Key Takeaways

📈 ESS offers a 3.51% forward dividend yield and has raised its dividend for 31 consecutive years, reflecting strong income stability and a disciplined payout strategy.

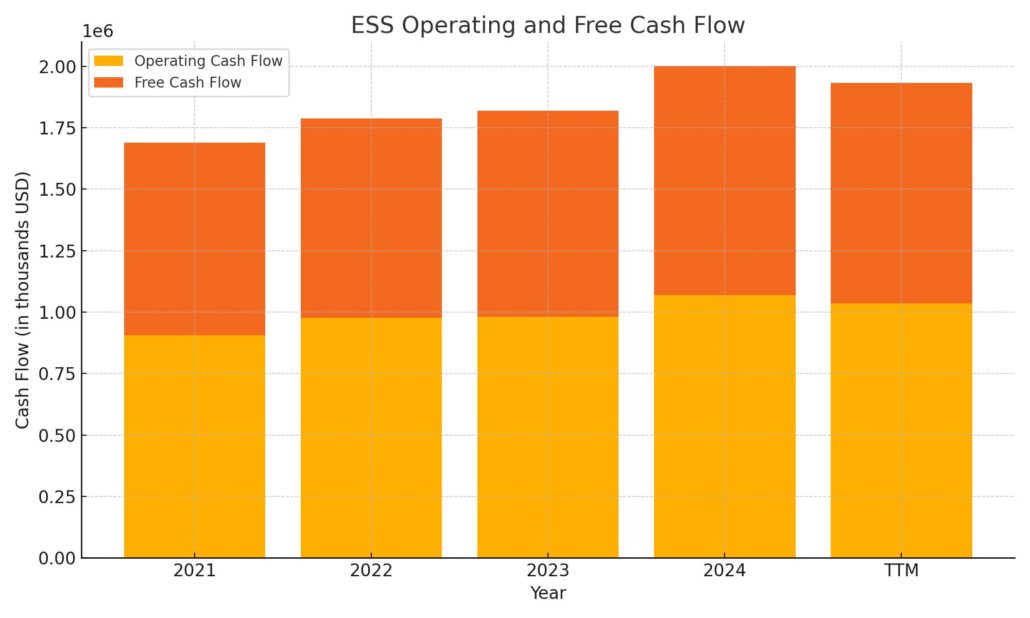

💵 The company generated over $1 billion in operating cash flow and nearly $900 million in free cash flow over the trailing twelve months, supporting both growth initiatives and consistent dividend payments.

🧐 Analysts hold a mixed but stable outlook with most maintaining “Hold” ratings; the current consensus price target stands around $306.79, reflecting cautious confidence in the company’s long-term fundamentals.

📊 Recent earnings showed a 3.7% year-over-year increase in core FFO, driven by higher rents and low delinquencies, with leadership reaffirming full-year guidance and ongoing development in key markets.

Last Update 5/4/25

Essex Property Trust (ESS) is a real estate investment trust focused on high-quality apartment communities in some of the most supply-constrained markets on the West Coast. With properties across California and the Seattle metro area, the company benefits from limited housing inventory, strong job centers, and consistent tenant demand. Its long-standing dividend growth streak and stable cash flows reflect a commitment to disciplined management and long-term value creation.

Over the past year, ESS has posted strong price performance, improved core FFO, and maintained steady occupancy levels. Leadership continues to prioritize capital recycling, modest development in key markets, and conservative financial management, all while returning value to shareholders through a growing dividend.

Recent Events

In the past year, ESS shares have quietly climbed nearly 15%, comfortably outpacing the broader market. It’s not the kind of move that grabs headlines, but it does say a lot about investor confidence in this name. With interest rates still elevated and economic uncertainty lingering, seeing a REIT like Essex outperform signals strength.

The company’s most recent earnings were a bit of a mixed bag. Revenue rose 8.8% year-over-year—solid growth in a sector that doesn’t typically see big top-line moves. However, net income fell by more than 25%, largely due to rising expenses. Interest costs have ticked up, as expected, and management has continued to invest in renovations and upgrades across its properties. None of this is cause for alarm, but it’s a reminder that even strong REITs feel the weight of higher rates.

Essex is carrying over $6.8 billion in debt, and the debt-to-equity ratio has climbed past 118%. That’s high by traditional standards, but pretty normal in the world of real estate investment trusts. What matters more is the company’s cash flow—and Essex is still bringing in more than $1 billion in operating cash annually, with around $794 million in free cash flow after expenses.

Key Dividend Metrics

💰 Forward Dividend Yield: 3.51%

📈 5-Year Average Dividend Yield: 3.41%

🧾 Trailing Dividend Rate: $9.92

📆 Dividend Growth Streak: 29 years and counting

🔁 Payout Ratio: 94.93%

📅 Last Dividend Paid: April 15, 2025

📅 Ex-Dividend Date: March 31, 2025

Dividend Overview

If you’re in this for income, this is where Essex truly stands out. The REIT has been raising its dividend every single year for nearly three decades. That kind of consistency is rare in any sector—and especially rare in real estate, where cash flow can be cyclical.

At 3.51%, the current yield is a touch higher than its five-year average. It may not jump off the page compared to some high-yield names, but the quality of the income here is what sets it apart. This is a dividend built on long-term leases, high-quality real estate, and a tenant base that tends to pay on time. There’s no chasing yield through leverage or complex financial engineering. Essex sticks to what it knows—and that’s stable, recurring rental income.

The payout ratio, sitting just under 95%, looks high at first glance. But remember, REITs are required to pay out at least 90% of their taxable income by law. So while it leaves a narrow margin, this level of payout is well within the norm for the industry. More importantly, it’s backed by dependable operating results and a healthy balance of retained earnings.

Dividend Growth and Safety

One of the hallmarks of Essex is its approach to growth. The company doesn’t swing for the fences—it builds slowly, adds value to its existing assets, and keeps its eye on long-term fundamentals. That mindset carries over to the dividend, which has been increased every year for 29 straight years. The most recent bump was modest, but enough to keep the streak alive and maintain investor confidence.

Behind the scenes, a few things are keeping this dividend machine running. First, the markets Essex operates in are notoriously difficult for new construction. Zoning restrictions, high land costs, and regulatory hurdles mean that competition remains limited. That gives the company pricing power—when leases come up, they can often nudge rents higher without much pushback.

Second, the type of renter Essex attracts isn’t living paycheck to paycheck. Its properties are in job-rich areas where employment tends to be more stable, especially in tech and healthcare. Even during downturns, these tenants often have the means to keep paying.

Now, there’s one area to watch—debt. With $6.84 billion in total borrowings, interest costs have definitely gone up. And as rates stay higher for longer, that’s something management will have to navigate. But Essex has options. Its properties are valuable, cash-generating assets. They can be refinanced, sold, or used as collateral on favorable terms. The real estate is that solid.

The stock trades with a beta of just 0.80, which tells you it moves less than the broader market. That lower volatility is exactly what long-term, income-focused investors want. It reflects the slow-and-steady nature of this business, as well as the reliability of its cash flows.

For dividend investors, Essex isn’t just a holding—it’s an anchor. It’s the kind of stock you can own through different market cycles, collecting a growing income stream while management stays focused on the fundamentals. There’s no hype here—just consistent performance and an unwavering commitment to returning cash to shareholders.

Cash Flow Statement

Essex Property Trust generated over $1.03 billion in operating cash flow over the trailing 12 months, showing consistent strength compared to prior years. This cash flow level underscores the reliability of its rental income stream, even as costs and rates fluctuate. Free cash flow came in at approximately $897 million, more than enough to cover the company’s dividend obligations and capital expenditures, which remained steady at around $138 million. The stability in both operating and free cash flows reflects the predictable nature of Essex’s core apartment rental business in tight housing markets.

On the investing side, the company used roughly $843 million, which appears largely driven by acquisitions and development, showing Essex continues to reinvest for long-term growth. Financing activities resulted in a net outflow of $592 million, mainly due to debt repayments exceeding new borrowings. While Essex raised over $2.8 billion in new debt during the period, it paid down $2.69 billion, reflecting an active approach to managing liabilities. The company’s end cash position improved to just under $108 million, up from the prior year, giving it a modest liquidity buffer while maintaining strong access to capital markets.

Analyst Ratings

Essex Property Trust (ESS) has attracted a fair share of analyst attention recently, with opinions split between cautious optimism and a wait-and-see approach. Most analysts are sticking with a “Hold” stance, reflecting a balanced view of both the potential and the risks at play in today’s interest rate environment.

🟢 One notable upgrade came from a major firm that shifted its rating from “Hold” to “Buy” while raising its price target to $314. This move came on the back of Essex’s ability to manage through rate pressures better than expected, thanks in part to its strong West Coast multifamily footprint. Analysts pointed to the company’s consistent rent collections, conservative balance sheet management, and stable occupancy as key reasons for the more bullish outlook.

🟡 On the flip side, another firm held its “Underweight” rating but still nudged the price target up to $309. While they remain cautious, especially about the broader REIT sector under higher rate conditions, the slight raise shows a begrudging respect for how Essex has maintained steady fundamentals in a tough market.

📊 The consensus 12-month price target now sits around $306.79, with individual targets ranging from $250 to as high as $355. That spread highlights the differing views on how well Essex can sustain its dividend and capital structure while continuing to reinvest in its core markets. Despite the varied outlooks, most analysts seem to agree on one thing: ESS is showing it still has room to operate effectively, even in less-than-ideal conditions.

Earning Report Summary

Essex Property Trust kicked off 2025 with a solid first quarter, showing once again that its focus on high-demand West Coast apartment markets continues to pay off. While net income dipped compared to last year, that’s mostly because last year included some one-off gains that didn’t repeat this time around. Strip those out, and what you’re left with is a company that’s still on steady footing.

Steady Growth in Core Operations

The company reported core FFO of $3.97 per share, which was a nice step up from last year and actually landed above the midpoint of its guidance. That figure matters a lot in the REIT world—it’s what really tells us how much cash flow the business is producing from its properties. Essex saw a boost in rental income and same-property revenue, helped by higher rents and fewer delinquent payments. Occupancy held up well, giving management room to be a bit more assertive with lease renewals.

Portfolio Moves and Development Progress

Essex was active on the acquisition front, picking up three properties in Northern California for just under $350 million. At the same time, they sold an older asset in Southern California for $127 million, part of a broader strategy to recycle capital into properties and markets with more upside. They also broke ground on a 543-unit development in South San Francisco, an area with strong job growth and tight housing supply. The project will cost about $311 million and adds to Essex’s development pipeline in some of the most competitive rental markets in the country.

Financial Health and Dividend News

The company also tapped into the bond market, issuing $400 million in 10-year notes at 5.375%, using the funds to pay off upcoming debt maturities. Nothing flashy here—just thoughtful, forward-looking balance sheet management. On the dividend front, shareholders got some good news. Essex bumped its annual dividend up to $10.28 per share, marking the 31st straight year of increases. That kind of consistency is rare, and it speaks to the company’s discipline and the quality of its cash flow.

Looking Ahead

Guidance for the full year was left unchanged, with management expecting core FFO per share to land between $15.56 and $16.06. As for rents, they’re projecting growth of 2.5% to 3.5% in the second quarter, with the strongest gains expected to hit mid-year. The tone from leadership was cautious but confident. They acknowledge that the broader economy has its uncertainties, but they’re sticking with what works—owning and operating high-quality properties in supply-constrained, job-rich cities. That strategy has served Essex well for decades, and they’re showing no signs of drifting from it.

Chart Analysis

Price Action and Moving Averages

ESS has had a fairly dynamic year. The stock started its climb in early summer, gaining momentum and peaking around November before encountering some volatility. What’s interesting is how closely the price hugged the 50-day moving average (red line) during the run-up. Around the end of the year, that support began to falter, and price action dipped below the 50-day mark while the 200-day moving average (blue line) continued to trend steadily upward.

Over the past few months, we’ve seen ESS bounce between both moving averages, with the 200-day line acting as a key support level. Most recently, the stock pulled off a strong recovery, rallying off a low in April and closing back above both the 50-day and 200-day averages—a technically positive move. This crossover hints at a shift back into upward momentum, which could support continued price stability if that trend holds.

Volume Behavior

Volume has been relatively stable, but a few spikes jump out—particularly in August, November, and again in late April. These surges often align with price inflections, suggesting institutional interest or earnings-related activity. What’s notable is that the late April bounce came on a clear rise in volume, which adds weight to the move. Sustained volume at this level tends to reflect conviction, not just short-term speculation.

RSI Momentum

The relative strength index (RSI) tells a story of rotation and recovery. For most of the year, RSI has floated in a healthy mid-range, occasionally pushing into overbought territory, particularly during price rallies in late summer and March. After a dip toward oversold conditions in early April, the RSI has roared back, now touching the upper end of the range once again.

This suggests that the recent price surge may have stretched a bit in the short term, but looking at the broader pattern, it’s been a cycle of consistent cooling and strengthening, which is characteristic of a stock being accumulated rather than aggressively traded.

Overall Technical Impression

ESS is showing a pattern of resilience. Price continues to find footing near long-term moving averages, and the recent recovery above both the 50-day and 200-day indicators adds a layer of confidence. The RSI bounce and rising volume paint a picture of renewed interest and momentum. These are the kinds of signs that suggest this name isn’t just coasting—it’s rebuilding after a correction and may be setting up for a more stable phase ahead.

Management Team

The leadership behind ESS has been a steady hand through various market cycles. The team, led by CEO Michael Schall, brings deep experience in West Coast real estate and a long track record of navigating both bull and bear markets with discipline. Schall, who has been with Essex for decades, is known for running the company conservatively, focusing on operational efficiency and sustainable growth.

One hallmark of their approach is long-term thinking. The team avoids chasing high-risk expansion strategies, instead sticking to the fundamentals—owning and managing well-located, high-quality apartment communities in markets where supply is tight. This mindset has helped Essex maintain financial strength while delivering steady returns to shareholders. CFO Angela Kleiman plays a key role in overseeing the balance sheet, guiding debt management with a focus on maintaining liquidity and supporting future investments.

What stands out is how quietly and consistently they execute their strategy. There’s no emphasis on headlines or splashy moves—just careful planning and methodical growth. It’s a leadership style that fits the company’s personality and aligns with its goal of steady, long-term performance.

Valuation and Stock Performance

ESS has had a relatively smooth ride over the past year. The stock is up more than 14 percent over the last 12 months, outperforming the broader market. That kind of movement is notable for a real estate investment trust, especially one operating in a higher interest rate environment and a region with some economic uncertainties.

Trading just under $293 per share, ESS is hovering close to its 200-day moving average. Valuation-wise, it looks fairly priced. It’s not trading at a discount, but it also isn’t in nosebleed territory. Price-to-FFO is in a neutral range, suggesting investors are valuing it based on known stability and the predictable nature of its earnings stream.

When viewed through the lens of forward price-to-earnings, it might appear elevated, though that’s typical in the REIT space. Traditional earnings metrics don’t always tell the full story for real estate companies. Price-to-book and enterprise value to EBITDA also lean toward a premium valuation, though one that reflects the quality of its portfolio and the reliability of its operations.

This isn’t a stock that’s likely to double overnight, but it isn’t meant to be. ESS has earned its premium by delivering consistent results, managing risk well, and returning capital to shareholders year after year.

Risks and Considerations

Like any company, Essex isn’t immune to risks. One of the biggest headwinds is interest rates. Rising borrowing costs can pressure margins and slow down acquisitions or development. While Essex has handled its debt with care, refinancing in a higher-rate environment remains a challenge.

Another consideration is regional exposure. ESS is highly concentrated in California and Seattle, areas that are attractive but come with regulatory complexities. Rent control laws, legal requirements, and housing policy shifts can all affect how quickly and efficiently the company can respond to market changes.

The company’s tenant base is largely composed of professionals in sectors like tech and healthcare. These tend to be resilient industries, but they are not completely immune to downturns. A slowdown in tech hiring or regional employment shifts could have an impact on demand, particularly in the Bay Area or Southern California.

Lastly, the stock’s valuation doesn’t leave much room for disappointment. If revenue growth or occupancy trends begin to slip, investors may be quick to reprice the stock. It isn’t expensive, but it’s priced with the assumption that management will continue delivering steady results. Any meaningful deviation could put pressure on the share price.

Final Thoughts

ESS continues to demonstrate what steady execution looks like in a complex market. The company doesn’t try to reinvent the wheel. Instead, it invests in what it knows—high-quality apartment properties in dense, supply-constrained cities with strong job markets. It focuses on cost control, careful capital allocation, and delivering consistent dividends.

This approach has worked well, and the leadership team has remained disciplined through multiple market cycles. That’s evident in its track record of dividend increases, balance sheet stability, and cautious yet effective expansion.

The stock’s performance over the past year has been quietly strong, and its valuation reflects a company that’s been doing the right things for a long time. While not without risks, Essex’s focused strategy and experienced team give it the tools to continue performing, even in a more challenging environment.

This is a company that moves deliberately, avoids unnecessary risks, and rewards shareholders through steady growth and a long-standing dividend commitment. It’s not about big moves—it’s about staying the course and doing it well.