Key Takeaways

📈 FCPT offers a 5.12% forward dividend yield with consistent annual increases around 4–5%, supported by reliable rental income from long-term net leases.

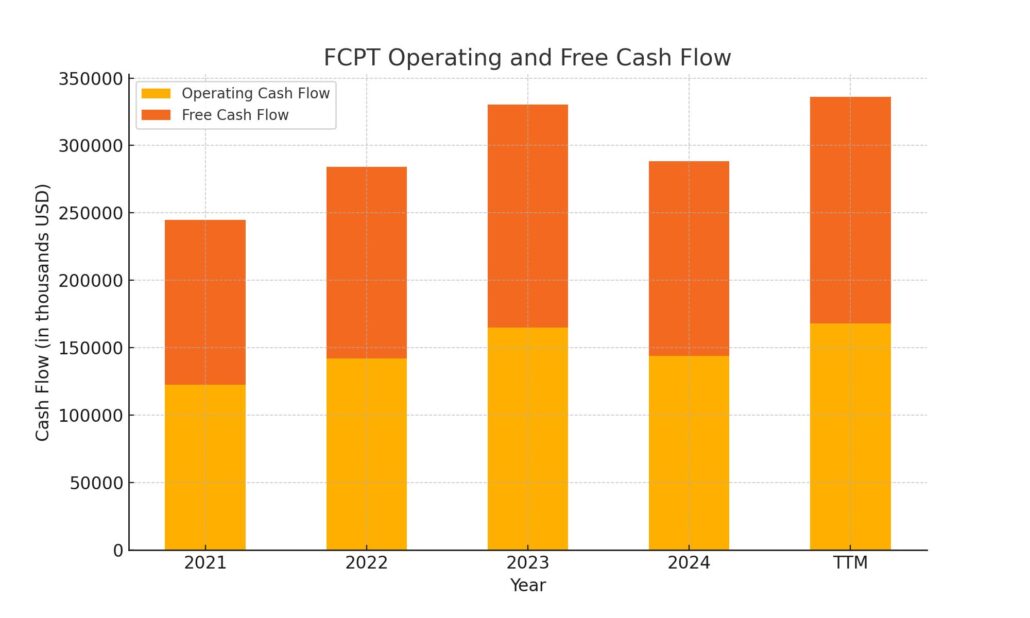

💰 The company generated $168 million in operating and free cash flow over the trailing twelve months, covering its dividend and funding new property acquisitions without overleveraging.

📊 Analysts maintain a Moderate Buy consensus with a $30.20 average price target, citing stable earnings, disciplined growth, and strong tenant performance.

Last Update 5/6/25

Four Corners Property Trust (NYSE: FCPT) is a net-lease real estate investment trust with a portfolio of over 1,200 properties across 47 states, primarily focused on restaurants, medical retail, and auto service tenants. Since its spin-off in 2015, the company has steadily expanded through disciplined acquisitions while maintaining a high occupancy rate of 99.4% and consistent rent collection.

With a 5.12% forward dividend yield and a history of stable cash flows, FCPT appeals to dividend-focused investors seeking reliability and income growth. Its leadership team, conservative financial management, and strong liquidity position support its ongoing expansion and ability to deliver shareholder value.

Recent Events

Over the past year, FCPT’s stock price has climbed about 15%, outpacing broader market gains. That’s not something many REITs can say in today’s environment, especially with interest rates higher than they’ve been in years. But FCPT isn’t just riding a wave—it’s making smart, deliberate moves that are paying off.

In its latest quarter, the company delivered 7.5% year-over-year revenue growth and nearly 9% earnings growth. Not flashy, but it’s the kind of slow and steady progress dividend investors tend to appreciate. Its acquisition strategy continues to focus on high-quality properties in stable sectors, and it’s sticking to its core strengths.

On the financial side, the company carries $1.21 billion in debt, with a debt-to-equity ratio just north of 84%. That’s not excessive for a REIT, but it does mean management needs to stay disciplined. Thankfully, FCPT has a solid liquidity position, with $37 million in cash and a current ratio above 2. With $168 million in operating cash flow over the past twelve months and over $130 million in free cash flow, the business is comfortably covering its dividend commitments.

Key Dividend Metrics

📈 Forward Yield: 5.12%

💰 Annual Dividend: $1.42 per share

📆 5-Year Dividend Growth: Steady at around 4.5%

🔄 Payout Ratio: 130.84% (based on EPS)

🛡️ Dividend Safety: Moderately secure, well-supported by cash flow

📉 5-Year Average Yield: 4.98%

📅 Next Dividend Payment: April 15, 2025 (Ex-Date: March 31, 2025)

Dividend Overview

FCPT’s dividend is really the heart of its investment appeal. With a forward yield just over 5%, it offers a generous income stream that’s been remarkably stable over time. Unlike companies that hike payouts aggressively and then backtrack, FCPT’s approach is much more grounded. It raises dividends in a predictable, measured fashion—rewarding long-term holders without overextending.

The trust owns over 1,000 properties, many of which are leased to well-known national restaurant brands. These tenants provide a stable rent roll, and the triple-net lease structure puts most of the property costs on the tenants themselves. That makes for consistent cash flow, even in turbulent economic periods.

Even though the payout ratio based on earnings looks high, that’s not unusual in the REIT space. What matters more is how the dividend stacks up against free cash flow and AFFO. With $168 million in operating cash and $131 million in free cash flow last year, FCPT has the coverage it needs to keep paying shareholders comfortably.

Dividend Growth and Safety

FCPT doesn’t chase high growth, but it doesn’t have to. The company has steadily grown its dividend by about 4–5% per year, which is exactly the kind of pace that fits well in retirement portfolios or long-term income strategies. It may not double your yield in a hurry, but it will steadily increase your income without drawing attention to itself.

There’s always a bit of a trade-off with high payout ratios, especially when earnings don’t fully cover the dividend. But in this case, FCPT’s strong and recurring rental income paints a clearer picture of dividend sustainability than GAAP numbers alone. Cash flow is key here, and so far, FCPT continues to generate plenty of it.

What’s also reassuring is the stock’s beta—at just 0.88, it tends to move less than the broader market. That lower volatility gives dividend investors one more reason to sleep well at night. In short, FCPT fits neatly into an income strategy built around quality, stability, and slow-but-sure growth.

Cash Flow Statement

Four Corners Property Trust posted $168 million in operating cash flow over the trailing twelve months, continuing a strong multi-year trend of healthy internal cash generation. That figure is up from $144 million in 2024 and keeps pace with the $165 million it saw in 2023. The company’s ability to produce consistent free cash flow—a match to its operating cash flow each year—gives it a firm foundation for covering dividends and funding operations without relying excessively on new debt or equity.

On the investment side, FCPT spent over $314 million acquiring new properties, which is in line with its prior years and shows a disciplined approach to portfolio expansion. Financing activities brought in $142 million, largely fueled by capital stock issuance and fresh debt. While debt repayments totaled $226 million, that was more than offset by $301 million in new debt raised, reflecting active capital management. The company ended the period with $22 million in cash—higher than previous years—giving it some added liquidity heading into the next cycle. Overall, cash flow trends point to a well-managed REIT that continues to strike a balance between growth, debt service, and shareholder returns.

Analyst Ratings

📊 Analyst sentiment for Four Corners Property Trust (NYSE: FCPT) has been steady, with a consensus rating of Moderate Buy based on six current analyst opinions. 🟡 Three analysts suggest holding the stock, while the remaining three recommend buying. The average 12-month price target sits at $30.20, which suggests a potential upside of about 9% from where shares currently trade around $27.67.

🔼 Wells Fargo recently bumped its price target slightly from $30.00 to $31.00, maintaining an Overweight rating. Their move signals confidence in FCPT’s dependable cash flow and disciplined acquisition strategy, especially in a REIT landscape where many players are struggling with rising financing costs.

🔽 On the other hand, Barclays made a minor revision, trimming its target from $31.00 to $30.00 while sticking with an Equal Weight rating. The shift suggests they see limited near-term catalysts but acknowledge the company’s steady performance.

⚖️ JMP Securities also weighed in, reaffirming a Market Perform stance. They see FCPT continuing to move in line with broader REIT peers and the general market environment.

Overall, the tone from analysts reflects cautious optimism. FCPT’s stability, strong rent collection, and reliable dividend are clearly valued, even if aggressive growth expectations are being tempered in the current interest rate climate.

Earning Report Summary

Solid Start to 2025

Four Corners Property Trust came into 2025 with a strong first quarter, keeping things steady while continuing to grow in the right places. Rental income reached $63.5 million, which is up about 8% compared to the same time last year. Net income to common shareholders came in at $26.2 million, or $0.26 per share. That’s right in line with where it was last year and shows the consistency investors have come to expect from this REIT.

Funds from operations, which are a better measure of performance for a real estate company, were flat at $0.41 per share. Adjusted FFO ticked up just slightly to $0.44 per share, showing a bit of positive momentum. Nothing dramatic, but reliable—and that’s the name of the game for FCPT.

Acquisitions and Portfolio Growth

During the quarter, FCPT added 23 new properties to its portfolio, spending about $56.5 million in the process. These weren’t just any properties—they were mostly quick-service restaurants and auto service locations, with long-term leases and an average remaining lease life of over 17 years. The average cash yield on these buys was 6.7%, which is solid, especially in this market.

CEO Bill Lenehan mentioned that this was actually the biggest Q1 for acquisitions in the company’s history, which says a lot about how they’re using their capital and reading the market. FCPT now owns more than 1,200 properties across 47 states, with occupancy holding strong at 99.4%.

Strengthening the Balance Sheet

The company wasn’t just busy buying. It also took steps to improve its financial flexibility. FCPT raised around $149 million by selling shares through its at-the-market program. They sold more than five million shares at an average price of $28.30, which helped bring in fresh capital without overleveraging the business.

They also increased their revolving credit facility to $350 million and lined up a new $225 million term loan. All in, they’ve got about $617 million in liquidity, which gives them a comfortable cushion for future opportunities. Net debt to EBITDA sits at 5.6 times, or 4.4 times if you include forward equity, which puts them in a relatively good spot compared to peers.

Steady Dividends and Reliable Income

FCPT continues to deliver when it comes to dividend reliability. Rent collection was at 99.5%, which supports their regular payout of $0.355 per share. While they missed revenue expectations slightly—coming in at $71.5 million versus the expected $66.9 million—investors didn’t seem concerned. The stock actually moved higher after earnings, likely a reflection of the trust in FCPT’s business model.

Looking forward, management stayed fairly quiet on giving exact acquisition targets but made it clear they’re optimistic about the pipeline. Their focus remains on disciplined deals and keeping the balance sheet strong, which should help them continue delivering for income-focused shareholders.

Management Team

Four Corners Property Trust is led by CEO Bill Lenehan, who has been steering the company since its spin-off in 2015. Lenehan brings deep real estate investment experience and has maintained a focused strategy centered around triple-net lease properties. His steady leadership has helped FCPT grow while remaining disciplined in capital allocation and acquisitions.

In May 2024, Patrick Wernig was promoted to Chief Financial Officer, replacing Gerry Morgan. Wernig has been with the company since 2016 and led the acquisitions team for several years. His background gives him a strong grasp of both operations and finance, and his elevation to CFO highlights the company’s preference for promoting talent from within. Alongside him is Joshua Zhang, the Chief Investment Officer, who continues to drive the firm’s property acquisition and investment strategies. Together, this management team has built a business focused on stable returns and long-term value.

Valuation and Stock Performance

As of early May 2025, shares of FCPT are trading near $27.89, with a market cap around $2.79 billion. The stock has quietly moved up over the past year, rising about 15 percent, which stands out in a sector that has had to navigate inflation pressures and interest rate uncertainty. That kind of steady gain points to investor confidence in the company’s consistent performance.

Valuation-wise, the company trades at a trailing P/E of 25.91 and a forward P/E of 25.19. These numbers put it in line with peers and suggest it isn’t being overvalued despite the recent price increase. The price-to-sales ratio is 9.75 and EV to EBITDA comes in at 19.07, both of which reflect a healthy cash flow profile backed by long-term lease contracts.

The analyst consensus price target sits at $30.20, which implies room for a bit more upside from current levels. Meanwhile, recent technical strength has helped the stock’s relative strength rating improve, reinforcing its stable outlook in a volatile market environment.

Risks and Considerations

There are a few risks to keep in mind. FCPT’s portfolio is still heavily tilted toward restaurant properties, and while these tenants are mostly national brands with established operations, the sector as a whole can be sensitive to consumer spending trends. Economic slowdowns or shifts in dining behavior could pose challenges.

Interest rate movement is another area of focus. While FCPT has managed its debt with care, maintaining a net debt to EBITDA ratio of 5.6x, persistent rate hikes could impact borrowing costs or put pressure on property valuations. The company has boosted its liquidity with new term loans and an expanded credit facility, but the broader rate environment remains a watchpoint.

Tenant quality is something investors should continue to monitor. With high occupancy and reliable rent collection, FCPT has shown strength here, but individual tenant performance still matters. Even strong tenants can run into unexpected challenges in today’s shifting landscape.

Final Thoughts

Four Corners Property Trust continues to deliver what income-focused investors want—steady dividends, strong occupancy, and a clean, understandable business model. Its leadership has proven adept at navigating market cycles, growing the portfolio without overreaching, and managing risk while staying focused on returns.

With its disciplined approach, the company has built a stable income stream backed by long-term leases. Liquidity is solid, the balance sheet is manageable, and the team continues to find ways to grow even in a more challenging economic setting.

For investors looking for a combination of income reliability and slow, steady growth, FCPT holds its place as a dependable option in the REIT space. It’s not a company chasing headlines or huge gains, but it’s one that has earned its reputation through consistency, smart management, and a clear commitment to delivering shareholder value.