Key Takeaways

📈 Hershey offers a 3.21% dividend yield, well above its 5-year average, with consistent dividend growth supported by a 67.4% payout ratio and strong free cash flow coverage.

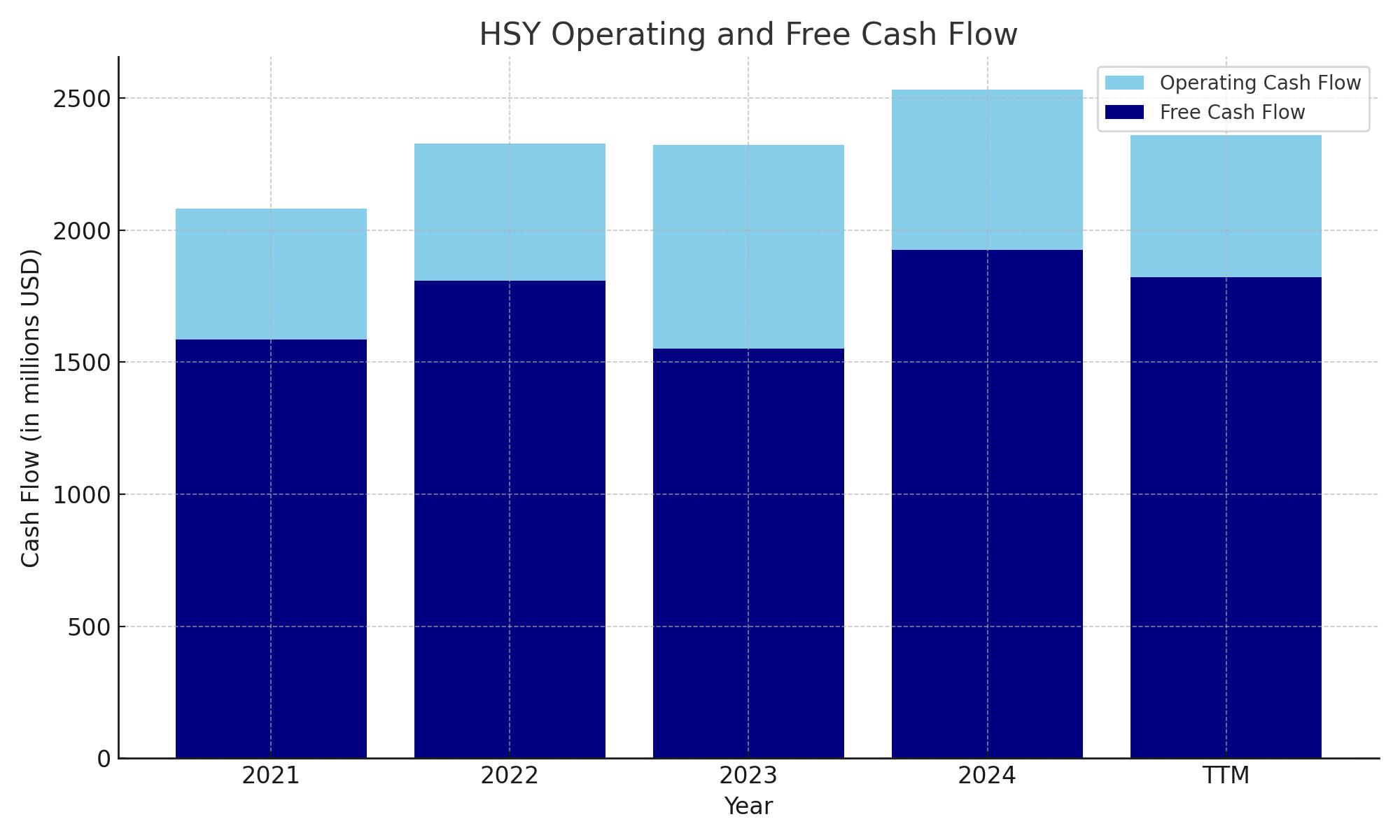

💵 Operating cash flow remains solid at $2.36 billion TTM, with free cash flow at $1.82 billion, providing a reliable foundation for dividend payments and ongoing investments.

📊 Analyst sentiment has turned cautious, with a consensus “Reduce” rating and a 12-month price target of $161.40, driven by concerns over cocoa costs and margin pressures.

Last Updated 5/11/25

Hershey (HSY) is a long-standing leader in the consumer staples space, known for its strong brand portfolio, consistent dividend history, and disciplined capital management. The company generates robust cash flow from its core confectionery business while expanding its footprint in the salty snacks and international segments. Despite recent pressure from rising input costs, especially cocoa, and a dip in North American volumes, Hershey continues to deliver healthy margins and maintains strong institutional support.

Shares have pulled back over the past year, presenting a yield of over 3%—well above its five-year average. With a forward P/E near 28 and a payout ratio just under 70%, the stock offers income stability backed by solid free cash flow. Management remains focused on productivity, global expansion, and evolving consumer preferences, even as short-term risks weigh on growth projections.

Recent Events

Hershey’s last twelve months haven’t been the smoothest. Revenue came in at $10.75 billion, but that’s down nearly 14% from the prior year. That kind of drop isn’t just a blip—it suggests consumers may be pushing back on price increases or pulling back altogether. Earnings growth also took a major step back, down more than 70% year-over-year for the most recent quarter.

These numbers aren’t pretty on their own, but context matters. The company still posted net margins above 15%, and operating margins are sitting close to 14%. Hershey isn’t in a crisis—it’s adjusting. Input costs, pricing challenges, and shifting consumer habits are squeezing profitability, but the core business remains incredibly resilient.

The stock, meanwhile, has slid about 18% over the past 12 months. For a company like Hershey, that kind of pullback is rare. Yet institutions are still heavily involved, holding nearly 87% of the float. Short interest has ticked up to over 6%, but there’s no sign of a rush for the exits. It’s more a case of cautious positioning, not panic.

This recent cooling in sentiment has opened the door for dividend yields to rise. At just over 3%, the yield is now comfortably above its five-year average. For patient investors, that’s something worth paying attention to.

Key Dividend Metrics

🟢 Dividend Yield: 3.21%

📈 Dividend Growth (5-Year CAGR): Approximately 9.2%

📅 Next Ex-Dividend Date: May 16, 2025

💵 Annual Dividend: $5.48 per share

💡 Payout Ratio: 67.4%

🧱 Dividend Safety: Well-supported by cash flows

📊 Free Cash Flow Coverage: Healthy, with plenty of buffer

Dividend Overview

Let’s talk about what makes Hershey a consistent name on many dividend watchlists. At a share price around $171, the dividend yield is now sitting at 3.21%. That’s not only higher than its historical norm—it’s one of the more attractive yields in the consumer staples space right now.

The $5.48 per share annual payout isn’t just a number. It’s backed by a business with a strong history of rewarding shareholders, even during times of pressure. The 67.4% payout ratio might look a bit high, but for a company like Hershey—where cash flow is predictable and sticky—it’s within a reasonable range. This isn’t a speculative dividend. It’s a payout with muscle behind it.

The company also has $1.25 billion in levered free cash flow. When you compare that to the roughly $810 million required to fund the dividend, the math works comfortably. Hershey is not stretching to maintain the payout—it’s well within its means. That’s especially important when navigating a softer earnings environment.

And then there’s the consistency. Hershey’s dividend cadence doesn’t miss a beat. If you’re a shareholder by May 16, you’ll receive the next quarterly payout on June 16. That level of dependability is exactly what long-term income investors crave.

Dividend Growth and Safety

Here’s where Hershey quietly shines. Over the past five years, dividend growth has averaged just north of 9% per year. It’s not flashy, but it’s steady—and it’s backed by real earnings and solid operations.

Even now, with pressure on earnings and revenue, the company hasn’t flinched. Management has kept its dividend strategy intact. That decision says a lot. It shows confidence, not just in the short-term stability of the business, but in its longer-term trajectory.

The payout ratio at 67.4% is elevated but not alarming. It suggests that while there’s less room for big dividend hikes in the immediate future, the existing payout is secure. And again, that free cash flow coverage helps ease any lingering concerns. With $1.25 billion in free cash flow, there’s enough of a cushion to weather additional pressure if needed.

Hershey also benefits from a low beta of 0.31, which means the stock tends to be less volatile than the overall market. That’s an added bonus for dividend investors looking for stable, reliable income in choppier markets.

So while the last year has brought some challenges, the dividend story remains strong. The yield is more attractive than it’s been in years, the payout is well-covered, and the company has a long history of rising distributions. For income-focused portfolios, that’s a combination worth paying attention to.

Cash Flow Statement

Hershey’s trailing twelve-month cash flow tells a story of stability in operations with a deliberate approach to capital allocation. Operating cash flow came in at $2.36 billion, a slight dip from the prior year’s $2.53 billion, but still well within the company’s long-term range. This consistent performance continues to support strong free cash flow generation, which totaled $1.82 billion for the period—plenty of breathing room for dividend commitments and reinvestment.

On the investment side, Hershey spent about $879 million, with capital expenditures at $538 million, indicating ongoing investments in capacity or efficiency. Financing cash flow was negative $538 million, reflecting a mix of debt repayments and restrained shareholder distributions this time around. Notably, the company issued nearly $2 billion in new debt while avoiding stock buybacks in this stretch, a shift from the more aggressive capital returns in prior years. The end cash position has more than doubled year-over-year, sitting at $1.46 billion, signaling strong liquidity despite recent earnings pressures.

Analyst Ratings

📉 Hershey’s stock has recently seen a shift in analyst sentiment, with a notable downgrade from a major research firm at the end of January. The rating was lowered from “neutral” to “underweight,” and the price target was trimmed from $153 to $120. The primary concern fueling this move is the rising cost of cocoa. Drought conditions in late 2024 have tightened global cocoa supply, pushing prices higher and raising concerns about margin pressure for chocolate manufacturers like Hershey. One analyst adjusted their 2026 earnings projection down to $7.05 per share from a prior estimate of $8.50, reflecting this cost burden.

📊 The broader consensus on Hershey right now leans cautious. The average 12-month price target sits at $161.40, with projections ranging from $120 on the low end to $225 at the high. With the current stock price hovering around $171, that implies a modest downside of roughly 5.6%. The consensus rating across analysts is “Reduce,” signaling that many expect Hershey to underperform in the near term.

🔄 Several firms have adjusted their views slightly without making major moves. One raised its price target from $160 to $165 while maintaining an “Equal-Weight” rating. Another firm nudged its target up by a dollar while keeping a “Neutral” stance. Meanwhile, one large investment bank trimmed its target from $175 to $170 but didn’t shift its rating. These changes reflect a market that respects Hershey’s brand strength but is wary of near-term cost headwinds.

Earning Report Summary

A Mixed Start to the Year

Hershey’s first quarter of 2025 was a bit of a balancing act. On one hand, the company managed to deliver stronger-than-expected earnings, with adjusted earnings per share landing at $2.09—comfortably above what analysts were expecting. On the other hand, sales didn’t quite hold up. Revenue for the quarter came in at $2.81 billion, which is nearly 14% lower than a year ago and just shy of what the market was looking for.

The drop in sales was largely due to softer volumes, especially in the North American confectionery segment. Consumers are starting to push back on higher prices, and that’s starting to show up in the numbers. But it wasn’t all sour news. Profitability held up well, with gross margins still sitting in a healthy range. That says a lot about Hershey’s ability to manage costs and keep operations tight even when top-line growth takes a hit.

Strength in Snacks and International

One bright spot was the performance of Hershey’s salty snacks division, which includes Dot’s Pretzels and SkinnyPop. That part of the business actually saw organic volume growth of about 4%, showing that consumers are still reaching for these products despite pricing pressures. It’s becoming an increasingly important piece of the company’s portfolio.

Internationally, Hershey also had some strong results. Markets like Brazil, India, and Mexico stood out, with solid momentum driven by new marketing pushes and fresh product launches. These regions have been on Hershey’s radar for a while, and they’re starting to make more of an impact.

Challenges Ahead

Looking forward, the company is realistic about the road ahead. Rising cocoa costs are creating a tougher backdrop, and there’s also the issue of potential new tariffs. Hershey estimates it could be looking at around $15 to $20 million in tariff-related costs next quarter alone. It’s already in talks with the government to try and ease the pressure, but it’s clear those expenses could weigh on margins if left unchecked.

That said, leadership sounded confident about the strategy in place. CEO Michele Buck highlighted a number of areas where the company is working to soften the blow—everything from supply chain adjustments to smarter pricing and sourcing decisions. There’s a focus on productivity improvements, and the team doesn’t seem rattled by the near-term bumps.

Even with all these challenges, Hershey isn’t backing away from its guidance. The full-year sales outlook still calls for about 2% growth. It’s not blockbuster growth, but in this environment, holding steady might be enough to keep long-term investors comfortable. The company is staying the course, leaning into innovation and international markets to fuel future growth.

Management Team

Hershey’s leadership team is a blend of experienced professionals guiding the company through both its traditional roots in confectionery and its expanding footprint in the snacking category. Michele Buck, who has been President, CEO, and now Chairman since 2017, brings over 30 years of experience in consumer-packaged goods. She’s been instrumental in broadening the company’s scope, especially through strategic acquisitions and a stronger emphasis on snacks and global growth.

Supporting Buck are several key executives with targeted roles. Andrew Archambault leads the U.S. Confection division, drawing from his background in beverage and retail strategies. Veronica Villasenor oversees the salty snacks portfolio, which includes fast-growing brands like Dot’s Pretzels and SkinnyPop. Rohit Grover heads up international markets, focusing on expansion across Latin America and Asia. The company also benefits from Deepak Bhatia’s leadership in technology and supply chain analytics, while Jason Reiman ensures operational efficiency as Chief Supply Chain Officer. James Turoff handles legal strategy and compliance, and Chris Scalia guides both HR and internal transformation efforts. Together, this team brings a strong mix of continuity, innovation, and operational expertise.

Valuation and Stock Performance

As of May 2025, Hershey stock trades near $171, down roughly 18% from its 52-week high. Despite this decline, the stock still maintains a valuation that suggests the market sees long-term value, even amid current earnings pressures. The consensus price target among analysts is $161.40, pointing to a slight downside from current levels. That said, price targets vary widely, reflecting differing views on how well Hershey can weather the current cost environment.

From a valuation perspective, the stock is trading at a forward P/E of about 28, which is elevated relative to its historic norms. Investors seem to be balancing the company’s consistent cash flow and brand strength against a backdrop of commodity cost pressures and softening consumer demand. The price-to-sales ratio is a little over 4, and the enterprise value-to-EBITDA is hovering around 16, which places Hershey in the more expensive tier of consumer staples—likely due to its perceived resilience and attractive dividend profile.

The dividend yield, now above 3%, is a notable draw for income-focused investors, especially since the payout has been rising steadily and is well-covered by free cash flow. That yield, combined with Hershey’s relatively low beta, keeps it on the radar for conservative investors looking for steady income and lower volatility.

Risks and Considerations

Hershey is currently contending with several headwinds. Chief among them is the price of cocoa, which has been climbing due to weather disruptions in major growing regions. If these cost pressures persist and consumers push back on higher prices, margins could tighten. The company has taken steps to manage this risk, but it remains a critical factor in the short term.

There are also potential tariff issues that could increase costs further, particularly if exemptions are not granted on key ingredients. Management has been proactive in addressing these risks, but external pressures remain largely out of their control.

Consumer preferences are evolving as well. There’s a growing shift toward healthier snacking and ingredient transparency. While Hershey has been expanding into salty snacks and innovating in better-for-you categories, the transition requires ongoing investment and agility. International markets offer growth, but they also bring exposure to currency fluctuations and local economic uncertainties.

Final Thoughts

Hershey remains one of the most recognized names in the food and beverage space. While the current environment presents some meaningful challenges—especially on the cost side—the company’s long-term positioning remains solid. The leadership team has shown they’re willing to make the moves necessary to adapt, whether that’s through product diversification, operational improvements, or exploring new markets.

The valuation may seem stretched by some measures, especially in light of slower top-line growth. But the stock offers a reliable income stream, a disciplined management team, and a resilient business model. As always, the ability to execute over the next few quarters will be key in determining whether Hershey can navigate through these issues and reaccelerate its momentum. Investors with a long-term view and an eye on stable dividends will likely keep watching closely.