Last Update 5/4/25

First Business Financial Services, Inc., ticker symbol FBIZ, isn’t one of those high-profile Wall Street names you see splashed across financial news every day. Instead, it’s a steady, disciplined bank headquartered in Madison, Wisconsin that has built its business on personal relationships and a laser focus on commercial clients. For income investors, that kind of slow-and-steady business model is often where the real value lies.

FBIZ primarily serves business owners, executives, and high-net-worth individuals with customized banking, lending, and wealth management solutions. It doesn’t try to be everything to everyone—and that’s a good thing. This specialized focus has helped the bank maintain healthy returns and manage risk while paying out a reliable dividend.

Trading around $49.68 as of May 2, 2025, FBIZ has had a strong run over the past year, climbing over 39% and easily outpacing broader indices. The valuation still looks reasonable, with a trailing P/E just over 9 and a price-to-book ratio of 1.27. That’s the kind of setup dividend investors should find comforting—solid profits, responsible capital allocation, and a company that knows what it is.

Recent Events

The most recent quarterly numbers show FBIZ continuing to deliver where it counts. Net income for the trailing twelve months hit $44.6 million, with earnings per share at $5.48. Compared to a year ago, earnings are up more than 26%. That’s not just healthy—it’s a sign of strong credit quality, effective cost control, and a bank that knows how to navigate a rising rate environment.

Revenue is trending in the right direction, too—up 12.5% year-over-year. That tells us the core business is growing. Management hasn’t needed to resort to flashy acquisitions or cost-cutting gimmicks to prop up results. Instead, they’ve stuck to what they do best: building deep client relationships and delivering financial solutions that keep people coming back.

Insider ownership sits around 5%, while institutions hold about 73% of the float. That kind of ownership mix usually signals aligned interests. Insiders have skin in the game, and professional investors see long-term value here. Average trading volume is modest at roughly 30,000 shares a day, reflecting a relatively quiet investor base.

Key Dividend Metrics 📌

💵 Forward Dividend Yield: 2.33%

📈 5-Year Average Yield: 2.65%

📅 Next Ex-Dividend Date: May 9, 2025

📊 Payout Ratio: 18.98%

🔁 Dividend Growth Trend: Positive

🧾 Trailing Dividend Rate: $1.04

📆 Dividend Frequency: Quarterly

📉 Stock Volatility (Beta): 0.67

💰 Cash per Share: $26.33

Dividend Overview

FBIZ’s dividend doesn’t scream for attention, but it does exactly what dividend investors want it to do—it shows up, it grows, and it’s backed by strong financials. The forward dividend yield of 2.33% sits slightly below its 5-year average of 2.65%, but that’s mostly due to the share price moving higher. When the price goes up and the yield stays steady, that’s often a good sign.

The payout ratio is just under 19%, which is very conservative. That tells you the company isn’t stretching to pay this dividend—it’s paying it out of solid, recurring earnings. When you see a low payout ratio combined with strong profitability, it’s the kind of setup that points to long-term sustainability.

This is a quarterly payer, with the next ex-dividend date coming up on May 9. That gives investors a bit of time if they’re looking to lock in the next payout. Based on the trailing dividend rate of $1.04 and the recent increase to $1.16 annually, it’s clear management is committed to a steady growth path for income distributions.

Dividend Growth and Safety

What stands out about FBIZ from a dividend safety perspective is how comfortably the dividend fits within the overall earnings and capital structure. The company posted a return on equity of 14.69% and a return on assets of 1.25%—strong numbers that suggest the bank is making good use of its resources. With more than $219 million in cash on the books, the balance sheet has plenty of flexibility.

Debt stands at about $339 million, but that’s not out of line for a bank of this size and capital structure. The fact that the company can maintain a conservative payout policy while still investing in the business says a lot about its management discipline.

The dividend increase from $1.04 to $1.16 may not look huge at first glance, but that 11.5% bump is meaningful. It reflects real confidence from management in the underlying earnings power. They aren’t overpromising or stretching just to keep income investors happy. Instead, they’re delivering what they can afford—and then growing it when they can.

Over the years, FBIZ has shown a consistent ability to match dividend increases to its earnings performance. That’s what you want to see. No gimmicks, no sudden changes. Just deliberate, thoughtful capital return to shareholders.

In short, FBIZ offers a compelling story for investors focused on income. The yield is attractive, the safety is high, and the growth is consistent. And that’s all backed by a business that knows exactly who its customers are—and how to serve them well.

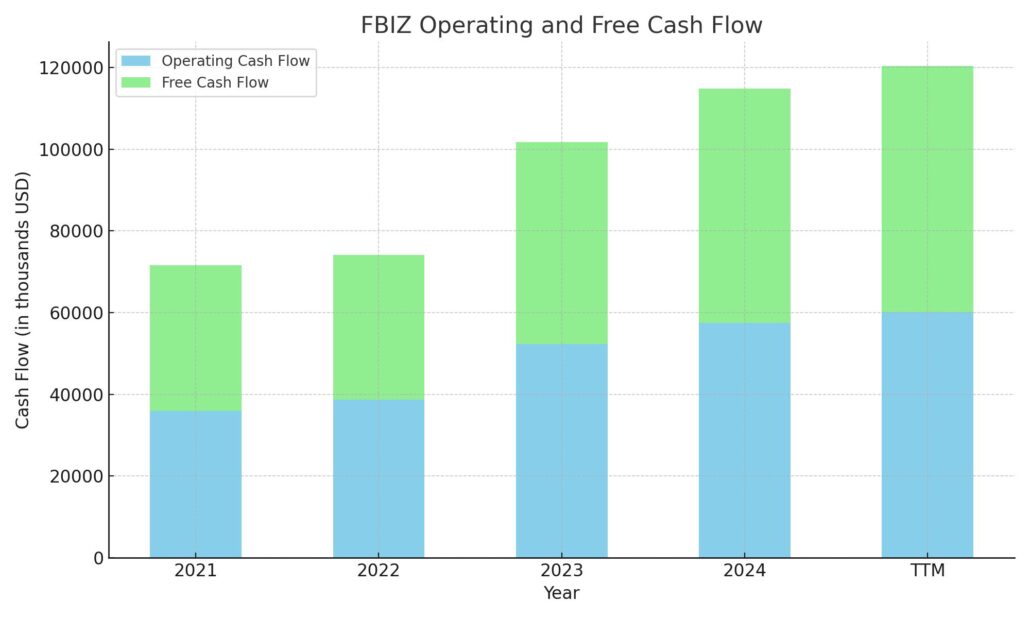

Cash Flow Statement

First Business Financial Services, Inc. continues to show strength in its core operations, with operating cash flow reaching $60.1 million on a trailing twelve-month basis. That’s a healthy uptick from $57.5 million in the prior year and reflects consistent income from its core lending and fee-based services. Free cash flow tells a similar story, rising to $60.2 million, up from $57.3 million, highlighting the bank’s ability to turn earnings into usable cash without tying it up in capital expenditures, which were minimal this period.

Investing and financing flows reflect the mechanics of a commercial bank managing liquidity and capital. The company reported outflows of $343.2 million in investing activities, tied primarily to loan originations and securities purchases—typical for a bank growing its asset base. On the financing side, inflows hit $381.6 million, largely driven by new debt issuance to support lending activity, offset somewhat by repayments and a modest level of stock repurchases. Ending cash climbed to $170.6 million, the highest in five years, providing a strong liquidity cushion. This cash flow pattern suggests a well-managed balance between growth and financial discipline.

Analyst Ratings

📈 First Business Financial Services (FBIZ) has recently caught the attention of analysts, prompting some updates to their ratings and price targets. Piper Sandler nudged its price target up from $57.00 to $58.00 while maintaining an overweight rating. The firm cited strong earnings momentum and a stable credit environment as key reasons for the boost. The bump, while modest, reflects growing confidence in the bank’s continued ability to expand margins and manage risk effectively.

🔍 Meanwhile, Keefe, Bruyette & Woods slightly trimmed their target from $60.00 to $59.00 but still held onto an outperform rating. Their view appears to remain optimistic, though the slight pullback in the price target suggests some caution tied to broader regional bank sector trends rather than company-specific concerns.

💬 Across the board, the analyst consensus leans toward a moderate buy. The average price target stands near $61.25, with estimates ranging from a low of $58.00 to a high of $63.00. That range points to continued upside potential from the current share price, driven by strong fundamentals, improving returns, and a disciplined capital strategy. For now, the Street seems to agree that FBIZ is well-positioned to keep delivering for shareholders.

Earning Report Summary

Strong Start to the Year

First Business Financial Services kicked off 2025 with a confident stride, posting net income of $11 million, or $1.32 per diluted share. That’s a healthy jump from the $8.6 million, or $1.04 per share, they logged in the same quarter last year. The bank’s operating revenue came in at $40.8 million, reflecting a 12.6% lift compared to a year ago. What’s driving that growth? Solid contributions from both interest and fee-based income, which is always a sign of a well-rounded performance.

Loan growth continues to be a cornerstone. The total loan portfolio rose by over 9%, reaching $3.18 billion. On the deposit side, the story is equally solid. Core deposits hit $2.46 billion, up more than 7% year-over-year, which points to continued strength in client relationships and trust in the bank’s approach.

Income and Margin Trends

Net interest income climbed to $33.3 million, an increase of 12.7%, thanks to both loan volume and pricing. The net interest margin did slip a bit to 3.69% from 3.77% last quarter, but it’s still higher than where it stood a year ago at 3.58%. So while margins may be tightening a little with rate pressures, they’re still moving in the right direction over the longer term.

Fee income also added meaningful support. Non-interest income reached $7.6 million, with private wealth fees up more than 12% year-over-year, totaling $3.5 million. The firm’s private wealth business now manages over $3.4 billion in assets—a new record. That steady fee growth adds stability to earnings, especially helpful when interest rates start moving around.

Expense Control and Efficiency

Operating expenses rose to $24.6 million, a 6.4% increase from last year, largely due to higher salaries and benefits. It’s not unexpected given the environment, and the bank is still keeping things efficient. Their efficiency ratio came in at 60.3%, a notable improvement from 63.8% a year ago. That kind of progress shows up in the bottom line.

Return metrics also moved in the right direction. Return on average assets hit 1.14%, and return on tangible common equity came in at 14.12%. Tangible book value per share rose to $37.58, up 14% from the prior year. For long-term investors, that’s an encouraging sign of underlying value creation.

Leadership Perspective

CEO Corey Chambas didn’t hesitate to highlight what’s working. He pointed to the bank’s steady, profitable growth across loans and deposits and emphasized the strength of their underwriting discipline. He also noted their balance sheet remains interest-rate neutral—an important edge in today’s shifting rate landscape.

Management made it clear they’re sticking with a game plan focused on controlled, sustainable growth. Their long-term target of 10% annual increases in loans, deposits, and revenue remains intact. So far, they’re making good on that promise, setting a strong tone for the rest of the year.

Management Team

First Business Financial Services is led by a seasoned and stable executive team, with Corey Chambas serving as CEO since 2006. He brings nearly two decades of leadership to the role and has built a company culture rooted in performance and accountability. Chambas also maintains a personal stake in the business, holding a meaningful percentage of shares, which further aligns his interests with those of long-term investors.

Supporting him is Dave Seiler, the President and Chief Operating Officer, who joined the firm in 2016. Seiler oversees the bank’s major revenue-producing segments along with internal operations, ensuring smooth execution across business lines. His nearly 30 years of industry experience have been a strong asset, especially in navigating a competitive banking environment.

Other key members of the leadership team include Jim Hartlieb, President and CEO of First Business Bank, and Laura Garcia, the Chief Risk Officer. Hartlieb has played an integral role in expanding the bank’s reach, while Garcia’s role in risk management ensures the institution maintains its cautious, well-capitalized posture. This collective leadership group has consistently delivered performance without overextending the balance sheet, a quality appreciated by income-focused investors.

Valuation and Stock Performance

First Business Financial Services has enjoyed a strong run in the stock market over the past year. Shares have climbed over 39% in the last 12 months, closing at $49.68 as of early May 2025. That performance stands out in a broader market that’s been much more reserved. The bank’s share price has benefited from consistent earnings growth, stable dividends, and investor appreciation for its predictable business model.

Despite the strong performance, the stock still trades at relatively conservative valuation multiples. With a trailing price-to-earnings ratio just above 9 and a forward P/E near 9 as well, FBIZ appears reasonably priced for a company delivering double-digit earnings growth. Its price-to-book ratio of 1.27 signals that the market is recognizing the bank’s growing tangible book value while still valuing the company modestly.

The dividend also plays a central role in the overall return. With a yield of 2.33% and a payout ratio below 20%, there’s plenty of room for continued increases. For those focused on stability, the stock’s beta of 0.67 signals less volatility than the broader market, which is appealing for anyone prioritizing consistent income over short-term swings.

Risks and Considerations

As with any investment in financial services, there are a few risks to consider. FBIZ remains exposed to the overall economy. If business activity slows or credit conditions tighten, loan demand could fall, or defaults could increase. While management has been disciplined in its underwriting, it’s not immune to macro headwinds.

Interest rate movements are another key factor. The bank has navigated the changing rate environment well, but if rates decline sharply or remain volatile, net interest margins could come under pressure. Rate-neutral strategies help, but there’s always some sensitivity in a banking business.

On the regulatory front, compliance costs and policy shifts can pose challenges. New banking rules or tighter capital requirements could affect growth plans or cost structures. Staying in line with evolving regulations is essential and time-consuming, even for well-run institutions.

Finally, a meaningful portion of FBIZ’s revenue is tied to relationships with a select group of commercial clients. While this reflects the bank’s high-touch service model, it also adds some concentration risk. A drop in activity from a few large clients could have a noticeable impact.

Final Thoughts

First Business Financial Services has proven itself as a reliable performer in the regional banking space. With a focus on commercial clients and a commitment to controlled growth, it has built a reputation for consistent earnings and prudent balance sheet management. That steady approach resonates with dividend-focused investors who value predictability over rapid expansion.

The leadership team has demonstrated long-term discipline, and that’s reflected in everything from credit quality to capital allocation. While no investment is without risk, FBIZ’s fundamentals remain strong. A conservative payout ratio, improving return metrics, and a rising dividend paint the picture of a well-run bank that still has room to grow.

Investors looking for a combination of income, value, and management stability may find FBIZ an appealing name to watch. The company isn’t trying to be the biggest—it’s focused on being one of the best at what it does. That measured, client-first strategy is what has helped the bank quietly deliver results year after year.