Key Takeaways

💸 Hawthorn offers a 2.82% dividend yield with consistent annual increases and a conservative 27.64% payout ratio, signaling both reliability and room for future growth.

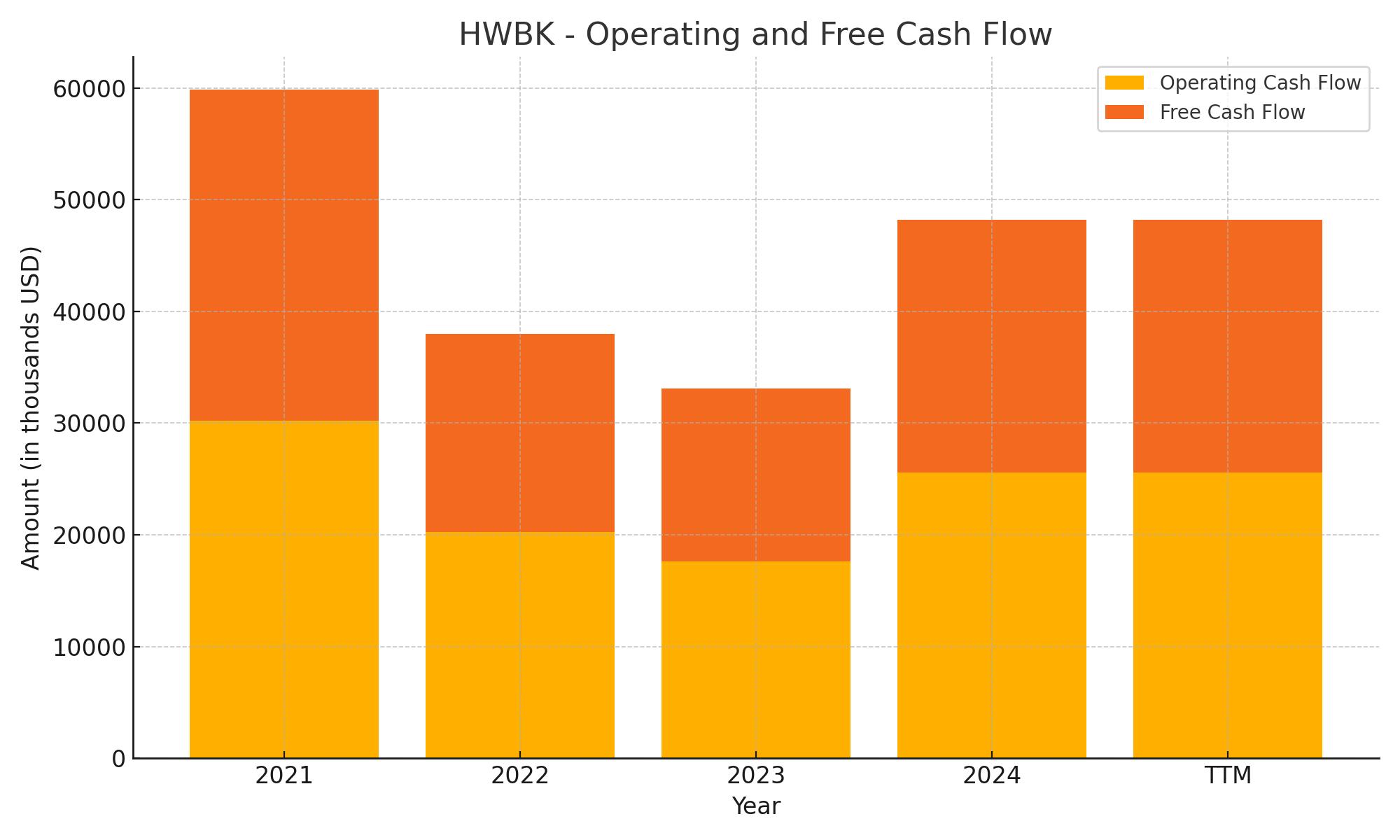

💰 Operating and free cash flow have remained strong, with trailing twelve-month free cash flow at $22.6 million, supporting ongoing dividend payments and financial flexibility.

📊 The stock was recently upgraded based on improved profit margins, insider ownership, and solid fundamentals, with a consensus price target near $32 and growing investor confidence.

Last Updated 5/11/25

Hawthorn Bancshares (HWBK), a Missouri-based regional bank, has quietly built a reputation on financial discipline, solid credit performance, and shareholder-friendly capital management. With a 2.82% dividend yield, a payout ratio under 30%, and strong year-over-year earnings growth, it offers a reliable income stream backed by healthy fundamentals. The stock has climbed more than 40% over the past year and still trades at just over 10 times trailing earnings, pointing to an appealing combination of value and stability.

Under CEO Brent Giles, the company has focused on growing core banking relationships, maintaining a clean balance sheet, and delivering consistent results across economic cycles. Recent upgrades in analyst ratings reflect improvements in margins, loan quality, and operational efficiency, while management continues to support dividend growth and prudent expansion.

Recent Events

Hawthorn has been on a quiet tear over the past year. Its stock is up roughly 43% over the last 12 months, significantly outpacing broader market benchmarks. Not bad for a small-cap regional bank that rarely shows up in financial news feeds.

In June 2023, the company executed a 104-for-100 stock split. It wasn’t the kind of move that changes the fundamentals, but it did reflect a desire to keep shares accessible to smaller investors and potentially widen the shareholder base. That, combined with solid operational performance, has attracted more attention to this underappreciated name.

Recent earnings have also added to the story. First-quarter 2025 results showed a 20.8% increase in earnings year-over-year, with revenue climbing more than 6%. Those kinds of numbers speak to efficient operations and strong loan demand, especially given the current rate environment. On a trailing basis, EPS stands at $2.75—solid for a bank of this size—and the P/E ratio around 10 times earnings suggests there’s still room to run.

Key Dividend Metrics

📈 Forward Yield: 2.82%

💰 Annual Dividend Rate: $0.80

🔁 5-Year Average Yield: 2.73%

🧱 Payout Ratio: 27.64%

📅 Next Ex-Dividend Date: June 13, 2025

📆 Next Pay Date: July 1, 2025

🚨 Dividend Growth Last Year: 5.26%

📊 Beta (5Y Monthly): 0.62

Dividend Overview

Hawthorn’s dividend doesn’t scream for attention, but it has a quiet appeal. The current yield sits at 2.82%, which puts it right in the sweet spot for conservative income investors. It’s not high enough to suggest elevated risk, but still comfortably ahead of what you’d get from parking cash in a CD or Treasury bill.

What makes the dividend even more attractive is how well it’s supported. With a payout ratio of just 27.64%, Hawthorn isn’t stretching to maintain its dividend. That’s important in the banking sector, where earnings can swing with interest rates and loan demand. This is a company leaving itself room to maneuver, even in more challenging environments.

Management also seems to understand the importance of a steady hand. They haven’t gone overboard with dividend increases, but they’ve been consistent. Last year’s 5.26% dividend hike is a great example—measured, realistic, and sustainable.

With 18% insider ownership, it’s also clear that those running the bank have skin in the game. That tends to be a good sign when it comes to dividend reliability, as management often thinks twice before making decisions that could undercut shareholder income.

Dividend Growth and Safety

For income investors, safety is just as important as yield—and Hawthorn offers both. Its low beta of 0.62 means the stock doesn’t whip around with every market move, which is exactly what you want when building a reliable dividend portfolio.

Cash on hand stands at around $52 million, which is roughly $7.45 per share. That provides a healthy cushion for both operations and future dividend payments. Debt totals $132 million, but there’s no immediate concern based on the company’s earnings power. Even without a stated debt-to-equity ratio, the numbers suggest the balance sheet is in good shape.

What makes HWBK’s dividend feel particularly secure is the way it aligns with the company’s overall financial health. Profit margins are healthy, and earnings continue to grow. With EPS at $2.75 and the payout at just $0.80, the company has plenty of room to maintain or even increase its dividend in the future.

The yield itself sits right in line with the company’s five-year average, which suggests stability rather than an artificially inflated payout. This isn’t a stock that’s been forced to raise its yield to attract buyers. Instead, it’s simply doing what it’s done for years: delivering a modest, sustainable income stream with minimal drama.

All in all, Hawthorn Bancshares isn’t trying to be the next big thing. It’s focused on doing one thing well—managing a local bank—and doing it in a way that supports long-term shareholder income. For dividend investors looking to add a steady, low-volatility name to their portfolios, it’s worth a closer look.

Cash Flow Statement

Hawthorn Bancshares has generated solid cash from operations over the trailing twelve months, with $25.6 million in operating cash flow. That’s a noticeable improvement from the prior year’s $17.6 million, pointing to stronger core banking performance and disciplined expense management. Free cash flow also came in at a healthy $22.6 million, reflecting a conservative approach to capital expenditures, which were modest at $3 million. This level of free cash flow provides breathing room for the company to support dividends and absorb any economic volatility.

On the financing side, outflows of $69.3 million over the TTM highlight significant repayments of debt and shareholder returns. Specifically, the company paid down $40.2 million in debt, while also continuing modest stock repurchases totaling $1.1 million. Meanwhile, investing cash flow was positive at $1.25 million, a reversal from larger outflows in previous years, suggesting more measured investment activity. Despite these sizable outflows, the company ended the period with nearly $51 million in cash—down from the previous year, but still a stable position for a bank of its size.

Analyst Ratings

📈 On April 23, 2025, Hawthorn Bancshares (HWBK) received an upgrade in its investment rating, moving from 65% to 72%. This adjustment was based on a model that emphasizes a mix of valuation strength and financial stability. The shift came as analysts took note of the bank’s improving fundamentals, especially in areas tied to profitability and capital discipline.

💼 Driving the rating higher were several specific metrics: strong profit margins, healthy operating cash flow, and notable insider ownership. These factors collectively suggest a business that’s not just stable but also run by leaders with a clear incentive to drive long-term value. The stock’s performance relative to its peers also played a role, with a notable uptick in relative strength.

⚠️ That said, not every box was checked. HWBK still lags in a few areas, including consistency in profit margins over time and its price-to-earnings growth (PEG) ratio. While these didn’t outweigh the positive signals, they do hint at where the bank could tighten up its game.

🎯 As of now, the consensus price target from analysts stands near $32, indicating modest upside from current levels. It’s a reflection of cautious optimism—clear recognition of the bank’s progress, without getting ahead of the fundamentals.

Earning Report Summary

Solid Start to the Year

Hawthorn Bancshares got off to a strong start in 2025, reporting first-quarter net income of $5.4 million, which was a healthy 20.8% increase from the same time last year. Earnings per share landed at $0.77, up from $0.63, giving investors something to feel good about. This jump in profitability was supported by a tighter grip on expenses, reflected in the bank’s improved efficiency ratio of 66.64%.

The net interest margin saw a lift too, coming in at 3.67% compared to 3.55% in the previous quarter. That means Hawthorn is doing a better job making money from its core lending business, even though total net interest income dipped slightly by around $100,000. What helped offset that was a boost in non-interest income, which rose 14.7% year-over-year, largely thanks to stronger returns from bank-owned life insurance.

Credit Quality and Capital Position

On the asset quality front, things looked even better. Non-performing assets dropped to just 0.21% of total loans, down significantly from 0.69% a year ago. That’s a clear signal that the loan book is healthy and borrowers are staying current. The bank also kept its allowance for credit losses at a solid $21.8 million, or 1.48% of total loans, which shows they’re well prepared for any bumps in the road.

Loan growth was modest, with loans held for investment ticking up by $4.2 million over the last quarter. Deposits also grew by $10.7 million, reflecting steady confidence from clients. On the capital side, the bank’s total risk-based capital ratio stood at 14.94%, which gives it plenty of room to grow and weather economic changes.

Looking Ahead

One of the more encouraging parts of the report came from CEO Brent Giles. He said the strong results are a reflection of the bank’s continued focus on building core relationships and improving outcomes across the board. There was a clear message that management is staying disciplined while also investing in better products and services to support long-term growth.

The board approved a quarterly dividend of $0.20 per share, which is a 5.3% bump from the previous year. That’s the kind of consistent dividend growth that long-term investors appreciate, especially those focused on income. With book value per share also climbing to $21.97, up $2.54 from a year ago, Hawthorn seems to be quietly building shareholder value in a very intentional way.

Management Team

Hawthorn Bancshares is led by a team that blends community banking values with pragmatic financial stewardship. At the helm is Brent Giles, who brings decades of experience in banking operations and leadership. Under his guidance, the bank has continued to grow steadily while maintaining a strong balance sheet and a disciplined credit culture. Giles has emphasized customer relationships and operational efficiency as cornerstones of the bank’s approach, and that direction is clearly visible in Hawthorn’s recent performance metrics.

Supporting him is a leadership group that includes long-tenured professionals with deep roots in the Missouri market. The executive team is notable for its continuity and experience, which has helped maintain a consistent strategic direction. They’re not chasing flashy trends or overextending into unfamiliar territory. Instead, the focus remains on growing core banking relationships, improving profitability, and enhancing shareholder value through prudent risk management and capital allocation.

With insider ownership around 18%, the management team is personally invested in the long-term success of the company. That alignment tends to keep decisions grounded and geared toward sustainable growth, rather than short-term gains. Investors looking for management that prioritizes capital discipline and measured expansion will find comfort in how this team operates.

Valuation and Stock Performance

HWBK’s share price has quietly posted an impressive run over the past year, rising over 43%, which is especially noteworthy given the challenges smaller banks have faced in a higher-rate environment. Despite the strong rally, the stock still trades at just over 10 times trailing earnings. That valuation doesn’t scream overbought, and when you consider the bank’s 26 percent profit margin and rising earnings, it suggests there’s still room for long-term investors to participate in the upside.

From a price-to-book perspective, HWBK is currently valued at roughly 1.29 times book value. That’s a fair premium for a bank that continues to deliver steady returns and grow book value per share at a double-digit pace. The five-year average dividend yield sits at 2.73 percent, almost exactly in line with the current yield of 2.82 percent. That tells us the stock hasn’t been pushed into yield-chasing territory. It’s reasonably valued for the income it delivers.

Volume remains low, as expected for a smaller regional bank, and the float is relatively tight. But for patient investors focused on total return, the current valuation reflects a balance between quality and opportunity. Hawthorn isn’t a stock that gets swept up in broad market swings, and its low beta of 0.62 reinforces its appeal as a defensive, income-producing name in volatile environments.

Risks and Considerations

Like any regional bank, Hawthorn faces its share of risks. Interest rate sensitivity remains a key factor. While the net interest margin has been improving, future rate movements could compress margins, especially if the yield curve remains inverted or if loan demand slows. The bank’s business is still tied closely to the Missouri market, and any economic disruption in its core footprint could weigh on loan performance and deposit growth.

Credit quality has improved, but it’s worth watching how that holds up in a softening economy. Loan losses have been minimal, and non-performing assets are low, but a reversal in employment trends or regional business health could change that. While the current allowance for credit losses seems adequate, shifts in borrower behavior or real estate valuations might stress reserves.

The relatively small size of the company can also limit scale advantages and access to capital markets. Hawthorn operates efficiently, but it may not benefit from the same leverage on technology, compliance, or infrastructure as larger peers. That could affect margins or competitive positioning over time.

Finally, liquidity and trading volume should be considered. HWBK doesn’t trade heavily, and that can make it more difficult for larger investors to enter or exit positions quickly without affecting the share price. For long-term holders, this may not be an issue, but it does add an element of illiquidity that should be understood before building a large position.

Final Thoughts

Hawthorn Bancshares may not be a household name, but it has shown that solid banking fundamentals and consistent leadership can deliver real value over time. The bank’s steady earnings growth, conservative balance sheet, and commitment to its dividend make it a solid candidate for investors focused on income and stability. It’s not chasing trends or swinging for the fences—it’s simply delivering the kind of disciplined performance that builds shareholder wealth slowly and surely.

With the recent upgrade in investment ratings, improving margins, and ongoing dividend growth, HWBK is showing it can keep pace in a changing market without taking on unnecessary risk. The management team has demonstrated a strong grasp of both strategic direction and day-to-day execution, and their approach continues to reward long-term investors.

For those building a portfolio around quality dividend payers with durable business models, Hawthorn stands out for its steady hand, its attractive valuation, and its willingness to return capital to shareholders. It’s the kind of stock that fits comfortably into a diversified income strategy, offering both peace of mind and the potential for modest, consistent appreciation over time.