Key Takeaways

💰 Dividend yield is 1.7% with steady annual growth and a conservative 26% payout ratio, leaving room for future increases.

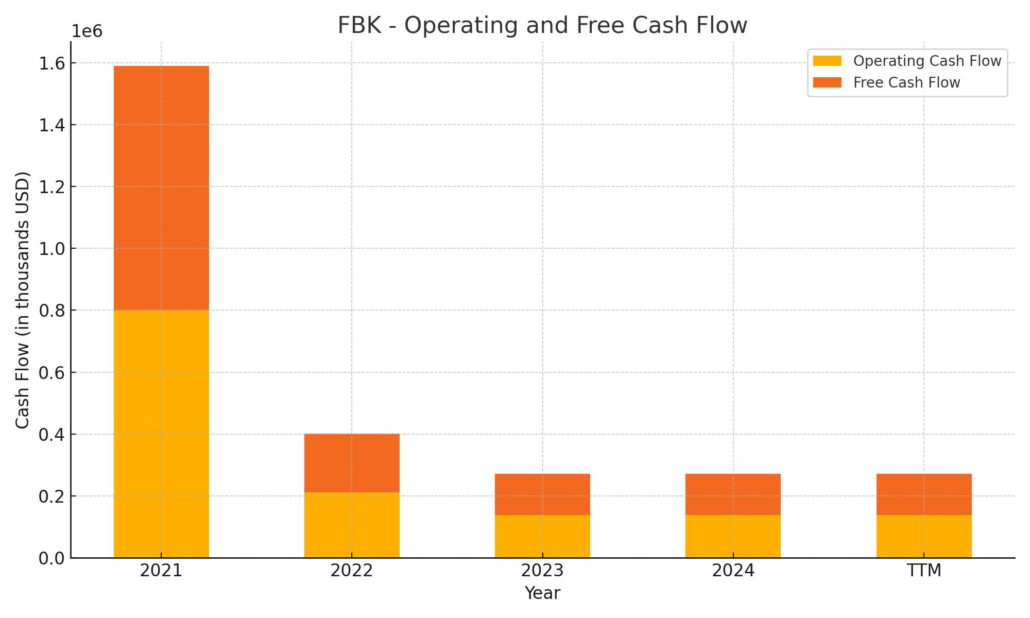

📈 Free cash flow and operating cash flow both totaled $138.8 million TTM, underscoring strong dividend coverage and financial stability.

🔍 Analysts show growing confidence, with upgrades from key firms and a consensus price target near $55.

📊 Q1 earnings delivered $39.4 million in net income and improved margins, highlighting operational strength in a cautious economic environment.

Last Update 5/4/25

FB Financial Corporation (FBK), based in Nashville, has quietly built a reputation for strong fundamentals, measured growth, and shareholder-friendly policies. With a market cap around \$2 billion, it operates through FirstBank, serving Tennessee and neighboring regions. The company reported a solid start to 2025, with \$39.4 million in net income and stable earnings per share. Its net interest margin expanded to 3.55%, while loan and deposit balances remained healthy.

Analysts have taken notice, offering a consensus price target in the mid-\$50 range and recent upgrades from key firms. The stock has risen over 15% in the past year, supported by consistent free cash flow and a 1.7% dividend yield. Backed by a seasoned leadership team and a prudent capital strategy, FBK continues to position itself for long-term strength.

Recent Events

FB Financial just turned in a strong first quarter, reporting a net income jump of over 40% from the same time last year. That’s a real pickup in performance and speaks to how well the bank is managing its operations, especially in a still-uncertain rate environment.

Revenue also grew more than 20% year over year. These aren’t numbers you often see at a regional bank, especially one with a market cap around $2 billion. The bank’s book value per share climbed to $34.44, and return on equity came in at a healthy 8.27%. Overall, this was a solid quarter that shows FBK isn’t just coasting—it’s making moves.

The market has taken notice too. Shares are up over 15% over the past year, outpacing the broader S&P 500. And while that performance isn’t jaw-dropping, it signals that investors are rewarding the fundamentals. For income-focused shareholders, the dividend is becoming a more central part of the story.

Key Dividend Metrics

🔵 Forward Dividend Yield: 1.70%

🟢 Trailing 12-Month Dividend Growth: +8.6%

🟠 5-Year Average Dividend Yield: 1.35%

🟣 Payout Ratio: 25.74%

🟡 Ex-Dividend Date: May 13, 2025

🟤 Dividend Per Share (Forward): $0.76

At first glance, a 1.70% yield might not stop you in your tracks. But this is a case where consistency, balance, and room to grow matter more than just the number itself. FBK’s approach to dividends is measured, not aggressive—there’s a long-term plan here.

Dividend Overview

FBK’s dividend isn’t the flashiest out there, but it shows signs of being sustainable and thoughtfully managed. The company currently pays out $0.76 per share annually, which translates to a 1.70% yield based on the latest share price. That’s a small bump from the trailing yield of 1.62%, and also sits comfortably above the bank’s five-year average of 1.35%.

It’s not trying to be a high-yield play. But when you consider that it’s doing this with a payout ratio under 26%, it starts to look a lot more appealing. Management is clearly leaving itself room to maintain or even raise the dividend, even if earnings hit a bump.

Another layer of reassurance? Insider and institutional ownership. Over 25% of the shares are held by insiders, and 67% are held by institutions. That kind of skin in the game tends to align interests—dividends aren’t being paid to check a box; they’re being paid because the folks running the business also benefit from them.

Dividend Growth and Safety

FBK’s dividend growth hasn’t been flashy, but it has been consistent—and that’s arguably even more important for investors looking for reliability. The most recent increase moved the payout from $0.70 to $0.76, which is about an 8.6% jump year over year. That’s a healthy raise, especially when it’s coming from a bank that’s still investing in its business and expanding across its core markets.

The low payout ratio is one of the biggest strengths here. At 25.74%, there’s a lot of headroom. This isn’t a company stretching to pay shareholders. In fact, with earnings per share at $2.72, the dividend feels well-supported. That kind of coverage gives FBK the flexibility to keep paying—even if the economic cycle hits a rough patch.

The bank’s financial position adds another layer of comfort. It holds nearly $795 million in cash, with just $228 million in debt. The exact debt-to-equity figure wasn’t provided, but with that kind of balance sheet, the company is clearly not overleveraged.

For dividend investors, there’s also some reassurance in the bank’s stability. A beta of 0.92 suggests it moves a bit less than the broader market—lower volatility often makes for a smoother ride when you’re collecting dividends.

Looking ahead to the next ex-dividend date on May 13, this remains a name worth watching if you value a steady dividend that comes with conservative financial management and solid fundamentals. FBK might not offer huge yields, but what it does provide is a strong foundation—and the discipline to keep delivering.

Cash Flow Statement

FB Financial’s cash flow picture over the trailing twelve months shows a mixed, yet ultimately stable position. Operating cash flow came in at $138.8 million, which is a noticeable step down from the previous two years, particularly 2021’s elevated $799.7 million. Still, this level of cash generation provides a solid base for maintaining the dividend and managing day-to-day operations. Free cash flow closely tracked operating cash flow at $132.3 million, indicating minimal capital expenditure requirements—a positive for dividend sustainability.

Investing cash flow was significantly negative at -$294 million, suggesting the bank continues to deploy capital into securities or loan growth, which aligns with its recent revenue expansion. On the financing side, cash inflows reached $386.8 million, reversing a large outflow the year prior. This shift was aided by reduced debt repayments and more restrained stock buybacks. The end cash position strengthened to just over $1 billion, up from $810 million the year before. While some volatility is visible across years, FBK remains well-capitalized, and its ability to support both growth and shareholder returns appears intact.

Analyst Ratings

FB Financial Corporation (FBK) has recently seen a mix of analyst actions, reflecting varying perspectives on its performance and outlook. 🟢 In April, Hovde Group upgraded the stock from “Market Perform” to “Outperform,” adjusting their price target slightly down from $60 to $59. This upgrade suggests confidence in FBK’s potential, possibly due to its solid financial performance and ongoing strategic execution.

🟠 On the other hand, Keefe, Bruyette & Woods maintained a “Market Perform” rating but lowered their price target from $58 to $52. This more cautious stance could reflect short-term uncertainty or broader concerns in the regional banking sector that are impacting sentiment, despite the company’s consistent results.

🟣 Piper Sandler continues to show confidence, maintaining an “Overweight” rating while trimming their price target slightly from $60 to $58. This implies they still see meaningful upside, though they’re tempering expectations slightly in light of current market conditions.

📊 The overall analyst consensus now places FBK’s average price target in the $54 to $55.20 range, with the highest outlook hitting $60 and the lowest falling to $42. That spread suggests moderate upside potential from current trading levels, while also acknowledging the bank operates in a challenging, competitive environment.

Earning Report Summary

Solid Start to the Year

FB Financial kicked off 2025 on a strong note, delivering a first-quarter performance that showed stability and a bit of momentum in the right places. The bank posted net income of $39.4 million, or $0.84 per share, which was right in line with what it achieved both in the previous quarter and the same period last year. Adjusted earnings came in just slightly higher at $0.85 per share. These numbers show consistency, which is often underrated in the banking world, especially when so many regional banks are dealing with pressure on both sides of the balance sheet.

One of the standout details this quarter was the improvement in the net interest margin, which edged up to 3.55% from 3.50% last quarter. That’s not a massive leap, but in this kind of interest rate environment, even a small gain signals that the bank is managing deposit costs well while keeping its lending business moving.

Loan and Deposit Trends

Loan growth is still happening, though at a measured pace. Total loans held for investment rose to $9.77 billion, which translates to an annualized growth rate of about 7.14%. That’s respectable, especially considering the mixed signals across the broader economy. Deposits held steady at $11.2 billion—no surge, but no shrinkage either, which is something many banks would be happy with right now.

Behind the scenes, FBK’s capital and liquidity positions continue to look healthy. They haven’t had to stretch or reach for yield, which puts them in a good position to stay flexible in the coming quarters.

Leadership Perspective

Christopher Holmes, the company’s CEO, acknowledged that the broader economy wasn’t moving as quickly as some had hoped, but he seemed upbeat about the bank’s positioning. He pointed to the disciplined approach to growth and capital deployment as key advantages, especially in an environment where caution is still the name of the game.

What stood out from Holmes’ remarks was the confidence in the bank’s ability to move on strategic opportunities. FBK recently entered new markets in Asheville, North Carolina, and Tuscaloosa, Alabama—both of which are part of its broader plan to grow thoughtfully in high-potential areas. Holmes made it clear that they’re not just expanding for the sake of it, but rather leaning into markets where they believe there’s real long-term value.

Taken together, the first quarter results didn’t bring any major surprises, but they reinforced a theme that’s been building with FBK: consistency, discipline, and smart execution. In a time when plenty of banks are treading water, that kind of approach feels like a competitive advantage.

Management Team

FB Financial Corporation is led by Christopher Holmes, who has served as President and CEO since 2013. Holmes joined the company in 2010 as Chief Banking Officer and played a key role in taking the bank public in 2016. His leadership has consistently emphasized strategic growth while maintaining the personalized approach of a community bank.

Holmes is supported by a strong executive team. Michael Mettee is the Chief Financial Officer, overseeing all aspects of financial planning and reporting. Travis Edmondson serves as Chief Banking Officer, focusing on lending, deposits, and customer engagement across the bank’s footprint. Aimee Hamilton manages the risk profile as Chief Risk Officer, while Beth Sims oversees the legal side of operations as General Counsel. These leaders bring decades of experience in banking, finance, and risk management, helping guide the company through both growth and economic shifts.

The board of directors adds another layer of seasoned leadership. Chairman William F. Carpenter provides strategic oversight and stability. Other board members include J. Jonathan Ayers, Agenia W. Clark, James W. Cross IV, and James L. Exum, among others. The board’s diverse background supports balanced decision-making and long-term focus.

Valuation and Stock Performance

FB Financial’s stock has held up well in the past year, showing a steady climb that reflects investors’ appreciation for the company’s disciplined approach. As of early May 2025, shares are trading near $44.69, marking a roughly 16 percent gain over the prior 12 months. In a choppy market for regional banks, that kind of performance signals confidence.

From a valuation standpoint, FBK is trading at about 16 times trailing earnings, which puts it right around the industry average. Its price-to-book ratio stands at 1.3, suggesting the market sees value in its franchise, even if it’s not pricing in dramatic upside. Analysts currently hold a consensus price target around $55, implying there’s still room to grow from current levels.

Dividend investors will appreciate the current yield of 1.7 percent. With a payout ratio of just 26 percent, the company has plenty of flexibility to raise its dividend further or deploy capital elsewhere if needed. It’s not a flashy dividend, but it’s a dependable one, backed by steady earnings and a conservative approach to capital management.

Risks and Considerations

No bank is immune to challenges, and FB Financial is no exception. The biggest headwinds continue to be margin pressures and loan competition. With deposit costs rising across the industry, FBK will need to keep a close eye on net interest margin sustainability.

Economic uncertainty also plays a role. A slowdown in commercial lending or regional real estate could impact asset quality. Although the bank has managed credit risk well so far, continued economic softness would raise the stakes. There’s also the potential for regulatory changes, which could increase compliance costs or alter how banks manage capital.

One more thing to watch: the pending acquisition of Southern States Bank. While strategic acquisitions have helped FBK grow in the past, integration is never guaranteed to go smoothly. Successfully combining systems, customer bases, and teams will be key to delivering on the expected benefits.

Final Thoughts

FB Financial has built a reputation for steady execution, thoughtful growth, and a strong culture rooted in community banking. Its management team, led by Christopher Holmes, continues to show a disciplined hand during a time when many regional banks are facing outsized volatility. Valuation remains reasonable, and the stock has shown healthy performance relative to peers.

Dividend investors looking for a conservative, reliable name in the banking space may find FBK worth keeping on the radar. The dividend is modest but stable, and the underlying fundamentals remain intact. While macroeconomic risks are ever-present, the company’s balanced approach to growth and capital management gives it a firm footing to navigate whatever comes next.