Key Takeaways

📈 Fastenal offers a forward dividend yield of 2.14%, supported by consistent annual increases and a payout ratio around 80%, with a focus on long-term shareholder returns.

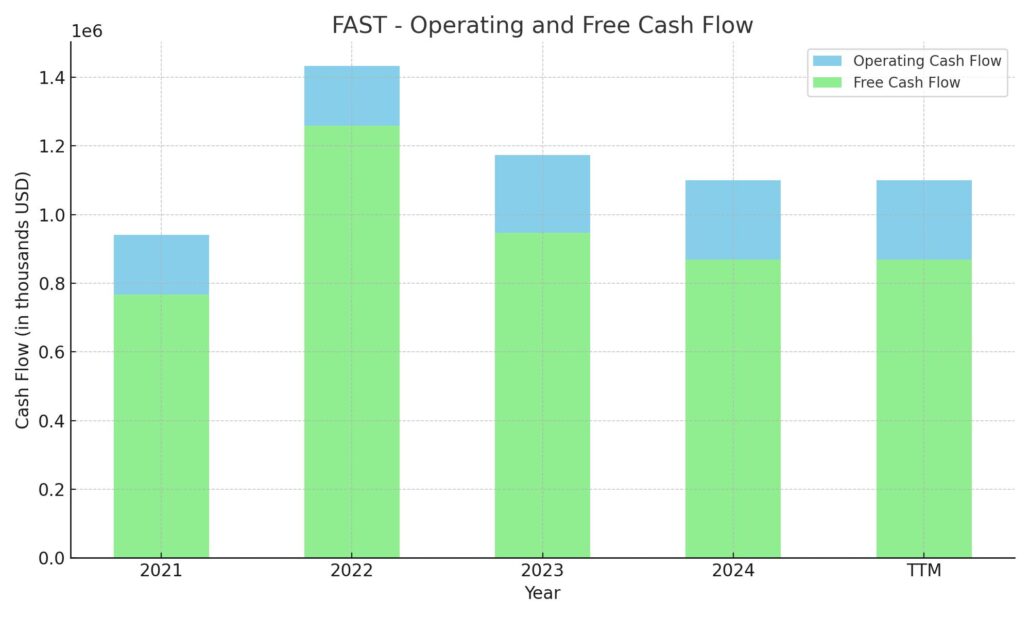

💵 The company generated $1.1 billion in operating cash flow over the trailing twelve months and maintained a strong free cash flow of $868.5 million, ensuring continued dividend coverage.

📊 Analyst sentiment remains mixed, with a consensus “Hold” rating and a price target near $79, reflecting both confidence in operational strength and caution about broader economic headwinds.

🧾 First quarter earnings showed 3.4% year-over-year revenue growth, stable margins, and continued digital sales momentum, with leadership emphasizing pricing discipline and operational efficiency.

Last Update 5/4/25

Fastenal Company (NASDAQ: FAST) has steadily built itself into a leading industrial distributor with a growing footprint in manufacturing and construction supply chains. With over \$7.6 billion in trailing twelve-month revenue and more than 60% of its sales now flowing through digital channels, the company blends traditional strength with modern execution. It continues to scale its non-fastener categories, improve onsite services, and prioritize automation and inventory management solutions.

Its consistent dividend, currently yielding 2.14%, is backed by solid free cash flow and a long track record of shareholder returns. Fastenal’s experienced management team, conservative balance sheet, and predictable operating performance have helped it outperform the market over the past year, even while navigating cost pressures, supply chain complexities, and mixed demand trends.

Recent Events

Fastenal’s latest quarterly earnings showed steady, if not spectacular, growth. Revenue edged up 3.4% year-over-year, coming in at $7.61 billion on a trailing twelve-month basis. EPS hit $2.00, with net income crossing the $1.15 billion mark. Operating margins held firm at 20.1%, reflecting solid cost management even as the broader economic backdrop remains choppy.

Management flagged some softness in construction-related demand, but they’re making up for it by leaning harder into onsite customer locations. These setups, which embed Fastenal directly into their customers’ operations, continue to expand and offer stickier, recurring revenue.

The stock’s been climbing, too—up more than 23% over the past year, outpacing the broader market. Fastenal now trades around $82.58, just shy of its 52-week high of $84.88. It’s not cheap, with a P/E ratio over 41 and a forward P/E of 38. But Fastenal’s consistent performance and strong returns tend to justify that premium.

Key Dividend Metrics

📈 Forward Yield: 2.14%

💰 Annual Dividend Rate: $1.76

🧾 Payout Ratio: 80%

🔁 5-Year Average Yield: 2.19%

🔒 Dividend Safety (Cash Flow Coverage): Healthy, with over $1.1B in operating cash flow

🗓️ Next Dividend Date: May 23, 2025

🚫 Ex-Dividend Date: April 25, 2025

📊 Dividend Growth Trend: Reliable with consistent increases

✂️ Last Stock Split: 2-for-1 in May 2019

Dividend Overview

Fastenal isn’t trying to chase the highest yield out there. That’s not the point. What it offers is a steady, dependable income stream that fits neatly into a long-term income strategy. The current yield of 2.14% might not scream “high dividend,” but it’s backed by years of uninterrupted growth and a payout that management clearly respects.

With an 80% payout ratio, Fastenal is giving back a good portion of its earnings to shareholders. That might seem high at first glance, but when you dig deeper, it’s clear this isn’t a stretch. The company produces strong, consistent cash flow—$1.1 billion over the last year—and keeps its balance sheet clean. It carries under $500 million in debt and holds about $231 million in cash, with a very healthy current ratio of 4.28. Simply put, the company isn’t taking on risks just to fund the dividend.

Fastenal also keeps its dividend cadence predictable. Investors know what to expect, with regular quarterly payments and a clear schedule. That kind of stability is underrated but incredibly valuable when you’re building a dividend-focused portfolio.

Dividend Growth and Safety

What really makes Fastenal shine for dividend investors is its commitment to growth and safety. Over the past decade, this company has steadily increased its dividend without missing a beat—even during the more chaotic stretches of the economic cycle. While others pulled back, Fastenal stayed the course.

Its 5-year average yield of 2.19% tells you the story: consistent performance, with a dividend that keeps pace as the stock appreciates. The current yield being a little below that average isn’t a negative—it’s actually a reflection of strong stock performance in the past year.

The numbers support the story. Cash flow is more than sufficient to cover the dividend. Even after reinvesting in the business and taking care of capex, Fastenal has room to maintain and grow its payout. Add to that impressive returns—over 32% return on equity and more than 20% return on assets—and you’re looking at a company that knows how to deploy capital effectively.

Institutional ownership stands strong at over 86%, which speaks to broader confidence in the company’s financial footing. Insider ownership is minimal, but that’s not uncommon at this stage of corporate maturity.

The valuation might be steep by traditional metrics, with a P/E over 40 and a PEG ratio near 3.8, but Fastenal isn’t priced like a typical industrial stock. It earns its valuation through high returns, a durable business model, and a consistent dividend history. For investors who care more about reliability than chasing double-digit yields, this stock delivers.

Cash Flow Statement

Fastenal’s trailing twelve-month (TTM) cash flow picture highlights a company that continues to generate dependable, robust cash from its operations. Operating cash flow came in at just under $1.1 billion, a slight dip from the prior year’s $1.17 billion, though still a healthy figure by any measure. Capital expenditures remained modest at $231.4 million, allowing the company to retain a free cash flow of $868.5 million. While this is a decline from peak levels in 2022, it still provides ample flexibility to fund dividends and reinvest in the business without financial strain.

On the financing side, Fastenal saw a net outflow of $881.8 million, primarily driven by consistent debt repayments that matched new debt issuance dollar-for-dollar. The company isn’t taking on excessive leverage, nor is it leaning heavily on financing to support operations. The cash position remains stable, ending the period at $235.3 million, virtually unchanged from recent years. Altogether, Fastenal’s cash flow statement shows a disciplined approach to capital allocation, balancing investment, debt management, and shareholder returns with a focus on sustainability rather than aggressive growth.

Analyst Ratings

📊 Fastenal has been navigating a mixed landscape of analyst sentiment in recent months. While the stock has seen some upward revisions, the overall consensus remains cautious. The average price target among analysts currently sits at $79.10, suggesting a modest downside from the recent trading price of $82.12. Targets range from a low of $59.00 to a high of $88.00, showing a wide range of views on the stock’s near-term direction.

📝 In April, Stephens & Co. nudged their price target up from $75 to $80, while keeping their rating at “Equal Weight.” Baird followed suit, raising its target from $80 to $86 and maintaining a “Neutral” outlook. These revisions reflect recognition of Fastenal’s steady operational performance, though both firms appear hesitant to call for breakout growth in the current environment.

🔻 Earlier this year, Stifel Nicolaus took a more cautious stance, trimming their price target from $86 to $82 and holding on to a “Hold” rating. This move was largely tied to macroeconomic uncertainty and the potential pressure from Fastenal’s price hikes related to tariffs. Analysts have flagged that while these pricing strategies help preserve margins, they might impact demand if customers begin to push back.

🧭 Overall, the view from Wall Street is one of guarded optimism. Fastenal’s fundamentals remain solid, but analysts are keeping an eye on broader economic trends and how those may ripple through the company’s customer base in the months ahead.

Earning Report Summary

A Solid Start to 2025

Fastenal kicked off the year with a steady performance that felt like business as usual—in the best way possible. For the first quarter of 2025, the company posted net sales of $1.96 billion, up 3.4% from the same time last year. When you adjust for the calendar, since there was one less business day this time around, daily sales actually grew by a healthy 5%. Earnings per share came in at $0.52, right in line with what many expected.

The shift in product mix continued, with non-fastener categories like safety gear and tools making up a larger slice of the pie. Those segments saw daily sales grow by 6.8%, which was stronger than the 1.1% growth in their bread-and-butter fastener business. It’s a sign that Fastenal’s broader strategy to be more than just a hardware supplier is working.

Margin Pressure and Operational Adjustments

Margins did tighten a bit, with gross profit slipping slightly to 45.1% from 45.5% last year. It wasn’t a huge drop, but it was noticeable. Leadership pointed to a few culprits—higher transportation costs, currency headwinds, and a product mix that leaned toward lower-margin items. Still, operating income inched up to $393.9 million and net income rose just enough to round out a decent quarter at $298.7 million.

Fastenal took a proactive stance on pricing this quarter, rolling out increases in April to help cushion the impact of rising costs, especially from tariffs. Management said those adjustments could add 3% to 4% to next quarter’s top line. And if the tariff pressure keeps building, they’re ready to revisit prices again later in the year.

Digital Momentum and Long-Term Focus

One of the more impressive parts of the report was the company’s continued push into digital. About 61% of sales were made through digital channels—a big step toward their goal of reaching 66% to 68% by the end of the year. This isn’t just about being modern; it’s helping customers order faster, track inventory better, and stay stocked without overbuying.

Fastenal also kept up its usual disciplined approach to capital. The company returned $246.7 million to shareholders in dividends during the quarter, while also investing in automated systems and infrastructure to improve long-term efficiency.

All in all, it was a quiet but confident start to the year. Fastenal didn’t break any records, but it did what it does best—manage costs, serve its customers, and keep things moving in the right direction.

Management Team

Fastenal’s leadership is built on longevity and a deep understanding of its business model. Dan Florness, who has been with the company since the mid-90s and previously served as CFO, has led Fastenal as CEO since 2016. Under his leadership, the company has focused on disciplined execution, organic growth, and enhancing customer relationships. In August 2024, Florness passed the role of president to Jeff Watts, a seasoned executive with 28 years at Fastenal and a strong background in sales and customer engagement.

The broader executive team is composed of long-serving professionals who have grown within the company. Sheryl Lisowski manages finance and compliance as Executive Vice President, Chief Accounting Officer, and Treasurer. Anthony Broersma oversees operations and logistics, while Charles Miller and William Drazkowski handle key aspects of global and national accounts. John Soderberg leads technology strategy, Noelle Oas manages human capital and employee development, and James Jansen directs Fastenal’s manufacturing arm. This leadership team is not flashy, but their steady, execution-focused approach has supported the company’s consistent financial and operational results.

Valuation and Stock Performance

Fastenal’s stock has had a strong run over the past year, currently trading around $82, not far off its 52-week high of $84.88. That performance reflects a gain of roughly 20%, which outpaces the broader market and shows the appeal of Fastenal’s steady cash generation and dividend reliability. While not a fast grower, the company’s consistency has earned it a loyal following among long-term investors.

Valuation-wise, the stock is trading at a premium, with a trailing price-to-earnings ratio above 41 and a forward P/E around 38. This isn’t a bargain-bin industrial, and the valuation reflects its dependable margins, strong return on capital, and a business model that tends to hold up even when broader economic conditions soften. The PEG ratio hovering near 3.8 suggests that growth expectations are already baked into the price, so any upside will need to be driven by continued execution and margin management.

The consensus analyst price target sits at approximately $79, slightly below where shares are trading today. There’s a mix of opinions in that target range, from bulls who see continued resilience in Fastenal’s customer base, to more cautious analysts who are waiting to see how inflation and demand fluctuations play out in the second half of the year. Still, the stock’s stability and rising dividend continue to attract steady interest from both institutional and income-focused investors.

Risks and Considerations

Fastenal operates in an environment where macroeconomic factors can quickly shift the landscape. A slowdown in industrial production or construction spending, particularly in North America, could weigh on volumes. Though the company has expanded its non-fastener offerings, its core business remains sensitive to demand cycles in heavy industry.

Tariffs and trade policies are another area to monitor. Fastenal has already responded to tariff-related cost pressures with pricing adjustments, but further increases could impact competitiveness or customer behavior. Supply chain friction, while easing compared to the height of disruptions, still presents logistical challenges in certain categories.

Labor availability and wage inflation are additional concerns. While Fastenal has done a good job keeping turnover low and investing in employee development, the tight labor market could create added expense or pressure in certain regions. The company’s strong internal culture and decentralized model help offset some of this risk, but it remains a factor worth watching.

On the financial side, the relatively high payout ratio—around 80%—means there’s less room for unexpected downturns before dividend sustainability becomes a topic of discussion. Right now, cash flow is more than sufficient, but it’s an area that investors should continue to monitor as capital allocation decisions evolve.

Final Thoughts

Fastenal doesn’t make headlines with big, splashy announcements, and that’s part of what makes it attractive. This is a company focused on execution, incremental improvements, and supporting its customers in the trenches. From automated inventory solutions to digital sales channels, it’s evolving in a way that strengthens its position without straying too far from its roots.

The management team brings continuity and discipline, and their approach has helped the company maintain solid performance across varying economic cycles. Valuation is on the higher side, reflecting investor confidence, and while there are real risks in play—from economic slowdowns to inflationary pressures—Fastenal’s track record suggests it has the tools to manage through them.

For investors looking for a reliable operator with a clear strategy and a steady dividend, Fastenal continues to be a name that earns its place in a long-term portfolio.