Key Takeaways

💰 FFMR offers a 2.97% dividend yield with a conservative 38.71% payout ratio, backed by steady earnings and a gradual dividend growth trend.

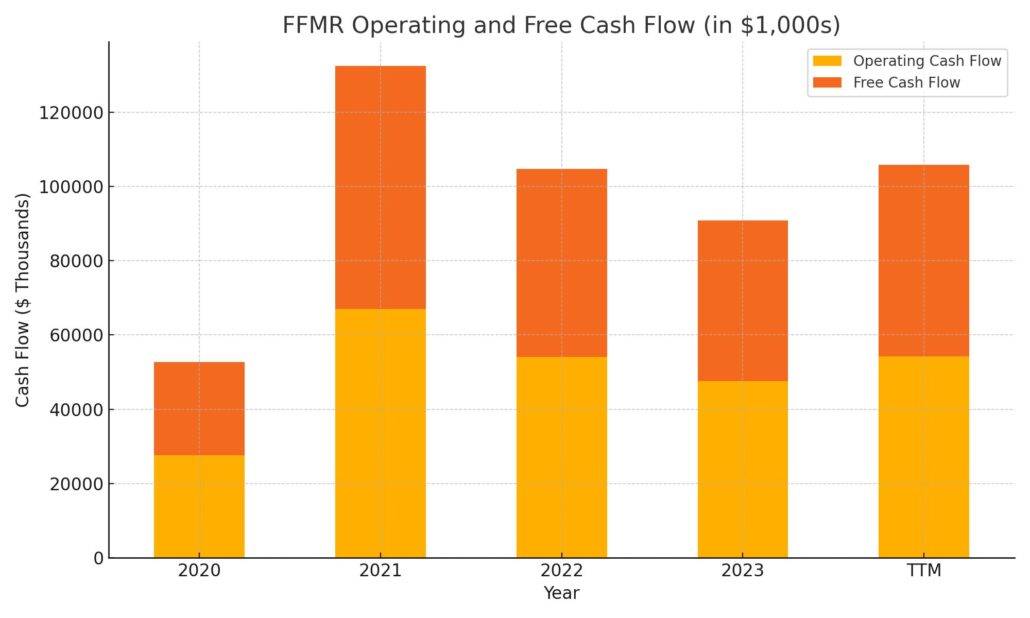

💵 The bank generated $54.2 million in operating cash flow and $51.6 million in free cash flow over the trailing twelve months, maintaining strong liquidity and modest capital expenditures.

📈 First-quarter earnings rose 30.5% year-over-year, driven by a 19% gain in net interest income and disciplined expense management, with leadership highlighting a strong capital position and continued digital investments.

Last Update 5/4/25

First Farmers Financial Corporation (FFMR), a Tennessee-based community bank, has quietly built a reputation for steady performance, disciplined management, and reliable dividends. With over four decades of leadership continuity, a strong balance sheet, and a conservative approach to lending, the company has consistently delivered solid returns to income-focused investors. Its net income rose 30.5% in the most recent quarter, supported by rising net interest income and expanding margins.

Trading at a modest 13.2x earnings with a forward dividend yield of 2.97%, FFMR combines financial strength with shareholder-focused policies like steady dividend growth and a recently announced \$4 million share repurchase plan. The stock’s low volatility, stable cash flow, and consistent earnings growth have made it a dependable choice for those seeking long-term, dividend-driven value.

Recent Events

In the last year, shares of FFMR have dipped slightly—about 3.65% down—but that kind of move feels almost irrelevant in the grand scheme of what the company stands for. Especially considering that many regional banks have had a rougher time, FFMR’s performance has actually highlighted its defensive posture. The stock has mostly traded within a narrow band, reflecting its low-beta, low-drama nature.

What’s more important is what’s happening under the surface. The company reported year-over-year earnings growth of 21.7%, and revenues grew 11.6%—numbers that signal a healthy, growing operation, not one treading water. This is especially impressive in a higher-rate environment where many banks are feeling the pinch.

Profitability metrics are solid: return on equity stands at 13.29% and return on assets at 1.13%. These are strong indicators of management’s discipline and the business’s overall efficiency. With nearly $88 million in cash on the balance sheet and a measured approach to debt, the company isn’t taking unnecessary risks.

Key Dividend Metrics

📅 Dividend Yield: 2.97%

📈 5-Year Average Yield: 2.83%

💵 Forward Annual Dividend: $1.96 per share

🔁 Payout Ratio: 38.71%

🧱 Dividend Growth Trend: Gradual and consistent

🗓️ Next Ex-Dividend Date: March 31, 2025

💥 Last Dividend Increase: Part of a steady growth pattern

Dividend Overview

At just under a 3% yield, FFMR’s dividend won’t knock your socks off in raw numbers, but that’s not really the point here. It’s the quality of the dividend—its consistency, its safety—that makes it compelling for income-focused investors.

The company pays out less than 40% of its earnings, which leaves plenty of breathing room. That’s not just about reducing risk; it’s about having the flexibility to keep paying and even increasing the dividend when conditions allow. This kind of discipline isn’t exciting, but it’s comforting if your goal is to collect a dependable income stream for years to come.

The dividend policy here reflects a thoughtful, measured approach. FFMR doesn’t chase yield. It builds it. You’re not going to see sudden spikes in the payout, but you also don’t have to worry about the bottom falling out.

Dividend Growth and Safety

What stands out the most is how quietly capable FFMR is when it comes to delivering income. It’s not a company trying to impress with big dividend hikes or flashy special payouts. Instead, it’s about regular, incremental growth, backed by fundamentals that continue to improve.

The 21% earnings growth over the past year, combined with a conservative payout ratio, makes room for future dividend increases—if management chooses to go that route. They’ve demonstrated a pattern of rewarding shareholders gradually, without putting the company’s financial health at risk.

Book value per share now stands at $38.97, and the stock trades at a price-to-book of 1.66. That’s not cheap by traditional banking metrics, but it reflects the market’s confidence in the underlying quality of FFMR’s business.

Then there’s volatility—or the lack of it. With a 5-year beta of just 0.17, FFMR is one of the most stable bank stocks out there. It moves less than the market and has proven time and again that it can weather bumps without getting knocked off course. That’s exactly what you want if you’re building a dividend-focused portfolio designed to last through market cycles.

Looking at the 52-week range, the stock is closer to the lower end, having traded between $64.10 and $69.99. That could be meaningful for investors who prefer to buy into strength with a margin of safety. But again, this isn’t a stock you own to time price swings. It’s one you hold for peace of mind, income reliability, and gradual appreciation.

As dividend investors know, it’s not just about yield—it’s about trust. And FFMR has earned that trust over the years by staying true to what it does best.

Cash Flow Statement

First Farmers Financial Corporation generated $54.2 million in operating cash flow over the trailing twelve months, showing consistent strength compared to the previous year’s $47.6 million. This steady cash generation reflects the company’s underlying profitability and operational efficiency. Free cash flow came in at $51.6 million, signaling a healthy ability to cover dividends and other shareholder returns without stretching the balance sheet. Capital expenditures remained modest at just $2.6 million, underscoring a capital-light model typical of regional banks.

Investing cash flow was sharply negative at -$251.4 million, a trend consistent with the past few years, primarily driven by loan originations and securities purchases. On the financing side, FFMR brought in $233 million, a mix of new debt issuance and repayments, along with modest stock repurchases. Notably, the end-of-period cash balance climbed to $133.8 million, more than doubling from the prior year. That increase in liquidity offers added flexibility, reinforcing the company’s ability to navigate interest rate shifts while continuing to fund its dividend.

Analyst Ratings

📊 First Farmers Financial Corporation (FFMR) isn’t currently under active analyst coverage, so there haven’t been any recent upgrades or downgrades issued by major Wall Street firms. That also means there’s no published consensus price target available right now. While this might sound like a red flag at first glance, it’s actually pretty typical for smaller, community-based banks that aren’t in the spotlight. These institutions often fly under the radar of the bigger research desks, especially when their operations are regional and their trading volumes are light.

💼 What matters more in this case is the story told by the numbers and management’s actions. FFMR recently initiated a $4 million stock buyback program, which sends a clear signal that leadership sees the shares as undervalued and wants to return capital directly to shareholders. That kind of move, especially from a bank that already pays a steady dividend, tends to reflect a strong balance sheet and a confident outlook. For investors focused on long-term income and stability rather than price speculation, this kind of shareholder-friendly move can carry just as much weight as an analyst upgrade.

Earning Report Summary

Strong Start to the Year

First Farmers Financial Corporation kicked off 2025 with a solid first quarter, reporting net income of $4.5 million. That’s a meaningful bump from where they were a year ago, reflecting a 30.5% increase in profitability. Earnings per share came in at $1.11, up from $0.82, showing that performance gains are translating directly into value for shareholders.

What really helped move the needle was a jump in net interest income, which grew 19% to reach $12.6 million. At the same time, the bank managed to cut interest expenses by a hefty 40%, which speaks to smart balance sheet decisions in a challenging rate environment. The net interest margin improved to 3.02%, a sign that First Farmers is navigating rate pressures more effectively than many peers.

Leadership Commentary and Future Direction

CEO Brian Williams called out balance sheet management and core deposit growth as key drivers behind the strong quarter. He acknowledged that loan demand remains a bit soft, but emphasized the bank’s disciplined approach to lending and maintaining high asset quality. It’s clear the focus is on being selective, not just growing for the sake of it.

The company also saw a notable increase in book value per share, which now sits at $36.85—up 23.2% from the same time last year and marking the highest level since 2020. That’s an important metric for long-term investors because it reflects the underlying value of the business beyond just quarterly results.

CFO Jill Giles highlighted the bank’s healthy capital position and pointed to ongoing investments in technology and mortgage services. Those areas seem to be a priority as First Farmers looks to stay competitive and deepen customer relationships. From the tone of leadership, there’s a sense of cautious optimism. They’re not rushing into aggressive expansion, but they’re positioning the bank to grow steadily without compromising their conservative foundation.

Management Team

First Farmers Financial Corporation is guided by a leadership team that blends extensive banking experience with a community-first mindset. Gene E. Miles, the long-standing President of both the Corporation and the Bank, has been with First Farmers since 1979 and brings over four decades of insight to his role. His leadership is steady, grounded, and deeply rooted in the bank’s core mission. Miles is active on several key committees that oversee areas such as asset and liability management, risk, investments, and executive compensation.

Supporting him is Keith D. Hill, Executive Vice President and Chief Financial Officer, who joined the company in 2016. Hill brings a solid financial background and plays a central role in shaping the company’s fiscal strategy. The wider executive team includes seasoned professionals overseeing operations, credit, and risk functions—each bringing specialized expertise to support the bank’s conservative growth model.

The Board of Directors is made up of individuals from a range of industries including agriculture, education, and small business. This mix brings diversity of thought and a well-rounded perspective to corporate governance. The team’s collective experience supports a stable operational environment, aligned with the bank’s long-term vision.

Valuation and Stock Performance

First Farmers shares recently traded at $66.00, marking a modest pullback of around 3.65% over the past twelve months. While the stock has underperformed the broader market in the short term, the price action has been relatively stable, reflecting its low volatility profile and conservative investor base.

The current price-to-earnings ratio sits around 13.2 times trailing earnings, a slight premium to the typical regional bank. This suggests that investors see value in the company’s earnings stability, dividend reliability, and prudent management practices. It’s not a speculative name, and that’s exactly what many long-term holders appreciate about it.

Looking back over five years, the stock has climbed by more than 43%. It’s not a rapid riser, but rather a slow and steady performer. The bank’s beta is very low at 0.17, meaning it tends to move far less than the market—an attractive trait for investors seeking calm in volatile times.

Risks and Considerations

No stock is without risk, and First Farmers is no exception. As a regulated financial institution, the company is subject to policy shifts that could affect profitability. Changes in interest rates, lending standards, or capital requirements can all play a role in shaping the bank’s operating environment.

One recent challenge was a cybersecurity incident in 2023, tied to a vulnerability in a third-party vendor’s software. While the issue was addressed, it serves as a reminder that even well-managed banks must stay vigilant about data protection.

The bank’s regional concentration and lending exposure to the agricultural sector also bring specific sensitivities. Factors like crop prices, climate events, or shifts in rural economic conditions could weigh on loan performance in select segments of its portfolio.

Final Thoughts

First Farmers Financial Corporation offers a strong value proposition for income-seeking investors who appreciate consistency, conservative management, and a community-focused business model. The leadership team has built a culture of discipline and reliability, and that’s reflected in the company’s earnings, dividend history, and balance sheet strength.

While the bank doesn’t operate on a grand scale, its stability is its strength. It has weathered industry shifts, rate cycles, and economic uncertainty without veering from its strategy. The risks are real but manageable, and the company has shown a clear ability to navigate them without losing focus.

For investors looking for a dependable dividend name with long-term staying power, First Farmers stands out as a quiet but solid contender. Its focus on shareholder value, balanced growth, and operational discipline makes it an attractive fit in a diversified income-oriented portfolio.