Updated 5/13/25

Hooker Furnishings Corporation (NASDAQ: HOFT) has been crafting furniture for over a century, steadily building a reputation in the residential and hospitality markets. With brands like Bradington-Young and Sam Moore under its umbrella, the company blends heritage with adaptability. Despite facing economic headwinds, Hooker remains focused on operational streamlining, product innovation, and maintaining strong ties with retail partners.

Shares have fallen significantly over the past year, and financial results have reflected the pressure—marked by a net loss and negative free cash flow. Still, the stock’s high dividend yield, seasoned leadership, and strategic restructuring have kept it on the radar for income-focused investors.

Recent Events

The past few quarters have been a mixed bag for Hooker. On the surface, there’s been decent progress—revenue is up nearly 8% year-over-year, with total sales reaching just under $400 million on a trailing basis. But that’s where the good news starts to run thin.

Profitability has taken a hit. Net income is firmly in the red at -$12.67 million, and diluted EPS sits at -$1.19. Margins have been squeezed hard, and the company reported negative EBITDA of -$7.43 million. For a company that relies on volume and operational leverage, that’s a significant concern.

What’s reflected in the stock price isn’t surprising. Shares are down more than 44% over the past year, and currently trade just above $10, close to the low end of their 52-week range. But when you strip it back and look at valuation, it’s clear this is already baked in. The stock is now trading at just 0.54x book and a mere 0.27x sales. That’s cheap by any measure.

Even with the challenging earnings picture, Hooker hasn’t cut its dividend. That alone should make income investors sit up and take notice.

Key Dividend Metrics

📈 Dividend Yield: 8.91%

💵 Annual Dividend: $0.92

📅 Ex-Dividend Date: March 17, 2025

📊 Payout Ratio: 650%

📉 5-Year Average Yield: 4.22%

🧾 Dividend Growth Record: Consistent, no recent increase

Dividend Overview

At nearly 9%, HOFT’s dividend yield is hard to ignore. It’s more than double its five-year average, and in a world where most yields are struggling to keep up with inflation, this one jumps off the page.

Still, let’s be clear—this isn’t a perfect dividend setup. The payout ratio, based on trailing earnings, is through the roof at 650%. Of course, that figure is inflated because earnings are currently negative. But it does highlight the disconnect between what the company is earning and what it’s distributing.

So why hasn’t Hooker pulled back? There’s a good chance management is signaling confidence in a turnaround. The balance sheet offers some breathing room. The company holds $6.3 million in cash and has a solid current ratio of 3.5, which suggests they can handle short-term obligations comfortably. Debt levels are also manageable, with a debt-to-equity ratio sitting at 34%.

There’s certainly room to maintain the dividend in the short term. But the burn from negative free cash flow (sitting at -$16.9 million) means they’ll need to stabilize operations relatively soon to avoid dipping into reserves or borrowing further just to keep the checks coming.

Dividend Growth and Safety

Hooker’s history of dividend payments is one of slow, steady consistency. There’s been no flashy growth in recent years, but the company hasn’t slashed or skipped a payment either. That in itself counts for something, especially in the small-cap space.

However, with earnings under pressure and no recent increases, we’re likely in a holding pattern. It doesn’t seem probable that a dividend hike is coming any time soon, not until margins improve and cash flow turns positive. Management seems more focused on preserving the current level than expanding it, which is a prudent approach given the circumstances.

Still, the fact that institutions hold nearly 80% of the float tells us that big players are comfortable enough sticking around. And that’s often a good sign when it comes to dividend stability—they typically won’t tolerate long-term dividend erosion without a strategic reset.

In short, the dividend appears safe for now. But it’s riding on management’s ability to navigate through a period of margin recovery and cash flow repair. If they can pull it off, today’s yield could prove to be an outsized reward for those willing to be patient.

Cash Flow Statement

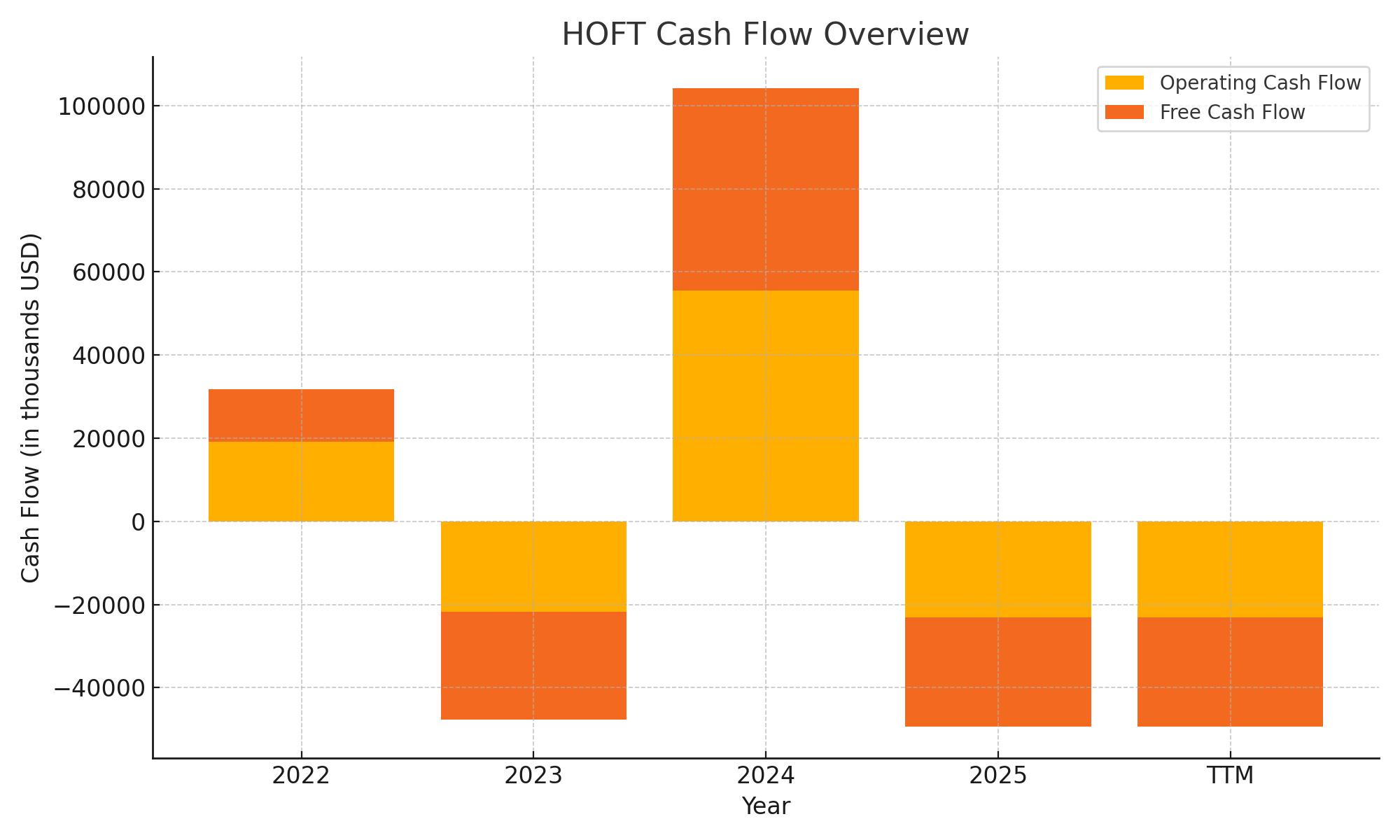

Hooker Furnishings has faced a sharp reversal in its cash flow dynamics over the trailing twelve months. Operating cash flow dropped into negative territory at -$23 million, a major shift from the $55 million generated the previous year. This shift reflects increased pressure on the company’s core operations, likely driven by compressed margins and ongoing inefficiencies. Free cash flow followed suit, sinking to -$26.3 million, which suggests the business isn’t generating enough internal capital to support both its operations and capital spending.

Investing activities remained modestly negative at -$2.7 million, mostly due to capital expenditures of $3.2 million. Financing activity saw a cash drain of -$11.1 million. While the company issued $22.1 million in new debt, it also repaid nearly the same amount—$22.9 million—effectively just rolling over its liabilities. No repurchases of capital stock occurred during this period, indicating a more cautious stance on capital allocation. As a result, Hooker ended the period with just $6.3 million in cash, significantly down from $43.2 million the prior year.

Analyst Ratings

Hooker Furnishings (NASDAQ: HOFT) has recently experienced a shift in sentiment from the analyst community. 🧐 Earlier in 2025, the stock was upgraded from a “Sell” to a “Hold” rating. This change reflects a more neutral outlook as analysts assess the company’s path forward amid a challenging backdrop of weak earnings and cash flow pressures.

The downgrade-to-upgrade shift didn’t come out of nowhere. While HOFT has been navigating significant hurdles—namely, operational inefficiencies and shrinking margins—there are signals that management is making progress in stabilizing the business. 🔧 The balance sheet remains relatively healthy, and the company’s strategic recalibrations could be positioning it for gradual improvement. Analysts appear to be acknowledging that the worst might be priced in, even if a full recovery isn’t yet underway.

Despite the challenges, analysts have pinned a consensus 12-month price target of $17.00 on the stock. 📈 That implies meaningful upside from where shares are trading today, suggesting a belief that the market may be underestimating Hooker’s ability to bounce back. While sentiment remains cautious, the revised outlook points to a wait-and-see approach, rather than a definitive exit signal.

Earning Report Summary

Mixed Results in a Tough Environment

Hooker Furnishings wrapped up its fiscal fourth quarter with results that were a bit of a mixed bag. The company reported a net loss of $2.3 million, or $0.22 per share. That’s a notable swing from profitability and a sign that margins remain under pressure. Adjusted earnings per share came in at just a penny, which was below what analysts were expecting.

On the brighter side, revenue came in a little stronger than anticipated, landing at $104.5 million for the quarter. That’s a positive sign that demand for the company’s products is still there, even if profitability is lagging. It shows the top line isn’t the main issue—it’s what’s happening beneath it that needs attention.

Leadership’s Focus and Forward Strategy

CEO Jeremy Hoff didn’t shy away from the challenges. He pointed to persistent macroeconomic headwinds and supply chain friction that continued to weigh on the quarter. But he also made it clear the company isn’t just waiting things out. There’s an active push toward tightening operations, trimming unnecessary costs, and making processes more efficient.

One of the focal points going forward will be enhancing product offerings and maintaining strong ties with key retail partners. The leadership team appears confident that these relationships, paired with internal streamlining, can help position the business better for whatever comes next.

Looking into the new fiscal year, the tone was cautiously optimistic. There’s recognition that the path to stronger results will depend on more than just internal moves—broader market stability will also have a role to play. Still, management believes the groundwork is being laid for improvement as they double down on execution and long-term strategy.

Management Team

Hooker Furnishings has seen several key leadership shifts in recent years, aimed at better aligning the company with current market dynamics. In 2021, Jeremy Hoff stepped into the role of CEO, taking the reins with a focus on operational tightening and strategic growth. Since then, the executive team has prioritized improving internal efficiencies while staying competitive in a shifting home furnishings market.

Earlier in 2025, longtime CFO Paul Huckfeldt retired after more than two decades with the company. He was succeeded by C. Earl Armstrong, a veteran within the organization who has held various financial roles since 2009. Armstrong’s familiarity with Hooker’s operations and financial structure adds a layer of continuity as the company navigates a tougher economic backdrop.

The leadership team also saw some restructuring with the departure of Chief Creative Officer Caroline Hipple and other senior executives. These changes are part of a broader effort to streamline decision-making and adapt the leadership structure to the company’s evolving strategic needs.

Valuation and Stock Performance

Hooker Furnishings’ share price has reflected the turbulence in its business over the past year. The stock has traded between $7.34 and $19.79 in the last 52 weeks and currently sits around $10.06. That’s a steep drop from its highs and mirrors the company’s recent struggles with profitability and cash flow.

Even so, the current valuation metrics suggest there may be a disconnect between market pricing and long-term potential. The stock trades at a price-to-book ratio of 0.54 and a price-to-sales ratio of 0.27, levels that imply the market is heavily discounting the company’s future. The forward P/E ratio of 24.88, while elevated due to low earnings, indicates that investors still see some room for a rebound.

Hooker’s dividend remains a prominent feature, with a yield of 8.91%—well above its five-year average of 4.22%. While attractive on paper, the 650% payout ratio makes it a precarious proposition. If cash flow and earnings don’t improve soon, there could be pressure to revise the dividend policy.

Risks and Considerations

There are a few notable risks that come with owning shares in Hooker Furnishings. As a company in the consumer discretionary sector, Hooker is particularly exposed to shifts in economic cycles. When consumer confidence dips, so do purchases of non-essential goods like furniture. That makes revenue streams inherently sensitive to broader macroeconomic conditions.

The company’s recent financials highlight some deeper operational issues as well. Negative free cash flow, coupled with net losses, points to structural inefficiencies that still need to be addressed. Although management is working to bring costs under control, results have yet to materially shift in a positive direction.

Hooker has also been navigating supply chain disruptions and cost inflation, which have weighed on margins. While some of these pressures may ease over time, others could persist longer than expected. There’s also the high payout ratio to consider. Without a rebound in earnings, maintaining the dividend at current levels could strain liquidity.

Additionally, environmental and regulatory compliance is another layer of risk, especially given the nature of its manufacturing and sourcing. While the company works to stay ahead of evolving standards, any lapses could have reputational and financial consequences.

Final Thoughts

Hooker Furnishings is in a period of transition. Leadership is changing, strategies are shifting, and the financial picture is still a work in progress. What stands out is the clear intent from the executive team to address inefficiencies and reposition the company for a more stable future.

The stock trades at a valuation that suggests the market has already priced in a fair bit of pessimism. For income investors, the dividend yield might be tempting, but it comes with caveats tied to earnings pressure and negative cash flow. That being said, if the company can execute on its plans and show progress on the bottom line, there’s potential for sentiment to shift.

For now, the story is one of careful monitoring. Watching how management follows through on its strategic priorities—and whether those efforts translate into real financial improvement—will be key to understanding the stock’s longer-term trajectory.