Key Takeaways

📈 FirstCash offers a forward dividend yield of 1.14% with a low payout ratio of 23.84%, allowing room for future dividend growth supported by strong free cash flow.

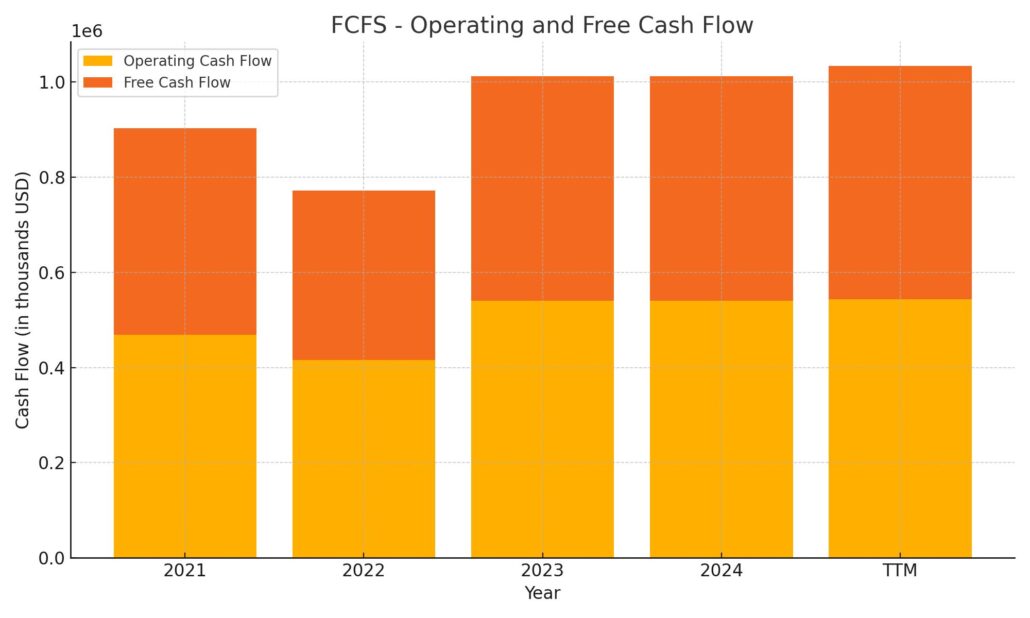

💰 Operating cash flow stands at $544 million with free cash flow at $489 million, providing solid coverage for dividends and enabling continued share buybacks and expansion.

🔍 Analysts have turned increasingly positive, with recent upgrades and a consensus price target of $148.33, suggesting roughly 10% upside from current levels.

📊 The latest earnings report showed a 36% year-over-year increase in net income, with strength across U.S. and Latin American pawn operations and improving margins in retail finance.

Last Update 5/4/25

FirstCash Holdings, Inc. (FCFS) has built a resilient and highly cash-generative business by serving consumers through its extensive pawnshop network and expanding retail point-of-sale financing segment. With over 3,000 locations across the U.S. and Latin America, the company delivers consistent earnings and strong free cash flow, making it a compelling option for dividend-focused investors.

Supported by a disciplined management team and a steady track record of quarterly performance, FirstCash has continued to expand, reward shareholders with growing dividends, and maintain a clear focus on capital efficiency. With a low payout ratio, healthy operating cash flow, and strategic growth initiatives in motion, the company’s long-term fundamentals remain well intact.

Recent Events

FirstCash’s most recent quarterly update confirmed the company is sticking to its strengths. Revenue came in at $3.39 billion for the trailing twelve months, essentially flat compared to the prior year. But it’s not all about growth at the top line. What caught the eye this time was the 36% year-over-year jump in earnings—proof that management is finding ways to widen margins and optimize operations.

Net income reached $281 million, while operating cash flow came in at $544 million. Better still, free cash flow hit $637 million, which is more than enough to cover capital needs and keep the dividend flowing.

The company does carry a fair amount of debt—$2.03 billion—but with a current ratio of 4.39 and $146 million in cash, its short-term liquidity is solid. The debt-to-equity ratio stands just under 99%, which sounds high but is manageable given the strength of the cash flows supporting it.

On the trading front, the stock just brushed up against its 52-week high at $134.85. It’s now trading around $133.91, sitting above both its 50-day and 200-day moving averages, suggesting solid momentum heading into the middle of the year.

Key Dividend Metrics

📅 Dividend Date: May 30, 2025

📉 Ex-Dividend Date: May 15, 2025

💵 Forward Annual Dividend Rate: $1.52

📈 Forward Dividend Yield: 1.14%

📊 Payout Ratio: 23.84%

📆 5-Year Average Dividend Yield: 1.45%

📆 Trailing 12-Month Dividend Yield: 1.12%

🧾 Last Dividend Increase: Quiet and consistent

🔁 Last Stock Split: 2-for-1 in February 2006

Dividend Overview

The yield isn’t going to raise eyebrows—1.14% won’t show up on high-yield screens—but that’s not the point here. This is about sustainability and reliability, and FirstCash delivers both. With a payout ratio under 24%, the company isn’t overextending itself to pay shareholders. That low ratio means there’s room to maintain, or even raise, the dividend without stressing the balance sheet.

The $1.52 per-share annual dividend reflects a deliberate approach. No aggressive hikes, no panic-driven cuts. It’s a steady path, matching the character of the business itself. For investors focused on long-term income rather than short-term excitement, this kind of dependability is a real asset.

FirstCash has shown it’s committed to this dividend strategy. Even in times of economic uncertainty, the company has kept its distribution consistent. That tells us the management team understands the importance of regular income to shareholders and has built its financial foundation with that in mind.

Dividend Growth and Safety

This is where FirstCash quietly impresses. The dividend hasn’t seen dramatic growth—but what it offers is a picture of financial discipline. A payout ratio below 24% gives plenty of room to absorb earnings fluctuations and still meet dividend obligations. That’s what dividend safety looks like.

The numbers back it up. With over $637 million in free cash flow and only about $67 million needed annually to fund the dividend (based on 44.36 million shares), there’s plenty of margin here. The company could fund its dividend multiple times over with the cash it’s generating. That’s a level of security few companies can match.

And the balance sheet, while leveraged, is built to support this. Operating cash flow remains strong, and the nature of the business—short-term loans backed by physical assets—creates a steady stream of inflows. It’s not speculative, it’s not cyclical in the traditional sense. It’s just steady.

For dividend investors looking to add a name that won’t surprise them in the wrong way, FirstCash offers something rare: a dependable, low-drama, income-generating business that just keeps performing. It may not make headlines, but in a portfolio built for the long haul, it plays a very valuable role.

Cash Flow Statement

FirstCash’s cash flow statement over the trailing twelve months highlights a business generating solid operational returns while maintaining a disciplined approach to both investment and capital return. Operating cash flow reached $544 million, continuing an upward trajectory over the past few years. This strength in operations is driven by reliable earnings from its core pawn business, which remains largely unaffected by broader credit cycles. Free cash flow came in at $489 million, giving the company considerable financial flexibility to support dividends, buybacks, and debt management.

On the investing side, the company spent $462 million, mostly tied to expansion and acquisitions to support long-term growth. Capital expenditures remained modest at just under $55 million, showing restraint in fixed asset spending. Financing activities reflected a mixed picture—$501 million in debt was issued, but that was partially offset by $341 million in repayments. The company also returned capital through $144 million in share buybacks. Overall, FirstCash ended the period with $158 million in cash, maintaining a healthy buffer and showing strong control over its capital allocation.

Analyst Ratings

FirstCash Holdings (FCFS) has recently caught the attention of several analysts who have shifted their ratings and price targets upward. 🟢 Loop Capital moved the stock from Hold to Buy and issued a price target of $140. Around the same time, TD Cowen upgraded FCFS from Hold to Buy, raising their target from $130 to $145. Stephens also maintained its Overweight rating while nudging their target up to $141 from $131. These adjustments reflect growing confidence in the company’s operational strength and earnings consistency.

What’s driving the renewed optimism? A lot of it comes down to execution. FCFS has quietly put together a string of earnings beats, outperforming consensus estimates in each of the last four quarters. Most recently, earnings per share came in at $2.07, well above the $1.75 estimate. 📈 That kind of steady overperformance is tough to ignore, and it’s leading analysts to recalibrate their expectations upward.

Right now, the average 12-month price target across analysts sits at $148.33. 🔮 Some are a bit more optimistic, with the high end reaching $150.00, while the more cautious outlooks still land at $145.00. With the stock currently trading around $133.91, that leaves room for an upside of roughly 10%. The sentiment has shifted noticeably more bullish, and it’s grounded in the company’s predictable cash flow, steady earnings, and clear financial discipline.

Earning Report Summary

FirstCash Holdings kicked off the year with a strong start, posting impressive results for the first quarter of 2025. The company delivered a 36% increase in net income year-over-year, pulling in $83.6 million. Adjusted earnings per share came in at $2.07, which comfortably cleared the bar analysts had set. Revenue held steady around $836 million, showing that demand for their core services continues to hold up well.

Pawn Operations Keep Leading the Way

In the U.S., FirstCash’s bread-and-butter pawn business was a standout once again. Same-store pawn receivables were up 13%, marking the seventh straight quarter of double-digit growth. That momentum translated into a 17% boost in pre-tax operating income, which hit $113 million. Latin America also held its own. While currency fluctuations took a bit of the shine off in U.S. dollar terms, local currency performance was strong, with pawn receivables growing 14% and margins holding steady at 17%.

AFF Delivers Quiet Strength

Their American First Finance segment turned in a quietly solid quarter. Pre-tax income from this arm jumped 58%, hitting $52 million. While total revenue dipped slightly, the business improved its credit quality and trimmed operating costs, leading to a 12% gain in net revenue. Expense control was a major theme here—operating expenses were down by 30%, which really helped push margins higher.

On the expansion front, FirstCash added 12 new pawn locations, pushing its total store count north of 3,000. They also continued investing in the long-term value of their footprint, buying the real estate under seven U.S. locations. And in a move that shows their confidence in the business, management repurchased $60 million worth of stock during the quarter. They also maintained their quarterly dividend at $0.38 per share, sticking to their approach of rewarding shareholders steadily over time.

What’s Ahead

Looking forward, leadership signaled that the rest of 2025 should build on the strong start. Pawn operations are expected to remain the core driver, contributing more than 80% of total pre-tax income. They’re planning additional store openings and staying open to acquisitions where it makes sense. Overall, the message from the top was clear: the fundamentals are strong, and they’re sticking to the game plan that’s been delivering results.

Management Team

FirstCash Holdings is led by a team with a deep understanding of the financial services landscape and a strong track record of executing growth strategies. At the helm is Rick Wessel, Chief Executive Officer and Vice Chairman of the Board. With nearly two decades in a leadership role, Wessel has steered the company through significant expansion phases, helping grow FirstCash into a dominant presence in both the U.S. and Latin American pawn markets.

T. Brent Stuart serves as President and Chief Operating Officer. Since joining in 2016, he’s played a key role in improving store operations, integrating acquisitions, and driving operational efficiencies. R. Douglas Orr, the company’s Executive Vice President and Chief Financial Officer, oversees the financial planning and capital management strategy, helping ensure the company remains financially disciplined as it scales. Chairman of the Board Daniel Feehan and Lead Independent Director Mikel Faulkner round out a board with a strong mix of operational expertise and independent oversight. The leadership team’s consistent execution and strategic vision have been critical to FirstCash’s ability to deliver stable earnings and shareholder returns over the long term.

Valuation and Stock Performance

The stock has been moving with a sense of quiet strength. After climbing steadily through the past several months, FirstCash recently touched a 52-week high of $134.85, reflecting growing investor confidence. At the time of writing, it’s hovering just below that peak, suggesting continued momentum. The company’s market capitalization now stands at roughly $5.94 billion.

When it comes to valuation, FirstCash trades at a trailing price-to-earnings ratio of 21.43 and a forward P/E of 15.36. These numbers don’t scream deep value, but they do suggest the market is willing to pay for a company that delivers dependable results quarter after quarter. The price-to-book ratio is at 2.89, supported by a healthy return on equity of nearly 14 percent. These metrics paint the picture of a stock that investors see as stable and reasonably priced for the quality of its earnings.

Analysts covering the stock have set an average 12-month price target around $148.33. The range of estimates runs from a more conservative $145 to a high of $150. That implies potential upside of around 10 percent from recent levels, assuming the company continues on its current path of growth and operational strength.

Risks and Considerations

No business is without its risks, and FirstCash is no exception. Regulatory uncertainty always looms over financial service providers, and pawn operations are closely monitored by state and local authorities. A shift in lending laws or oversight requirements could impact store-level economics or force adjustments in how loans are structured and collected.

Another area of concern is currency exposure. A meaningful portion of FirstCash’s business is conducted in Latin America, and foreign exchange fluctuations can eat into earnings even when local operations are performing well. That’s always a factor for companies with international operations, and it’s something investors need to keep in mind.

Debt levels are worth watching too. With just over $2 billion in total debt and a debt-to-equity ratio sitting around 99 percent, the company is fairly leveraged. Now, it’s managing that debt with strong cash flow, but if earnings were to soften unexpectedly, it could limit flexibility. Rising interest rates could also impact refinancing costs over time.

Lastly, the retail point-of-sale finance business brings its own set of competitive dynamics. FirstCash is up against both established lenders and new fintech players that are aggressively targeting consumers and retailers alike. Maintaining growth and profitability in that space will require continued investment in technology and a sharp focus on underwriting and customer experience.

Final Thoughts

FirstCash Holdings offers a unique combination of steady cash flow, disciplined leadership, and consistent returns. The company has built a business model that thrives in a variety of economic conditions, and its diversified footprint across pawn and retail finance gives it multiple avenues for growth. The management team has shown they know how to scale responsibly, and the company’s financial performance over the past several years speaks to that capability.

That said, investors should be mindful of the key risks—regulatory changes, currency exposure, and debt levels all warrant attention. But for those looking to add a name with stable fundamentals and reliable dividends, FirstCash brings a lot to the table. It’s the kind of business that doesn’t need to dominate headlines to create real long-term value.