Key Takeaways

📈 GABC offers a 3.02% forward dividend yield with a steady growth history and a conservative 44% payout ratio, signaling both income reliability and room for future increases.

💵 Free cash flow remains strong at $90.72 million TTM, more than covering the dividend and supported by consistent operating cash generation.

🔍 Analysts maintain a moderately positive outlook with a $46.40 price target, highlighting stable earnings and improving net interest margins despite merger-related one-time costs.

Last Update 5/7/25

German American Bancorp, Inc. (GABC) is a regional bank rooted in Indiana with a growing presence in Kentucky and Ohio, recently expanded through its acquisition of Heartland BancCorp. The bank continues to demonstrate a disciplined approach to lending, dividend growth, and long-term shareholder value.

With a 3.02% dividend yield, consistent free cash flow, and a solid balance sheet, GABC stands out for income-focused investors. Its leadership team, conservative capital management, and strong asset quality have positioned it to navigate economic shifts while delivering reliable returns.

🔑 Key Dividend Metrics

📅 Ex-Dividend Date: May 9, 2025

💰 Forward Dividend Yield: 3.02%

📈 5-Year Average Yield: 2.60%

🧮 Payout Ratio: 44.18%

💵 Forward Dividend Rate: $1.16

📊 Trailing Dividend Rate: $1.12

📆 Next Dividend Payable: May 20, 2025

📉 Dividend Growth Trend: Steady and reliable

Recent Events

It hasn’t all been smooth sailing for German American recently. While revenues climbed 10.3% compared to the previous year, net earnings saw a significant drop—down 44.7% year over year. That kind of decline might send up red flags elsewhere, but here, the context is key.

Despite the earnings hit, the company is still delivering healthy profitability metrics. Net margin came in at over 29%, and return on equity remains close to 9%. It’s a reminder that not all declines are created equal. Even when earnings dip, GABC continues to generate strong results relative to its size and peer group.

More importantly for dividend investors, the bank hasn’t blinked when it comes to its payout. The next dividend of $0.29 per share is scheduled for May 20, with the ex-dividend date just around the corner on May 9. The message from management is clear: the dividend is not on the chopping block.

Dividend Overview

The draw of GABC’s dividend isn’t about jaw-dropping yields—it’s about steady, dependable income. With a forward yield of just over 3%, the stock comfortably beats what you’d find in a typical broad-market ETF. And the fact that it’s running slightly ahead of its five-year average yield is a signal that shares may still be undervalued from a dividend-income perspective.

What’s more telling is the 44% payout ratio. That’s a sweet spot—enough to reward shareholders while leaving plenty of cushion to protect the dividend if profits take another hit. It also hints at room for future increases, which is always something income investors like to see.

That’s been the trend too. GABC doesn’t announce huge dividend hikes, but it raises the payout with consistency. The current $1.16 forward rate for 2025 is a modest step up from $1.12 last year, continuing a pattern of incremental increases that has held firm over the years.

Dividend Growth and Safety

Consistency is the theme here, and GABC delivers on that front. The dividend growth might not grab headlines, but it’s reliable—typically increasing by a few percentage points annually. Over time, that adds up, especially for investors who reinvest their dividends or are building out retirement income streams.

Safety-wise, the picture remains solid. The bank holds a manageable amount of debt, with $216 million on the books and nearly $80 million in cash. While those numbers won’t turn heads at a national level, they’re more than adequate for a bank that runs a focused, local lending model and doesn’t chase risk.

GABC is also trading at a 1.38 price-to-book ratio. For a smaller bank, that kind of valuation suggests investor confidence—not just in its operations, but also in its ability to continue rewarding shareholders. It’s a subtle vote of confidence from the market, which tends to punish regional banks with weaker fundamentals or stretched payout policies.

The shareholder base is another quiet strength. With institutional investors holding more than 45% of the float and insiders owning over 4%, there’s a healthy mix of long-term ownership and skin in the game from management. That kind of alignment often helps reinforce dividend discipline, especially during times of economic uncertainty.

All in all, German American Bancorp doesn’t try to be something it’s not. It offers what income-focused investors truly value—predictable returns, a disciplined approach, and a dividend policy that leans heavily toward consistency and sustainability.

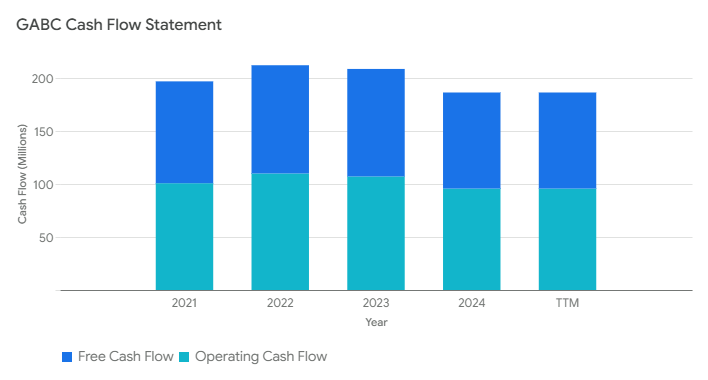

Cash Flow Statement

German American Bancorp’s trailing twelve-month cash flow profile reveals a healthy operating foundation, with $95.76 million generated through core operations. While that’s slightly below the previous year’s $107.23 million, it still signals consistency in the bank’s ability to generate internal cash—an important trait for sustaining dividends. Free cash flow also held steady at $90.72 million, reflecting minimal capital expenditures and solid earnings quality. This level of free cash comfortably supports the company’s dividend commitments, with plenty of cushion left over.

On the investing side, the bank saw an outflow of $82.40 million, reversing a rare inflow from the prior year. Most of that likely reflects a return to a more traditional investment strategy after a volatile 2022. Financing activities, meanwhile, brought in $60.10 million, largely driven by new debt issuance of $75 million, offset somewhat by repayments. Interest paid has climbed meaningfully to $99.06 million, reflecting the current rate environment. Despite those pressures, GABC ended the period with $188.79 million in cash, up sharply from the prior year. This increase in liquidity, even while managing higher interest expenses, suggests a disciplined capital approach and a continued ability to support shareholder returns.

Analyst Ratings

📊 In recent months, German American Bancorp (GABC) has attracted more analyst attention, with a generally optimistic tone across the board. The current consensus stands at a “Moderate Buy,” and the average 12-month price target is sitting at $46.40. That points to an upside of around 27% from where the stock is currently trading.

🔼 Keefe, Bruyette & Woods recently maintained their “Market Perform” rating but nudged their price target from $46 to $47. That small bump signals confidence in the bank’s direction. Piper Sandler echoed a similar tone, holding onto their “Neutral” stance but slightly trimming their target from $49 to $48. These moves show that analysts aren’t overly aggressive, but they’re not backing away either. GABC seems to be earning steady respect in the analyst community.

💼 The story behind these rating shifts ties back to recent financial results. GABC reported a net interest margin of 3.96% in the first quarter of 2025, which marked an improvement from the prior quarter. That came from stronger yields on earning assets and solid loan growth. Still, it wasn’t all smooth sailing—one-time M&A costs hit $5.9 million and there was a $16.2 million Day 2 credit provision, which put pressure on the bottom line.

🔍 Even with those headwinds, analysts seem comfortable with where GABC is heading. The overall view is that the bank is well-positioned for stable growth, with a clean balance sheet and a consistent approach that fits the mold of what long-term investors look for.

Earning Report Summary

A Big Quarter with a Bigger Move

The first quarter of 2025 was a turning point for German American Bancorp. The big headline was the completion of their acquisition of Heartland BancCorp, which officially closed in February. This wasn’t just a small bolt-on deal—Heartland brought in meaningful expansion into Ohio, giving GABC a foothold in key markets like Columbus and Cincinnati. As a result, total assets jumped to $8.42 billion by the end of March.

That acquisition helped push revenue up nearly 34% compared to the same time last year, landing at $81.41 million. But the story wasn’t all about top-line growth. The bank had to navigate the typical bumps that come with a deal of this size, including $5.9 million in merger-related expenses and a $16.2 million provision tied to new credit loss expectations. Those one-time costs hit the bottom line, bringing net income down to $10.5 million, or $0.30 per share.

Stripping Out the Noise

When you take those unusual charges out of the equation, the picture looks a lot cleaner. On an adjusted basis, net income came in at $27.3 million, or $0.79 per share—which is right in line with what the company delivered in the previous quarter. That level of stability, especially in a transitional quarter, shows that the core operations are on solid footing.

The net interest margin was another bright spot. It climbed to 3.96% from 3.54%, reflecting better yields on the bank’s loan book and a healthy level of loan demand. Even when you remove the impact of the Heartland acquisition, GABC still posted about 4% organic loan growth. Credit quality also stayed strong, with very low levels of non-performing assets and charge-offs.

Management’s Take

Leadership sounded upbeat about where things are headed. They acknowledged the short-term hit from the merger expenses but emphasized that the integration is going smoothly. There’s confidence that the Heartland deal will start paying off this year, both in terms of earnings contribution and expanded customer reach.

The broader focus moving forward is pretty straightforward: keep loan quality strong, make the most of the larger market footprint, and continue improving efficiencies as they combine operations. The message to investors was one of steady hands—no major strategy shifts, just careful execution of a bigger plan that’s already in motion.

Management Team

German American Bancorp’s leadership has remained remarkably consistent, a quality that has shaped its identity as a stable and conservatively run regional bank. At the top, CEO D. Neil Dauby brings nearly two decades of experience within the organization. His steady hand has helped the company grow methodically, never straying from its core mission of community-centered banking. Since becoming CEO, Dauby has guided the bank through a shifting interest rate environment and successfully led its latest expansion into Ohio through the Heartland BancCorp acquisition.

What stands out about Dauby and the rest of the executive team is their disciplined approach. They don’t chase growth for its own sake. Instead, their focus stays on long-term shareholder value, sound credit practices, and maintaining high capital quality. The team includes Chief Financial Officer Clay W. Ewing, who has overseen financial operations with a steady eye on costs and return metrics, and President Bradley Rust, who continues to play a vital role in customer-focused growth. Together, they form a leadership group that values consistency over flash, and results over speculation.

Their communication with investors reflects that mindset—clear, grounded, and rarely promotional. As GABC scales up after the Heartland merger, this leadership team is staying close to its roots, emphasizing smooth integration and organic growth while remaining attentive to asset quality and operational efficiency.

Valuation and Stock Performance

German American’s stock has been on a steady upward trend, returning nearly 19% over the past year. It’s a quiet kind of performance—not the stuff of headlines, but exactly what long-term investors like to see from a regional bank with a dividend focus. The stock recently traded in the high $30s, which is still well below its 52-week high near $47. That gap leaves room for potential upside, particularly as investors gain more clarity around post-merger earnings potential.

Valuation-wise, the stock looks balanced. Its trailing price-to-earnings ratio is around 15.4, while the forward P/E is closer to 12.8. That difference reflects expectations for steady earnings growth over the next 12 months. The market appears to be rewarding GABC for its stability without pricing in excessive optimism. The price-to-book ratio of 1.38 is modestly above the average for peers, but it also indicates investor confidence in the bank’s asset quality and earnings durability.

GABC has also performed well technically. The stock has spent most of the past few months trading above its 50-day moving average, showing continued support from the market. With daily trading volume on the lighter side and short interest hovering below 3%, there’s little sign of speculative pressure. All in, the stock’s performance and valuation paint a picture of measured strength—consistent with the kind of reliability that income-focused investors are drawn to.

Risks and Considerations

While the outlook for German American Bancorp remains favorable, there are a few risks worth acknowledging. First, the macro environment. Although rising interest rates have been a tailwind for net interest margins, a prolonged period of higher rates could eventually drag on economic activity, slowing loan growth or raising default risks. GABC has historically navigated interest rate cycles well, but these conditions can change quickly, and regional banks are often the first to feel pressure if credit markets tighten.

The recent acquisition of Heartland BancCorp adds another layer of complexity. Integration efforts are underway, and while management has laid out a clear plan, mergers always carry execution risk. Cultural alignment, customer retention, technology systems, and cost synergies all need to line up. Any stumbles in these areas could delay the earnings benefits management expects to realize this year.

Regulatory oversight has also become more intense across the banking sector. While GABC hasn’t encountered any compliance issues, smaller banks are now under closer scrutiny than in years past. Staying ahead of capital requirements, stress testing, and reporting expectations is more time-consuming and costly than it used to be, especially for banks expanding into new territories.

Lastly, the stock’s relatively low liquidity compared to larger financial institutions may not suit all investors. While this isn’t necessarily a downside for long-term holders, it does mean that large positions may be harder to enter or exit without influencing price. That low float also contributes to the stock’s quiet nature—less analyst coverage, fewer headlines, and slower response times to news compared to national names.

Final Thoughts

German American Bancorp continues to deliver what long-term dividend investors look for: stability, dependable income, and a leadership team that plays the long game. The integration of Heartland BancCorp adds another chapter to the bank’s growth story, offering new markets and opportunities without straying from its conservative roots.

The dividend remains well-supported, with a payout ratio in the mid-40% range and consistent free cash flow generation. That’s not just a number—it’s a reflection of operational discipline and financial planning. And while the bank isn’t immune to macro pressures, its strong balance sheet and thoughtful lending practices have helped it steer through uncertainty without missing a beat.

From a valuation standpoint, the stock doesn’t scream bargain or overbought—it sits right in the zone where income investors can still find value without taking on unnecessary risk. The price may not double overnight, but for those building a portfolio designed to generate reliable cash flow, GABC is delivering exactly what it promises.

With a seasoned management team, steady earnings profile, and expanding footprint, German American Bancorp is proving that boring doesn’t have to mean underwhelming. For the investor who values predictable income and modest capital appreciation, this is the kind of bank that fits quietly but effectively into the long-term plan.