Key Takeaways

📈 Franklin Electric has raised its dividend for 31 consecutive years, offering a 1.21% forward yield with a low 26.5% payout ratio, allowing room for continued growth.

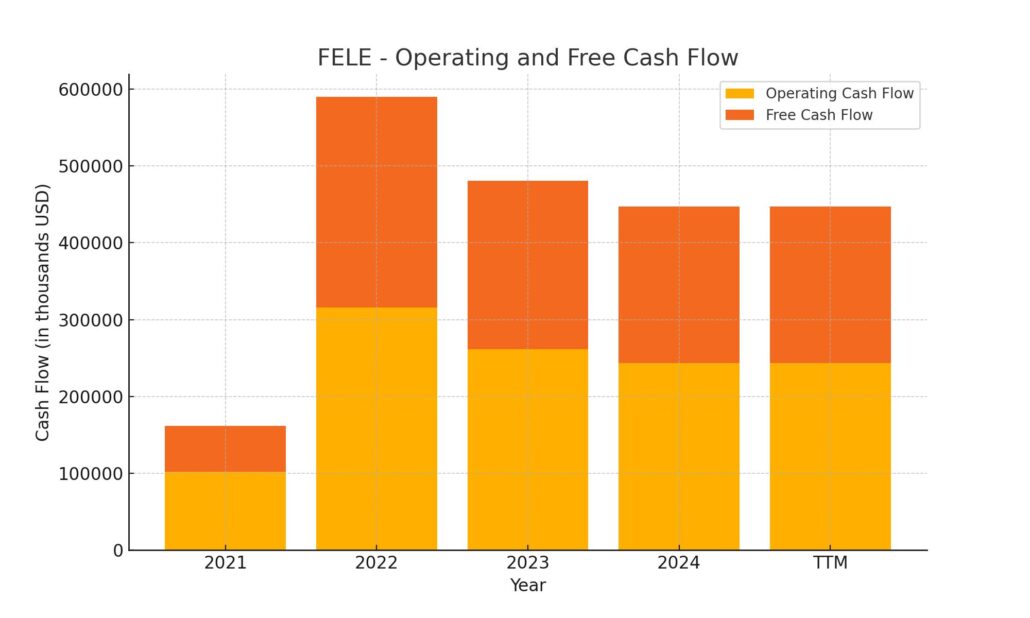

💵 Strong operating and free cash flow, with $243 million and $204 million respectively, support ongoing dividend payments and reinvestment.

🧐 Analysts maintain a Hold rating with a consensus price target of $97.50, reflecting steady expectations despite a slightly weaker earnings quarter.

Last Update 5/6/25

Franklin Electric (FELE) has built a strong presence in essential infrastructure, manufacturing water and fueling systems used across agriculture, municipal, and industrial markets. With over 30 years of consecutive dividend increases, a solid payout ratio, and disciplined cash flow management, the company continues to appeal to income-focused investors seeking long-term reliability.

Leadership changes, including the appointment of CEO Joe Ruzynski, signal a strategic focus on operational efficiency and sustainable growth. Supported by a capable team, Franklin has maintained strong margins, delivered consistent free cash flow, and upheld a clear commitment to returning value to shareholders—even amid cyclical headwinds.

Recent Events

In the latest quarter ending March 31, 2025, Franklin reported a slight year-over-year dip in both top and bottom lines. Revenue was down 1.2%, and earnings growth softened, with EPS at $3.83 for the trailing twelve months, representing a 6.1% decline. These aren’t shocking drops, more like the kind of short-term turbulence you expect from an industrial name when global conditions get a bit cloudy.

Despite those headwinds, the company’s ability to generate cash remained solid. Operating cash flow came in strong at $243 million, and levered free cash flow held up at $186 million. That kind of financial strength speaks volumes about management’s ability to run a tight ship—even when growth takes a temporary breather.

The stock itself has come down from its highs. After hitting $112 over the past year, FELE has pulled back to the $86 range. This might raise an eyebrow among value-conscious income investors. While the broader market has posted gains, Franklin’s modest pullback could present an opportunity for long-term dividend-focused portfolios.

Key Dividend Metrics

🪙 Forward Dividend Yield: 1.21%

📈 5-Year Average Yield: 0.93%

📆 Dividend Growth Streak: 31 years

🧮 Payout Ratio: 26.5%

💰 Forward Dividend Per Share: $1.06

🔔 Next Ex-Dividend Date: May 8, 2025

📊 Recent Dividend Increase: Around 5%

Dividend Overview

At a glance, Franklin’s dividend yield won’t blow anyone away. A 1.21% forward yield is modest, especially when compared to high-yield players in sectors like REITs or utilities. But that simplicity is part of the appeal. This is a business that grows its dividend year after year, and has done so for over three decades straight.

Interestingly, the current yield is running slightly ahead of its five-year average of 0.93%. That’s largely a result of the recent share price dip, which has made the dividend slightly more attractive for new buyers.

Quarterly payouts are made with a sense of discipline. At a 26.5% payout ratio, there’s no sense of stretching to appease shareholders. That leaves room for flexibility, particularly if economic conditions become more unpredictable. It’s not a flashy story—but it is a stable one, and that’s exactly what many income investors prefer.

Management’s long-standing commitment to returning capital to shareholders isn’t just about routine—it’s clearly strategic. There’s a deliberate effort to balance reinvestment in the business with steady dividend growth, and over time, that tends to compound in an investor’s favor.

Dividend Growth and Safety

When you zoom in on the dividend’s safety, there’s a lot to like here.

Start with the payout ratio. It’s low, and that matters more than some investors might realize. Franklin could easily absorb a dip in earnings without jeopardizing the dividend. In fact, even if EPS fell significantly, the company would still have room to maintain or modestly grow the payout. That’s a strong position to be in.

Debt levels also support the case for dividend sustainability. Total debt sits at around $225 million, with a very manageable debt-to-equity ratio under 18%. The balance sheet is healthy, and there’s nearly $84 million in cash on hand. Add in a current ratio close to 2.0, and there’s no concern about liquidity or short-term financial strain.

Cash generation is a quiet strength for Franklin. With over $240 million in operating cash flow and a sizable cushion of free cash flow, dividends aren’t being funded with borrowed money or squeezed out of earnings. They’re coming from a solid operational base.

Looking at growth, Franklin has raised its dividend for 31 consecutive years. That kind of consistency is rare, especially in industrials. Over the past five years, dividend growth has averaged around 9% annually, although the most recent increase was closer to 5%. Even if the pace slows slightly, the long history of thoughtful raises adds confidence.

There’s no drama here, and that’s what makes Franklin Electric attractive to dividend investors who prefer substance over flash. It may not offer a yield you can retire on right away, but over time, the combination of steady increases, conservative financial management, and reliable cash flow makes for a compelling case.

For the patient investor who values quiet strength and consistent income, Franklin Electric is one of those names that earns its place in a portfolio the slow, steady way.

Cash Flow Statement

Franklin Electric’s cash flow profile over the trailing twelve months (TTM) reflects strong operational efficiency and disciplined capital management. The company generated $243 million in operating cash flow during this period, a figure that, while slightly below last year’s total, still underscores solid performance relative to historical norms. Free cash flow was also robust at nearly $204 million, showing Franklin’s ability to convert earnings into usable cash even as revenue growth has moderated. This strength in free cash flow provides a reliable foundation for dividends and other capital priorities.

On the investment side, Franklin allocated over $151 million to capital expenditures and acquisitions, up considerably from recent years. This uptick may reflect strategic investments aimed at long-term growth or operational enhancements. Meanwhile, financing activity was a net outflow of $70 million, driven by continued debt repayments and dividend distributions. The company raised over $260 million in new debt but paid back $223 million within the same period, maintaining balance sheet flexibility. Cash on hand ended at just under $87 million, down from the prior year, but still adequate given the strength in recurring cash generation. Overall, the cash flow picture remains healthy and well-balanced.

Analyst Ratings

Franklin Electric’s stock has drawn a cautiously balanced view from the analyst community in recent weeks. 🧐 DA Davidson nudged its price target up from $85 to $90, but kept a neutral rating. This move reflects a slight uptick in confidence without a shift in broader sentiment. Meanwhile, 🧮 Baird made a small downward adjustment, trimming its target from $107 to $105 while also maintaining a neutral stance. These subtle target shifts suggest that while analysts don’t see any major red flags, they’re also not ready to signal a breakout.

🎯 The current consensus price target sits at $97.50, pointing to a mild upside from the recent trading levels in the mid-$80s. Most analysts are sitting in “Hold” territory, which tends to mean expectations are steady but not especially high in the short term.

📉 The reason for this cautious stance lies in Franklin’s recent earnings results. While cash flow remains strong, both revenue and EPS came in slightly below expectations. This has sparked a wait-and-see approach, with analysts watching how the company navigates a slower industrial environment and whether margin improvements can offset softer demand. For now, the street appears comfortable with Franklin’s long-term positioning, but near-term enthusiasm remains measured.

Earning Report Summary

Franklin Electric’s first quarter of 2025 came in with a bit of a mixed bag—solid in some areas, pressured in others. While the numbers weren’t flashy, they showed a company navigating a tough environment with a steady hand. Sales for the quarter landed at $455.2 million, a slight step down from $460.9 million the year before. Operating income slipped to $44.1 million from $47.9 million, and earnings per share dipped slightly to $0.67. Not dramatic changes, but enough to show that external factors played a role.

Bright Spot: Energy Systems

One of the highlights was the Energy Systems segment, which posted an 8% increase in sales. That brought in $66.8 million, with operating income climbing to $21.9 million—up from $18.8 million. That kind of strength, particularly in a soft industrial environment, suggests they’re doing something right on the product and pricing front. Leadership credited improved volume and strategic pricing moves for that lift.

Water Holds Steady, Distribution Takes a Hit

Water Systems, Franklin’s largest business, managed to inch up in sales—just under 1% growth to $287.3 million. But margins took a hit, and operating income dropped to $43.4 million from $47.1 million. It wasn’t a disappointing result per se, but it was clear that inflation and cost pressures are being felt here. The Distribution segment didn’t fare as well. Sales fell 3% to $141.9 million, and even though income nudged slightly higher to $2.1 million, this arm of the business struggled with slower demand—particularly tied to tough winter weather that delayed construction and repair work in some regions.

CEO Insight and the Road Ahead

CEO Joe Ruzynski acknowledged the uneven quarter but framed it as manageable. He pointed out that the company’s diverse business mix helped offset the rougher patches—particularly in the Distribution side. He also mentioned that some non-recurring costs, like executive transition expenses and recent acquisitions, weighed on the bottom line, but weren’t a cause for concern moving forward.

Looking ahead, Franklin Electric reaffirmed its full-year 2025 revenue guidance in the $2.09 to $2.15 billion range. However, they did trim the low end of their EPS forecast, adjusting it to $3.95 to $4.25. The message was clear: the company remains on track, but management is keeping an eye on global uncertainties, including tariffs and industrial demand softness. Still, Ruzynski expressed confidence in the company’s long-term strengths—solid brands, strong customer relationships, and a well-positioned operating model.

Management Team

Franklin Electric’s leadership brings together a solid blend of industry experience and fresh energy. At the top is CEO Joe Ruzynski, who stepped into the role in mid-2024. He brings with him a history of leadership from companies like nVent Electric and Pentair, where he focused on segments that align closely with Franklin’s core operations. His background suggests a strategic eye for scaling business while maintaining operational discipline.

He’s backed by Executive Chairperson Gregg Sengstack, who held the CEO role for a decade and has been with Franklin since 1988. That long tenure gives the company a sense of continuity that investors often value. Interim CFO Russ Fleeger adds financial expertise to the mix, having previously led finance teams at Zimmer Biomet and Surestep. Jonathan Grandon, Chief Administrative Officer and General Counsel, brings legal and compliance depth, while DeLancey Davis and Jay Walsh oversee the Distribution and Energy Systems segments, respectively. Both have extensive experience with Franklin and know the business from the ground up.

Valuation and Stock Performance

Franklin Electric’s shares have seen some movement over the past year, recently trading around $88. That’s off the high of $111.94 reached earlier in the year. With a market cap of just over $4 billion and a P/E ratio sitting near 22.6, the stock is not aggressively priced, but rather reflects steady investor expectations.

The company’s five-year return has been impressive, nearing 92%. That sort of long-term performance speaks to how Franklin has managed growth while steadily rewarding shareholders. The dividend has certainly played a part in that appeal, with 31 consecutive annual increases and a payout ratio that leaves plenty of room for future raises.

Analysts are generally holding steady with their expectations, with the current consensus price target at $97.50. While not a dramatic upside from current levels, it suggests a level of confidence in the company’s ability to navigate near-term pressures and deliver over time.

Risks and Considerations

Franklin Electric, while a well-managed and financially sound company, operates in industries that can be cyclical. Economic slowdowns, changes in infrastructure spending, and global macro uncertainties all have the potential to affect demand for its products. When business investment tightens, capital equipment purchases like pumps and motors tend to follow suit.

The company also faces pressure from supply chain logistics and raw material pricing, especially in a tight global market. With an increasing footprint in international markets, it must also deal with foreign currency fluctuations, different regulatory frameworks, and geopolitical instability.

Competition is another factor. While Franklin has carved out a strong position in its niche, it doesn’t operate in a vacuum. Other players are continually working to gain market share, which can influence pricing and margin dynamics. All of this is worth keeping in mind for investors thinking long-term.

Final Thoughts

Franklin Electric continues to be a name that appeals to patient investors. It’s not the stock that will make headlines every week, but it’s one that has earned a place in portfolios looking for consistency, modest growth, and rising income. With a management team that understands the business and a strategy that leans into its strengths, the company seems well-prepared to weather market cycles.

The dividend track record alone tells a story of dependable stewardship. As with any investment, it’s wise to weigh the potential risks against your own goals. But Franklin Electric offers a combination of operational strength, shareholder focus, and industry relevance that makes it worth a look for those thinking beyond the next quarter.