Key Takeaways

📈 GPC offers a 3.47% forward dividend yield with 68 consecutive years of increases, though recent growth has been modest at under 5% annually.

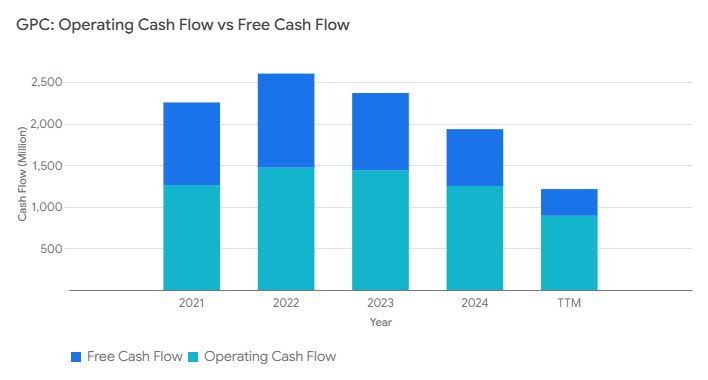

💵 Cash flow has tightened, with trailing 12-month operating cash flow at $892 million and free cash flow down to $321 million, reflecting higher capital expenditures and softer earnings.

🔍 Analysts maintain a Moderate Buy rating with a consensus price target of $130.86, suggesting moderate upside from current levels despite recent downgrades.

Last Update 5/7/25

Genuine Parts Company, known for its ownership of NAPA Auto Parts and Motion Industries, has built its legacy on consistency, operational strength, and an unwavering commitment to dividend growth. With nearly a century in business and 68 consecutive years of dividend increases, it’s a name that holds steady appeal for income-focused investors. The company operates in both the automotive and industrial distribution sectors, offering a broad base of recurring revenue across multiple geographies.

Recent financial results have shown modest revenue growth alongside margin pressures and a dip in earnings, but leadership remains confident in its long-term strategy. A new CEO is now at the helm, and while the stock has pulled back over the last year, it offers an attractive yield and a history of steady performance through various economic cycles.

Recent Events

It’s been a bit of a bumpy ride for GPC lately. The stock has taken a hit over the past year, down more than 24% from its highs. That’s a reflection of broader worries about the industrial sector and some softness in earnings. The most recent quarterly results showed EPS down almost 22% year-over-year, which doesn’t exactly inspire confidence in the near term.

But revenue still inched higher, up 1.4% from the same quarter a year ago. That growth, albeit slow, was largely driven by stable performance in the auto parts segment. Gross profit margins are holding up reasonably well, but operating margins have slipped to just under 6%, showing that cost pressures are still very much in play.

One area to keep an eye on is cash flow. While the company generated nearly $900 million in operating cash flow over the last 12 months, free cash flow turned slightly negative. That can be a concern if it continues, especially given the company’s sizable debt load. At $6.1 billion, total debt is on the high side, and the debt-to-equity ratio has climbed above 136%. That said, GPC isn’t new to managing through tighter financial conditions, and its long-term stability gives it a bit more breathing room than most.

Key Dividend Metrics

💰 Forward Dividend Yield: 3.47%

📈 5-Year Average Yield: 2.72%

💸 Trailing 12-Month Dividend: $4.03

📅 Next Ex-Dividend Date: June 6, 2025

📊 Payout Ratio: 66.17%

🏆 Consecutive Years of Dividend Increases: 68

Dividend Overview

There aren’t many companies that can match GPC’s dividend history. Sixty-eight straight years of dividend increases puts it in the top tier of income stocks. That kind of track record doesn’t happen by accident—it’s the result of a business model that’s proven, dependable, and deeply committed to rewarding shareholders.

Today’s dividend yield stands at 3.47%, noticeably higher than the five-year average of 2.72%. That’s the kind of signal long-term investors look for: a solid company trading at a more attractive yield than usual. It suggests the stock may be under pressure for reasons that don’t affect its long-term ability to pay.

The payout ratio is sitting at 66%, which is getting close to the comfort ceiling for some investors. But in GPC’s case, the steady revenue and historically reliable cash flows make that level more palatable. They’ve managed similar ratios before without skipping a beat.

What’s also worth mentioning is the regularity of these payments. GPC sticks to a consistent dividend schedule, rarely surprising investors. That kind of reliability becomes even more valuable when markets are volatile and predictability is in short supply.

Dividend Growth and Safety

While the dividend is rock solid, the pace of growth has cooled a bit in recent years. The most recent hike was just under 5%. It’s a more measured increase than in previous years, but still respectable considering the current economic climate and earnings dip.

Over the past five years, GPC has delivered average annual dividend growth around 6%. Not groundbreaking, but certainly good enough to keep up with inflation and help income investors maintain their purchasing power.

When evaluating dividend safety, it’s important to look beyond just the payout ratio. GPC does carry a sizable amount of debt and isn’t sitting on a mountain of cash. With only around $420 million in the bank and a current ratio of 1.15, they’re not flush with liquidity. But the business generates nearly $900 million in operating cash flow a year, which gives them plenty of fuel to keep dividends flowing even during rough patches.

There’s also the stock’s beta to consider. At 0.77, GPC tends to move less than the market as a whole. That lower volatility can be comforting to dividend investors who prefer steady income over roller-coaster returns. It’s another signal that GPC leans more toward stability than speculation.

All in all, GPC’s dividend might not be the fastest growing, but it’s one of the steadiest around. In a world where income can be hard to find, Genuine Parts continues to quietly do its job—paying shareholders, year after year.

Cash Flow Statement

Genuine Parts Company’s cash flow picture over the trailing 12 months shows a business in transition. Operating cash flow has declined to $892 million, a notable drop from its historical range above $1.2 billion. This softness in operating cash reflects some pressure on earnings and working capital movements, aligning with the broader slowdown seen in net income and margin compression. Free cash flow, at $320 million, is significantly lower than in recent years, squeezed by both weaker operational inflow and higher capital expenditures, which reached $571 million

.

.

On the investment side, GPC has remained aggressive, with investing cash flow showing a $1.48 billion outlay over the last twelve months—largely driven by acquisitions and infrastructure spending. Financing activity was slightly negative at just under $30 million, a shift from the more substantial financing outflows in previous years. While the company raised $1.69 billion in new debt, most of that was used to pay down $1.02 billion in existing obligations. Cash on hand has slipped to $428 million, its lowest in five years, reinforcing the importance of restoring operating cash strength in the months ahead.

Analyst Ratings

📉 In early April, Goldman Sachs downgraded Genuine Parts Company (GPC) from “Neutral” to “Sell,” and cut its price target from $133 to $114. The call was based on growing concerns about underperformance in the NAPA Auto Parts division, weaker demand trends across European markets, and heightened macroeconomic risks that could weigh on the industrial segment. Analysts noted that these pressures might continue to compress margins and limit near-term earnings potential.

📈 On the other hand, Truist Securities held firm with a “Buy” rating and even bumped its price target up slightly from $133 to $137. They pointed to steady financial execution and solid quarterly results as reasons to stay optimistic. While not immune to economic headwinds, GPC’s diversified business model and long history of operational consistency were seen as positives.

🎯 The broader analyst community maintains a consensus rating of “Moderate Buy.” The average 12-month price target currently stands at $130.86, suggesting potential upside of around 11% from recent trading levels. This reflects a market view that, despite recent softness, GPC’s fundamentals remain intact enough to support a gradual rebound in valuation.

Earning Report Summary

Genuine Parts Company kicked off 2025 with a mixed first quarter. On one hand, they managed to grow revenue slightly, pulling in $5.87 billion, which was about 1.4% higher than the same period last year. The automotive business carried most of the weight here, climbing 2.5% thanks to steady demand and some pricing efforts. The industrial side, though, lagged behind a bit, dipping by around 0.4%.

Margin Pressure Hits Earnings

Where the numbers took a hit was on the profit side. Earnings per share came in at $1.75, down from $2.22 a year ago. That drop wasn’t unexpected, but it still reflects the challenges the company is navigating. Net income fell nearly 22%, a decline largely driven by higher interest expenses and some of the integration costs tied to recent acquisitions. There’s a bit more pressure on margins these days, and leadership didn’t shy away from acknowledging that.

Staying the Course in 2025

Despite the softness in earnings, management held steady on their full-year outlook. They’re still expecting revenue to grow somewhere between 2% and 4%, and they believe earnings per share will land in the $7.75 to $8.25 range by year-end. They also anticipate strong cash generation, with projected operating cash flow between $1.2 billion and $1.4 billion, and free cash flow in the $800 million to $1 billion range.

Leadership Outlook

The tone from leadership was realistic but forward-looking. They pointed to persistent inflation and tariff-related uncertainty as ongoing headwinds, but stressed that the company’s long-term strategy remains intact. Continued investments in the supply chain and selective acquisitions are at the center of that strategy, with the goal of driving steady, profitable growth over time. The sense was that while the road isn’t without its bumps, they’re confident in the direction they’re heading.

Management Team

Genuine Parts Company recently completed a leadership transition that signals a focus on continuity and long-term vision. William P. Stengel, who joined the company in 2019 as Chief Transformation Officer, moved into the role of President in 2021, followed by a promotion to Chief Operating Officer in 2023. As of June 3, 2024, he stepped into the top position as President and Chief Executive Officer. His progression through leadership roles suggests a deep familiarity with GPC’s operations and a steady hand at the helm.

Paul D. Donahue, who previously served as CEO, has taken on the role of Executive Chairman. His continued involvement ensures that the transition keeps institutional knowledge intact while giving Stengel room to guide the company into its next phase. Alongside them, Bert Nappier serves as Executive Vice President and Chief Financial Officer, and Naveen Krishna leads technology strategy as EVP and Chief Information & Digital Officer. Together, this executive team blends tenure, transformation experience, and digital focus—an increasingly important mix for an industry in flux.

Valuation and Stock Performance

As of early May 2025, Genuine Parts Company shares are trading around $117. That’s down significantly from its 52-week high near $159, reflecting more than a 25% drop over the last year. The stock has been under pressure amid margin concerns and slowing earnings growth, and it currently trades below both its 50-day and 200-day moving averages. That positioning tends to suggest a bearish sentiment in the short term.

Still, analysts maintain a moderately constructive view. The consensus 12-month price target is hovering around $131, indicating some expected upside from current levels. Compared to peers in the auto parts distribution space, GPC has underperformed, but it remains favored by many long-term investors for its reliability and consistent dividend history. While the valuation has come down, the forward price-to-earnings ratio in the mid-teens keeps it within a reasonable range for income-oriented portfolios.

Risks and Considerations

There are a few risks worth watching. One is GPC’s reliance on acquisitions as a growth lever. While the strategy has added scale and geographic reach, integration always brings challenges—from aligning systems to blending corporate cultures. It also opens the door to execution risk, especially when acquiring across borders.

Another long-term consideration is the changing nature of the automotive industry. GPC has deep roots in supplying parts for internal combustion engine vehicles, and while it has taken steps to modernize its offerings, the accelerating shift toward electric vehicles could reshape demand. EVs typically have fewer moving parts, and that could mean a smaller aftermarket opportunity in certain categories unless the company pivots effectively.

Macroeconomic conditions also weigh on the business. Inflation and higher interest rates increase the cost of doing business and can dampen spending in both the automotive and industrial segments. The industrial side of GPC’s business is especially tied to broader economic cycles, making it more vulnerable in periods of contraction.

Final Thoughts

Genuine Parts Company continues to be a name associated with resilience, scale, and dividend dependability. The leadership change at the top has been methodical, and there’s a clear plan to maintain operational momentum. While the last year hasn’t been easy—between margin pressures, softening demand, and broader economic concerns—the long-term fundamentals remain intact.

For income-focused investors, the company’s record of annual dividend increases speaks for itself. And while near-term stock performance has lagged, GPC’s underlying business continues to generate solid cash flow. The path forward will depend on how well the company adapts to a changing automotive landscape and maintains discipline in its acquisition strategy. It’s a business that’s evolving—slowly, perhaps—but with a clear commitment to returning value to shareholders.