Key Takeaways

📈 Graco offers a forward dividend yield of 1.34% with over two decades of annual increases, supported by a low 36.75% payout ratio and consistent high single-digit growth.

💵 Strong operating cash flow of $628 million and free cash flow of $548 million in the trailing twelve months provide ample support for dividends and share repurchases.

📊 Analysts maintain a positive outlook with a consensus price target of $91.97, highlighting steady growth expectations and operational consistency.

Last Update 5/8/25

Graco Inc. (GGG) is a Minneapolis-based industrial manufacturer known for its fluid-handling systems used across construction, automotive, industrial, and semiconductor sectors. With a history dating back to 1926, the company blends consistent revenue growth with strong operating margins and minimal debt. Its presence in essential markets and steady cash flow generation make it a reliable performer through various economic cycles.

Dividend investors will find a lot to like here. Graco has a track record of over 20 years of consecutive dividend increases, a payout ratio under 40%, and growing free cash flow that supports continued shareholder returns. Backed by a management team focused on long-term value, the company maintains strong fundamentals and a disciplined approach to capital allocation.

Recent Events

Graco’s most recent quarter didn’t come with fireworks—and that’s just how this company likes it. On March 28, 2025, the fluid-handling equipment maker posted modest but steady growth. Revenue climbed 7.3% year-over-year, hitting $2.15 billion, and earnings nudged up to $2.83 per share. Nothing spectacular, but definitely consistent.

Margins continue to be a strength for Graco. The operating margin sits at an impressive 27.3%, and profit margin isn’t far behind at 22.7%. For a manufacturer, those numbers speak volumes about efficiency and pricing power. Even better, this kind of profitability is backed by a pristine balance sheet. Graco holds over $536 million in cash and carries just $50 million in debt, resulting in a low debt-to-equity ratio of 2.03%. The current ratio of 3.61 adds another layer of security.

This kind of financial discipline matters for dividend-focused investors. Graco isn’t the kind of business that overextends itself chasing fast growth. It leans on decades of operational strength and reinvests wisely without jeopardizing its shareholder return policies.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.34%

💰 Trailing Dividend Yield: 1.30%

🔁 5-Year Average Yield: 1.15%

📆 Recent Dividend Date: May 7, 2025

📉 Payout Ratio: 36.75%

📈 5-Year Dividend Growth Rate: High single digits

🏦 Cash Flow Coverage: Strong – supported by $419.7 million in levered free cash flow

Dividend Overview

Graco isn’t here to wow with eye-popping dividend yields. What it offers instead is a history of consistent and sustainable dividend payments—something every long-term income investor should appreciate. At a forward yield of 1.34%, Graco may not look overly generous, but the payout is reliable and growing.

This is a company that has increased its dividend every year for over 20 years. It’s part of Graco’s DNA—steadily reward shareholders while keeping the core business healthy. And with a payout ratio of just 36.75%, there’s plenty of cushion built in. The latest annual dividend stands at $1.10 per share, with the most recent payment going out on May 7.

One of the best parts? Graco doesn’t rely on borrowing to fund these distributions. Dividends come straight from cash flow, which remains solid year after year. That alone puts it ahead of many companies that use debt to maintain or increase their payouts.

Dividend Growth and Safety

When you look under the hood, the real appeal of Graco’s dividend comes from its dependability and growth potential. The company has steadily increased its dividend in the high single-digit range over the last five years—without compromising on financial strength.

The numbers tell the story. Graco generated over $628 million in operating cash flow and $420 million in levered free cash flow over the last twelve months. Compare that to the estimated $183 million in annual dividend payments, and it’s clear the dividend is well covered.

That margin of safety gives management flexibility. Whether it’s investing in new opportunities, riding out economic turbulence, or simply maintaining the status quo, there’s breathing room built into Graco’s dividend policy.

It also helps that Graco’s customer base is broad and entrenched. Their products are used across industries like automotive, aerospace, construction, and food processing. These systems aren’t easily swapped out or sidelined, which makes recurring demand a key strength.

Top it all off with a balance sheet that has more cash than debt and a shareholder base made up of 90% institutions, and you’ve got a setup where the dividend isn’t a risk—it’s a core part of the strategy.

Cash Flow Statement

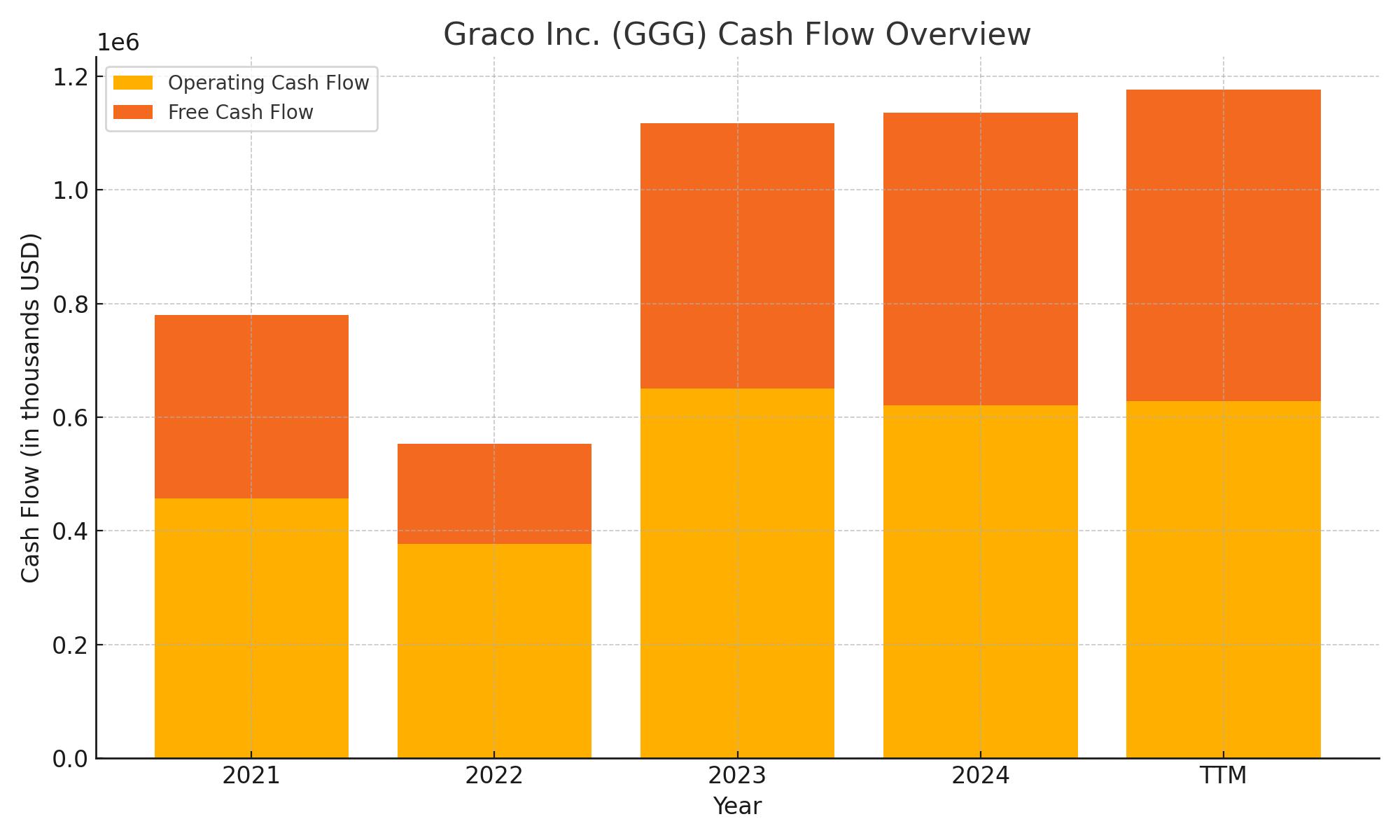

Graco’s cash flow profile over the trailing twelve months underscores its disciplined financial management and operational efficiency. Operating cash flow came in at $628 million, a slight increase from the prior year and evidence of consistent earnings conversion. Capital expenditures have moderated to $80 million, compared to more aggressive investments in previous years. As a result, free cash flow reached $548 million—an all-time high over the past five years—providing ample room to support dividends, share repurchases, and reinvestment initiatives.

On the financing side, outflows totaled $396 million, largely driven by $269 million in stock repurchases and sustained dividend payments. The company continued its strategy of avoiding new debt, with no issuances and minimal repayments, keeping its balance sheet flexible and low-risk. While cash at the end of the period dipped to $533 million from $675 million a year earlier, that decline is directly tied to returning capital to shareholders rather than operational stress. Overall, the cash flow statement reflects a mature company balancing growth, capital returns, and liquidity with confidence.

Analyst Ratings

Graco Inc. (GGG) has seen a few notable analyst calls lately, signaling a blend of steady confidence and tempered expectations. 🟢 RBC Capital kept its “Outperform” rating on the stock and nudged the price target higher from $93 to $97 earlier this year, pointing to strong confidence in Graco’s long-term fundamentals and market resilience. 🟡 Meanwhile, Baird maintained a “Neutral” view, trimming its target slightly from $88 to $85, reflecting a more cautious outlook as analysts wait to see how broader market conditions settle.

📊 The current consensus one-year price target stands at $91.97, based on a range of analyst projections that stretch from a conservative $81.10 to a more optimistic $110.25. With GGG trading around the low $80s, that consensus suggests modest upside potential if the company continues to deliver on margins and execution.

📈 Much of the positive sentiment is tied to Graco’s consistency—predictable margins, clean financials, and low debt. These are all qualities analysts tend to reward, especially in a shaky economic backdrop. But at the same time, there’s a sense of realism. Macroeconomic uncertainties and cyclical pressures in industrial demand are keeping some firms from turning overly bullish. Overall, analyst sentiment remains stable, with most viewing Graco as a reliable player in a volatile sector.

Earning Report Summary

Graco’s first-quarter results for 2025 showed the kind of quiet consistency that long-term investors appreciate. Revenue came in at $528.3 million, up 7% from the same quarter last year. That bump was fueled in part by some smart acquisitions and solid demand in both their Industrial and Expansion Markets segments. While the company isn’t seeing explosive growth, the progress was steady and well-balanced across regions and business lines.

Operating and Net Earnings

Operating earnings landed at $144 million for the quarter, which was an 8% jump year-over-year. Net income edged up 2% to $124.1 million, and earnings per share came in at $0.72, just a tick higher than the $0.71 posted a year ago. One of the few soft spots in the report was a bit of margin pressure. Gross margins dipped slightly—about two percentage points—mainly due to higher product costs and the mix of lower-margin businesses from recent acquisitions. Still, profitability remains strong.

Segment and Regional Performance

The Contractor segment was a standout this quarter, growing 11% to $255 million. The Industrial side added 3%, coming in at $231.7 million, while Expansion Markets saw a 12% jump to $41.6 million. Each of these segments contributed in their own way, with particularly strong showings in semiconductor and industrial applications. In terms of geography, Asia Pacific led with a 13% increase, EMEA followed with 9%, and the Americas added 5%. Currency fluctuations were a slight drag but didn’t meaningfully change the story.

Leadership Outlook

CEO Mark Sheahan described the quarter as another example of Graco’s ability to grow in a disciplined, focused way. He noted that organic growth in key markets continues to drive momentum and that recent acquisitions are integrating smoothly. He also acknowledged some headwinds, especially with tariffs and shifting trade policies related to China, which could impact revenue by a percent or two this year.

That said, the company is holding steady on its full-year guidance and expects low single-digit revenue growth for 2025 on an organic, constant-currency basis. Graco remains committed to investing in the business, keeping margins healthy, and delivering on long-term value. The tone from leadership was confident, not overly aggressive, but grounded in the kind of operational execution that’s become typical for the company.

Management Team

Graco’s leadership team brings a wealth of experience and a steady hand to the company’s operations. At the helm is Mark W. Sheahan, serving as President and CEO. With a strong background in finance and operations, Sheahan has been instrumental in steering Graco through various market cycles with a focus on long-term growth and operational excellence. Supporting him is David M. Lowe, the Chief Financial Officer and Treasurer, who ensures disciplined financial management and strategic capital allocation.

Angela F. Wordell, as Executive Vice President and Chief Operations and Supply Chain Officer, plays a key role in keeping Graco’s global operations running efficiently. Joseph J. Humke, Executive Vice President, General Counsel, and Corporate Secretary, oversees legal and regulatory affairs, guiding the company through a complex global compliance landscape. Kathryn L. Schoenrock, the Chief Information Officer, leads Graco’s technology transformation, helping to modernize systems and streamline operations.

The executive team also includes Inge Grasdal in Corporate Development and Laura Evanson as Chief Marketing Officer. Together, this leadership group is focused on driving innovation, expanding into new markets, and maintaining the company’s strong financial footing.

Valuation and Stock Performance

As of early May 2025, Graco shares are trading around $82 with a market capitalization near $13.7 billion. The stock’s valuation metrics suggest investor confidence in the company’s ability to deliver on its earnings potential. The trailing price-to-earnings ratio stands at 28.97, with a forward P/E of 27.78, indicating expectations of continued profitability.

Graco’s share price has moved within a 52-week range of $72.06 to $92.86. While the stock hasn’t dramatically outperformed the market, it has held up well in a choppy environment, thanks in part to consistent execution and strong fundamentals. The 50-day moving average sits slightly below the 200-day, reflecting some recent pressure but overall price stability.

Analysts currently peg the consensus price target at $91.97, suggesting a moderate upside from current levels. That figure reflects steady earnings projections and a view that Graco’s balance between organic growth and disciplined capital returns will continue to support long-term shareholder value.

Risks and Considerations

Despite its strong position, Graco does face several risks that investors should keep in mind. The company operates globally, and that comes with exposure to currency fluctuations and shifting trade dynamics. Tariffs and regulatory changes, particularly those related to operations in China, have the potential to affect supply chains and revenue performance.

Acquisitions are another part of Graco’s growth strategy, and while they’ve generally been successful, integration always carries some degree of uncertainty. Ensuring that new additions align with Graco’s operating model and culture is essential to maintaining its margins and efficiency.

The company also has to navigate raw material cost fluctuations, supply chain constraints, and demand volatility across industries like automotive, construction, and aerospace. These pressures can impact both top-line growth and margin stability, especially in more cyclical periods.

Final Thoughts

Graco has built a reputation for disciplined execution, smart capital allocation, and reliable performance. The management team remains focused on driving operational efficiency and long-term strategic growth. Even in a market filled with uncertainty, Graco’s combination of low debt, consistent cash flow, and targeted investments in innovation make it a company that stays the course.

For dividend-focused and long-term investors, it offers a mix of financial stability and growth potential without the rollercoaster ride of more volatile names. While risks remain, particularly tied to global operations and industrial cycles, the company has shown time and again that it can adapt, execute, and deliver.