Key Takeaways

📈 AGM offers a forward dividend yield of 3.36% with a 14-year streak of annual dividend increases and a conservative 34% payout ratio.

💵 Strong cash generation with $612.6 million in operating cash flow over the trailing twelve months and more than $1 billion in liquidity.

🧭 Analysts currently rate the stock as a “Hold” with a consensus price target of $230, reflecting cautious optimism and steady performance.

📊 Recent earnings showed 24% year-over-year growth in quarterly net income, supported by rising net interest income and solid capital ratios.

Last Update 5/4/25

Federal Agricultural Mortgage Corporation (AGM), known as Farmer Mac, supports the rural economy through agricultural lending and rural infrastructure financing. With consistent earnings growth, a well-capitalized balance sheet, and a 3.36% forward dividend yield, it presents a strong case for income-focused investors seeking stability and long-term value.

Backed by disciplined leadership and a clear strategic direction, the company has increased its dividend for 14 consecutive years. Solid profitability, over \$1 billion in cash, and a low payout ratio reflect financial strength that continues to support both ongoing operations and shareholder returns.

Recent Events

There’s been no dramatic news cycle surrounding AGM recently, but that doesn’t mean the story hasn’t been evolving. The latest quarterly earnings show strength beneath the surface: revenue is up 15.6% year-over-year, reaching just over $360 million. Net income climbed 18.7%, and the company is running a tight ship operationally. Its profit margin stands at an impressive 57.46%, and operating margin is even stronger at nearly 70%.

Earnings per share over the last 12 months hit $16.43, and return on equity sits at 14.28%. Those numbers are healthy, especially for a business that sticks to a relatively niche lending focus. But what really jumps out is the cash. AGM is sitting on more than $1 billion in cash, which translates to over $100 per share in liquidity. Compare that with a stock price near $178, and you start to see the strength AGM brings to the table.

Yes, debt is high—about $29 billion—but that’s part of the model. This isn’t uncollateralized debt; it’s backed by real assets. The stock has held up reasonably well, too, trading in the middle of its 52-week range and maintaining a stable beta around 1.03.

Key Dividend Metrics

📈 Forward Yield: 3.36%

💰 Trailing Yield: 3.20%

🧾 5-Year Avg Yield: 3.20%

🧮 Payout Ratio: 34.06%

📅 Next Dividend Date: March 31, 2025

📆 Ex-Dividend Date: March 14, 2025

📦 Annual Dividend Rate: $6.00

These are not eye-popping numbers, but they’re exactly the kind of metrics that appeal to investors who value stability and a disciplined payout strategy.

Dividend Overview

AGM’s dividend doesn’t scream for attention, but it quietly does its job—and does it well. At a 3.36% forward yield, it’s offering income that beats many blue-chip financials and does so with room to grow. The $6.00 annual dividend is more than just sustainable—it’s backed by real earnings and a conservative payout policy.

Management has kept the payout ratio in check, right around 34%. That’s a healthy buffer. It suggests AGM is in no rush to overextend, opting instead to pay shareholders from solid net income rather than financial engineering or short-term gains.

There’s a strong consistency to how this dividend has behaved over the years. It may not rise in giant leaps, but it keeps moving in the right direction. That kind of quiet, consistent income is exactly what many dividend investors are after—especially those focused on preservation and long-term compounding.

What’s also worth noting is that AGM doesn’t play games with special dividends or irregular payouts. The program is predictable, and that predictability is part of its appeal. It tells you the business model is working, the earnings are real, and the board sees value in returning that income to shareholders rather than hoarding it or deploying it too aggressively.

Dividend Growth and Safety

This is where AGM starts to stand apart. While some companies are stretching to maintain their dividend amid softening earnings or rising costs, Farmer Mac is doing the opposite. The dividend is backed by a growing business, strong cash flows, and plenty of room for future increases.

The low payout ratio gives AGM a cushion if economic conditions shift. It also leaves the door open for growth. With EPS on the rise and revenue momentum still strong, there’s no immediate need to choose between reinvesting in the business and rewarding shareholders—AGM can do both.

From a safety standpoint, the structure of AGM’s business helps as well. Its lending is asset-backed and focused on agriculture—a sector with long-term demand that tends to be less volatile than others. It also doesn’t rely heavily on consumer behavior or discretionary spending, which adds a layer of protection during downturns.

The numbers speak to a well-run business. Return on equity at 14.28% and margins north of 50% show that this isn’t just a sleepy government-sponsored entity—it’s a profitable operation with real discipline. The massive cash position further bolsters the dividend safety net, and while the company carries a high level of debt, it’s structured and expected in a financial intermediary model like this.

There’s also broad confidence in the stock from institutional investors, who hold over 82% of the float. That level of ownership signals that large, long-term money sees AGM as a stable income vehicle. And for retail dividend investors, that vote of confidence shouldn’t be overlooked.

Over the last five years, AGM has demonstrated a steady pace of dividend increases. The growth may not be aggressive, but it’s consistent. And that consistency is key—especially when you’re building a portfolio meant to pay you for decades to come.

AGM might not deliver the excitement of a high-flying tech stock or the headline-yield of a stretched REIT, but for those who care about durable income and financial strength, it continues to offer something quietly valuable.

Cash Flow Statement

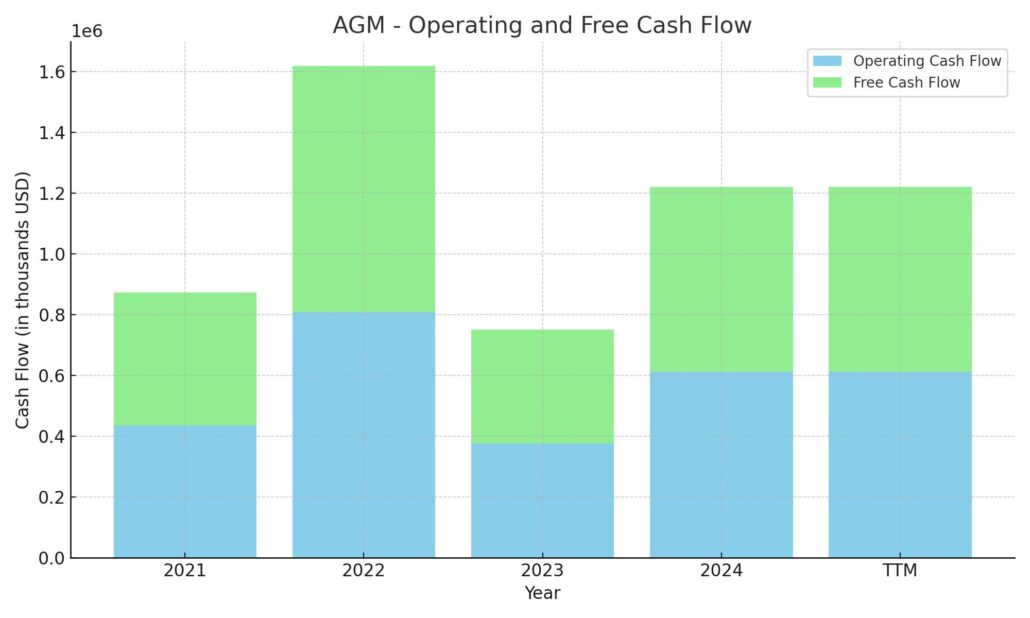

Over the trailing twelve months, Federal Agricultural Mortgage Corporation (AGM) generated $612.6 million in operating cash flow, showing a substantial year-over-year increase from $375.8 million. This improvement reflects the company’s expanding core lending and securitization activities. Free cash flow came in just slightly under that figure at $607.4 million, indicating limited capital expenditures and a business model that doesn’t require heavy reinvestment to sustain operations.

Investing cash flow remained significantly negative at -$1.68 billion, consistent with the company’s strategy of deploying capital into long-term agricultural loan assets. On the financing side, AGM brought in $1.2 billion in net cash, mainly from its regular issuance and repayment of debt, which is a natural function of its loan-backed funding model. The balance between these financing activities and operational cash generation helped push its end-of-period cash position to just over $1 billion, reinforcing its liquidity strength and ability to support ongoing dividends.

Analyst Ratings

Federal Agricultural Mortgage Corporation (AGM) has recently seen a shift in sentiment from analysts. 🧭 Keefe, Bruyette & Woods downgraded the stock from “Outperform” to “Market Perform” while nudging the price target slightly higher from $212 to $215. 📈 This kind of move usually signals a more neutral outlook—confidence in the company’s fundamentals remains, but expectations for near-term upside may have softened. It’s a signal that AGM has likely performed well, possibly outpacing earlier expectations, prompting a more measured view going forward.

At the same time, analysts haven’t turned their backs on the stock. The consensus 12-month price target sits at $230.00 🏷️, reflecting roughly 28.6% upside from the current share price. That’s a solid figure for a company in the financials sector with a relatively conservative business model. The overall analyst rating has settled around a “Hold” 🟡, suggesting the stock is fairly valued at current levels and may need a new catalyst or stronger earnings momentum to break out further.

The message here is nuanced: there’s still belief in AGM’s long-term positioning, but analysts are tempering expectations in the short run. It’s less about concerns and more about recognizing how much has already been priced in.

Earnings Report Summary

Strong Finish to the Year

Federal Agricultural Mortgage Corporation wrapped up 2024 on a high note, reporting solid growth in both quarterly and full-year earnings. For the fourth quarter, net income available to common stockholders hit $56.5 million, which works out to $4.63 per diluted share. That’s a 24% improvement from the same time last year, and it capped off a full year of steady performance. Over the course of 2024, net income totaled $180.4 million, a modest increase from the prior year’s $172.8 million.

What’s notable is the consistency in their core earnings, which came in at $15.64 per share. That aligns closely with last year, showing that the company’s operational strength remains on solid ground. Net interest income rose to $353.9 million, up about 8% year-over-year. Even more telling, the net effective spread also moved higher, reaching $339.6 million, which reflects efficient management of their funding and lending activities.

Capital Strength and Liquidity

Farmer Mac’s balance sheet remains in excellent shape. They ended the year with $1.5 billion in core capital and a Tier 1 Capital Ratio of 14.2%, both of which provide a strong buffer against any unforeseen economic pressures. Liquidity is another area where they shine—at year-end, they had enough on hand to cover 264 days of funding needs. That kind of cash position gives them a lot of flexibility moving forward.

Leadership’s Outlook

CEO Brad Nordholm shared a confident tone when talking about the results. He pointed out the company’s strong capital position, diverse business mix, and disciplined risk management. More importantly, he emphasized their continued mission to support rural America by delivering financing solutions that are both reliable and impactful. It’s clear leadership is focused on not just maintaining performance, but growing responsibly and with purpose.

Dividend Growth Continues

In a move that will be well-received by income-focused investors, the board approved a 7% increase in the quarterly dividend, bringing it to $1.50 per share. This marks the fourteenth consecutive year of dividend hikes, reinforcing the company’s commitment to delivering shareholder value alongside its broader mission-driven objectives.

Looking Ahead

The message going forward is one of resilience and strategic growth. Management appears confident in the business model and its ability to withstand market fluctuations. They’ve signaled a continued push toward expanding their presence in agricultural and rural infrastructure finance, with an eye on both opportunity and risk. With a diversified lending portfolio and a disciplined approach, Farmer Mac seems well-positioned to continue building on this momentum into the next year.

Management Team

The leadership at Federal Agricultural Mortgage Corporation brings a blend of private sector experience and public mission-minded focus. At the helm is Brad Nordholm, the company’s President and CEO, who has guided Farmer Mac with a steady hand through changing market dynamics and interest rate environments. His background spans decades in financial services and renewable energy finance, which has helped shape Farmer Mac’s strategic direction as it deepens its presence in rural infrastructure and agricultural lending.

Under Nordholm’s leadership, the management team has remained focused on balancing growth with disciplined risk management. CFO Aparna Ramesh has played a key role in maintaining the company’s strong capital and liquidity position, helping to ensure the dividend is well-supported. The rest of the executive team brings a mix of capital markets knowledge, agricultural policy experience, and deep roots in structured finance—traits that are essential for navigating the specialized terrain of rural credit markets. Together, the team has fostered a performance culture that keeps shareholders in mind while executing on the broader mission of supporting the backbone of rural America.

What stands out is the alignment between Farmer Mac’s leadership and its long-term strategy. There’s no overpromising or aggressive forecasting. The tone from management has consistently emphasized sustainable growth, thoughtful capital deployment, and a commitment to shareholder returns.

Valuation and Stock Performance

At a recent trading price of around $178, AGM currently trades at a trailing price-to-earnings ratio of just under 11. That places it on the lower end of the valuation spectrum for financial services firms, especially when you consider the 14% return on equity and high operating margins. From a forward-looking perspective, the P/E ratio tightens even further to about 10.4, reflecting expectations for continued earnings growth and stable fundamentals.

The price-to-book ratio sits near 1.8, which is modest considering the company’s consistent profitability and cash-rich balance sheet. While the stock isn’t dirt cheap, it’s not richly priced either. The valuation appears to reflect a market that sees Farmer Mac as a solid, steady performer rather than a high-growth play. That’s actually ideal for dividend investors, who typically seek companies with reliable cash flow and low downside risk.

Over the past year, AGM has traded between $159 and $217. The stock currently sits toward the lower-middle end of that range, down slightly over the last twelve months. However, in the context of broader market volatility and rising interest rates, the fact that AGM has held its ground without major drawdowns says something about investor confidence. The 50-day and 200-day moving averages suggest a relatively stable technical setup, with no major breakdowns or runaway rallies.

Analysts have pegged a consensus 12-month price target around $230. If the company continues to execute at its current pace, particularly with earnings and cash flow remaining strong, that target doesn’t feel out of reach. And with a dividend yield north of 3%, investors are getting paid to wait.

Risks and Considerations

Farmer Mac’s model is unique, but it doesn’t come without risk. The most prominent concern is its exposure to the agricultural sector. While agriculture tends to be less volatile than many sectors, it’s not immune to weather events, commodity price fluctuations, and shifts in federal policy. Any disruption in rural credit markets could affect loan performance or demand for Farmer Mac’s services.

There’s also interest rate sensitivity to consider. Though the company has done a good job managing its spread and maintaining profitability in a rising rate environment, further tightening or unexpected rate volatility could put pressure on margins. Its business depends on funding loans through the capital markets, and any dislocation there could increase costs or dampen demand.

Another area to watch is regulatory changes. As a government-sponsored enterprise operating with a public charter, Farmer Mac has to balance private shareholder interests with policy goals. Any shift in federal oversight, capital requirements, or program mandates could alter the company’s operating environment.

Leverage is high, with a debt-to-equity ratio near 2,000%. That might sound alarming at first glance, but it’s a reflection of the company’s role as a secondary market lender—this is a business built on structured debt. Still, it’s important for investors to remember that such a model works only as long as liquidity and risk management stay intact. A misstep in underwriting or a sharp deterioration in loan quality could challenge the balance sheet.

Finally, the stock itself tends to be thinly traded, with relatively low daily volume. This can sometimes lead to higher volatility during periods of selling pressure or broader market swings. For long-term investors, that may not be a problem, but it’s something to keep in mind for anyone looking at entry or exit points.

Final Thoughts

Farmer Mac isn’t a household name, and that’s part of its charm. It doesn’t chase trends or fight for headlines. Instead, it focuses on doing one thing very well—delivering financing solutions to the rural and agricultural economy—and returning value to shareholders through disciplined management and consistent dividends.

For dividend-focused investors, AGM offers a lot to like. The payout is well-covered, the yield is competitive, and the track record of increases stretches well over a decade. Add in a solid balance sheet, strong earnings growth, and a management team that seems more focused on execution than excitement, and you’ve got a stock that can play a dependable role in an income-oriented portfolio.

It’s not without risk, of course. Macroeconomic conditions, rate movements, and agriculture-specific shocks could all introduce volatility. But the company’s structure and leadership approach suggest it’s built for resilience. With a valuation that leaves room for upside and a dividend policy that rewards patience, Farmer Mac stands out as a steady hand in an otherwise noisy market.