Key Takeaways

💰 Havertys offers a forward dividend yield of 6.8%, well above its five-year average, with consistent quarterly payouts and a long-standing history of rewarding shareholders.

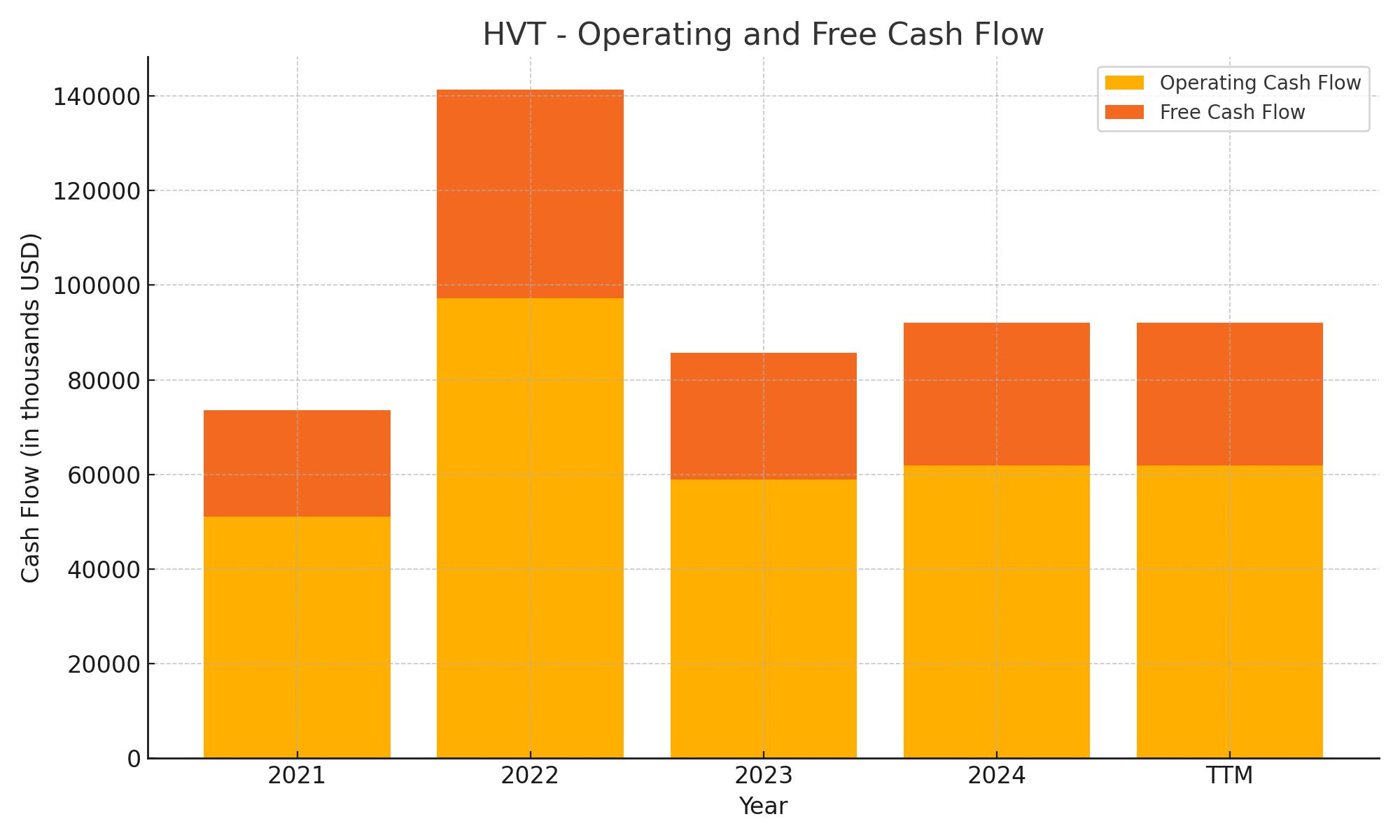

📊 Strong operating cash flow of $61.9 million and $30.1 million in free cash flow for the trailing twelve months support the dividend and reflect disciplined financial management.

📈 Analysts maintain a positive outlook with a consensus price target of $30.60, citing improved earnings and a strong balance sheet as drivers of long-term value.

Last Update 5/8/25

Haverty Furniture Companies, Inc. (HVT) has been in business for over 140 years, operating more than 100 stores across 16 states with a focus on quality home furnishings and customer service. Its management team continues to prioritize steady growth, operational discipline, and strong capital returns, even during tougher retail environments.

The company currently trades at a modest valuation, offers a dividend yield near 7%, and holds a debt-free balance sheet backed by over \$100 million in cash. With a long-standing dividend history, improving margins, and a shareholder-aligned leadership team, Havertys presents a steady, income-generating opportunity within the retail sector.

Recent Events

Over the past year, HVT has seen its share price decline by nearly 35%. That’s significant, but it hasn’t come with a collapse in business fundamentals. On the contrary—quarterly earnings actually jumped nearly 58% year-over-year, while revenue slipped only slightly.

The company reported $720 million in revenue over the trailing twelve months. It’s not flashy growth, but it’s steady. Gross profit stood at $439 million, and EBITDA clocked in at a respectable $44 million. This is a business that knows how to manage costs and stay lean when times get tight.

Cash flow from operations hit $62 million, giving Havertys the flexibility to support its dividend even when earnings are compressed. The balance sheet is well managed, with just over $110 million in cash and $218 million in debt. A current ratio of 1.81 suggests they’re in no danger of liquidity strain.

And then there’s the valuation. At just 1.0x book and under 0.5x sales, this stock looks cheap on traditional metrics. The market may be underestimating how much stability is baked into this business model.

Key Dividend Metrics

📈 Forward Dividend Yield: 6.80%

💵 Annual Dividend Rate: $1.28 per share

🛡️ Payout Ratio: 100%

📆 Last Dividend Paid: March 21, 2025

🔁 Dividend Frequency: Quarterly

📊 5-Year Average Yield: 3.79%

Dividend Overview

Let’s get right to the point—Haverty’s dividend is generous. At 6.8%, that yield is almost double what the company has offered on average over the past five years. The regular quarterly payout of $1.28 annually hasn’t wavered, and with the recent pullback in share price, the yield has climbed significantly.

This isn’t a flash-in-the-pan dividend story. Havertys has paid a dividend consistently for more than 90 years. That kind of track record shows up when you need it most—during times of uncertainty. And when the business is flush with cash, management has been known to toss in special dividends as well. That happened in both 2021 and 2022.

The current payout ratio is sitting at 100%, which can raise eyebrows. But in this case, it’s not as risky as it sounds. The company has plenty of cash on hand, a history of measured capital allocation, and rising earnings that suggest the ratio may come down naturally over time.

There’s also a cushion in free cash flow. Havertys generated over $17 million in levered free cash flow over the past year—enough to keep the dividend flowing. And with $7 per share in cash, the balance sheet isn’t stretched.

Dividend Growth and Safety

If you’re looking for dividend consistency with a side of growth, Haverty’s is worth your time. The payout has increased steadily over the past five years—from $0.72 in 2018 to $1.28 today. That’s an average growth rate of more than 12% per year. It’s not just keeping up with inflation—it’s staying ahead of it.

That growth has come without sacrificing balance sheet health. Total debt remains manageable, and the business generates healthy operating cash flow to support both operations and distributions.

Institutional ownership is also worth noting—nearly 89% of shares are held by institutions. That level of commitment suggests a strong belief in the company’s stability. Meanwhile, insiders hold just under 11%, which is a good sign that leadership has skin in the game.

The dividend’s future isn’t carved in stone, but all signs point to sustainability. If earnings growth continues—and recent numbers show that’s happening—there’s room for modest increases ahead. And even if the payout ratio remains high, the strong cash position offers a buffer most companies don’t have.

Cash Flow Statement

Haverty Furniture’s cash flow picture over the trailing twelve months reflects solid operational efficiency and a disciplined financial approach. The company generated $61.9 million in operating cash flow, a steady figure that shows resilience compared to the prior year. While not reaching the 2022 highs, this level of cash generation comfortably supports its dividend obligations and leaves room for strategic reinvestment. Capital expenditures totaled $31.8 million, nearly identical to the previous year, indicating a consistent investment pace in the business infrastructure, whether for new stores, renovations, or technology.

.

On the financing side, outflows of $30.1 million continue to reflect a shareholder-focused capital return strategy. Although there were no new borrowings or debt repayments, the company has remained active in buybacks and dividend payments, consistent with prior years. Despite negative investing and financing flows, Havertys ended the period with a healthy $118.3 million in cash. This balance, while down slightly year over year, still reflects strong liquidity. Free cash flow, at just over $30 million, adds to the stability of the overall dividend story, reinforcing the company’s ability to sustain distributions without compromising financial health.

Analyst Ratings

📈 Haverty Furniture Companies, Inc. (NYSE: HVT) recently caught the attention of analysts following a better-than-expected earnings report. A “Strong Buy” rating was reaffirmed earlier this month by one of the few covering firms, reflecting ongoing confidence in the company’s financial direction and its operational execution. The rating came with a reaffirmed price target of $45.00, suggesting analysts see meaningful upside from current levels.

🎯 The broader analyst consensus now pegs the average 12-month price target at $30.60. The estimates range from a more cautious $25.25 on the low end to a bullish $36.75 on the high end. With the stock recently trading below $19, these targets imply that Wall Street expects a recovery or re-rating of the stock as fundamentals continue to stabilize.

💹 Analysts have been responding to a few key developments—first, the company’s strong earnings rebound, and second, its continued operational discipline amid softer industry demand. HVT’s focus on streamlining expenses and maintaining healthy margins even during flat revenue periods hasn’t gone unnoticed. While coverage is light compared to larger cap names, the signals from those watching closely point to a positive trajectory in both sentiment and valuation expectations.

Earnings Report Summary

A Stronger Bottom Line Despite Softer Sales

Haverty Furniture’s first-quarter 2025 results were a bit of a mixed bag, but with some standout positives. Earnings per share came in at $0.23, a solid improvement from $0.14 this time last year. That’s a 64% jump in profitability, even as sales slipped a little. Total revenue landed at $181.6 million, down about 1.3%, and comparable store sales were off by nearly 5%. Still, the company managed to hold the line where it really mattered—margins and costs.

Gross profit margins improved to 61.2%, a nice uptick from 60.3% the year before. That kind of gain doesn’t happen by accident. It points to smarter pricing and better control over expenses. On top of that, Havertys shaved $2.2 million off its selling and administrative expenses, which helped keep the earnings momentum going. The environment wasn’t easy—there were some unusually harsh winter weather events in the South, a housing market that hasn’t fully found its footing, and shaky consumer sentiment.

Leadership’s Take and What’s Ahead

CEO Steven Burdette didn’t sugarcoat the headwinds, but he also didn’t sound worried. He acknowledged the tough quarter, but leaned into the company’s long-standing ability to weather storms. With 140 years under its belt, Havertys has been through much worse. Burdette pointed to the company’s strong balance sheet as a key advantage moving forward.

Looking to the rest of the year, Havertys is planning to scale back capital expenditures a bit. They’re now targeting $24 million in spending, which is about $3 million less than earlier guidance. That reduction comes in response to the uncertainties around tariffs, which could impact product costs and supply chain planning. Despite that, the company still expects to grow retail square footage by around 2%, and they’re holding the line on gross margin guidance at 60.0% to 60.5%.

Cash remains a strong point, with $118.3 million on hand and no debt to speak of. That kind of financial position gives Havertys the flexibility to manage through market swings while continuing to reward shareholders. There’s no drama here—just a company quietly executing its plan, keeping costs tight, and staying focused on long-term performance.

Management Team

Haverty Furniture’s leadership is anchored by a team with decades of industry experience and a no-nonsense approach to growth. CEO Steven G. Burdette brings a practical, hands-on leadership style, shaped by years within the company. His focus is on improving operational efficiency, expanding the digital footprint, and keeping the customer experience front and center. He’s not chasing hype—his strategy is rooted in consistency and delivering value over the long haul.

Supporting Burdette is CFO Richard Hare, who’s helped keep Havertys financially sound by emphasizing cost control and clean accounting. The absence of long-term debt under his tenure speaks volumes about the company’s risk management philosophy. The executive team favors sustainable moves over flash, preferring to grow organically, maintain strong liquidity, and return capital to shareholders in measured ways.

Institutional ownership is high, and insiders still hold a meaningful stake. That kind of alignment between management and shareholders is increasingly rare, and it’s one of the reasons Havertys remains a favorite among long-term income investors who value stability and predictability.

Valuation and Stock Performance

Right now, Havertys is trading at valuation levels that would catch the attention of any value-focused investor. With the stock recently priced under $19, it’s hovering around 1.0 times book value and less than 0.5 times sales. Those are compelling figures, especially given the company’s consistent earnings and strong free cash flow. The trailing price-to-earnings ratio sits around 14.7, with the forward P/E a bit lower at 13.5. That suggests analysts expect continued earnings support, even without major growth.

In terms of price performance, the last twelve months have been tough. Shares have dropped about 35%, driven more by macro pressures than company-specific issues. The home furnishings sector, broadly speaking, has been weighed down by softer housing activity and inflationary pressures cutting into discretionary spending. Havertys hasn’t been immune, but it hasn’t stumbled operationally either.

Despite the drop in stock price, Havertys still delivers value through its dividend. A nearly 7% yield is hard to find these days, especially from a company with no debt and a solid history of consistent payouts. For investors looking past the short-term sentiment, the current valuation could be an entry point into a high-yield stock that isn’t fundamentally broken.

Risks and Considerations

There are certainly risks to be mindful of. The company’s fortunes are closely tied to the housing market. When home sales slow or consumer confidence dips, big-ticket items like furniture are often the first to feel it. This was evident in the most recent quarter, where sales declined despite solid execution.

Tariffs and global trade policies also pose a risk. Many of Havertys’ products or components are sourced internationally, and any shifts in trade regulations or costs can quickly squeeze margins. Management already signaled caution here by trimming capital expenditure plans due to uncertainty around tariffs.

The competitive landscape is also evolving. Traditional retailers now face pressure from digital-native furniture brands offering customization, fast shipping, and aggressive pricing. While Havertys has made strides with its online presence, staying competitive will require continued investment and adaptation.

Another factor is liquidity. Havertys’ stock doesn’t trade at high volumes, which can mean more pronounced price swings, especially on news or earnings releases. It’s something to keep in mind, particularly for larger investors or those who value smoother price action.

Final Thoughts

Havertys is a company that keeps things simple—and in today’s market, that’s not a bad thing. Sell a quality product, keep the balance sheet clean, and reward shareholders along the way. It’s a philosophy that’s worked for over a century, and one that’s allowed the company to quietly build a loyal customer base and a solid reputation.

Even with a softer sales environment, the company’s strong gross margins and disciplined expense control have allowed it to keep earnings intact. That’s a reflection of the leadership’s deep experience and cautious approach. There’s nothing flashy in how Havertys operates, but there’s a quiet confidence in the way it manages its business.

Right now, the dividend yield is one of the most attractive aspects of the stock, supported by solid free cash flow and a strong cash position. Investors who value income, along with a conservative management style, may find Havertys to be a compelling long-term hold.

As always, it’s not without its risks. The company will need to stay sharp in adapting to consumer trends and potential shifts in trade policy. But the fundamentals are there—strong leadership, healthy margins, a debt-free balance sheet, and a track record of returning value to shareholders. It’s a story of stability in a market that’s often anything but.