Key Takeaways

💸 Exxon has a dividend yield of 3.73% with a consistent history of annual increases and a conservative 51% payout ratio, backed by over 40 years of uninterrupted payments.

💰 The company generated $55 billion in operating cash flow over the trailing twelve months, with $30.7 billion in free cash flow, supporting both shareholder returns and reinvestment.

📊 Analysts maintain a moderate buy consensus with a $126.50 average price target; recent revisions reflect oil price sensitivity but recognize Exxon’s long-term earnings strength.

📈 Q1 2025 earnings came in at $7.7 billion with increased production volumes and solid cash generation, while leadership highlighted upcoming projects and improved cost efficiency.

Last Update 5/4/25

Exxon Mobil (XOM) stands as one of the most enduring names in the global energy industry, with a legacy built on scale, operational depth, and reliable capital returns. The company has delivered decades of uninterrupted dividends, supported by disciplined leadership, a strong balance sheet, and efficient operations across upstream, downstream, and chemical segments.

Over the past year, Exxon has expanded production, enhanced cost structures, and returned billions to shareholders through dividends and buybacks. While macro pressures and commodity cycles remain a factor, the company’s focus on high-return assets and long-term value creation continues to drive its performance and appeal.

Recent Events

Exxon’s first quarter in 2025 painted a picture of a company that knows how to manage through change. Revenue came in around $83 billion—steady compared to last year—and earnings clocked in at $8.2 billion. Yes, that’s a slight dip from the year prior, but when you consider the softness in energy prices and a refining market that wasn’t firing on all cylinders, the results were solid.

One major move that drew attention was Exxon completing its acquisition of Pioneer Natural Resources. That deal expands Exxon’s footprint in the Permian Basin, widely regarded as one of the most productive shale regions in the world. It adds a deep inventory of low-cost barrels that should keep Exxon flush with free cash flow for years to come.

And speaking of cash flow, Exxon continues to put its money where its mouth is when it comes to shareholder returns. In 2024, the company bought back $17.5 billion worth of its own shares. That’s on top of the dividend. In this kind of capital return strategy, dividend investors get a double benefit—steady income and shrinking share count, which often leads to stronger per-share fundamentals over time.

📊 Key Dividend Metrics

🛢️ Forward Dividend Yield: 3.73%

💰 Forward Dividend Rate: $3.96 per share

🧮 Payout Ratio: 51.46%

📈 5-Year Average Yield: 4.73%

📆 Next Ex-Dividend Date: May 15, 2025

📉 Trailing Dividend Yield: 3.67%

Dividend Overview

What really makes Exxon stand out for income-focused investors is its commitment to maintaining and growing its dividend. At a 3.73% forward yield, it sits just under its five-year average. That tells you the stock isn’t overly stretched, nor is the yield artificially inflated by a price drop. It’s comfortably sustainable—and that’s the sweet spot.

The dividend is well-supported by Exxon’s strong free cash flow profile. The company generated over $53 billion in operating cash flow over the last twelve months. Even after servicing debt and reinvestment needs, Exxon still had nearly $22 billion in levered free cash flow. That leaves plenty of room to comfortably support the dividend without needing to dig into reserves or stretch the balance sheet.

The payout ratio hovering just above 51% also shows discipline. It’s high enough to be meaningful for shareholders but low enough to preserve financial flexibility. And that’s important in a business like this where prices can swing wildly based on global supply and demand dynamics.

Then there’s Exxon’s reputation. This is a company that hasn’t cut its dividend in more than 40 years. That includes some pretty rough stretches—the oil collapse in 2015, the pandemic’s demand destruction in 2020, and everything in between. When companies talk about protecting the dividend, Exxon has the receipts.

📈 Dividend Growth and Safety

Exxon isn’t necessarily the kind of stock that’s going to deliver aggressive dividend hikes year after year. But it has shown a steady hand. The latest increase was about 4.3%—not enormous, but enough to keep up with inflation and send a signal that the board remains committed to growing shareholder income.

Looking back over the past decade, Exxon’s dividend has grown at a compound annual rate of about 3.3%. Again, it’s not flashy—but that’s part of the appeal. This is a name for investors who value consistency over speculation.

It also helps that Exxon has spent the last couple of years cleaning up its balance sheet. Total debt now stands at around $37.5 billion, with a very manageable debt-to-equity ratio under 14%. That gives the company breathing room during downturns and reduces the odds of the dividend ever coming under pressure, even in a weaker oil price environment.

Another layer of protection comes from Exxon’s integrated business model. When upstream (exploration and production) margins compress, downstream (refining and chemicals) segments often pick up the slack. This natural hedge across the energy value chain helps smooth out earnings and cash flow, adding more stability to the dividend.

All of these factors add up to one thing for income investors: confidence. Exxon isn’t just paying a dividend—it’s doing so in a way that reflects careful planning, smart capital allocation, and a long history of putting shareholders first.

Stay tuned for the next section, where we’ll look deeper into Exxon’s capital spending priorities, balance sheet strength, and how its valuation stacks up against peers.

Cash Flow Statement

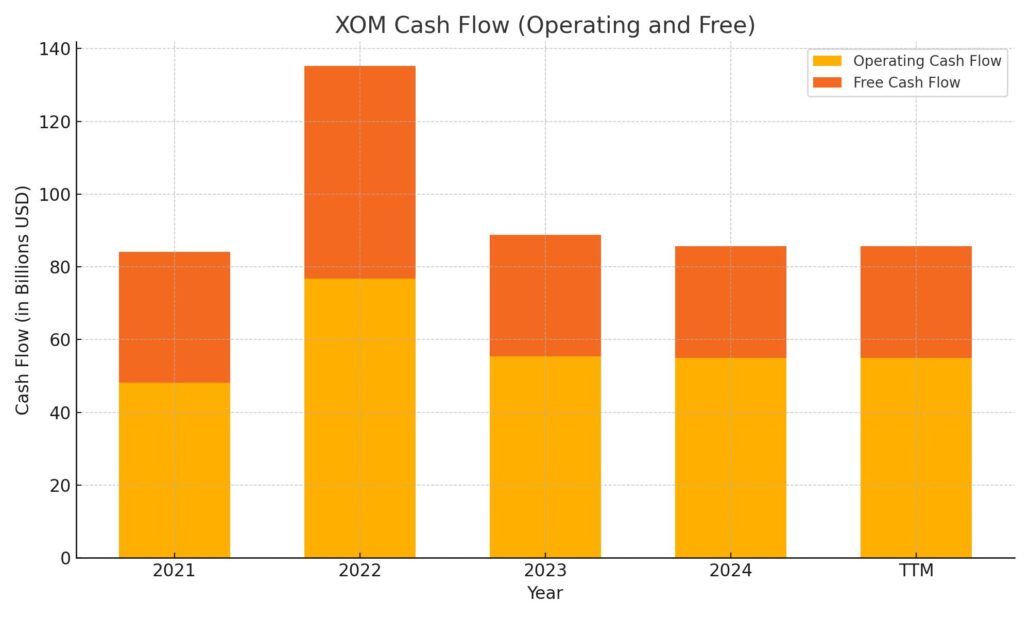

Exxon Mobil’s cash flow performance over the trailing twelve months reflects a strong operational foundation, even as commodity pricing has moderated. Operating cash flow came in at $55 billion, roughly flat compared to the previous year. While not as elevated as the $76.8 billion peak from 2022, it still signals consistent demand and efficient production, especially considering macroeconomic softness. Free cash flow reached $30.7 billion, demonstrating that Exxon continues to generate meaningful excess cash even after covering substantial capital expenditures.

On the investing side, the company spent just under $20 billion, with over $24 billion directed toward capital expenditures, a sign of ongoing investment in future production and infrastructure. Financing activities saw significant outflows, totaling nearly $43 billion. This included $19.6 billion in share repurchases and $5.9 billion in debt repayments, outpacing any new debt issuance. Exxon’s ending cash position stood at $23.2 billion, lower than the previous year but still comfortably above historical norms. The drop in cash is largely a result of deliberate capital returns and strategic reinvestment, not operational strain.

Analyst Ratings

Exxon Mobil has recently seen some movement in analyst sentiment, with a number of updates reflecting changes in oil market expectations and broader economic factors. 📊 The consensus rating still leans toward a “Moderate Buy,” and the average 12-month price target now sits at $126.50. That implies a potential upside of about 19% from the current stock price, a decent premium for income-focused investors who also want some capital appreciation.

📉 In April, a few notable firms lowered their price targets. Barclays trimmed its target from $135 to $130 but kept an “Overweight” rating. Their reasoning focused on weaker oil price assumptions for the coming years and ongoing uncertainty in the macro landscape. UBS took a similar step, dialing back its target from $135 to $131 while maintaining a “Buy” call. They cited updated cash flow projections reflecting the recent decline in oil prices. Morgan Stanley followed suit, dropping its target slightly from $138 to $133. They noted that while the fundamentals are intact, softer oil pricing in the short to medium term has them adjusting their models.

💡 On the more optimistic end, Jefferies still holds a price target of $145. That suggests confidence in Exxon’s long-term production growth and capital efficiency. Analyst John Gerdes from Gerdes Energy Research even upgraded Exxon to “Buy,” pointing to its standout development projects in the Permian Basin and Guyana. He expects these assets to support strong free cash flow through the end of the decade, potentially driving returns well north of 20%.

🛢️ So while the near-term view is a bit cautious, especially around energy pricing, analysts continue to see meaningful long-term value in Exxon’s disciplined approach and strategic asset base.

Earning Report Summary

Exxon Mobil’s first-quarter 2025 results came in solidly, showing a business that’s not only adapting to a shifting energy landscape but still managing to deliver strong returns to shareholders. While earnings dipped a bit year-over-year, leadership remains confident in the long-term game plan and the company’s ability to navigate whatever the markets throw its way.

Steady Performance in a Mixed Environment

For the quarter, Exxon posted earnings of $7.7 billion, or $1.76 per share. That’s a little lower than the $8.2 billion from the same time last year, but still a strong showing, especially considering weaker oil prices and tighter refining margins. What really stood out was the 20% jump in oil and gas production, thanks in large part to the Pioneer acquisition and continued momentum in the Permian Basin and Guyana. Upstream earnings climbed to $6.8 billion, a solid improvement from last year’s $5.7 billion.

On the other hand, refining and chemicals faced some pressure. Refining profits fell to $827 million, partly due to scheduled maintenance and lower margins. The chemical segment also took a hit as margins compressed and new project startups brought on extra costs.

Cash Flow and Capital Discipline Remain Strong

Exxon continues to be a cash-generating machine. Operating cash flow hit $13 billion, and free cash flow came in at $8.8 billion. Even with those numbers, they still returned $9.1 billion to shareholders—splitting that almost evenly between dividends and buybacks. That keeps them on track with the $20 billion annual share repurchase target.

Capital spending landed at $5.9 billion for the quarter, which fits within their full-year plan of $27 to $29 billion. The company also remains laser-focused on efficiency. Since 2019, they’ve racked up over $12.7 billion in structural cost savings and are targeting $18 billion by the end of the decade.

Eyes on Growth and Long-Term Strength

Looking ahead, Exxon has ten new projects slated to go live this year. These developments are expected to bring in more than $3 billion in additional earnings by 2026. CEO Darren Woods didn’t mince words when talking about the company’s position, saying that Exxon is “built for this,” referring to the uncertain market landscape. He also pointed out that strategic moves made since 2019 have added about $4 billion in quarterly earnings capacity based on today’s prices.

The balance sheet is in great shape too. With a net debt-to-capital ratio of just 7%, Exxon has more than enough flexibility to keep investing in its future while rewarding shareholders along the way. Their focus on disciplined capital allocation, high-return projects, and operational efficiency shows they’re not just playing defense—they’re positioning for long-term strength.

Chart Analysis

Price Action and Moving Averages

XOM has spent the past year moving through a fairly wide range, with prices fluctuating between just under $100 and peaking around $126. For most of the year, the stock hovered above its 50-day moving average, riding the momentum from mid-2023 through early December. However, as we moved into late December and early January, a noticeable shift occurred. The price dipped below both the 50-day and 200-day moving averages, and the 50-day eventually crossed below the 200-day, forming what technicians refer to as a bearish crossover. That trend held through March, with prices unable to gain traction for a sustainable breakout.

Over the last few weeks, there’s been a rebound attempt, but the price remains capped under both moving averages. The 50-day is starting to flatten, but the 200-day is still pointing down slightly. This suggests that while short-term momentum is trying to turn around, there isn’t enough sustained demand to shift the longer-term trend just yet.

Volume Behavior

Volume has been relatively steady, with no extreme spikes outside of a few bursts during notable selloffs and recoveries. What stands out is the lack of strong volume support during recent attempts to rally, especially in April. That makes any bounce feel more tentative. The stock did see a bit more participation near the lows in early April, which may have helped fuel the recovery, but for a larger move to stick, more consistent volume support would be reassuring.

RSI Trends

Looking at the relative strength index (RSI), the stock spent a good chunk of the year bouncing between neutral and overbought zones. The RSI dipped below 30 during the selloff in April, signaling short-term oversold conditions. Since then, it’s climbed back to the upper 60s, just shy of the overbought level. That’s a fairly quick recovery, but it’s also a place where past rallies have lost steam. If RSI moves back above 70 and price can hold above key moving averages, that could mark a shift in momentum. Otherwise, this could be another false start within a broader consolidation.

General Trend and Takeaway

Over the past twelve months, the stock’s trend has weakened compared to the strong uptrend it enjoyed earlier. The sharp drawdown from December to April and the current inability to break above resistance suggests that the stock is still in a corrective phase. However, the recent bounce and improved RSI are early signs of stabilization. The long-term structure remains intact above $100, which has served as a support floor. For now, XOM looks like it’s trying to carve out a base, but it hasn’t broken into a new upward leg yet. Patience and price confirmation would be needed before calling this a full reversal.

Management Team

Exxon Mobil’s leadership continues to operate with a steady hand, even as the global energy landscape evolves rapidly. Darren Woods, who has served as CEO since 2017, has guided the company through significant changes by prioritizing capital efficiency and consistent shareholder returns. Under his leadership, the company shifted from a focus on volume to a strategy grounded in high-return investments and financial discipline.

Woods has also championed significant cost-cutting measures, helping Exxon achieve billions in structural savings while maintaining operational strength. Neil Chapman, who oversees upstream operations, has played a key role in expanding production from high-margin regions such as the Permian Basin and Guyana. Kathy Mikells, the Chief Financial Officer, has focused on maintaining a strong balance sheet and ensuring liquidity, even through uncertain cycles. Together, the executive team has shown a strong commitment to shareholder value while positioning Exxon to compete effectively in a changing world.

Valuation and Stock Performance

At around $106 per share, Exxon Mobil is trading at a forward price-to-earnings ratio of just under 14. That places it in a fairly neutral valuation band for a large integrated energy company. While it’s not trading at a steep discount, it also doesn’t reflect an overvalued or overheated name. The company’s price-to-book ratio is near 1.74, and the price-to-sales ratio is 1.37, which both align closely with its historical trading ranges.

The past year has been relatively flat in terms of share price movement. After peaking near $126, the stock fell to just below $100 before finding its footing again. The performance mirrors broad-based caution across the sector, particularly as oil prices faced renewed volatility. While the 50- and 200-day moving averages are still slightly downward-sloping, price action in recent weeks suggests that the stock may be working through a base-building phase.

From a return perspective, Exxon continues to stand out. The company returned over $9 billion to shareholders in the most recent quarter alone, balancing buybacks and dividends. This disciplined capital return strategy has helped the stock remain appealing during periods of price softness. While the growth may be modest, the consistency in income and operational execution remains a key feature of Exxon’s value proposition.

Risks and Considerations

Despite Exxon’s financial strength and management’s clear strategic direction, the company still faces several risks. The most prominent is commodity price volatility. Oil and gas prices are influenced by a wide range of global factors, from geopolitical tensions to changes in demand due to economic slowdowns. While Exxon is better insulated than most thanks to its scale and integration, it’s not immune to sudden price shocks.

There’s also increasing pressure on energy companies to transition toward lower-emission operations. While Exxon has made some moves in this direction, including selective investments in carbon capture and alternative technologies, its primary revenue base remains tied to fossil fuels. Regulatory changes, policy shifts, and public sentiment could create challenges or require more aggressive pivots in the future.

Operational risks, such as delays in new projects or higher-than-expected capital costs, can also affect near-term results. Exxon’s global footprint means that political or logistical issues in one region can have ripple effects across its operations. On top of that, any sharp downturn in global economic activity would impact demand across its refining, chemicals, and upstream segments.

These factors don’t necessarily threaten the core stability of the company, but they can create headwinds that investors need to consider when evaluating near-term expectations.

Final Thoughts

Exxon Mobil remains a well-run, dependable business with deep roots and a clear long-term plan. The current leadership team has steered the company through significant industry changes with a measured approach, prioritizing efficiency and financial strength over expansion for its own sake. They’ve focused on unlocking value from high-margin assets and maintaining a balanced capital allocation policy that supports both growth and shareholder returns.

While the stock may not be at a bargain price, it trades within a rational valuation range given its strong cash flow generation and low debt. For those who are focused on consistency and want to avoid unnecessary surprises, Exxon still holds appeal. It isn’t chasing rapid transformation but is instead evolving at a deliberate pace—preserving what works while adjusting where needed.

That deliberate, steady approach does mean there are risks tied to its exposure to fossil fuels and cyclical demand. But the company’s deep reserves, strong balance sheet, and experienced leadership give it flexibility and staying power. It’s a business built on fundamentals that tend to hold up well, even in turbulent markets. And for many investors, that reliability can be just as valuable as rapid growth.