The market has caught on to the company’s consistency, and as the price climbs, the yield naturally comes down a bit. But with strong earnings growth and a conservative payout ratio, there’s room for future dividend increases to push the effective yield higher over time.

So far, Houlihan Lokey checks all the right boxes: sustainable dividend, reliable growth, minimal debt, and strong cash generation. For investors looking to build or maintain a portfolio around stable, growing income, it offers a compelling foundation.

Cash Flow Statement

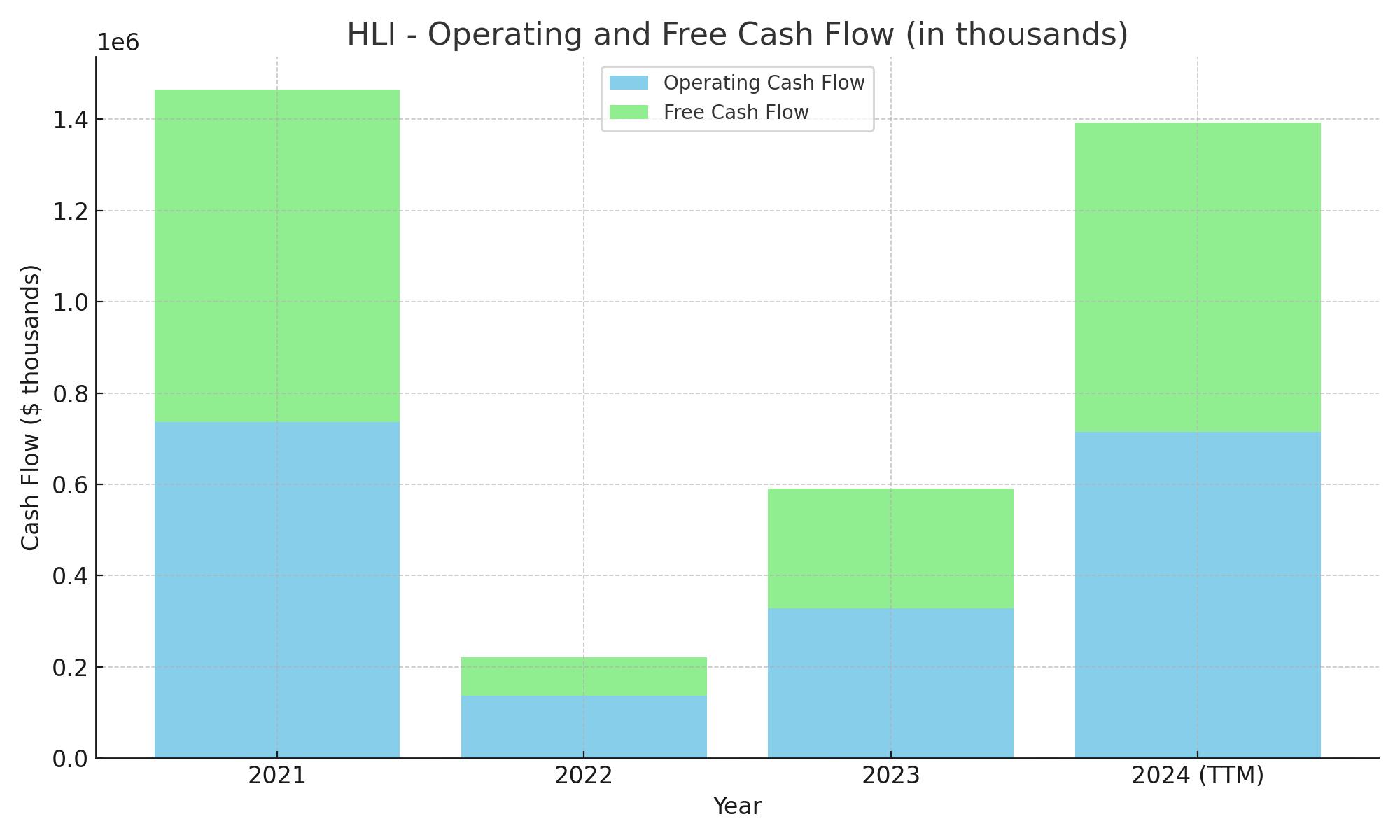

Houlihan Lokey’s cash flow profile over the trailing twelve months tells a story of stability and efficient cash generation. Operating cash flow surged to $715 million, marking a sharp recovery from prior years and returning to levels not seen since 2021. Free cash flow followed closely at $678 million, showing that after covering capital expenditures, a significant amount of liquidity remains available to support shareholder returns and strategic initiatives.

On the investment side, the company spent $173 million, more than double the prior year but still measured. Most of this was directed toward capital expenditures and strategic investments, not excessive outlays. Financing activities led to a net outflow of $274 million, primarily due to dividend distributions and a modest repurchase of stock. Notably, the company hasn’t relied on issuing or repaying debt recently, keeping its balance sheet clean. Houlihan Lokey ended the period with $824 million in cash, providing a solid financial cushion and reinforcing its ability to maintain its dividend and possibly expand it in the future.

Analyst Ratings

📊 Houlihan Lokey has recently seen a mix of analyst actions, reflecting varying perspectives on the stock’s valuation and future prospects. 🎯 The consensus 12-month price target stands at $185.00, with estimates ranging from a low of $156.00 to a high of $230.00. This average target suggests a modest upside from current levels.

📈 In March, Morgan Stanley upgraded Houlihan Lokey from Underweight to Overweight, adjusting the price target from $201 to $190. This upgrade was driven by the company’s resilience in its advisory services and optimism around a pickup in deal activity. However, in April, the same firm held its Overweight rating but lowered the price target from $190 to $156, flagging short-term valuation concerns amid broader market fluctuations.

💼 Wells Fargo kept an Overweight rating in place but revised the price target slightly downward from $179 to $170 in April. This was linked to a recalibration of earnings expectations under current economic conditions. Meanwhile, UBS stayed bullish, maintaining a Buy rating and nudging its target higher from $229 to $230, showing continued confidence in Houlihan Lokey’s strategic position and growth momentum.

🤝 The overall sentiment remains in the Moderate Buy territory, with analysts balancing strong company fundamentals against external market pressures.

Earnings Report Summary

Solid Finish to the Fiscal Year

Houlihan Lokey wrapped up its fiscal year with a strong fourth quarter, posting revenue of $666.4 million—well ahead of the $520 million they reported the same time last year. Net income for the quarter came in at $121.9 million, which breaks down to about $1.76 per diluted share. When adjusted for certain items, earnings per share landed at $1.96, beating expectations on Wall Street.

For the full year, Houlihan Lokey brought in $2.39 billion in revenue and booked $399.7 million in net income, or $5.82 per share. These numbers reinforce the idea that the firm has found a strong rhythm despite an environment that’s been anything but predictable for many in the financial sector.

Leadership Perspective and Business Momentum

The leadership team sounded an optimistic tone. CEO Scott Adelson pointed out that while big-ticket deals have slowed due to global uncertainty, mid-sized transactions—the firm’s bread and butter—are holding steady. He mentioned that their deal pipeline is growing and that the pace of deal making is beginning to pick up again. His message was clear: the company feels good about where it’s heading.

Adelson even described the current climate as a kind of sweet spot for their business. M&A is on the rebound, and restructuring opportunities remain high. That combination sets Houlihan Lokey up well, given how balanced its service lines are.

Strength in Key Business Areas

A big part of the recent success came from growth in both corporate finance and financial restructuring. The company made meaningful investments here, increasing its corporate finance team to 240 managing directors and adding nearly 20 new directors in the restructuring unit. While those moves pushed compensation expenses up by about 25% to $1.5 billion, they also helped drive revenue and maintain service quality across an expanding client base.

What stood out this quarter wasn’t just the numbers—it was the positioning. By focusing on mid-cap deals and staying disciplined in how it grows, Houlihan Lokey has created a model that can thrive whether markets are charging ahead or navigating rough patches.

Outlook Going Forward

Looking ahead, the firm expects its restructuring business to stay busy, which makes sense given current economic trends. At the same time, there’s growing confidence that M&A is slowly working its way back to more normal activity levels. Management made it clear they feel well-positioned to handle both sides of the market cycle, whether it’s helping companies grow or helping them reset.

Houlihan Lokey isn’t chasing headlines, but the way it’s executing—focused, steady, and clear-eyed—has kept it on solid ground and gives reason to expect continued strength in the year ahead.

Management Team

Houlihan Lokey’s leadership is characterized by continuity and deep institutional knowledge. Scott Adelson, who stepped into the CEO role in March 2024, has been with the firm for nearly four decades. His transition from Co-President and Global Co-Head of Corporate Finance to CEO was seamless, reflecting the firm’s preference for promoting from within and maintaining a steady strategic course. Adelson’s approach emphasizes stability and long-term growth, ensuring that the company’s culture and client relationships remain strong.

Supporting Adelson is a seasoned team of executives. Scott Beiser, the former CEO, continues to contribute as Co-Chairman, bringing his extensive experience to the boardroom. Eric Siegert, Global Co-Head of Financial Restructuring, also serves as Co-Chairman, highlighting the importance of the restructuring division within the firm’s operations. David Preiser, previously Co-President, now holds the position of Vice Chairman, further reinforcing the leadership’s depth. This cohesive team, with decades of shared experience, provides a solid foundation for Houlihan Lokey’s ongoing success.

The firm’s commitment to nurturing talent is evident in its recent promotions. In April 2025, Houlihan Lokey announced a new class of Managing Directors, recognizing individuals who have demonstrated exceptional dedication and performance. These promotions span various regions and business units, reflecting the firm’s global reach and diverse expertise. By investing in its people, Houlihan Lokey ensures that its leadership pipeline remains robust and aligned with its strategic objectives.

Valuation and Stock Performance

Houlihan Lokey’s stock has shown resilience and steady growth over the past year. Trading around $178.49, the stock has appreciated approximately 30% year-over-year, outperforming many of its peers in the investment banking sector. This performance reflects the market’s confidence in the firm’s business model, which balances advisory services with counter-cyclical restructuring work.

The company’s financial metrics support its strong valuation. With a trailing twelve-month revenue of $2.39 billion and net income of $399.7 million, Houlihan Lokey demonstrates solid profitability. Earnings per share stand at $5.82, and the firm maintains a healthy balance sheet with minimal debt. The return on equity is notable, indicating efficient use of shareholder capital.

Analysts have set a consensus 12-month price target of $185.00 for the stock, suggesting modest upside potential. Price targets range from a low of $156.00 to a high of $230.00, reflecting varying perspectives on the firm’s growth prospects and market conditions. The stock’s beta of 0.83 indicates lower volatility compared to the broader market, making it an attractive option for investors seeking stability.

Risks and Considerations

While Houlihan Lokey has demonstrated strong performance, investors should be mindful of potential risks. The firm’s revenue is closely tied to the volume of mergers and acquisitions, which can fluctuate with economic cycles. A slowdown in deal activity due to macroeconomic factors could impact the firm’s advisory business.

Regulatory changes in the financial services industry could also pose challenges. Increased compliance requirements or shifts in policy may affect the firm’s operations and profitability. Additionally, the competitive landscape in investment banking is intense, with numerous firms vying for market share. Maintaining a competitive edge requires continuous investment in talent and technology.

The firm’s global operations expose it to geopolitical risks and currency fluctuations. Events such as political instability or changes in trade policies could impact cross-border transactions and client activity. Furthermore, while the firm’s restructuring division provides a counterbalance during downturns, prolonged economic weakness could strain multiple areas of the business.

Final Thoughts

Houlihan Lokey’s consistent performance, experienced leadership, and balanced business model position it well in the investment banking sector. The firm’s focus on mid-market transactions and restructuring services provides diversification and resilience across economic cycles. With a strong financial foundation and a commitment to nurturing talent, Houlihan Lokey is poised to navigate future challenges and opportunities effectively.