Key Takeaways

📉 GFL’s dividend yield is modest at 0.12%, but it’s fully covered by free cash flow and signals potential for growth as the company matures.

💵 Operating cash flow reached $1.45 billion in the trailing twelve months, with positive free cash flow of $239 million, supporting ongoing investments and shareholder returns.

📊 Analysts maintain a positive outlook, with recent price target increases up to $56, reflecting confidence in GFL’s balance sheet improvements and strategic direction.

Last Update 5/7/25

GFL Environmental Inc. is a major player in the North American environmental services industry, offering a mix of solid and liquid waste management and infrastructure services across Canada and the U.S. Led by founder and CEO Patrick Dovigi, the company has grown rapidly through acquisitions and operational scale, with a clear focus on long-term expansion.

Backed by strong revenue growth, improving margins, and disciplined capital management, GFL is steadily transitioning from a growth-heavy model to one focused on efficiency and shareholder returns. Its rising cash flow, active deleveraging, and renewed share repurchase program signal a more mature phase taking shape.

Recent Events

GFL has had an active stretch lately, both operationally and in the markets. The company’s revenue is nearing $8 billion on a trailing twelve-month basis, growing about 9% year-over-year. That growth has come from a blend of acquisitions and organic pricing gains. But it’s not all smooth sailing. Net losses remain significant, with a trailing loss of over $800 million. That’s largely due to heavy non-cash expenses like depreciation and interest payments, which are the byproduct of a debt-fueled expansion strategy.

Debt remains a major feature of the balance sheet. Total liabilities top $7.4 billion, leading to a debt-to-equity ratio north of 90%. Profitability metrics like return on assets (1.6%) and return on equity (-9.6%) still show strain, but there’s also strong cash generation. Operating cash flow is solid at $1.45 billion, and levered free cash flow comes in at $860 million—enough to give some breathing room when it comes to shareholder returns.

The stock itself has had a good run. It’s currently trading just under its 52-week high, well above both its 50-day and 200-day moving averages. That kind of momentum often draws interest, even from income-focused investors who typically prefer slow-and-steady over high flyers.

Key Dividend Metrics 📊

📈 Forward Yield: 0.12%

💵 Forward Annual Dividend Rate: $0.06

🔁 Dividend Frequency: Quarterly

🔒 Payout Ratio: 53.1%

🕐 5-Year Average Yield: 0.13%

💰 Last Dividend Paid: April 30, 2025

📅 Ex-Dividend Date: April 14, 2025

Dividend Overview

Let’s be honest—GFL isn’t turning heads with its dividend yield. At just 0.12%, it’s one of the smaller payouts in the market. But even a small dividend carries meaning. In this case, it signals the company’s intent to start building a track record of returning cash to shareholders, even as it prioritizes growth.

The current payout stands at six cents per share annually, spread over quarterly installments. It’s a modest amount, but it’s notable that GFL continues to maintain it despite posting net losses. The company’s management appears committed to offering at least a symbolic return to shareholders while preserving the flexibility needed to fund growth and manage debt.

For long-term dividend investors, especially those with an appetite for companies still in the building phase, that commitment could prove important. The question isn’t whether GFL is a high-yield stock today—it’s whether it has the foundation to become one in the future.

Dividend Growth and Safety

Right now, there’s no real history of dividend growth from GFL. It’s a young public company, and the payout has been flat. That said, the dividend appears relatively safe in the short term. Despite the losses on paper, the company generates ample cash from operations. The $860 million in levered free cash flow covers the current dividend many times over.

But there’s a trade-off. GFL’s balance sheet is heavy with debt, and the current ratio under 1.0 signals some pressure on liquidity. In a rising interest rate environment or during any slowdown in waste collection volumes, the company could feel a pinch. While the dividend could be sustained, investors shouldn’t expect major increases until the company reduces leverage or sees a meaningful uptick in profitability.

Still, the potential is there. Waste management is a sticky business with high recurring revenue and strong pricing power. As GFL integrates its acquisitions and benefits from economies of scale, margins could improve—and that’s when real dividend growth might begin.

For now, GFL’s dividend story is one of patience. This isn’t a stock for yield chasers, but for those willing to wait, it could turn into a compelling long-term play. The small payout today might be a placeholder for something more meaningful down the road.

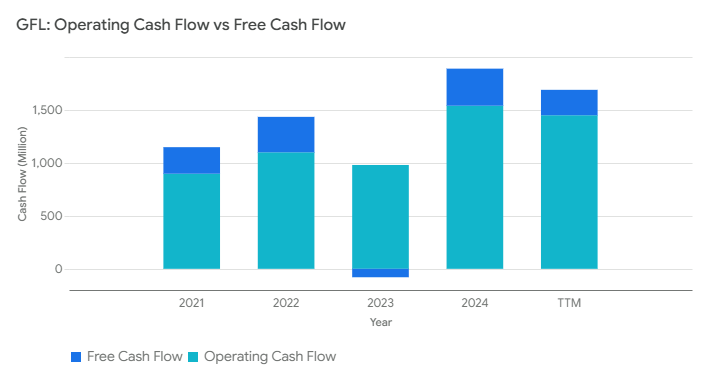

Cash Flow Statement

GFL Environmental’s cash flow profile over the trailing twelve months shows strong operational fundamentals paired with significant capital deployment. The company generated $1.45 billion in operating cash flow, reflecting its stable and recurring revenue base. However, free cash flow came in at $239.2 million, a noticeable drop from the prior year. This compression stems from heavy capital expenditures, which totaled $1.21 billion, consistent with the company’s strategy of aggressive reinvestment into its asset base and expansion projects.

On the financing side, the activity has been intense. GFL issued $3.37 billion in new debt but repaid an even larger $6.26 billion, resulting in a net financing cash outflow of over $5 billion. This deleveraging effort stands out, as it coincides with a sharply improved year-end cash position of $547.1 million—up more than fourfold from the prior year. The combination of rising operating cash and selective financing activity suggests a company actively managing its capital structure while staying committed to infrastructure growth.

Analyst Ratings

GFL Environmental has recently garnered positive attention from analysts, reflecting growing confidence in the company’s strategic direction. 📈 Scotiabank’s analyst maintained a “Sector Outperform” rating and raised the price target from $54 to $56, pointing to the company’s solid execution and favorable market positioning. 🟢 Similarly, RBC Capital Markets upped its target from $53 to $56 while keeping an “Outperform” rating. This highlights continued belief in GFL’s operational momentum and potential for upside.

💬 The general consensus among analysts shows a moderate upward bias for the stock. The average 12-month price target hovers around $54.14, with projections ranging from $42 on the low end to as high as $58. This spread signals a degree of cautious optimism—while there’s recognition of near-term challenges, the longer-term growth narrative appears intact.

📊 Recent strategic moves are helping fuel this outlook. GFL’s decision to divest its hazardous waste unit has been well received, especially with plans to use the proceeds for debt reduction and potential share buybacks. Moves like these can improve the company’s financial profile, lower leverage, and ultimately make the equity more attractive to both institutional and retail investors. 🪙

Overall, the latest wave of analyst sentiment paints a picture of a company that’s earning greater credibility in the market, with upgrades and raised targets reflecting belief in GFL’s ability to manage growth while strengthening its balance sheet.

Earnings Report Summary

Strong Top-Line Growth with Margin Expansion

GFL Environmental kicked off 2025 with a solid first quarter, showing real progress on both revenue and efficiency. Revenue climbed 12.5% year-over-year to hit $1.56 billion, thanks to stronger pricing, a steady rise in volumes, and contributions from recent acquisitions. The company also tightened up its operations, expanding adjusted EBITDA margins by 120 basis points to reach 27.3%. That kind of margin improvement is a good sign, especially in a business that requires scale to thrive.

Despite the top-line growth, the company still reported a net loss from continuing operations of $213.9 million. That’s a bit wider than the $195.8 million loss from the same quarter a year ago. That said, the adjusted net loss was smaller, at $34.5 million. So, while GFL isn’t quite out of the woods on profitability, it is making some headway on the efficiency front.

Leadership Confident in Strategy and Direction

CEO Patrick Dovigi had a confident tone when discussing the quarter, pointing to the strong results as validation that the company is moving in the right direction. He was particularly upbeat about the sale of GFL’s Environmental Services segment. That sale helped knock down the company’s net leverage to 3.1 times EBITDA, the lowest level in GFL’s history. Lower debt opens up more room for flexibility—whether that’s growth through acquisitions or simply giving the balance sheet some breathing room.

Another move that stood out this quarter was the company restarting its share buyback program. GFL repurchased 31.7 million shares, a clear sign that leadership sees value in the stock and is committed to rewarding shareholders. While those buybacks are encouraging, free cash flow did take a dip, falling to $13.7 million from $16.4 million a year earlier. That drop was mainly due to higher capital spending and investments in working capital—typical for a company still investing heavily in growth.

Looking Ahead with Solid Foundations

The market didn’t cheer the earnings release right away—shares slipped in after-hours trading—but the fundamentals tell a more encouraging story. GFL is sharpening its focus, cleaning up its balance sheet, and putting itself in a position to grow without overstretching. That’s not a quick fix, but for long-term investors, especially those watching the company’s evolution into a more mature, cash-generating operation, the pieces are starting to fall into place.

All in all, the first quarter of 2025 showed that GFL is still in building mode, but it’s doing so with a clearer sense of direction and a stronger financial base than it’s had in the past.

Management Team

GFL Environmental is led by founder and CEO Patrick Dovigi, who has been instrumental in shaping the company’s bold and fast-paced growth strategy. Since starting the business, Dovigi has pushed a clear vision: build a vertically integrated environmental services company capable of competing at the top tier of North America’s waste and recycling sector. His leadership style is entrepreneurial and direct, and that’s translated into a strategy centered on acquisitions, operational scaling, and long-term market share growth.

Supporting him is a management team with a mix of operational and financial expertise. CFO Luke Pelosi has played a key role in managing the company’s balance sheet through aggressive expansion. The executive team is also closely aligned with shareholders, shown through recent actions like cutting leverage, selling non-core assets, and restarting the company’s share repurchase program. GFL may still be young as a public company, but its leadership appears focused on sustainable long-term growth while staying attentive to shareholder value.

Valuation and Stock Performance

GFL shares have had an impressive run over the past year, rising more than 56% and outperforming many peers and the broader market. At just over $51, the stock is trading close to its 52-week high. That kind of momentum reflects strong investor sentiment and optimism about where the company is heading.

From a valuation standpoint, GFL is priced for growth. The forward price-to-earnings ratio is notably high, hovering in the mid-70s. While that’s well above the sector average, it’s important to remember that GFL’s current earnings don’t fully reflect its cash generation or long-term potential. The price-to-sales ratio is about 3.4, and enterprise value to EBITDA stands at just over 27, indicating that the market is factoring in future margin improvement and top-line expansion.

Investors seem to be betting on the long-term durability of GFL’s model. Waste management isn’t flashy, but it’s dependable, and GFL’s integrated structure gives it exposure to multiple revenue streams. As the company continues to find efficiencies and scale up recent acquisitions, there’s room for those valuation multiples to normalize without cutting into investor expectations.

Risks and Considerations

Debt remains one of the more prominent risks on the table. Even with progress in bringing leverage down, GFL is still carrying over $7 billion in total debt. That’s a heavy burden, particularly in an environment where borrowing costs could stay elevated. Interest expenses could eat into cash flow, and any disruption to operations could leave less room for maneuvering.

There’s also integration risk to consider. GFL’s acquisition pace has been rapid, and combining multiple operations across geographies is never seamless. If synergies take longer to realize or if the company encounters unexpected costs, that could drag on margins and dampen investor enthusiasm.

Environmental and regulatory changes are another ongoing consideration. As governments continue to tighten standards around waste disposal, emissions, and recycling practices, GFL needs to stay ahead with technology and compliance. While this presents added capital requirements, it also creates long-term opportunities for companies willing to innovate.

Finally, GFL’s high valuation creates pressure. With expectations already priced in, the company has little room for error in quarterly performance. A single earnings miss or a weaker-than-expected margin trend could lead to a sharp market response.

Final Thoughts

GFL Environmental is reaching a pivotal stage in its evolution. The growth story is still playing out, but the foundation appears much stronger than in earlier years. The company is no longer just about acquiring market share—it’s now focused on making those acquisitions efficient, profitable, and durable.

For dividend-focused investors, the current yield may not be compelling on its own, but it signals the early steps toward a more mature capital allocation strategy. With strong operating cash flow, improved debt metrics, and a growing focus on returning capital to shareholders, GFL is slowly building credibility with long-term investors.

What stands out is the company’s ability to maintain strategic clarity even as it scales. Leadership remains focused, financial execution is improving, and the broader waste management industry provides a relatively stable backdrop. While there are still risks, particularly around leverage and integration, GFL looks increasingly well-positioned to turn growth into lasting value. The coming quarters will be important, but for now, the company is trending in the right direction.