Key Takeaways

💸 Erie offers a 1.5% dividend yield backed by a 33-year growth streak and a conservative payout ratio under 60%, signaling long-term reliability.

💼 Operating cash flow topped $610 million in the trailing 12 months, with free cash flow exceeding $510 million, showing strong liquidity and financial discipline.

📊 Analyst sentiment is cautious due to valuation, with a recent downgrade to “Hold” and a revised price target of $426, though long-term fundamentals remain intact.

📈 First quarter earnings rose year-over-year, with net income of $138.4 million and increased management fee revenue, despite higher expenses and one-time catastrophe losses.

Last Update 5/4/25

Erie Indemnity Company (ERIE), headquartered in Pennsylvania, serves as the managing attorney-in-fact for the Erie Insurance Exchange, providing administrative and operational services in exchange for a percentage of premiums. Its fee-based business model creates a reliable revenue stream that has supported consistent profitability, strong cash flow, and a dividend that’s been growing for over three decades.

The company’s stock, while down from last year’s highs, still trades at a premium valuation reflective of its steady financial performance and conservative management approach. Backed by a clean balance sheet, disciplined capital allocation, and a clear long-term strategy, ERIE continues to focus on supporting its agent network, investing in technology, and delivering sustainable shareholder returns.

🧾 Key Dividend Metrics

📅 Dividend Yield: 1.50%

💰 Annual Dividend Rate: $5.46

📈 5-Year Average Yield: 1.77%

🧮 Payout Ratio: 55.79%

🧨 Dividend Growth Streak: 33 years

💹 1-Year Dividend Growth: ~4%

📆 Next Ex-Dividend Date: July 8, 2025

Recent Events

Erie’s most recent quarterly update, covering the period ending March 31, 2025, shows business humming along just fine. Revenue climbed more than 12% year-over-year, hitting $3.9 billion, while net income rose over 11% to reach $614 million.

From a profitability standpoint, the company continues to impress, with a profit margin just under 16%. Return on assets is also strong at 16.3%, and the return on equity is a robust 32.4%. These aren’t just accounting wins—they reflect a well-oiled machine that generates steady cash without stretching itself thin.

Perhaps what’s most striking, especially for conservative income investors, is the balance sheet. Erie carries just under $13 million in total debt. When stacked against nearly $290 million in cash, it’s almost negligible. That kind of balance sheet strength offers a lot of breathing room—not just for operations, but for dividend continuity too.

The stock, though, has had a rough patch. After peaking near $547 in the past year, shares have pulled back to around $364. That’s a significant drop, but it’s also brought valuations closer to earth and may catch the attention of investors who were previously priced out.

Dividend Overview

Let’s get this out of the way—the yield isn’t going to knock your socks off. At 1.50%, it sits below what many income-focused investors might screen for. But Erie isn’t about chasing yield. It’s about delivering year after year, without interruptions or drama.

This company has now raised its dividend for 33 straight years. That covers recessions, market crashes, and just about everything else. It’s an impressive streak built on reliable cash flow rather than financial engineering or one-time boosts.

Backing that up is a payout ratio under 56%, which signals that the company isn’t stretching to cover the dividend. With over $642 million in operating cash flow and a lean capital structure, the dividend has plenty of coverage. Free cash flow clocks in at $362 million—not flashy, but healthy.

One of the overlooked perks here is how insulated Erie is from market volatility. With a beta of 0.46, the stock tends to move less dramatically than the broader market. That can add a layer of calm to a portfolio, especially for those looking to reinvest dividends over the long term.

Dividend Growth and Safety

Erie’s dividend growth isn’t in-your-face aggressive, but it is reliably upward. Over the last five years, the company has increased its payout at a steady clip of just under 6% annually. The most recent raise was just shy of 6%, moving the quarterly payout from $1.29 to $1.365.

That kind of growth might not dominate headlines, but in a low-yield environment, it adds up. Especially when paired with a solid foundation of recurring cash flows and minimal reinvestment requirements. Erie’s business model—earning management fees from the insurance exchange—doesn’t require heavy capital outlays. That frees up more cash to support the dividend.

Safety-wise, Erie’s payout looks extremely well-protected. The company isn’t overextending, the balance sheet is strong, and the earnings base is stable. Even in a slowdown, this dividend should hold firm.

It’s also worth mentioning insider alignment here. Nearly 45% of shares are held by insiders, which tends to bode well for long-term dividend dependability. When management is holding a big stake, they’re more likely to prioritize steady shareholder returns.

Unlike some dividend payers that rely on financial engineering or cyclical windfalls, Erie’s payouts come from a dependable, slow-growing core. And with the share count remaining stable—no ongoing dilution to speak of—each increase in the dividend flows cleanly to shareholders.

This isn’t the most exciting dividend stock on the market, but for investors who value consistency over fireworks, Erie Indemnity offers a quiet, reassuring presence in any income-focused portfolio.

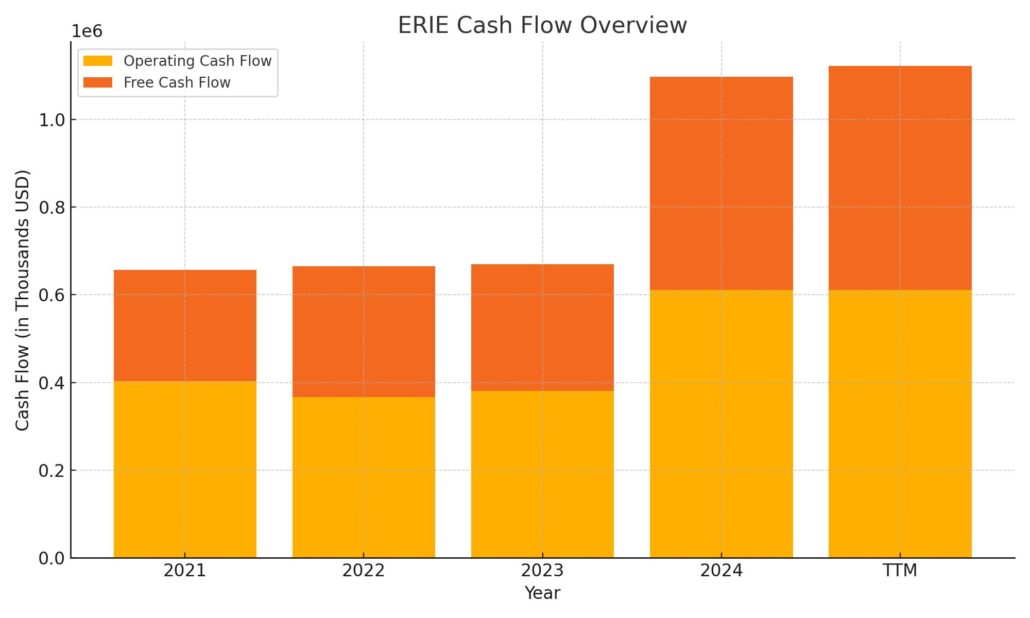

Cash Flow Statement

Erie Indemnity’s cash flow profile highlights the strength and predictability of its business model. Over the trailing twelve months, the company generated more than $610 million in operating cash flow, a notable increase from $381 million the prior year. This strong uptick aligns with revenue and earnings growth, suggesting that the company’s operations are translating efficiently into actual cash. Free cash flow also remains robust at over $510 million, reflecting disciplined capital spending and solid operating efficiency.

Investing activity over the same period saw a significant cash outlay of nearly $298 million, mainly tied to capital expenditures, which have risen consistently in recent years. Financing cash flow was firmly negative at around $229 million, in line with past years, due to steady dividend payments and the absence of new debt issuance. Erie’s ending cash position stands at roughly $260 million, providing a comfortable liquidity cushion and reinforcing the company’s ability to continue funding its dividend without strain.

Analyst Ratings

Erie Indemnity Company (ERIE) has recently experienced a shift in analyst sentiment. 🟡 One notable change came when Argus Research moved its rating from a “Buy” to a “Hold,” revising its price target to $426. This adjustment reflects some caution due to valuation concerns, as the stock had seen a significant price increase before pulling back in recent weeks.

🔎 Despite the downgrade, sentiment among analysts remains generally favorable, albeit limited. There is currently just one analyst formally covering ERIE, and they maintain a “Buy” rating. However, the lack of broad coverage also means there isn’t a widely reported average price target, which can make it a bit harder to gauge consensus expectations.

📉 The downgrade seems to be more about where the stock is priced rather than any issues with Erie’s performance. Fundamentally, the company continues to deliver consistent results with rising revenue and stable profit margins. Its conservative financial posture, minimal debt, and reliable free cash flow have helped reinforce confidence in its long-term outlook.

📊 While analysts are signaling some short-term caution on valuation, Erie’s core business remains steady. Investors weighing this recent analyst action may want to focus on the long-term strength and predictability that ERIE continues to offer.

Earnings Report Summary

Solid Start to the Year

Erie Indemnity kicked off 2025 with a strong first quarter, continuing to show why it’s often viewed as a steady hand in the insurance world. Net income came in at $138.4 million, up from $124.6 million a year ago. That works out to $2.65 per share, a solid improvement over last year’s $2.38. Operating income before taxes also moved higher, growing just over 9 percent to reach $151.4 million.

The company’s management fee revenue, which is its core business line, rose by 13.4 percent to $755 million. That growth reflects a combination of higher written premiums and continued strength in the underlying business. Investment income, although a smaller piece of the puzzle, also helped out with $19.5 million in earnings compared to $15.1 million last year.

Rising Costs, but Still in Control

Not everything came easy this quarter. Expenses were up, particularly commissions and operating costs. Agent commissions rose by $61.1 million, which isn’t a surprise given the jump in premiums. Non-commission expenses climbed by $16.3 million, largely due to ongoing tech investments and higher personnel costs.

Leadership acknowledged the cost pressures but framed them as necessary investments in long-term growth. They pointed to technology improvements and service enhancements that are meant to keep the company competitive and responsive as customer needs continue to evolve.

Looking Ahead

One of the bigger hurdles in the quarter was a significant catastrophe event in March, which drove up claims and had a noticeable impact on underwriting results. It added about 13 points to the catastrophe loss ratio for the quarter, pushing the combined ratio up to 108.1 percent. That’s a tough number in insurance terms, but not unexpected given the size of the event.

Despite that, leadership struck a confident tone about the direction of the business. Their focus remains on growing the policy base and keeping costs disciplined. The message coming out of the earnings call was clear: they’re playing the long game, staying disciplined, and making moves now to protect and expand their position in the years ahead.

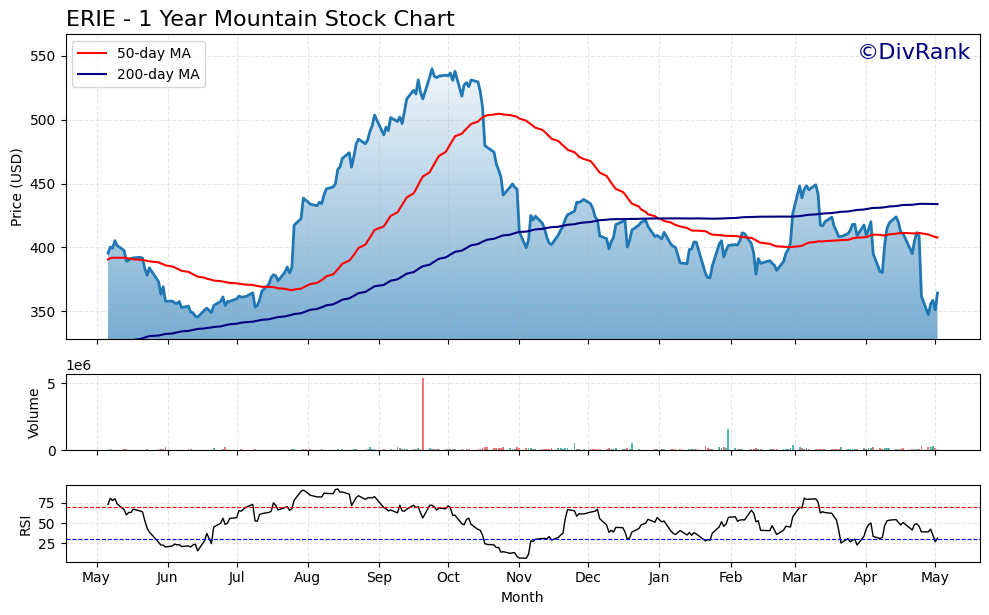

Chart Analysis

Trend and Moving Averages

ERIE has gone through a noticeable cycle over the past twelve months. The stock began the period near the $400 mark, dipped briefly in early summer, and then launched into a strong uptrend that peaked just above $540 in the fall. Since that high, momentum has reversed sharply, with the price pulling back and trading more erratically through the winter and spring.

The 50-day moving average (red line) followed the stock higher during its rally but began to roll over in late November. It has since declined steadily and now sits above the current price, confirming a short-term bearish tilt. The 200-day moving average (blue line) has maintained a slow, upward slope, suggesting that the broader long-term trend has not completely broken down, but there’s definitely some pressure building from above.

Volume and Support

Volume has stayed relatively quiet for most of the year, aside from a spike in October that likely marked a major shift in sentiment. More recently, the lower volume levels suggest a wait-and-see stance from participants, with no strong conviction to push the price decisively in either direction.

Support appears to be forming around the $350–$360 zone, where the stock has bounced multiple times. However, repeated testing of this level raises the risk that it may eventually give way if buying pressure doesn’t increase. Resistance, meanwhile, seems to have built up around $430–$440, a level that’s capped several rallies since February.

Relative Strength Index (RSI)

Looking at the RSI at the bottom of the chart, the stock has dipped into oversold territory several times this year, especially in April and again recently. Each of those trips near the 30 line has brought a modest rebound, but not enough to kickstart a lasting uptrend. The RSI is currently closer to the low end of its range, indicating that the stock remains under some selling pressure and has yet to regain momentum.

There’s a pattern of quick dips and sharp recoveries that could signal the early stages of base formation, but the price action remains choppy and indecisive. If RSI can climb back above 50 with price following through, that would be a healthier signal. For now, the setup is cautious, with the chart still looking for a stronger directional cue.

Management Team

Erie Indemnity is led by a team that values consistency, long-term planning, and strong relationships with its network of independent agents. The company isn’t known for dramatic leadership shifts or aggressive changes in strategy. Instead, it’s defined by a steady, measured approach to decision-making. Tim NeCastro, who has been serving as President and CEO since 2016, brings a long history with the company and has helped guide it through a period of digital modernization while maintaining its core focus on personal service.

The broader executive team is made up of individuals with deep tenure at Erie, and that continuity shows up in how the business is run. They’ve focused on improving service, investing in technology, and making the business more efficient—all without compromising the company’s core identity. You won’t often hear about major acquisitions or splashy initiatives from this group. What you will find is a thoughtful, deliberate approach to growth and a strong commitment to capital discipline. Their messaging to shareholders emphasizes the importance of financial stability and long-term performance over quarter-to-quarter results.

Valuation and Stock Performance

Erie Indemnity doesn’t fall into traditional growth or value categories. It trades at a premium relative to many in the insurance space, with a trailing price-to-earnings ratio above 30 and a price-to-book ratio around 9. These multiples can look expensive at first glance, but they reflect the reliability and quality of the company’s earnings stream. Investors typically pay up for businesses with consistent margins, dependable cash flow, and limited financial surprises—and Erie fits that description well.

Over the past year, the stock has traveled a bumpy road. It saw a strong climb during the middle of the year, reaching a high above $540, before falling back sharply to its current level near $364. That’s a meaningful correction and brings the stock closer to longer-term valuation support. While some investors may see this as a setback, others might view it as a more reasonable entry point after an overheated run.

Even with the decline, Erie continues to trade above key support zones. The 200-day moving average is still trending upward, suggesting that the long-term trend hasn’t completely broken down. At the same time, the 50-day average has started to turn lower, showing near-term pressure. Despite the technical weakness, the broader fundamentals remain intact.

The dividend yield of 1.5 percent isn’t high by traditional income standards, but it’s backed by a payout ratio under 60 percent and a history of reliable increases. That combination of stability and growth potential tends to appeal to long-term holders who value consistency over flash. Total return investors who reinvest dividends may find this kind of stock quietly rewarding over time.

Risks and Considerations

While Erie offers a solid foundation, there are a few risks worth watching. The company’s earnings are directly linked to the performance of the Erie Insurance Exchange, which it manages. If premium growth at the Exchange slows or if underwriting results become volatile, it could put pressure on the fees that drive Erie Indemnity’s revenue.

Another factor is geographic concentration. Erie has a strong presence in several states across the Midwest and Northeast, which gives it a deep understanding of its markets, but also exposes it to regional economic swings and weather events. The severe weather event in March was a reminder of how unpredictable these risks can be, even when a company isn’t taking on direct underwriting exposure.

The pace of digital change in the insurance space is also something to monitor. While Erie has made investments in technology, it operates in a world where customer expectations continue to evolve. Competitors are rolling out more automated, self-service tools and digital-first platforms, and staying competitive will require continued tech investment without sacrificing the company’s core agent-first approach.

Erie is also lightly followed by analysts, which can make its stock more sensitive to broader market swings or sudden news events. Less coverage often leads to less liquidity, and that can make price action more volatile in the short run.

Final Thoughts

Erie Indemnity has proven itself over time as a steady, well-managed business with a strong foundation. It doesn’t chase trends or overextend itself in pursuit of growth. Instead, it focuses on delivering quality results year in and year out. That philosophy is reflected in how the company approaches its dividend, its capital spending, and its relationships with policyholders and agents.

While the stock has pulled back from recent highs, the core business remains in good shape. Revenue is growing, cash flow is strong, and leadership remains focused on building long-term value rather than chasing short-term results. Investors looking for a more predictable stream of returns may find this kind of company well-suited to their approach.

There are risks, including exposure to regional disruptions and the need to keep up with a changing tech landscape, but Erie’s cautious financial management and consistent strategy offer some protection against those uncertainties. The company doesn’t need to be exciting to be effective. Its value lies in its ability to keep doing the fundamentals right, year after year.