Updated 5/13/25

Horace Mann Educators Corporation, known by its ticker HMN, has a straightforward mission—serve America’s educators. Founded back in 1945 by teachers, the company provides insurance and financial services tailored for the education community. From auto and home coverage to life and retirement solutions, it’s a company that’s never strayed far from its roots.

It’s not flashy. It’s not chasing headlines. But for dividend investors, that’s part of the appeal. Horace Mann isn’t here for a quick pop—it’s designed to reward patient shareholders with steady income and solid fundamentals. It’s the kind of stock that works quietly in the background, doing what you expect it to do.

Recent Events

Over the past year, Horace Mann’s share price has made a respectable move, gaining nearly 19% and handily outpacing the broader market. That strength didn’t come from hype—it came from fundamentals. Revenue saw a small bump, up 1.5% year over year, and while earnings dipped slightly, the company has remained remarkably stable.

At a glance, its trailing price-to-earnings ratio is at 15.11, a reasonable figure that signals investor confidence without implying overvaluation. Return on equity has held up at 8.35%, while the company has kept its operating margin near 14%, which speaks to efficient management in a heavily regulated space.

One thing that stands out is how Horace Mann continues to be a true low-volatility play. With a five-year beta of just 0.29, this stock is far less likely to swing dramatically with market sentiment. For dividend-focused investors, that kind of stability can make all the difference when you’re looking for reliable returns over time.

Key Dividend Metrics

💸 Forward Dividend Yield: 3.36%

📅 Dividend Payout Ratio: 54.84%

📈 5-Year Average Dividend Yield: 3.48%

💰 Annual Dividend Rate: $1.40 per share

📆 Most Recent Dividend Paid: March 31, 2025

⚠️ Ex-Dividend Date: March 17, 2025

Dividend Overview

What makes Horace Mann stand out in a dividend portfolio isn’t just the yield—it’s how that yield is delivered. The current forward yield of 3.36% puts it comfortably ahead of most large-cap stocks, and it has managed to keep that figure right around its five-year average. This is a company with a clear income strategy that doesn’t waver much.

The payout ratio just shy of 55% gives HMN room to breathe. They’re not overextending to maintain the dividend, and they’re not being stingy either. It’s a sensible middle ground. With insurance being a capital-heavy business, having that balance between shareholder returns and operational reserves is key.

Cash flow is another important piece of the story. Over the trailing twelve months, Horace Mann brought in $452 million in operating cash flow and nearly $300 million in levered free cash flow. That’s more than enough to support their dividend policy without touching debt or compromising on growth initiatives.

The company’s financial position remains solid. Cash on hand is at $146.6 million, with a current ratio of 2.24 showing more than enough coverage of short-term obligations. Debt is on the higher side, with a debt-to-equity ratio of 120.27%, but in the insurance sector, that’s more a feature than a bug. As long as the cash flows are there—and they are—the dividend looks safe.

Dividend Growth and Safety

Horace Mann isn’t trying to be a rapid dividend grower, but there’s been quiet, consistent progress over the years. The company raises its dividend thoughtfully, in line with earnings and cash flow. That’s the kind of behavior long-term investors can appreciate.

The fact that its five-year average yield sits at 3.48%—almost exactly where it is today—says a lot. Even as the stock has moved, the dividend has remained anchored. That’s a strong sign of consistency and predictability, two traits that are worth their weight in gold for income-focused investors.

Institutional investors clearly see the value. Over 105% of the float is institutionally held, suggesting that big players trust the company’s dividend strategy and see it as sustainable. When those types of investors commit capital to a name like this, it usually means the foundation is solid.

Book value per share has also been climbing, now at $31.51, which shows the company is growing its underlying assets. And with shares trading at just 1.27 times book, there’s no sense of overpricing here. The stock looks fairly valued in relation to its balance sheet strength and cash flow generation.

Horace Mann isn’t the kind of stock that turns heads on TV. It doesn’t need to be. It delivers a dependable yield, stable financials, and just enough growth to keep moving forward. For dividend investors who value predictability, HMN has the kind of profile that’s easy to live with year after year.

Cash Flow Statement

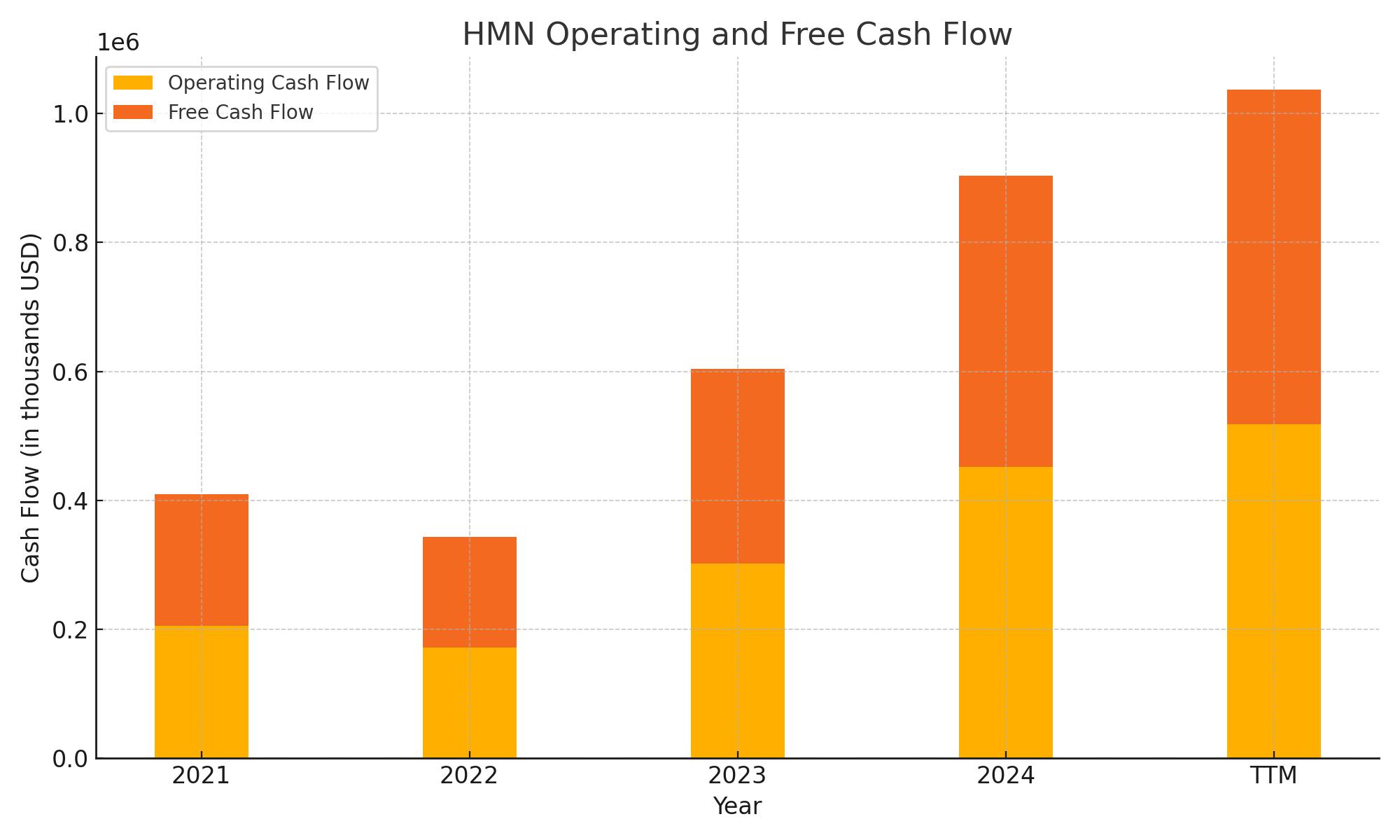

Horace Mann’s cash flow picture shows a company that’s gaining operational strength while managing its capital carefully. Over the trailing twelve months, it generated $518.4 million in operating cash flow, a substantial increase from $452.1 million in the prior period and more than double the amount from just two years ago. That’s a strong signal that its core insurance and service businesses are producing real, scalable cash—essential for supporting dividends and long-term obligations.

On the flip side, the company has been aggressive in paying down debt, with $507 million in repayments over the last year. That move significantly tightened the financing cash flow, which ended at negative $397.1 million. Even after accounting for that, HMN maintained a modest end cash position of $30.3 million. Investing cash flow remains negative, primarily due to ongoing portfolio activity, but nowhere near the outflows seen in earlier years. Overall, the business is leaning on rising free cash flow to both return capital and clean up its balance sheet—moves that reflect disciplined financial management and a clear focus on sustainability.

Analyst Ratings

Analyst sentiment for Horace Mann Educators Corporation (HMN) has been consistent lately, with most firms keeping a “Hold” recommendation. The average 12-month price target is hovering around 🧭 $44.50, reflecting a slight upside from the current share price in the low $40s.

🏦 Keefe, Bruyette & Woods reaffirmed their “Hold” rating earlier in 2025, lifting their price target from $44 to $45. Their outlook seems to rest on HMN’s dependable earnings and a dividend policy that continues to appeal to income-focused investors. Piper Sandler also kept a “Hold” rating, raising their target price from $42 to $44, suggesting a steady level of confidence in the company’s operating performance and financial health.

Back in late 2024, Keefe, Bruyette & Woods made a notable move by downgrading HMN from “Buy” to “Hold” while at the same time increasing their target from $39 to $44. That combination signals a shift in expectations—not because of worsening fundamentals, but likely due to the stock’s valuation approaching what analysts saw as fair value. In other words, they liked the stock’s stability, but believed the easy gains had already been realized.

📊 In general, analysts appear to appreciate HMN’s role as a steady, income-generating play. With consistent dividends and conservative financials, it’s the kind of company that stays on the radar—not because it surprises, but because it rarely disappoints.

Earnings Report Summary

Horace Mann wrapped up 2024 with some impressive momentum, delivering a strong finish to the year that caught the attention of long-time shareholders and analysts alike. The fourth quarter saw core earnings climb to $1.62 per share, nearly doubling the same period last year. For the full year, earnings hit $3.18 per share, which is more than twice what the company posted in 2023. It’s a clear sign that the business is regaining strength after a challenging stretch.

Revenue for the year came in at $1.6 billion, up close to 7%. That growth was fueled largely by a healthy increase in net premiums and contract charges, which rose by 8%. This kind of top-line growth isn’t flashy, but it’s steady—just what you’d expect from a company built to serve educators.

Property & Casualty Makes a Comeback

One of the standout areas was the Property & Casualty segment. This part of the business had a solid turnaround, with the combined ratio improving by 15 points to land at 97.9% for the year. What’s behind that? A mix of smart pricing decisions and tighter underwriting, especially in regions where weather-related claims can be a major headache. Those changes are paying off.

Sales also looked strong across several lines. Auto, individual supplemental, and life insurance all posted double-digit growth. The company’s investments in expanding its agent network and generating more leads seem to be clicking. It’s not just about writing more policies—it’s about reaching more educators and families in meaningful ways.

Looking Ahead

As for what’s next, leadership is sounding optimistic but measured. They’ve set expectations for 2025 core earnings to land somewhere between $3.60 and $3.90 per share. That would put the company on track for a double-digit return on equity, which, in this industry, is a mark of real efficiency and discipline.

The focus moving forward is all about profitable growth. Management is staying committed to keeping the business lean and effective, while also pushing forward on strategic initiatives. Whether it’s technology upgrades, agency development, or simply staying disciplined on costs, there’s a clear plan in place. They’re not chasing headlines—they’re building something that lasts.

All in all, the message from the top was clear: the company is on firmer footing, the fundamentals are improving, and there’s a strong belief in where things are headed next.

Management Team

Horace Mann’s leadership team is built on experience, stability, and a deep understanding of its core market. At the helm is President and CEO Marita Zuraitis, who has led the company since 2013. With decades of experience in insurance and financial services, she’s been the driving force behind Horace Mann’s focused strategy of serving educators with tailored insurance and retirement products. Her leadership style leans toward long-term consistency rather than short-term results, a quality that dividend investors often value highly.

Working alongside her is CFO Bret Conklin, who brings a clear sense of financial discipline to the table. He’s played a central role in managing the company’s balance sheet, guiding capital allocation decisions, and supporting the company’s cash flow growth. The rest of the executive team shares that same long-term vision—expand the educator base, drive profitable growth, and invest where it matters most, such as technology and agency outreach. It’s not an aggressive team, but a steady one, and that’s been working well for the business and its shareholders.

Valuation and Stock Performance

Horace Mann’s stock has posted a respectable performance over the past year, rising about 19% and showing strong resilience in a market full of uncertainty. The shares are trading around the low $40s, with a trailing price-to-earnings ratio of approximately 15. This valuation reflects modest market expectations, even as the company’s fundamentals continue to improve. For income-oriented investors, this pricing represents an attractive entry for a company that’s growing slowly but steadily.

Its price-to-book ratio sits at 1.27, suggesting that the stock isn’t being overvalued by the market, especially when viewed alongside its historical performance. The dividend yield is hovering around 3.4%, which, paired with a conservative payout ratio, makes the total return potential solid. What’s especially encouraging is the high level of institutional ownership—more than 105% of the float is held by institutions. That kind of backing implies confidence from larger investors who tend to favor dependable, income-producing companies like Horace Mann.

This stock won’t deliver explosive growth, but that’s not its role. It’s meant to provide income and a buffer against volatility, and so far, it’s doing just that.

Risks and Considerations

Like any insurer, Horace Mann faces risks tied to unpredictable events. Natural disasters, particularly wind and hail in sensitive regions, could impact its Property & Casualty segment despite improvements in underwriting and pricing strategies. Even with a more refined risk model, events outside the company’s control can quickly affect margins and financial results.

Interest rates also play a meaningful role in Horace Mann’s financial outlook. Rising rates have been a tailwind recently, boosting investment income. However, if the rate environment shifts or becomes unstable, it could affect both returns and capital positioning. Since the company manages long-duration assets, it has to stay nimble in adapting to these changes.

Market competition is another factor. While Horace Mann has long held a specialized position serving educators, it isn’t immune to broader competition from larger insurance companies with deeper pockets and more aggressive digital strategies. While its educator-focused identity is a strength, it must continue to innovate to protect its share.

Debt levels are worth monitoring too. With a debt-to-equity ratio over 120%, the company does carry more leverage than some of its peers. This hasn’t been a problem given strong free cash flow, but if financial performance weakens, it could limit flexibility.

Final Thoughts

Horace Mann stands out not because it’s fast-growing or flashy, but because it does exactly what dividend investors want—a steady return of capital, reliable earnings, and minimal drama. It’s a well-managed company with a clear mission, a consistent track record, and the financial footing to keep delivering shareholder value year after year.

The management team stays disciplined, the valuation remains attractive, and the stock has performed well without needing to make big moves. It’s the kind of investment that fits comfortably into a portfolio designed for the long term, offering a combination of income, stability, and modest capital appreciation.

There are risks, like in any business, but they’re the kind of risks that are known and being actively managed. For investors focused on building wealth patiently through dividends and conservative stock selection, Horace Mann continues to present a compelling case as a reliable income-producing asset.