Key Takeaways

📈 Franklin Resources offers a 6.4% forward dividend yield and has increased its dividend for 42 consecutive years, reflecting a strong income-focused track record.

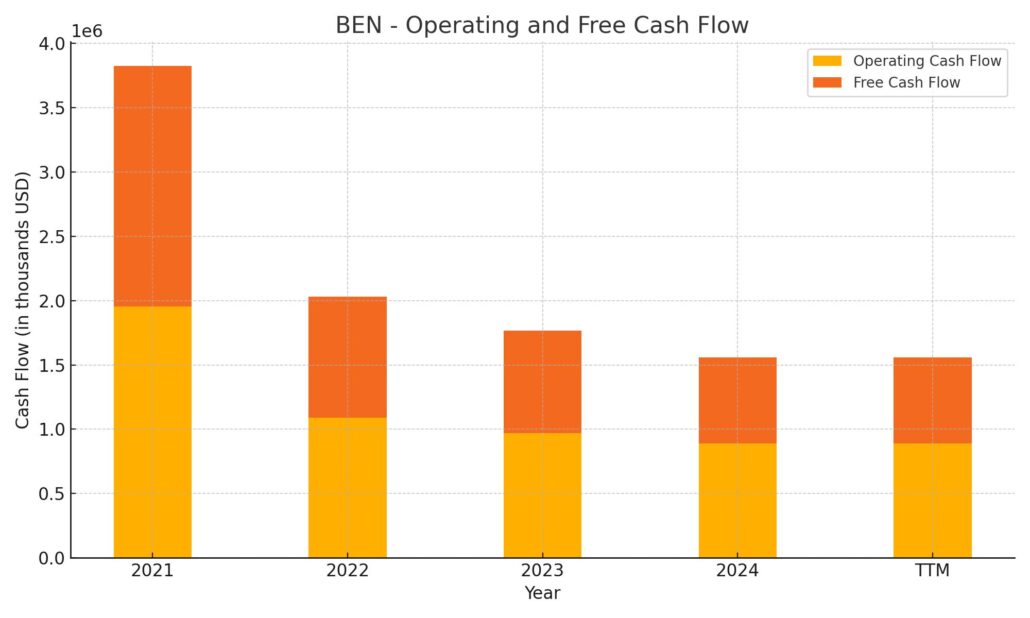

💰 Operating cash flow remains solid at $891 million TTM, with free cash flow of $666 million, supporting ongoing dividend payouts despite industry challenges.

🔍 Analysts hold mixed views with a consensus price target of $18.96, reflecting caution amid fund outflows but some optimism around operational improvements.

Last Update 5/6/25

Franklin Resources, Inc. (NYSE: BEN) is a global investment manager with over \$1.5 trillion in assets under management, known for its longstanding commitment to dividend payments and disciplined financial operations. The firm has increased its dividend for 42 consecutive years and currently offers a forward yield of 6.4%, supported by stable operating cash flow and a strong liquidity position. Its diversified platform spans equities, fixed income, multi-asset strategies, and expanding alternatives.

Recent results show improved earnings performance, with revenue up 13% year-over-year and operating income back in the black after a soft previous quarter. CEO Jenny Johnson and her team continue to invest in innovation while realigning parts of the business to boost efficiency. With a low valuation relative to peers, cautious analyst sentiment, and ongoing strategic shifts, Franklin remains a steady income-generating option amid broader changes in the asset management landscape.

Recent Events

BEN’s past year has been a mixed bag. The stock’s traded between a low of $16.25 and a high just under $25, which isn’t surprising given how much the market has moved around lately. Recent earnings showed signs of life, with earnings per share jumping nearly 22% from the prior year, even though revenues slipped slightly. Margins remain thin—operating margin sits just below 10%—and return on equity is modest at 2.8%. Still, the company remains profitable and, more importantly for income seekers, hasn’t wavered on the dividend.

The asset management business isn’t what it used to be. Fee compression and changing investor behavior have cut into profitability industry-wide. But Franklin Resources still generates solid operating cash flow—just under $900 million in the last twelve months. That’s helped support a dividend that, at today’s share price, yields an eye-catching 6.4%.

Even as the business adapts, Franklin continues to prioritize its dividend. And for long-time shareholders, that consistency speaks louder than any quarterly beat or miss.

Key Dividend Metrics

📈 Forward Yield: 6.40%

💸 Annual Dividend Rate: $1.28

📆 Dividend Growth Streak: 42 years

💰 5-Year Average Yield: 4.68%

🧮 Payout Ratio: 182.61%

📉 Trailing EPS: $0.69

📈 Most Recent Dividend Date: April 11, 2025

🚫 Ex-Dividend Date: March 31, 2025

Dividend Overview

A 6.4% forward dividend yield is hard to ignore, especially from a company with a multi-decade history of consistent payouts. That figure is well above both its own five-year average and the broader market. But it’s the payout ratio—clocking in at more than 180%—that usually triggers a double take. Does that mean the dividend’s at risk?

On paper, maybe. But context is everything. Franklin’s dividend isn’t funded solely out of net income. Instead, it’s supported by substantial cash reserves and a balance sheet that’s still pretty healthy. The company has $2.75 billion in cash, carries a low debt-to-equity ratio just over 24%, and has a current ratio of 6.6. So, while net earnings aren’t covering the payout right now, liquidity and long-term management strategy suggest there’s no immediate pressure to cut.

Insiders still hold nearly half the company’s shares, which can’t be overstated when it comes to dividend safety. If executives and founders are relying on those same checks hitting their accounts, there’s strong incentive to maintain the current policy.

What’s more, BEN’s dividend payments haven’t just been steady—they’ve grown over time. Even if the increases have slowed, the company hasn’t missed a payment in over four decades. That kind of dependability is a rare trait, and for income investors, it’s often more valuable than a stock price that jumps around chasing quarterly trends.

Dividend Growth and Safety

Franklin Resources is one of those names that’s managed to grow its dividend through just about every economic cycle since the early 1980s. The streak now stands at 42 years. That alone puts it in elite company among dividend-paying firms.

In recent years, the pace of growth has cooled. That’s not unusual, especially for mature companies facing industry-wide margin pressure. Still, they’ve made it a point to keep nudging the dividend upward, rather than taking the easy route and freezing or trimming it.

A high payout ratio will always raise eyebrows. But when a company’s cash flow remains healthy and management stays disciplined with capital, it becomes less of a red flag. Free cash flow in the latest 12 months was slightly negative, driven by reinvestments and some short-term financing moves. That said, the company isn’t relying on debt to fund the dividend, and there’s enough liquidity to stay flexible.

The key for Franklin moving forward is client retention and continued evolution of their product mix. More assets flowing into fixed income and alternative strategies could improve margins and give earnings a lift. For now, though, they’re playing defense—keeping costs in check, maintaining their cash position, and ensuring that dividend checks keep clearing.

Cash Flow Statement

Franklin Resources’ trailing 12-month cash flow statement shows a company still generating meaningful operating cash flow, though at a lower level than in past years. For the TTM period, operating cash flow came in at $891 million, a noticeable decline from $1.09 billion in 2023 and nearly $2 billion back in 2021. This drop reflects both tighter margins across the asset management industry and reduced fee revenue, which is typical when equity markets flatten and investor preferences shift.

On the investing side, outflows remain substantial, totaling over $3 billion in the TTM. These investments are likely tied to portfolio acquisitions, product development, and strategic growth initiatives. Meanwhile, Franklin was active on the financing front, with $1.56 billion in net inflows driven largely by new debt issuance of over $7.3 billion, partially offset by $5.1 billion in debt repayments. Free cash flow for the period came in at $666 million, down from the peak levels of 2021 but still enough to support dividend payments. The company’s end cash position dipped below $3.55 billion, continuing a multi-year trend of gradually drawing down reserves, though it still maintains a comfortable liquidity cushion.

Analyst Ratings

Franklin Resources (NYSE: BEN) has seen several analysts adjust their outlooks recently, mostly reflecting caution around the firm’s performance and sector dynamics. 🔻 One notable downgrade came with a reduced price target from $18 to $15, pointing to struggles in maintaining asset flows and pressure on overall profitability. Another firm lowered its target from $22 to $17, holding an underweight stance due to persistent margin compression and continuing net outflows. There was also a shift from $19 to $17 by a different analyst team, attributing their downgrade to the broader challenges facing traditional asset managers in a rapidly changing investment landscape.

On the flip side, not all outlooks have been gloomy. 🟢 Goldman Sachs bumped its target up from $19 to $21.50 while keeping a neutral stance, suggesting a more balanced view of BEN’s ability to weather near-term headwinds. Wells Fargo followed suit with an upward revision from $20 to $21.50, signaling some optimism that Franklin might stabilize asset flows and continue streamlining operations effectively.

🎯 As it stands, the consensus 12-month price target for BEN hovers around $18.96. The estimates range from a cautious low of $14 to a more hopeful high of $23. While sentiment remains mixed, analysts appear to be watching closely for signs of operational improvement or renewed fund inflows before shifting more decisively.

Earnings Report Summary

Steady Progress Despite Headwinds

Franklin Resources kicked off fiscal 2025 with a quarter that showed some encouraging signs, even as challenges in the asset management space continue to linger. The company reported net income of $163.6 million, or $0.29 per share. That’s a bounce back from the prior quarter’s loss, though still below the $0.50 per share from the same time last year. While not flashy, it’s a step in the right direction, especially in an environment where client flows and performance fees can swing earnings in big ways.

Revenue came in at $2.25 billion, a 13% jump year-over-year, helped along by stronger investment management and distribution fees. Operating income for the quarter landed at $219 million, a notable improvement after a tough previous quarter that had dipped into the red. Leadership seems focused on tightening things up operationally, with a real emphasis on controlling costs and improving efficiencies without stalling out the firm’s growth initiatives.

AUM Shift and Leadership Commentary

Assets under management finished the quarter at $1.58 trillion. That’s down from $1.68 trillion last quarter, largely because of long-term net outflows totaling about $50 billion. A big part of that came from Western Asset Management, which saw outflows of nearly $68 billion. On the brighter side, Franklin did manage to bring in roughly $17 billion in new flows across equity, multi-asset, and alternative strategies.

CEO Jenny Johnson shared a measured but optimistic tone about the quarter. She pointed out that long-term inflows have improved by more than 30% compared to last year, and she credited the company’s diversified lineup and global reach as key reasons for that progress. She also acknowledged the challenges at Western Asset, where some restructuring is underway to centralize certain corporate functions—though the core investment team is being left to operate independently, which seems to be a nod to preserving performance while enhancing efficiency.

Alternatives and Innovation

One area that continues to see traction is alternatives. Franklin raised $6 billion in alternative assets during the quarter, with private market strategies accounting for $4.3 billion of that. They also rolled out a new evergreen private equity fund targeting wealth clients, and it hit its initial cap of $900 million right out of the gate. That suggests strong interest from advisors and clients looking to move beyond traditional asset classes.

All in all, Franklin seems to be leaning into what it does best while trying to adapt to an industry that’s changing rapidly. The numbers weren’t perfect, but they’re moving in the right direction, and management appears to be focused on the long game—balancing innovation with discipline.

Earnings Report Summary

Steady Progress Despite Headwinds

Franklin Resources kicked off fiscal 2025 with a quarter that showed some encouraging signs, even as challenges in the asset management space continue to linger. The company reported net income of $163.6 million, or $0.29 per share. That’s a bounce back from the prior quarter’s loss, though still below the $0.50 per share from the same time last year. While not flashy, it’s a step in the right direction, especially in an environment where client flows and performance fees can swing earnings in big ways.

Revenue came in at $2.25 billion, a 13 percent jump year-over-year, helped along by stronger investment management and distribution fees. Operating income for the quarter landed at $219 million, a notable improvement after a tough previous quarter that had dipped into the red. Leadership seems focused on tightening things up operationally, with a real emphasis on controlling costs and improving efficiencies without stalling out the firm’s growth initiatives.

AUM Shift and Leadership Commentary

Assets under management finished the quarter at $1.58 trillion. That’s down from $1.68 trillion last quarter, largely because of long-term net outflows totaling about $50 billion. A big part of that came from Western Asset Management, which saw outflows of nearly $68 billion. On the brighter side, Franklin did manage to bring in roughly $17 billion in new flows across equity, multi-asset, and alternative strategies.

CEO Jenny Johnson shared a measured but optimistic tone about the quarter. She pointed out that long-term inflows have improved by more than 30 percent compared to last year, and she credited the company’s diversified lineup and global reach as key reasons for that progress. She also acknowledged the challenges at Western Asset, where some restructuring is underway to centralize certain corporate functions—though the core investment team is being left to operate independently, which seems to be a nod to preserving performance while enhancing efficiency.

Alternatives and Innovation

One area that continues to see traction is alternatives. Franklin raised $6 billion in alternative assets during the quarter, with private market strategies accounting for $4.3 billion of that. They also rolled out a new evergreen private equity fund targeting wealth clients, and it hit its initial cap of $900 million right out of the gate. That suggests strong interest from advisors and clients looking to move beyond traditional asset classes.

All in all, Franklin seems to be leaning into what it does best while trying to adapt to an industry that’s changing rapidly. The numbers weren’t perfect, but they’re moving in the right direction, and management appears to be focused on the long game—balancing innovation with discipline.