Key Takeaways

💰 Gorman-Rupp offers a 2.02% forward dividend yield with over 50 consecutive years of increases, supported by a 43% payout ratio and steady dividend growth.

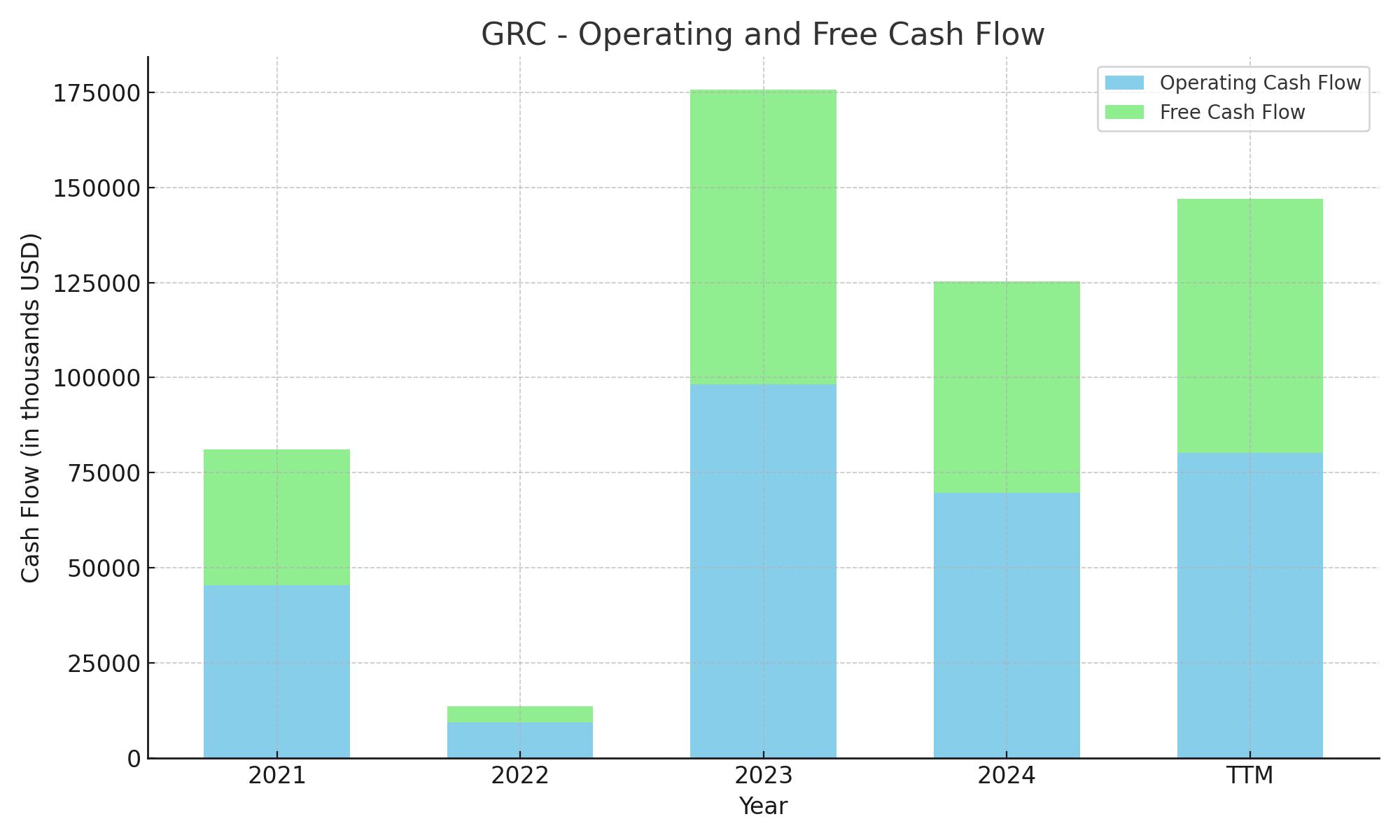

💵 Strong free cash flow of $66.8 million and operating cash flow of $80.2 million in the trailing 12 months indicate solid financial health and dividend coverage.

📊 Analysts have raised the average price target to $53.00, citing improved earnings, strong order flow, and growing confidence in the company’s long-term strategy.

Last Update 5/8/25

The Gorman-Rupp Company, trading under the ticker GRC, is a long-established industrial manufacturer focused on pump and fluid handling systems used across municipal, agricultural, and industrial sectors. Headquartered in Ohio and operating since 1933, the company generates over \$660 million in annual revenue and maintains a stable dividend, which it has increased annually for more than 50 consecutive years.

With a forward P/E of 18.4 and a dividend yield of just over 2%, GRC continues to appeal to long-term income investors. Its consistent earnings growth, strong operating cash flow, and prudent debt reduction efforts reflect a disciplined approach to both operations and capital allocation.

Recent Events

Gorman-Rupp’s first quarter results for 2025 didn’t break records, but they added another layer to its stable story. Revenue grew by nearly 3% year-over-year, and earnings were up sharply—jumping more than 50% over the same quarter last year. That kind of profit growth is rare in a company this size and points to real operational leverage.

Some of that lift is likely due to stronger demand from infrastructure projects and a pickup in the water and wastewater segments. This isn’t just random quarterly noise either. It’s a reminder that Gorman-Rupp benefits from long-term macro trends like water system upgrades and municipal spending.

The one cloud on the horizon? Debt. The company has a bit more leverage than it did in the past, with total debt now sitting at $353 million. But management hasn’t gone overboard. The current ratio is a healthy 2.42, and they’re still sitting on more than $21 million in cash. That gives them flexibility, and so far, there’s no reason to think they’ve stretched beyond their means.

From a valuation standpoint, the stock trades at just under 22 times trailing earnings, with the forward P/E dropping to around 18. That puts it squarely in the “fairly valued” camp for a high-quality industrial name. You’re not getting a bargain, but you’re getting a reliable company with solid fundamentals.

Key Dividend Metrics 📊💰🌱🛡️

📊 Yield: 2.02% (forward)

💰 Payout Ratio: 43.2%

🌱 5-Year Dividend Growth Rate: ~6.5% (est.)

🛡️ Dividend Streak: Over 50 years of annual increases

Dividend Overview

Let’s be clear—this is a dividend investor’s stock. Gorman-Rupp has paid dividends uninterrupted since 1961 and has raised them annually for more than 50 years. That puts it among the elite group of companies known as Dividend Kings. But what really stands out is how little drama there’s been over that stretch. No cuts, no freezes, just a slow, steady march higher.

The forward annual dividend sits at $0.74 per share, which gives you a yield just north of 2% at current prices. That’s in line with its five-year average, and while it’s not a sky-high yield, it’s comfortably above what you’ll find in most industrial names. The next payment is set for June 10, 2025, with the ex-dividend date coming up on May 15.

Unlike some companies that rely on financial engineering to support dividends, Gorman-Rupp pays out what it earns and reinvests the rest. The 43% payout ratio leaves plenty of breathing room. That matters because it means the company can keep hiking the dividend even in years when profits flatten out.

You also won’t see Gorman-Rupp throwing cash around with buybacks or flashy announcements. The playbook here is simple: build good products, run a lean operation, and reward shareholders. It’s not exciting—but it works.

Dividend Growth and Safety

One of the most important things for long-term dividend investors is not just how much you get paid today, but how much that payout can grow over time. Gorman-Rupp checks that box with quiet confidence. While the growth isn’t flashy, the company’s dividend has increased at a healthy mid-single-digit pace over the past five years. It’s the kind of consistency that, when compounded over decades, becomes very meaningful.

Safety is another big piece of the puzzle. And here again, Gorman-Rupp delivers. Free cash flow over the last twelve months came in at almost $64 million, easily covering the dividend. Even with higher debt levels than in previous years, the company isn’t stretching. The balance sheet is in solid shape, and management has shown time and again that they’re not going to jeopardize the dividend for short-term gain.

Also worth noting: Gorman-Rupp’s core business—things like water systems and municipal infrastructure—isn’t highly cyclical. That gives the company some cushion in economic slowdowns. People and cities still need clean water and functioning sewer systems, even during recessions.

That kind of stability, paired with careful financial management, makes the dividend not just appealing, but sustainable. And that’s ultimately what dividend-focused investors are after. Not the biggest yield. Not the fastest growth. Just a company you can count on.

Cash Flow Statement

Gorman-Rupp’s trailing 12-month cash flow profile shows a company generating healthy operating cash flow, with $80.2 million pulled in from its core operations. This marks an uptick from the prior year and reflects stronger earnings quality and working capital management. After accounting for $13.4 million in capital expenditures, free cash flow stood at $66.8 million—ample coverage for dividends and a comfortable buffer for internal reinvestment.

On the financing side, GRC has been actively deleveraging. Over the past year, it repaid $453.3 million in debt, a significant step that followed prior years of heavy borrowing, particularly around its acquisition activity in 2021. The cash burn from this repayment cycle led to a drawdown in cash reserves, which now sit at $22.5 million. Meanwhile, investing activity remains modest, signaling a focus on steady capex rather than expansionary moves. Overall, the cash flow picture highlights a return to disciplined balance sheet management and sustainable shareholder returns.

Analyst Ratings

📈 Gorman-Rupp has recently gained favorable attention from analysts following its solid first-quarter results. The company posted earnings per share of $0.46, exceeding expectations and signaling improved operational performance. This positive surprise encouraged analysts to revisit their forecasts and take a fresh look at the stock’s valuation.

💡 The average price target among covering analysts has now moved up to $53.00. That’s a meaningful increase from prior estimates and reflects a roughly 44% upside from the recent closing price of $36.63. It’s a clear sign that sentiment is shifting in a more optimistic direction.

🔍 Several factors are driving the upgrade momentum. First, the company’s continued growth in revenue and improved profitability show that management is executing well. Second, its focus on expanding into new end markets and upgrading product lines seems to be paying off, helping diversify revenue sources and reduce reliance on any one segment. Lastly, GRC’s strong cash flow generation and disciplined use of capital are reassuring, especially for long-term investors.

🛠️ Altogether, these analyst moves suggest growing confidence in Gorman-Rupp’s ability to keep delivering—not just operationally, but financially as well. That’s helped push expectations higher and placed a brighter spotlight on the company’s outlook going forward.

Earning Report Summary

A Strong Start to the Year

Gorman-Rupp kicked off 2025 with a solid first quarter, reporting $163.9 million in net sales. That’s a 2.9% jump compared to this time last year. The growth came mostly from increased demand in the municipal and repair markets, which benefited from ongoing infrastructure investment. There was also some strength in areas like OEM, petroleum, and fire suppression. Not every segment performed as well—construction, agriculture, and industrial markets saw some pullback—but the overall picture was positive.

Gross profit for the quarter came in at $50.3 million, with a gross margin of 30.7%, just a tick above last year’s 30.4%. Price increases helped offset higher labor and overhead costs. Operating income improved to $22.1 million, and net income jumped to $12.1 million, or $0.46 per share, up from $0.30 per share a year ago. Adjusted EBITDA reached $29.7 million, reflecting a year-over-year gain of over 5%. It was a clean, encouraging quarter across the board.

Debt Down, Cash Flow Up

One of the more notable highlights was Gorman-Rupp’s continued effort to bring down its debt. They knocked off another $14.6 million during the quarter, which helped bring interest expenses down from $10.1 million to $6.2 million. That’s real savings, and it shows up in improved net income and more breathing room for the balance sheet.

Cash flow from operations more than doubled, coming in at $21.1 million. That kind of growth is exactly what long-term investors like to see. It was driven by stronger net income and good management of working capital. On the capital spending side, they put $3.0 million to work, mostly for equipment upgrades. For the full year, they’re expecting to spend around $20 million.

Orders Remain Strong

Gorman-Rupp ended the quarter with a backlog of $217.8 million. That’s down a bit from the same time last year, but it’s an increase from the end of 2024. Orders for the quarter totaled $177.7 million—just slightly below the record set in Q1 of the prior year. All in all, the order book remains healthy.

Leadership Perspective

President and CEO Scott King sounded upbeat about the quarter and the path ahead. He pointed to strong order flow, especially in the municipal market, as a good sign for the rest of the year. The company is seeing steady demand for things like flood control and stormwater management—areas where their engineering strengths really stand out.

King also mentioned their ongoing work to manage tariff impacts, mainly through pricing adjustments and strategic supplier relationships. He emphasized a continued focus on profitability and disciplined growth, signaling that Gorman-Rupp isn’t just chasing revenue—it’s committed to long-term value.

Management Team

Gorman-Rupp’s leadership team combines deep operational knowledge with a steady hand on strategic direction. Leading the company is Scott A. King, who joined back in 2004. He started out on the operations side and worked his way up, eventually stepping into the role of President and CEO. King’s long tenure and wide-ranging experience give him an inside-out understanding of the business, which is evident in the company’s smooth execution and consistent performance.

Jeffrey S. Gorman currently serves as Executive Chairman, continuing a legacy of leadership that has helped shape Gorman-Rupp into the steady performer it is today. The broader executive team brings solid bench strength. James C. Kerr is the Executive Vice President and CFO, while Brigette A. Burnell serves as General Counsel and Corporate Secretary. Angela M. Morehead oversees treasury functions, Ronald F. Stoops leads finance, Barbara A. Woodman heads human resources, and D. Patrick Wischmeier handles IT strategy and systems. Together, they maintain the company’s long-standing focus on disciplined growth and operational soundness.

Valuation and Stock Performance

As of early May 2025, Gorman-Rupp trades at about $36.56 per share, giving it a market cap of just under $1 billion. The stock’s current P/E ratio sits around 21.6, a valuation that suggests investors are willing to pay a premium for the company’s reliable earnings and dividend profile. It’s not a flashy growth name, but it has carved out a reputation for resilience and stable returns.

Over the past year, the stock has moved up by just over 5 percent, slightly outperforming the S&P 500. That kind of performance reflects the market’s confidence in the company’s fundamentals. What stands out is the stock’s relatively low volatility. Weekly price movements have been modest, making it a name that attracts long-term investors who prefer predictability over drama. With a 2 percent dividend yield and a half-century streak of dividend increases, Gorman-Rupp offers a rare mix of income, dependability, and gradual capital appreciation.

Risks and Considerations

No company is risk-free, and Gorman-Rupp is no exception. One of the primary concerns is its exposure to economic cycles. A significant chunk of its revenue is tied to municipal spending, and if those budgets tighten, demand for pumping systems could slip. This could impact top-line growth in a downturn, especially if infrastructure spending is delayed or reprioritized.

Competition is another ongoing challenge. Gorman-Rupp faces a crowded field, and maintaining market share requires constant product improvement and pricing discipline. There’s also pressure from raw material and labor costs, which can compress margins if not managed carefully. Add to that the complexity of global operations, and the company must stay nimble to comply with varying regulations and standards across regions. Environmental, social, and governance factors are also becoming more significant. While Gorman-Rupp hasn’t had major controversies, its current ESG rating reflects an opportunity to strengthen efforts in sustainability and transparency.

Final Thoughts

Gorman-Rupp has earned its place as a steady performer in the industrial space. It’s not chasing fast growth or trying to make headlines. Instead, it delivers solid results, quarter after quarter, and continues to reward long-term shareholders with consistent dividend increases. The leadership team brings the kind of operational continuity and industry knowledge that keeps the business on track, even in turbulent markets.

For investors who value a business with roots, reliability, and a disciplined approach to growth, Gorman-Rupp checks a lot of boxes. Risks remain, as they do with any company, but its strong cash flow, conservative balance sheet, and focus on core markets provide a sense of stability that many income-focused portfolios are built around. It’s a quiet story, but one that speaks volumes to those listening for long-term value.