Key Takeaways

📈 Franco-Nevada offers a steady dividend yield near 0.90%, with 18 consecutive annual increases and a conservative 50% payout ratio supporting ongoing dividend growth.

💵 The company generated $829.5 million in operating cash flow and $421.5 million in free cash flow over the trailing twelve months, with a cash position of $1.45 billion and no debt.

🔍 Analysts maintain a moderately positive outlook with a consensus price target of $162.25, highlighting confidence in the company’s financial strength and royalty-based model.

Last Update 5/6/25

Franco-Nevada (FNV) is a royalty and streaming company focused on precious metals, offering investors exposure to gold, silver, and energy assets without the risks of direct mining operations. With over 400 assets spread across the globe and zero debt on its balance sheet, the company has built a resilient business model that generates reliable cash flow through commodity cycles.

In 2024, Franco-Nevada reported \$1.11 billion in revenue and maintained a strong operating margin of nearly 70%. The stock gained over 33% in the past year, backed by a solid dividend history, consistent earnings, and a management team committed to long-term value.

Recent Events

Franco-Nevada has quietly been making a comeback in 2025. After dipping to a 52-week low of $112.70, the stock has climbed back to $171.82, showing a strong recovery that’s caught the attention of long-term investors. This bounce is happening alongside a broader rally in gold prices, but more importantly, it reflects growing confidence in the company’s unique business model.

Unlike traditional miners, Franco-Nevada doesn’t own or operate mines. Instead, it provides upfront capital to mining companies in exchange for royalties or metal streams. That means it gets a piece of the production revenue without the operational headaches or capital costs. In a world where commodity prices swing unpredictably, that’s a pretty smart place to be.

Financially, they’re looking solid. Revenue for the trailing twelve months came in at $1.1 billion, with net income topping $550 million. Their profit margins are impressive, sitting over 50%, and their operating margin is around 70%. It’s not just profitable—it’s efficient. Add to that a cash balance of $1.45 billion and zero debt on the books, and you’ve got a fortress-like balance sheet that provides serious dividend flexibility.

Recent quarters have shown modest revenue growth, and while we haven’t seen explosive earnings jumps, the stability here is what really matters. Especially for those of us who invest with dividends in mind.

Key Dividend Metrics

🪙 Forward Dividend Yield: 0.90%

📈 5-Year Average Dividend Yield: 0.93%

💵 Forward Annual Dividend Rate: $1.52 per share

🧾 Payout Ratio: 50.17%

📅 Most Recent Dividend Date: March 27, 2025

📆 Ex-Dividend Date: March 13, 2025

🧮 Dividend Growth (5-Year CAGR): Consistently increasing

📊 Beta (5Y Monthly): 0.53

Dividend Overview

Let’s not sugarcoat it—Franco-Nevada isn’t here for investors chasing high yields. At just under 1%, the yield might not light up a screen full of dividend stocks. But what it does offer is reliability and a strong record of paying shareholders year after year, without the drama.

This company has been paying and raising its dividend since 2007, and it’s never missed a beat. What stands out isn’t the size of the payout, but the consistency. There’s no volatility in how they handle their dividend, which is refreshing in a sector that tends to swing with commodity cycles.

Their business model helps a lot with this. Since they’re not directly involved in operations, they sidestep the massive capital expenditures and cost overruns that often trip up mining companies. That leads to steadier cash flow, which translates into a more secure dividend stream.

And diversification is another strength. While gold and silver royalties are their bread and butter, Franco-Nevada also generates income from oil, gas, and other resources. That mix helps cushion them when precious metal prices soften, which further supports their ability to keep paying that dividend through thick and thin.

Dividend Growth and Safety

Franco-Nevada’s dividend growth isn’t flashy, but it’s incredibly dependable. Over the past five years, the annual increases have come through like clockwork. They’re not swinging for the fences with double-digit hikes, but what they deliver is consistency—which is exactly what many income investors are looking for.

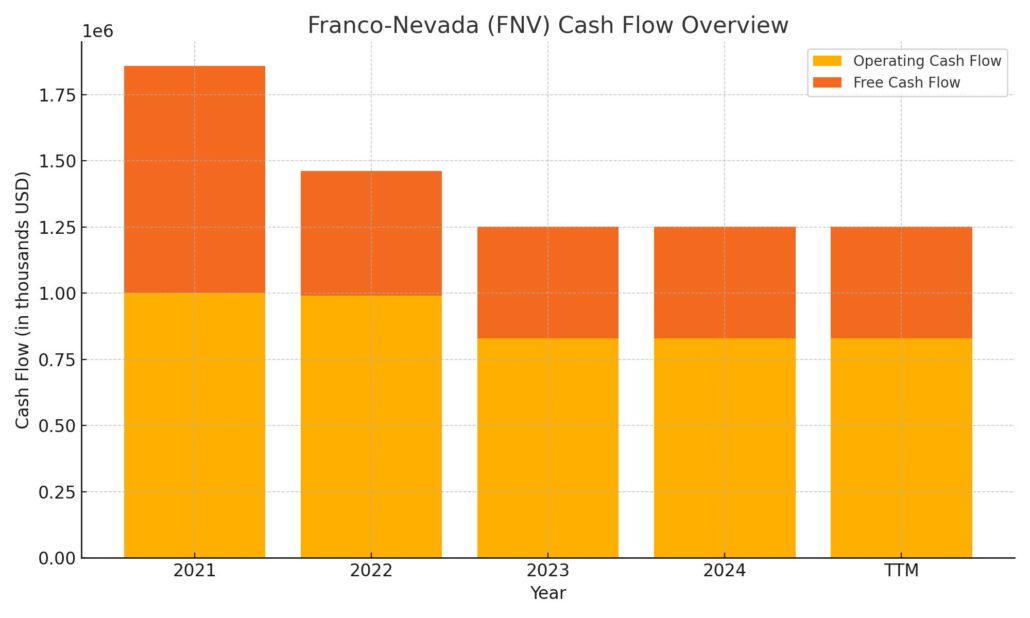

Their current payout ratio of about 50% shows there’s room to keep growing the dividend without putting strain on their cash flow. With $829.5 million in operating cash flow and over $244 million in free cash flow, they’re in a strong position to keep this trend going.

The lack of debt is a major plus. With interest rates still a factor in the market, not having to worry about refinancing or paying down loans gives Franco-Nevada extra breathing room. They can focus on growing their royalty portfolio and returning capital to shareholders without juggling debt obligations.

Their dividend strategy isn’t reactionary. It’s measured. They don’t hike the payout just because gold prices spike, and they don’t pull back when prices dip. Instead, they aim for long-term stability. That’s why the dividend has steadily grown regardless of market noise.

So while you’re not going to retire off Franco-Nevada’s yield alone, what you are getting is a very rare thing in the world of commodity-linked stocks: predictability, resilience, and a commitment to rewarding shareholders year in and year out.

Cash Flow Statement

Franco-Nevada’s trailing twelve-month cash flow paints a picture of consistency with a tilt toward conservatism. Operating cash flow came in at $829.5 million, a slight pullback from previous years but still robust enough to comfortably support dividends and capital allocation. Free cash flow for the period stood at $421.5 million—down from highs seen in 2021 but within a healthy range for a company that doesn’t shoulder the high costs of operating mines directly. This positions them well to continue funding royalty acquisitions while steadily increasing shareholder returns.

On the investing side, the company spent $537.3 million, which aligns closely with the prior year’s outflows. That’s largely attributable to continued investment in royalty and streaming agreements rather than infrastructure or equipment. Financing cash flow was negative at $240.4 million, reflecting dividend payments and likely some share repurchases. Notably, Franco-Nevada’s end-of-period cash balance reached $1.45 billion, an increase from prior years and a strong cushion to carry into future quarters. With minimal interest payments and no debt issuance or repayments this year, they’ve preserved financial flexibility in a way that underlines their low-risk approach to capital management.

Analyst Ratings

📈 Franco-Nevada has seen a wave of analyst activity recently, with sentiment leaning generally positive. UBS reiterated its buy stance and nudged its price target higher from $170 to $190, citing the company’s resilient cash flow and diverse asset base across gold, silver, and energy. The stock’s ability to hold steady while peers struggle has added to the bullish outlook. Raymond James echoed this sentiment, raising its target from $162 to $181. They noted Franco-Nevada’s ability to deliver consistent returns without taking on operational risk as a major advantage. HC Wainwright also kept a strong buy rating and lifted its target from $165 to $180, impressed by how the company has maintained growth despite mixed commodity conditions.

🔍 On the flip side, TD Securities took a more cautious turn, downgrading the stock from buy to hold and setting a price target of $152. Their reasoning centered on valuation concerns—they see the current price as reflecting much of the upside already. Scotiabank stuck to a hold rating as well but lifted its target from $150 to $165, recognizing the company’s solid fundamentals but warning of potential commodity market softness that could limit near-term gains.

🎯 The average analyst price target now sits around $162.25, with the consensus leaning toward a moderate buy. While there’s broad respect for Franco-Nevada’s conservative financial posture and royalty-driven model, analysts are split between those who see more room to run and those who feel the current price already captures much of the value.

Earnings Report Summary

Solid Finish to the Year

Franco-Nevada wrapped up 2024 on a strong note, showing resilience even without one of its usual revenue drivers, the Cobre Panama mine. In the fourth quarter, the company posted $321 million in revenue, up 6% from the same time last year. What’s impressive is that this growth came even as Cobre Panama remained offline. When you take that mine out of the equation, revenue actually climbed 30%, which speaks volumes about how well the rest of the portfolio is performing.

They sold about 120,000 gold equivalent ounces in Q4, which is down year-over-year, mostly due to the situation with Cobre Panama. But without that mine in the mix, the drop was only 3%. Cash flow from operations hit $243 million, and adjusted EBITDA grew 9% from the year before. On the bottom line, net income came in at $175 million, or $0.91 per share, which is a significant turnaround from a large write-down and loss they reported in Q4 of 2023.

Full-Year View and Leadership’s Outlook

For all of 2024, Franco-Nevada brought in $1.11 billion in revenue. That’s a 9% dip compared to 2023, but again, if you back out Cobre Panama, revenue was actually up 15%. Gold equivalent ounces sold came in at just over 463,000 for the year. The absence of output from one major mine obviously had an effect, but it’s notable how steady the rest of the assets were. Operating cash flow for the full year was $829 million, and adjusted EBITDA hit $951 million, showing a solid core performance.

CEO Paul Brink sounded upbeat about the results, pointing out that the company hit the upper end of its revised guidance, even without Cobre Panama. He also mentioned how their strong balance sheet allowed them to spend over $1.3 billion in acquisitions and commitments during the year. That new activity is expected to bring in around 85,000 to 95,000 gold equivalent ounces annually in the medium term, which should help offset the gaps left by any temporary setbacks.

Staying Lean and Focused

The company ended the year debt-free and with a cash war chest of $2.4 billion in available capital. That kind of financial flexibility is rare in the sector and gives them plenty of room to maneuver, whether it’s to pursue more deals or simply weather a soft patch in the metals market. They’ve already announced a dividend increase for Q1 2025, now at $0.38 per share, continuing their streak of annual hikes.

Franco-Nevada’s leadership is hopeful about the potential restart of the Cobre Panama operation, with discussions possibly on the table for 2025. In the meantime, the company is keeping its focus on growing the portfolio and maintaining the steady cash flow that investors have come to expect.

Management Team

Franco-Nevada’s leadership is led by Paul Brink, who has served as President since 2018 and CEO since 2020. Brink brings a steady hand and long-term perspective to the company’s strategy, focusing on building a diversified, low-risk portfolio of royalties and streams. Under his leadership, the company has remained financially conservative, avoiding debt and positioning itself to grow through selective acquisitions.

Supporting him is Chief Financial Officer Sandip Rana, who joined the team in 2010. Rana’s role has been critical in maintaining the company’s strong balance sheet and guiding capital allocation in a disciplined way. Other key figures include Lloyd Hong, the Chief Legal Officer and Corporate Secretary, and Eaun Gray, Chief Investment Officer, who both play active roles in evaluating new opportunities and managing risk. Chairman David Harquail, the former CEO, continues to provide leadership and continuity at the board level, offering strategic guidance rooted in deep sector experience.

This team has built a reputation for avoiding excess and staying grounded in fundamentals. That stability and methodical approach have earned investor trust and allowed the company to navigate shifting commodity cycles without compromising its financial footing.

Valuation and Stock Performance

Franco-Nevada has delivered a strong showing over the past year, both in terms of stock performance and investor sentiment. As of early May 2025, shares are trading near $168, reflecting a solid gain of over 33% from the previous year. That rise comes even with headwinds from the temporary halt at Cobre Panama, showing the strength of the broader portfolio.

With a market cap around $31.7 billion, the stock commands a premium valuation, trading at a forward P/E of about 38. That might seem high compared to other miners, but the market clearly values the lower-risk nature of the royalty model. Investors aren’t paying for production—they’re paying for steady cash flows and fewer surprises.

The average analyst price target sits around $162, suggesting that some see limited near-term upside from current levels. Still, that hasn’t shaken confidence in the company’s long-term prospects. A low beta of 0.53 also makes the stock appealing to more cautious investors who want some exposure to commodities without the volatility of traditional miners.

Franco-Nevada has continued to reward shareholders with steady dividend growth. The most recent quarterly dividend was increased to $0.38 per share, keeping their track record of annual hikes alive. That consistency—especially in a sector known for boom and bust—is one of the reasons investors stay loyal.

Risks and Considerations

As reliable as Franco-Nevada has been, there are still a few things investors need to keep in mind. Commodity prices are always a key factor. While the company doesn’t run mines itself, its income is tied to the output of those who do. If gold prices were to fall sharply, royalty payments would drop too, even if operating costs remain insulated.

There’s also the challenge of integrating recent acquisitions. In 2024 alone, the company made more than $1.3 billion in commitments and new deals across multiple countries. Making sure those assets deliver what’s expected—especially in terms of production and timing—is going to be important for meeting growth targets.

Geopolitical risk is another area to watch. Franco-Nevada’s assets are spread across the globe, including countries with changing regulations or political uncertainty. While diversification helps, it doesn’t eliminate the risks entirely. The company’s ESG standards and local partnerships help reduce exposure, but unexpected shifts in tax laws or permitting frameworks can still affect outcomes.

Final Thoughts

Franco-Nevada has carved out a unique space in the metals and mining world. Instead of chasing growth through debt and large-scale mining projects, it has quietly built a business that thrives on simplicity and discipline. The royalty model allows it to tap into the resource sector’s upside while avoiding the risks that often come with direct operations.

With a proven management team, a cash-rich balance sheet, and an approach that values consistency over flash, the company continues to offer something rare in the commodities space—stability. Whether you’re looking for steady income, inflation protection, or just exposure to gold without the drama, Franco-Nevada remains a name that long-term investors can understand and rely on.