Key Takeaways

💸 The dividend yield sits at 2.94% with monthly payments, but the payout ratio over 125% signals limited room for growth and a need for close monitoring.

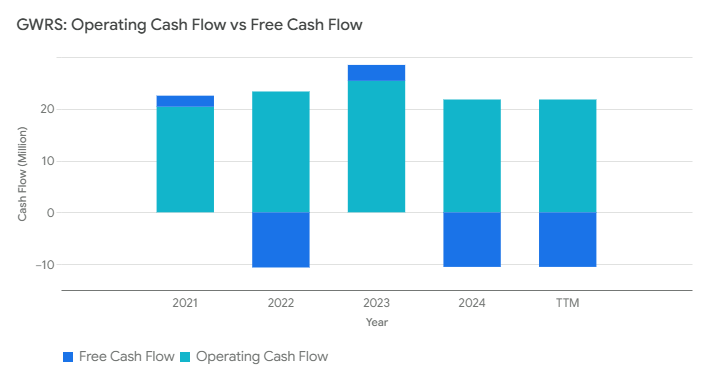

💰 Operating cash flow remains strong at $21.79 million, though heavy infrastructure spending pushed free cash flow into negative territory, raising some concerns about near-term financial flexibility.

📊 Analysts maintain a “Strong Buy” consensus with a $15.50 average price target, citing the company’s stable operations, consistent dividends, and long-term regional growth potential.

Last Update 5/7/25

Global Water Resources, Inc. provides regulated water, wastewater, and recycled water services across fast-growing Arizona communities, with a business model built on steady infrastructure investment and monthly dividend payouts. Its strategy centers on expanding service connections and maintaining operational efficiency in a capital-intensive, highly regulated environment.

With a consistent dividend, insider-aligned leadership, and active investment in system upgrades, GWRS appeals to long-term income investors. While the stock has faced recent valuation pressures and carries a high payout ratio and debt load, management remains focused on sustainable growth and navigating rate cases to support future earnings stability.

Recent Events

Over the past year, shares of GWRS have slipped nearly 19%, sliding from a high of nearly $14 to around $10.35. It’s not a collapse, but it’s been a noticeable drop that reflects broader headwinds in the utility space. Higher interest rates, regulatory delays, and growing infrastructure costs are taking a toll. For a small company like Global Water, those pressures are even more pronounced.

Earnings are down sharply, with year-over-year quarterly profit falling over 60%. That’s not ideal, and it’s not just a one-time issue. Rising costs and limited pricing flexibility are real challenges. But on the revenue side, things are more stable. Sales are up 7% year-over-year, a modest but welcome increase that shows demand for water services remains intact.

What raises some eyebrows is the company’s leverage. With total debt over $124 million and a debt-to-equity ratio above 260%, this is a highly leveraged business. The current ratio is below 1 as well, meaning short-term liquidity isn’t exactly flush. But that’s not entirely unusual in the utility world. Many of these businesses operate with significant debt because they invest heavily in infrastructure that pays back over decades. The key is whether they can service it—and for now, Global Water can.

Key Dividend Metrics

📅 Dividend Yield: 2.94%

💸 Forward Annual Dividend Rate: $0.30 per share

📈 5-Year Average Dividend Yield: 2.26%

⚖️ Payout Ratio: 125.61%

🗓️ Ex-Dividend Date: May 16, 2025

📆 Dividend Frequency: Monthly

Dividend Overview

For investors looking to smooth out their income stream, GWRS offers a rare benefit: monthly dividend payments. At just under 3%, the yield isn’t the highest you’ll find, but it’s steady and paid like clockwork. That’s something income-focused investors value more than flashy increases or special payouts.

The payout has remained at $0.0246 per share every month, without much movement. That lack of growth might turn off those seeking compounding dividend hikes, but for those who simply want reliable, regular income, it gets the job done.

There’s no getting around the fact that the payout ratio is high—well over 100%. That means the company is paying more in dividends than it’s making in net income. That kind of math doesn’t work forever, but for a utility, especially one with solid cash flows, it’s not an immediate red flag. Global Water has been using its operating cash to cover the dividend, and while free cash flow has dipped into negative territory recently, the company has kept those monthly payments coming.

One factor helping reinforce that commitment is insider ownership. Over half the shares are held by insiders, which often leads to a more cautious and shareholder-aligned approach to capital allocation. When the people running the business are collecting those same dividends every month, they’re more likely to maintain them.

Dividend Growth and Safety

When it comes to growth, this isn’t a dividend that’s going to increase every year. In fact, it hasn’t budged in quite some time. That might seem like a drawback, but it actually gives you a clear picture of what to expect—consistent, flat payouts rather than promises of future hikes that may not materialize.

As for the safety of the dividend, it’s a mixed bag. Operating cash flow is still healthy, coming in at over $21 million, which supports the payout for now. But there’s no cushion. Levered free cash flow is negative, and with that kind of payout ratio, the dividend is walking a bit of a tightrope. If costs go up further, or if new customer growth stalls, the company may have to make some hard choices.

That said, utilities tend to have a level of built-in stability. Rates are regulated, demand is consistent, and infrastructure, once in place, generates steady revenue. That makes the dividend feel more stable than the numbers might suggest. Still, it’s fair to say there’s very little room for error.

To truly improve dividend safety, GWRS would need to either grow earnings or start reducing debt. Neither is likely to happen overnight, but they’re both achievable goals over time. For now, the dividend remains intact, supported by cash flow and a management team that has made it clear where their priorities lie.

Cash Flow Statement

Global Water Resources generated $21.79 million in operating cash flow over the trailing twelve months, a solid showing that indicates the core utility business is still reliably producing income. While that’s a step down from the $25.39 million it delivered in 2023, the numbers remain consistent with past performance. Cash from operations is covering day-to-day needs, but it’s the capital spending that’s making the picture more complicated.

The company invested heavily this past year, with $32.32 million in capital expenditures, pushing free cash flow into the red at -$10.54 million. That shortfall has been largely offset by financing activity, including $22.36 million in new debt issuance, which helped fund operations and investments. After debt repayments and interest, Global Water ended the period with $11.16 million in cash, up significantly from $4.76 million the year before. The business is clearly leaning on debt to support infrastructure buildout while maintaining its dividend, and for now, cash levels are being sustained despite the negative free cash flow.

Analyst Ratings

📊 Global Water Resources (GWRS) currently holds a consensus rating of “Strong Buy” from the two analysts who actively cover the stock. 🛒 Both have issued bullish outlooks, indicating confidence in the company’s long-term strategy and dependable revenue model. 🔄

🎯 The average 12-month price target is $15.50, pointing to a potential upside of roughly 49% from the current trading level of $10.35. Price targets among analysts range from $13.00 on the low end to as high as $18.00, signaling a shared belief that the stock is undervalued at its present price. 📈

💼 One firm recently initiated coverage with a “Buy” rating and a $17 price target, citing the company’s disciplined operational model and strong customer growth in key Arizona markets. Another firm reaffirmed their “Buy” rating and nudged their target up from $19 to $21, highlighting the long-term benefits of GWRS’s acquisition strategy and infrastructure investments. 🔧

💰 These upgrades are being fueled by the company’s consistency in dividend payments, forward-looking capital plans, and the positive impact of rate adjustments. The outlook also reflects optimism around GWRS’s ability to expand its customer base and strengthen cash flows through a combination of regulated returns and measured debt management. 🏗️📥

Earnings Report Summary

Solid Operational Progress Despite a Few Setbacks

Global Water Resources wrapped up 2024 with a mixed bag of results. On one hand, the company continued to see steady operational growth—active service connections rose by 4.4%, pushing the total to 64,520. That was supported by a modest increase in water consumption, which ticked up by 3.3%. Regulated revenue was up 4.9%, driven by this growth in customer base and usage.

But not everything was moving in the right direction. Total revenue actually dipped slightly, down 0.6% compared to the previous year. The main reason for that drop was the lack of one-time, non-regulated revenues that gave 2023 a bit of a lift. Without those, the top line came in a bit softer, even though the underlying operations looked pretty healthy.

Profit Decline, But Adjusted Results More Stable

The bottom line told a similar story. Net income fell to $5.8 million, or 24 cents per share—down from 33 cents the year before. That drop raised a few eyebrows, but again, it was more about year-over-year comparisons than a fundamental decline in business strength. When you strip out some of the noise, adjusted net income actually nudged up 2%, and adjusted EBITDA grew over 5% to $26.7 million.

Leadership pointed to these adjusted figures as a better reflection of the company’s ongoing performance. They also highlighted continued investment in infrastructure, with $32.3 million spent in 2024 to support long-term growth. These projects aren’t cheap, but they’re essential for expanding service areas and maintaining high standards.

Dividend Growth and Looking Ahead

On the dividend front, shareholders got a small but welcome boost. The annualized payout was increased to just over 30 cents per share, with the first higher payment landing in December. That kind of consistency is what many investors look for in a utility stock like this.

Looking forward, the company’s leadership signaled plans to stay on offense. A new rate case has been filed for two of its key utilities, aiming for an additional $6.5 million in annual revenue. They’re also expanding their footprint through acquisition—adding seven water systems from the City of Tucson, which should bring in around 2,200 new connections.

There was also a leadership update worth noting. Robert J. Kuta joined the executive team to lead engineering and environmental initiatives, bringing a fresh focus to infrastructure strategy and sustainability.

While 2024 wasn’t a blockbuster year, it was one where the foundation was clearly being reinforced. The company is staying focused on long-term growth, regulatory alignment, and stable returns, even as near-term profits faced some pressure. For a small utility player, the commitment to both service and shareholders remains front and center.

Management Team

Global Water Resources has long positioned itself as a company with a steady hand at the wheel, and that reputation starts at the top. The leadership team brings a mix of operational experience and a focus on disciplined growth, which is crucial in the highly regulated utility space. CEO and Chairman Ron Fleming has been with the company in various roles for over a decade, and under his leadership, GWRS has developed a strategy centered around “Total Water Management”—a model that emphasizes conservation, efficiency, and sustainability.

One of the more notable updates recently was the appointment of Robert J. Kuta as Executive Vice President of Engineering and Environmental Resources. His background brings deep technical and environmental insight, which aligns well with the company’s growing emphasis on infrastructure renewal and environmental compliance. It’s a forward-thinking move, given the increasing importance of sustainability and regulatory scrutiny in the water sector.

This is a team that tends to avoid over-promising. Instead, they focus on consistent delivery and building the business through measured expansion. The tone from leadership has remained optimistic but realistic, acknowledging near-term headwinds while pointing toward a path of stable growth. Their communication with investors reflects a clear understanding of the long game, especially in a business as capital-intensive and regulated as water utilities.

Valuation and Stock Performance

From a valuation standpoint, GWRS doesn’t look cheap in the traditional sense. The stock is trading at over 43 times trailing earnings, and the forward P/E ratio isn’t much lower. That might raise eyebrows, especially for investors used to seeing utilities trade at more modest multiples. But it’s worth noting that GWRS isn’t your typical utility. Its growth potential, particularly through service expansion and acquisitions in fast-growing Arizona regions, gives it a different kind of appeal.

Enterprise Value to EBITDA sits around 14.8x, which puts it in the upper range for the utility sector. Price-to-book is close to 6, a premium compared to larger peers. But again, much of this valuation reflects investor confidence in its ability to grow both organically and through M&A, while continuing to return cash to shareholders via a reliable monthly dividend.

The stock itself has had a rough stretch over the past year, down nearly 19 percent from its 52-week high of $13.98. It’s now hovering around $10.35. For some, that pullback may represent a valuation reset; for others, it’s a reaction to rising interest rates and softening profitability. It’s important to remember, though, that utility stocks tend to attract long-term capital. Their role in portfolios is more about stability and income than rapid price appreciation. In that context, GWRS still holds a place, especially for dividend-focused investors who value the predictability of a monthly payout.

Risks and Considerations

Despite the stability often associated with utility stocks, there are a few real risks that come with owning GWRS. First and foremost is the leverage. The company’s debt-to-equity ratio stands north of 260 percent, which is significant. While debt is a normal part of financing infrastructure in the utility world, it does limit flexibility—particularly when interest rates are high. With levered free cash flow running negative and capital expenditures still rising, there isn’t much breathing room.

Another concern is the payout ratio. At over 125 percent, it’s clear that earnings alone aren’t covering the dividend. That’s not necessarily a red flag in isolation, especially with healthy operating cash flow, but it does mean that any dip in performance or unexpected expense could test the company’s commitment to maintaining that monthly check to shareholders.

Regulatory lag is another factor. Utilities must often wait months, if not years, to see rate increases approved and implemented. In the meantime, costs can rise faster than revenues, putting pressure on margins. While the company has filed a new rate case, there’s no guarantee of timing or approval of the full requested amount.

There’s also the geographic concentration risk. GWRS operates exclusively in Arizona, which, while a growth market, does bring exposure to regional economic conditions, drought regulations, and local politics. Any disruption in this core area could have an outsized impact on the company’s performance.

Lastly, while the acquisition of new water systems adds customers, it also brings integration challenges and upfront costs. These systems may need upgrades, and the company must ensure that service standards and regulatory compliance are maintained across a growing network.

Final Thoughts

Global Water Resources offers something relatively unique for income-oriented investors—a small, focused utility with a reliable monthly dividend, a growth-minded leadership team, and a footprint in one of the country’s most dynamic states. The model is simple, but its execution has been disciplined. The company doesn’t overextend, doesn’t chase risky expansion, and continues to reinvest in its infrastructure.

Yes, there are pressures. The payout ratio is high. The debt load is considerable. And recent earnings haven’t shown much upward momentum. But that’s the nature of a regulated utility—stable, slow, and methodical. This isn’t the kind of stock that’s going to deliver flashy returns, but it’s not trying to.

What you get here is consistency. Even when net income falters, the company continues to make capital investments, integrate new systems, and pay that monthly dividend without skipping a beat. The management team is clear in its direction and open about the headwinds. They aren’t promising the moon, but they are focused on building long-term value.

For dividend-focused investors, especially those who appreciate the rhythm of monthly payments and a steady hand at the helm, Global Water Resources fits the bill. It’s a measured play in a space that matters every single day—delivering clean, reliable water to homes and businesses in a growing region. The growth may be slow, but it’s intentional, and for many long-term investors, that’s exactly what they’re looking for.