Key Takeaways

💰 GATX offers a 1.66% forward dividend yield with a consistent track record of annual increases and a conservative 29.75% payout ratio, signaling strong dividend safety and steady growth potential.

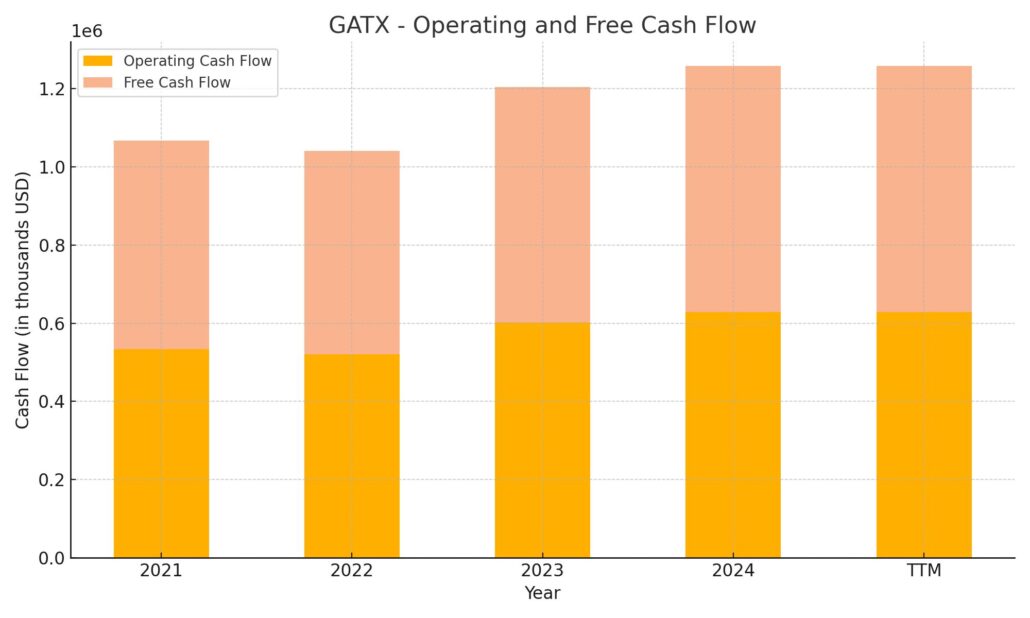

📊 The company generated $628.7 million in operating and free cash flow over the trailing twelve months, maintaining a strong cash position while continuing to invest heavily in its fleet.

📈 Analysts maintain a moderate buy consensus with a price target of $168, reflecting confidence in GATX’s stable performance and upward earnings momentum.

Last Update 5/6/25

GATX Corporation, a railcar leasing company with over a century of operational history, offers a stable income stream through consistent dividend payments and reliable asset performance. With operations spanning North America, Europe, and India, the company maintains high fleet utilization, strategic lease pricing, and a well-diversified customer base. Its core business continues to generate strong operating cash flow, and recent quarterly results reflected growth in both revenue and earnings per share.

Leadership remains a key strength, with a seasoned executive team led by CEO Robert C. Lyons focusing on long-term value creation and disciplined capital deployment. Despite operating in a capital-intensive industry, GATX manages risk with steady cash flow, thoughtful fleet investments, and a conservative dividend policy. For investors seeking dependable returns and proven execution, GATX stands out as a well-run and resilient business.

Recent Events

GATX turned in another solid performance this past quarter, with revenue climbing 11% year-over-year, reaching $1.63 billion over the trailing twelve months. Earnings per share rose to $7.90, supported by healthy leasing activity and strong demand for railcars. Net income for the same period landed at $283.6 million, showing a company that continues to operate with efficiency.

The stock has moved up 12.53% over the last 12 months, comfortably outpacing the broader market. That price strength reflects underlying business momentum more than any hype-driven rally. Investors have been responding to the consistent cash generation and sound operating metrics that GATX delivers quarter after quarter.

Operating cash flow stood at $628.7 million, further confirming the company’s ability to turn earnings into actual dollars. Levered free cash flow remains in the red, but that’s not unexpected given the capital-intensive nature of the rail leasing business. The company continues to invest in its fleet, which is part of the long-term value proposition for shareholders. GATX also maintains a high level of debt—about $8.93 billion—which again is typical for this type of asset-backed model. With a current ratio of 2.78, the company is in a comfortable liquidity position.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.66%

💰 Forward Annual Dividend Rate: $2.44 per share

🔄 5-Year Average Dividend Yield: 1.99%

🧮 Payout Ratio: 29.75%

📅 Next Ex-Dividend Date: June 13, 2025

🏦 Dividend Payment Date: June 30, 2025

Dividend Overview

GATX offers a clean, no-fuss dividend that speaks more to dependability than flash. The current forward yield of 1.66% might not jump off the page, especially when compared to some high-yield sectors, but it comes with a low payout ratio and a management team with a long history of consistency.

The dividend rate sits at $2.44 per share annually, and it’s been climbing slowly and steadily. Compared to its 5-year average yield of 1.99%, the current payout is on the conservative side. But that’s not a negative—it reflects how the share price has risen alongside earnings and shows that investors continue to value GATX’s steady hand.

With a payout ratio under 30%, the dividend is well-covered and not putting strain on the company’s financials. GATX isn’t trying to stretch itself just to impress shareholders—it pays what it can afford comfortably, and then reinvests the rest into the business.

Dividend Growth and Safety

There’s something to be said for consistency, and GATX delivers just that when it comes to dividend growth. It has raised its dividend every year for over a decade, showing a clear commitment to rewarding shareholders. The latest increase pushed the annual rate to $2.44, in line with a long track record of annual hikes.

Growth has been measured—averaging around 5% per year over the last five years. That kind of pace won’t win any records, but it reflects a well-managed capital allocation strategy. GATX doesn’t overpromise. Instead, it delivers increases that match the stability of its operations.

On the safety side, there are few red flags. The company generates consistent operating cash flow and keeps its payout ratio modest. Its 2.78 current ratio suggests it’s well-positioned to handle short-term obligations, while its substantial asset base provides long-term security.

Debt is high, no question about that, with leverage playing a key role in the business model. But GATX knows how to handle it. With a return on equity of 11.84% and an operating margin above 32%, the company is clearly getting value out of every dollar invested.

For dividend investors, it’s not just about the yield—it’s about knowing the check will arrive, quarter after quarter. GATX has built a reputation on that kind of dependability, and it continues to deliver.

Cash Flow Statement

GATX’s cash flow activity over the trailing twelve months reflects a business continuing to reinvest heavily in its asset base while maintaining solid operating performance. Operating cash flow totaled $628.7 million TTM, representing a steady increase from prior years and showcasing consistent earnings power from its core leasing operations. Free cash flow mirrors operating cash flow for now, indicating minimal impact from working capital or other adjustments.

On the investing side, outflows reached $1.34 billion, primarily driven by ongoing capital expenditures—most likely tied to fleet expansion and maintenance. Financing activity surged to $987.1 million, supported by a fresh $1.62 billion in debt issuance. While the company paid down $520.1 million in debt during the same period, the net effect reflects a clear strategy of leveraging to fund long-term investment. GATX’s year-end cash position more than doubled to $755.2 million, giving it added financial flexibility despite its capital-intensive model.

Analyst Ratings

📈 GATX Corporation has recently caught the attention of analysts, with a few changes in how the stock is being viewed. Goldman Sachs began coverage with a buy rating and assigned a price target of $185.00. This outlook suggests the firm sees solid long-term potential in GATX’s railcar leasing model, especially given the company’s consistent revenue stream and operational discipline.

🔄 On the other hand, Sidoti shifted its rating from buy to hold, while still raising the price target from $152 to $158. This adjustment signals a more neutral stance—acknowledging the company’s strengths but also recognizing potential headwinds, such as macroeconomic pressures or capital cost considerations tied to its heavy asset base.

💬 Overall, analysts are leaning toward a moderate buy on GATX, with the average consensus price target sitting around $168.00. That consensus reflects a general confidence in GATX’s strategy and resilience, balanced by a clear-eyed view of the risks that come with its capital-intensive business model. While not everyone is overly bullish, the sentiment remains constructive, especially for those valuing reliability and income over rapid growth.

Earnings Report Summary

A Strong Start to the Year

GATX kicked off 2025 with a solid performance that showed strength across its core business. Net income for the first quarter came in at $78.6 million, translating to $2.15 per diluted share. That’s a bump up from last year’s $2.03 per share and signals that the company continues to operate from a position of stability and efficiency. Total revenue reached $421.6 million, a number that came in above expectations and reflects the ongoing demand for railcar leasing.

North America remains a key driver, and this quarter was no exception. Fleet utilization stayed incredibly strong at 99.2%. That’s about as full as it gets. Lease renewal activity was also encouraging—renewal success came in at 85.1%, and lease rates were up by nearly 25% on renewals. Customers are signing longer leases too, with an average renewal term of just over five years. GATX also made smart moves by selling some older cars and bringing in over $30 million through secondary market sales. It’s a good sign they’re not just growing, but managing their fleet thoughtfully.

International and Aviation Contributions

Things are looking steady overseas too. GATX Rail Europe reported fleet utilization of 95.1%, while operations in India were even tighter at 99.6%. Lease pricing firmed up in both regions, showing that the demand for rail assets isn’t just a North American story—it’s global.

Their aviation leasing arm also pulled in solid numbers. The Engine Leasing segment, which includes a joint venture with Rolls-Royce, posted $38.6 million in profit. Demand for spare aircraft engines has stayed high, especially as global travel rebounds. That part of the business continues to quietly add value to the broader portfolio.

Focused Investment and Steady Guidance

In terms of investment, GATX spent around $300 million this quarter, with the majority going to expand and maintain its North American railcar fleet. It’s a capital-heavy business, but the spending seems targeted and in line with long-term goals.

Leadership has kept its full-year earnings guidance steady, still expecting between $8.30 and $8.70 per share. That consistency in their outlook says a lot about their confidence, especially in a market that continues to deal with interest rate uncertainty and economic headwinds.

CEO Bob Lyons made it clear that GATX is well-positioned no matter what the macro picture looks like. The company’s long-lived assets, reliable cash flow, and strong credit rating give it the flexibility to adapt and keep moving forward. That kind of message is exactly what long-term investors like to hear.

Management Team

GATX Corporation is steered by a steady and experienced leadership team, with Robert C. Lyons serving as President and Chief Executive Officer since April 2022. Lyons has spent much of his career within the company, previously holding the roles of Chief Operating Officer and Executive Vice President. His leadership style leans heavily on operational strength, efficient capital deployment, and maintaining high utilization across the company’s railcar fleet.

Supporting him is Thomas A. Ellman, the Executive Vice President and Chief Financial Officer. Ellman has been with GATX since the mid-1990s, offering financial stability and deep institutional knowledge. Together, this leadership duo emphasizes long-term value creation through disciplined capital allocation, consistent earnings growth, and conservative risk management. Other key leaders within the organization also bring extensive backgrounds in rail operations, finance, international leasing, and asset management.

The company encourages a culture of accountability and collaboration. It promotes talent development through leadership programs and creates an inclusive work environment where employees are expected to take ownership of results. GATX’s management appears focused on both business performance and maintaining a strong, sustainable organizational culture that supports long-term investor interests.

Valuation and Stock Performance

GATX shares currently trade near $145.94, reflecting a solid 12-month gain of roughly 12.5 percent. That performance has outpaced the broader market during the same period, underlining the company’s ability to generate steady returns through its leasing model. While it’s not a flashy stock, it has shown reliability, which resonates well with long-term and income-focused investors.

The company’s valuation metrics show a trailing price-to-earnings ratio of 18.63, suggesting the stock is reasonably valued relative to earnings. The price-to-book ratio sits at 2.06, indicating investors are willing to pay a premium based on confidence in asset value and the reliability of its earnings stream. The stock doesn’t scream undervalued, but it isn’t priced for perfection either—it sits in a zone where it reflects quality and predictability.

Analysts have generally maintained a moderate buy outlook on the stock, with an average price target around $168. That price point suggests room for modest appreciation, particularly if the company continues executing well. The dividend yield sits at 1.66 percent based on a $2.44 annual payout, making it appealing for investors who value consistent income alongside capital preservation.

Risks and Considerations

Despite the company’s strengths, GATX isn’t without its risks. The business model relies heavily on long-term debt to finance its fleet, with the debt-to-equity ratio topping 350 percent. While that level of leverage is common in leasing-based models, it still increases exposure to interest rate changes and refinancing cycles. Rising rates could put pressure on margins if not offset by higher lease rates.

The leasing business is also tied to broader economic conditions. When industrial activity slows, so does the demand for railcars. Although long-term contracts help cushion that impact, they can’t eliminate it entirely. Commodity cycles, especially in oil, chemicals, and agriculture, can directly influence the types of railcars in demand and how easily GATX can keep them leased at favorable rates.

There are operational risks as well. In 2023, GATX had one of its railcars involved in a derailment in East Palestine. While the incident brought some headlines, a jury later determined that GATX was not at fault, placing responsibility on the train operator. Even though GATX was cleared, incidents like this highlight the complexity of risk in the leasing business and the importance of maintaining strong safety and maintenance practices.

Regulatory shifts—particularly those targeting environmental performance or rail safety—could also lead to increased compliance costs. GATX will need to continue managing its fleet proactively to remain compliant while keeping costs in check. The company’s long history in this space suggests it’s well prepared for such challenges, but they remain important to monitor.

Final Thoughts

GATX has built a reputation as a steady, well-run company with a business model that rewards patience and discipline. It’s not designed for explosive growth, but rather for consistency and resilience. Investors looking for a dependable stream of income and a company with a long view on capital management will likely find its characteristics appealing.

With a strong leadership team, thoughtful capital deployment, and a well-maintained fleet, GATX is in a position to continue generating stable cash flows. Its dividend policy aligns with its conservative approach to business, offering a yield that, while not high, is well supported by earnings.

The company still faces risks tied to leverage, market cycles, and regulation, but it has shown a solid track record of managing through those variables. For long-term investors focused on durability and a clear operational story, GATX represents a name that continues to earn its place in income-focused portfolios.