Key Takeaways

📈 GIC offers a forward dividend yield of 4.10% with a steady payout ratio of 63.92%, backed by consistent dividend growth and strong coverage through free cash flow.

💵 The company generated $47.7 million in operating cash flow and $45 million in free cash flow over the past 12 months, with low capital spending and a solid cash position of $39 million.

🧐 Analysts maintain a “Hold” rating with a consensus price target of $38, reflecting cautious optimism driven by stable earnings and margin performance despite modest revenue declines.

Last Update 5/7/25

Global Industrial Company (GIC) delivers essential MRO products to businesses and government clients with consistency and discipline. Backed by a leadership team with deep operational expertise and high insider ownership, the company focuses on margin strength, free cash flow, and shareholder alignment.

With a forward dividend yield over 4%, a payout ratio below 65%, and a clean balance sheet, GIC stands out as a reliable dividend payer. Despite recent revenue softness and tariff headwinds, it continues to protect earnings and maintain financial flexibility, offering a steady profile for income-focused investors.

Recent Events

Over the past year, GIC’s stock has taken a bit of a tumble — down nearly 28% from its 52-week high of $36.17 to around $25 now. That might raise eyebrows, but it’s also opened up a higher yield for new investors, and the core business remains intact.

The company’s latest quarterly update showed a minor drop in revenue, down 0.7% year-over-year. But despite that softness, GIC still managed to post a 3% gain in earnings. That’s no small feat in this environment and speaks to their cost controls and margin focus.

What really stands out is their cash flow. Over the last 12 months, GIC pulled in nearly $48 million in operating cash flow and kept over $36 million of that as levered free cash flow. That’s healthy. Their balance sheet is also in good shape, with $39 million in cash and a debt-to-equity ratio just under 28%. In other words, they’re not overextended, and they have room to breathe.

Key Dividend Metrics

💰 Dividend Yield: 4.10% (forward)

📈 5-Year Average Yield: 2.39%

📅 Next Ex-Dividend Date: May 12, 2025

💸 Payout Ratio: 63.92%

📆 Dividend Date: May 19, 2025

🏦 Cash Flow Coverage: Strong, with $36.9M in free cash flow

🧾 Annual Dividend Rate: $1.04 (forward)

📉 Stock Price Performance: Down ~27% over the past year

Dividend Overview

Right now, GIC is offering a forward dividend yield of 4.10%, which is a big step up from its five-year average. That kind of jump is mostly due to the drop in share price, not an aggressive dividend bump — and that makes it interesting. For income investors, the math just got a little more favorable without the company having to stretch to deliver it.

The payout ratio sits at just under 64%, which is quite reasonable. They’re paying out a little more than half of what they earn — a middle-of-the-road approach that gives shareholders a meaningful income stream without hamstringing the business. It’s a signal that the company is prioritizing consistent returns but still has room to invest internally.

Perhaps more important than the earnings payout is how the dividend looks against free cash flow. GIC is comfortably covering its dividend with actual cash, not just paper profits. That’s a critical factor for long-term sustainability and something dividend-focused investors should always look for.

Dividend Growth and Safety

GIC’s dividend growth hasn’t been flashy, but it has been thoughtful. This isn’t a company that’s trying to impress Wall Street with big hikes. Instead, it’s focused on keeping the dividend well within its means while continuing to grow steadily.

Over the past couple of years, dividend increases have been modest but consistent. And with free cash flow this healthy, there’s every reason to believe that the company can keep raising its payout in the years to come — as long as it maintains its current pace of cash generation.

There are a few things that stand out when it comes to the safety of this dividend:

- The company has a solid balance sheet. Debt is low, liquidity is strong, and the current ratio sits above 2. That means short-term obligations are easily covered.

- Cash flow is predictable. GIC sells the kind of essential supplies that businesses need on an ongoing basis. That gives them a dependable revenue stream, even if the economy slows.

- Insider ownership is high. Over 52% of the company is held by insiders. That kind of alignment tends to favor careful capital management — and that’s what dividend investors like to see.

- The stock has a low beta, around 0.79, which means it’s generally less volatile than the broader market. That adds a layer of comfort for income investors who prefer stability to speculation.

GIC’s approach to dividends is refreshingly straightforward: generate solid free cash flow, cover the dividend with room to spare, and raise the payout when it makes sense. For those looking to add a dependable income stream to their portfolio, this company quietly checks a lot of boxes.

Cash Flow Statement

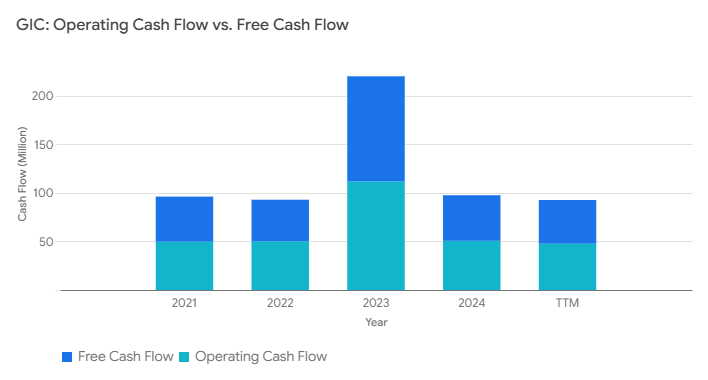

Over the trailing twelve months, Global Industrial Company (GIC) generated $47.7 million in operating cash flow, a modest decrease from $50.7 million in 2024 but still a strong figure relative to the company’s size. Free cash flow came in at $45 million, reflecting minimal capital expenditure needs at just $2.7 million. This signals that GIC is highly efficient in converting its operations into usable cash, even as its top-line revenue growth has softened.

On the financing side, the company continued to return cash to shareholders and reduce liabilities. Financing cash flow totaled -$35.9 million, a sign of steady dividend payouts and limited reliance on new debt. Despite these outflows, GIC’s cash position actually improved over the years, ending at $39 million — nearly tripling from 2021 levels. Investing activity was minimal, with just $2.7 million in outflows, reinforcing the conservative capital approach management has taken. Overall, the cash flow profile remains healthy and supportive of ongoing dividends.

Analyst Ratings

Global Industrial Company (GIC) currently holds a consensus analyst rating of “Hold.” 🟡 The average price target sits around $38.00, which suggests a potential upside of close to 58% from its current trading level. 📈 That kind of gap between the market price and target price often signals undervaluation, but the hold rating shows that analysts are still cautious.

After the company reported quarterly earnings that came in ahead of expectations — with revenue of $321 million and EPS at $0.35 — most analysts chose to maintain their existing ratings and targets. ✅ The general sentiment is that the strong financials are already priced into the stock, especially considering its recent price dip and current yield attractiveness.

No major firm has recently upgraded or downgraded GIC, but the market is watching for signals. Analysts appear to be looking for either a stronger growth catalyst or more evidence of sustained operational gains before moving their ratings off neutral. 🕵️ That said, the upside baked into the consensus target could catch more attention if fundamentals continue to hold steady or improve.

In the meantime, GIC is holding ground as a dependable mid-cap with income appeal, while the analyst community waits for clearer direction.

Earning Report Summary

Modest Dip in Revenue, Stronger Margins

Global Industrial Company’s latest earnings gave a snapshot of a business that, while facing some headwinds, is still managing to push forward. For the first quarter of 2025, revenue came in at $321 million, which was just a touch below last year’s mark—a 0.7% drop. But rather than letting that minor decline define the quarter, the company managed to widen its margins and improve profitability.

Gross profit landed at $112.1 million, and margins expanded to 34.9%, slightly up from the 34.3% posted a year ago. Operating income ticked up as well, hitting $18.2 million for the quarter. Net income came in at $13.5 million, or about 35 cents per share. These results show that while top-line growth paused briefly, the company was more efficient in how it managed costs and executed its operations.

CEO Commentary and Business Direction

CEO Anesa Chaibi spoke to the dynamics behind the numbers. January started slower than expected, partly due to how the New Year’s holiday fell mid-week, which impacted early-month order volume. But things turned around as the quarter progressed, with March seeing a rebound that helped offset the slow start. She pointed out that growth in the Indoff segment and momentum in strategic accounts helped balance out the softness elsewhere.

One issue hanging over the quarter—and likely beyond—is the impact of new tariffs implemented in April. These have created some challenges in the supply chain, affecting both product availability and pricing. Leadership made it clear that they’re actively working with suppliers to stay ahead of the curve. The company’s priority is to provide customers with clarity and consistent service, even as conditions shift.

Financial Position Remains Solid

Despite these operational pressures, GIC remains in a strong financial position. The company ended the quarter with $39 million in cash and access to over $120 million through its credit facility. That flexibility gives them room to navigate uncertainty while continuing to invest where needed. Whether it’s expanding product lines, improving tech infrastructure, or shoring up supply chains, GIC has the financial muscle to keep moving forward.

While the revenue line might not have impressed on the surface, the underlying improvements in profit margins and leadership’s steady approach to supply chain challenges give a clearer picture of where things are heading. It’s not just about reacting to short-term shifts—it’s about keeping the business well-positioned for the long term.

Management Team

Global Industrial Company’s leadership team runs a tight, focused operation centered on efficiency and steady growth. Leading the charge is Anesa Chaibi, whose background in the industrial and distribution space is evident in the way she guides the business. Since taking over as CEO, she’s emphasized operational strength, digital transformation, and customer-centric service—priorities that have shaped the company’s recent progress.

Chaibi is known for her execution-driven approach. During her tenure, GIC has improved its gross margins, navigated supply challenges with relative ease, and delivered consistent profitability. She’s backed by a streamlined team that includes an experienced CFO and a leadership group focused on distribution, technology, and customer solutions. Rather than chasing scale for the sake of it, they’ve taken a measured route that supports sustainable growth.

Perhaps most important for investors is how aligned this leadership team is with shareholder interests. With more than half of the company’s shares held by insiders, there’s a real sense that management’s goals are tied directly to long-term shareholder value. That kind of alignment often encourages conservative capital allocation and careful planning—both of which GIC has shown through its dividend policy and cash flow management.

Valuation and Stock Performance

Global Industrial’s stock has taken a hit over the past year, down nearly 28% from its high of $36.17. At today’s level around $25, the valuation has become more reasonable, especially when considering its consistent profitability and growing free cash flow. The trailing P/E ratio is hovering around 16, with forward estimates pushing that closer to 17. While those numbers don’t scream “cheap,” they reflect a fairly priced industrial business with a solid income stream.

The stock’s underperformance can be linked to investor concerns about short-term revenue softness and broader market caution toward smaller industrial players. Still, GIC has done something many of its peers struggle with: holding margins steady despite topline pressure. Its earnings haven’t collapsed with revenue, and that’s a sign of operational strength, not weakness.

For dividend-focused investors, the silver lining in the stock’s pullback is the resulting yield. With a forward dividend yield above 4 percent and free cash flow comfortably covering that payout, the income stream is not only attractive but sustainable. Analyst targets for the stock sit around $38, implying room for upside if sentiment shifts or results surprise to the upside.

GIC’s beta sits at 0.79, meaning the stock is less volatile than the broader market. That lines up with what it is—a slow-moving, cash-generating business that doesn’t rely on big swings to create value. It’s not built for drama; it’s built for consistency.

Risks and Considerations

Tariffs are front and center right now for GIC. New policies introduced in April are creating headaches across the supply chain, with price adjustments and availability issues affecting both vendors and customers. While the company is working hard to adapt, there’s no getting around the fact that tariffs could add pressure to margins in the near term.

Another thing to keep an eye on is revenue growth. GIC has proven it can protect earnings without top-line expansion, but eventually the market will want to see both. Strategic accounts and acquisitions have helped, but longer-term growth will need to come from expanding wallet share, adding new customers, or pushing into new categories.

Customer demand is also cyclical in some segments. If industrial activity slows or business investment softens, GIC’s order volume could feel it. So far, they’ve been able to smooth these out, but the potential for reduced customer spending always lingers, especially in uncertain economic climates.

Input costs and labor inflation are additional concerns. Although the company has done well managing through those challenges, any sharp spikes could hit margins quickly. That’s especially true for a business built on distribution and fulfillment, where cost control is key to maintaining profitability.

Lastly, the high insider ownership, while generally positive, does limit float and can affect trading liquidity. For most retail investors, that won’t be a problem, but it’s something to keep in mind when evaluating long-term investor interest and volume trends.

Final Thoughts

Global Industrial Company is the kind of stock that might not command attention in daily financial headlines, but it earns its keep quietly and consistently. It provides essential products to businesses that rely on reliable supply partners, and its operations reflect a disciplined, no-frills strategy that works.

The dividend stands out as one of its core strengths. It’s well-funded by free cash flow, regularly paid, and has room to grow if earnings continue on their current trajectory. Leadership clearly takes a measured view of capital allocation, choosing long-term health over short-term pops.

Recent stock weakness has made the valuation more approachable, and for investors who care about income, that sets up a more compelling yield than in years past. Risks remain, especially around tariffs and macro shifts, but the company’s solid foundation helps offset many of those concerns.

Global Industrial may not aim to be the biggest name in its space, but it’s aiming to be one of the most consistent. That focus, combined with shareholder alignment, makes it an interesting name for long-term investors seeking reliable income and steady performance.