Key Takeaways

💸 Enpro offers a forward dividend yield of 0.83% with a strong track record of annual increases, supported by a low payout ratio and consistent dividend growth.

💰 The company generated $162.9 million in operating cash flow and $130 million in free cash flow over the trailing twelve months, providing solid coverage for its capital needs and dividend.

📊 Analysts maintain a “Buy” consensus with a price target range of $190 to $215, reflecting confidence in the company’s earnings stability and long-term outlook.

📈 In its most recent quarter, Enpro matched revenue and EPS expectations, reaffirmed full-year guidance, and highlighted continued strength in its Sealing and Surface Technologies segments.

Last Update: 5/1/25

Enpro Inc. (NPO) operates in the industrial technology space, delivering high-performance materials and components used in critical applications like semiconductors, aerospace, and life sciences. The company has steadily refined its focus, transitioning away from cyclical businesses and into specialized, high-margin markets. This strategic shift, led by a stable and disciplined management team, has strengthened its fundamentals and positioned it for consistent performance.

Supported by a solid balance sheet, strong free cash flow, and a growing dividend, Enpro has built a track record of operational efficiency and shareholder return. With a measured approach to capital allocation and a clear long-term strategy, the company continues to prioritize value creation over market noise.

Recent Events

Over the past year, Enpro has shown slow but steady progress. Revenue rose to $1.05 billion over the trailing twelve months, a 3.7% year-over-year increase. While that kind of growth won’t grab headlines, it reflects solid execution in a business that isn’t built on flash but on consistency. More telling are the margins. With an operating margin above 15% and a profit margin just under 7%, Enpro is showing it knows how to manage costs and run lean without cutting corners.

On the balance sheet side, the company holds $236 million in cash against $694 million in total debt. The debt load isn’t insignificant, but a debt-to-equity ratio under 50% shows it’s manageable. Cash flow tells a clearer story—levered free cash flow came in around $147 million, giving the company flexibility to cover its dividend, pay down debt, and reinvest without stretching itself too thin.

The stock has been treading water for much of the past year. Trading at $149.40 at the close of April 30, it’s down from its 52-week high of $214.58, but also holding well above the $133.50 low. What’s changed is valuation. A forward P/E of just over 20 and an EV/EBITDA ratio around 15 suggest the stock is no longer trading at a premium. For long-term investors, that’s not necessarily bad news—it could be an opportunity to step into a quality company without paying a sky-high multiple.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.83%

💸 Trailing 12-Month Dividend: $1.20

💹 5-Year Average Yield: 1.09%

🛡️ Payout Ratio: 34.78%

📆 Last Dividend Paid: March 19, 2025

📆 Ex-Dividend Date: March 5, 2025

📊 Dividend Growth (5-Year CAGR): ~5%

Dividend Overview

Let’s call it like it is—this isn’t a stock for those chasing high income today. The yield is below 1%, and at first glance, it may not seem worth noting. But there’s more under the hood.

What stands out is how comfortably that dividend is covered. With a payout ratio below 35%, Enpro is in no danger of overextending itself. The company is deliberately keeping its dividend modest, likely because it sees better returns reinvesting in its own operations. That’s not a bad thing. In fact, it speaks to a measured, mature approach to capital allocation.

Free cash flow backs that up. With close to $147 million in levered free cash flow and roughly $26 million required to fund the dividend, there’s a wide margin of safety. It gives the company room to maneuver if business conditions tighten or if it decides to return more to shareholders down the line.

The dividend here isn’t meant to wow. It’s meant to build trust. And it does that well. Over time, this is the kind of stock that could grow into a more rewarding income stream, especially if the company keeps scaling margins and revenue like it has been.

Dividend Growth and Safety

Enpro doesn’t make a lot of noise when it raises its dividend—but it does raise it. The growth has been steady, if unspectacular, with a roughly 5% compound annual rate over the past several years. That’s not going to triple your income in a decade, but it reflects a consistent pattern and a clear intent to reward shareholders in a measured way.

What’s even more important is the security of the payout. That sub-35% payout ratio isn’t just a number—it’s a signal. Enpro could handle a temporary earnings dip and still keep the dividend intact. That kind of flexibility is what makes the dividend dependable, even if the yield isn’t high.

With a current ratio of 2.59, solid operating cash flow, and careful financial management, there’s every reason to believe the dividend can keep growing—even if only modestly. Institutional investors seem to agree, with over 100% of the float held through a mix of direct ownership and short positions. That’s not a vote of confidence you see in every mid-cap industrial name.

Ultimately, Enpro’s dividend is about stability and slow, deliberate growth. It might not catch the eye of income seekers at first glance, but for investors looking for a foundation to build on, it’s a name worth keeping in the mix.

Cash Flow Statement

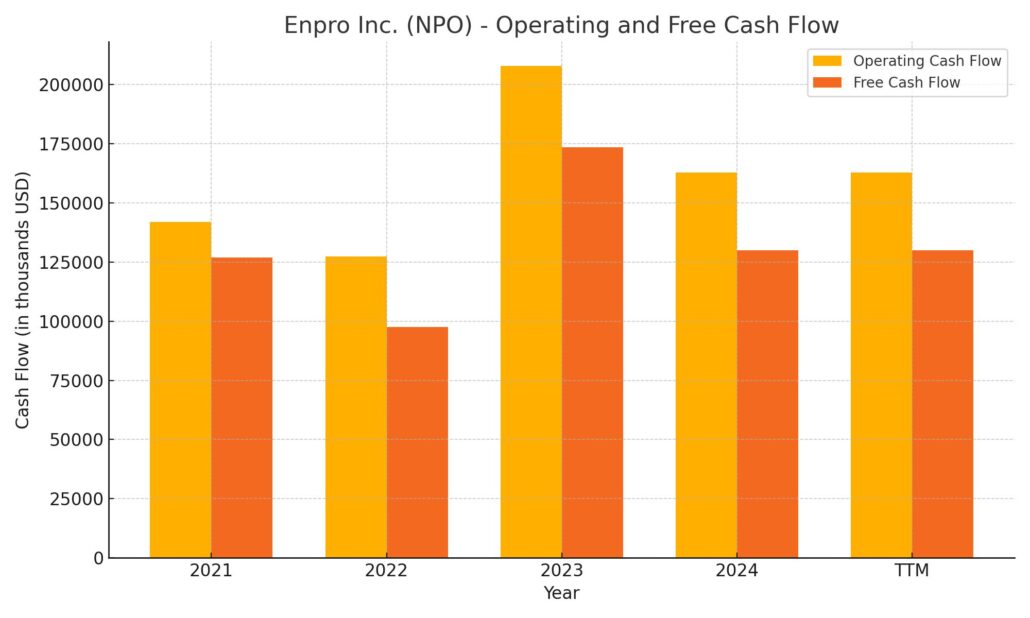

Enpro generated $162.9 million in operating cash flow over the trailing twelve months, showing strong underlying business performance and the ability to convert earnings into real cash. Free cash flow came in at $130 million after $32.9 million in capital expenditures, a solid figure that comfortably covers the company’s dividend obligations and leaves room for debt service and reinvestment. Compared to previous years, operating cash flow has cooled slightly from its 2023 level of $207.8 million but still reflects efficient cash generation.

On the investing side, the company reported a significant cash outflow of $241.5 million, indicating major investments—possibly acquisitions or expansion efforts—after a minimal $7.4 million outlay the year before. Financing activities also led to a net cash outflow of $50.5 million, largely driven by $60.6 million in debt repayments, partially offset by $52.5 million in new debt issuance. The end cash position sits at $236.3 million, lower than the prior year but still offering healthy liquidity. Overall, Enpro appears to be managing its cash with discipline, balancing investment with financial obligations while preserving a strong cash buffer.

Analyst Ratings

Enpro Inc. (NPO) has caught the attention of Wall Street recently, with analysts offering a generally favorable view. 🟢 The consensus rating sits at “Buy,” supported by input from three covering analysts. The average twelve-month price target is $202.50, suggesting a solid potential upside of around 33% from current levels. 🎯 Analyst expectations vary, with the lowest target at $190.00 and the highest reaching $215.00.

Back in April 2025, KeyBanc Capital Markets revised its outlook on the stock. 🔄 While maintaining an “Overweight” rating, they lowered their price target from $230.00 to $190.00. The shift reflected a recalibration of valuation expectations amid a slightly more cautious stance on near-term market conditions. Still, the reaffirmed positive rating suggests confidence in Enpro’s long-term positioning.

In contrast, Oppenheimer boosted its price target on the stock in December 2024, raising it from $170.00 to $215.00. 🚀 They maintained their “Outperform” rating, citing the company’s ongoing execution in its high-performance materials segments and improved operational metrics.

Overall, the tone among analysts remains optimistic. 📈 Enpro’s focus on high-margin, specialized industrial applications and its disciplined use of capital continue to resonate positively with the analyst community, pointing to a business that’s steadily building long-term value.

Earnings Report Summary

Solid Start to the Year

Enpro Inc. kicked off 2025 with a quarter that was steady and in line with expectations. The company brought in $266.2 million in revenue for Q1, right around where analysts had pegged it. Earnings per share landed at $1.57, again matching the street’s forecast. There were no surprises here—and that’s not a bad thing. The quarter showed consistency, which fits with Enpro’s identity as a disciplined, margin-focused business.

Behind those numbers, the Sealing Technologies segment continued to pull its weight. Sales in that group were up 11%, with organic growth contributing nearly 7% of that gain. Margins were impressive, with adjusted EBITDA topping 32%—a sign that management is keeping a close eye on efficiency. The Advanced Surface Technologies segment also chipped in with solid mid- to high-single-digit sales growth. EBITDA margins in that segment stayed north of 20%, reinforcing the strength of Enpro’s specialty focus.

Staying the Course

Enpro isn’t changing its outlook for the full year, and that tells you something. Leadership is standing by its guidance for adjusted EBITDA in the range of $262 million to $277 million. They’re also forecasting adjusted EPS between $7.00 and $7.70. There’s a sense of quiet confidence coming from the top, and that was echoed in the tone of the company’s messaging.

Management continues to lean into long-term growth opportunities, particularly in sectors like semiconductors, aerospace, and clean energy infrastructure. These are areas where Enpro’s products and capabilities can play a bigger role over time, and it’s clear they’re investing accordingly.

They also announced another quarterly dividend of $0.31 per share, payable mid-June. That marks the tenth straight year of dividend increases—another nod to consistency and shareholder value. While the payout isn’t massive, it fits the company’s profile: steady, reliable, and well-supported by cash flow.

Overall, the message from this report was clear—no drama, just progress. Enpro continues to execute, and its leadership seems focused on balancing near-term discipline with longer-term opportunity.

Chart Analysis

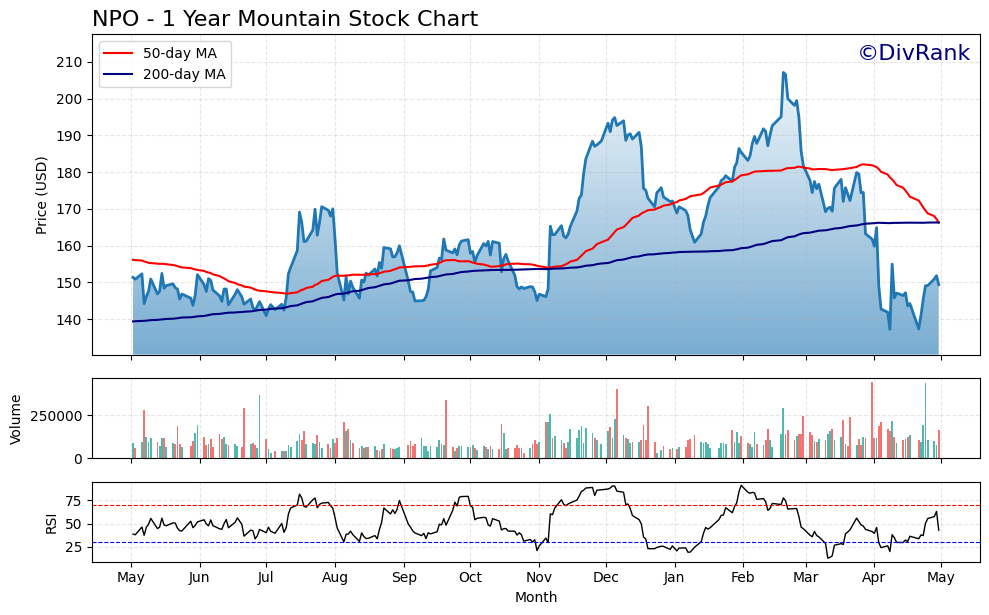

Trend and Moving Averages

Looking at the past year of trading activity, NPO has seen a significant shift in momentum. The stock had a strong run through late 2023 and into early 2024, breaking above $200 at one point. However, that upward momentum lost steam heading into spring. The 50-day moving average, shown in red, has rolled over sharply and now sits well above the price, signaling short-term weakness. The 200-day moving average, in blue, has remained relatively stable but is starting to flatten—often a sign that the broader trend may be losing strength.

What stands out is how far the current price has dropped below both moving averages, particularly in April, before staging a minor bounce. That kind of divergence suggests the stock may have been oversold and is now attempting to find footing. It’s not uncommon to see some consolidation after such a steep decline, especially with technical support kicking in around the $140 to $150 range where it’s bounced multiple times in the past.

Volume and Market Participation

Volume over the year has been generally steady, but there were a few notable spikes during price drops—especially in early April. That kind of volume surge on down days often hints at forced selling or institutional repositioning. More recently, volume has calmed down, which could imply the panic phase has passed. Still, participation on rebound days hasn’t been aggressive, which means confidence hasn’t fully returned yet.

Relative Strength Index (RSI)

The RSI tells a similar story. After dipping into oversold territory below 30 in April, the RSI has started to climb back toward neutral. That bounce is important—it shows that selling pressure has eased, but the index hasn’t reached the overbought range. There’s still room for upward movement without stretching too far technically. This could be a setup for a base to build, though it’s too early to say whether a sustained rally is forming.

Overall Read

What this chart reflects is a stock that got ahead of itself in the first quarter, corrected sharply, and is now in the process of stabilizing. The long-term average remains intact, which is encouraging, but the shorter-term trend has clearly turned downward. Investors are watching for signs of a reversal, and the recent RSI recovery may be the first hint of that. Price will need to retake and hold above the 50-day moving average before any sustained strength can be confirmed.

Management Team

Enpro’s leadership has taken a methodical and strategic approach over the past several years, steering the company away from its legacy manufacturing roots and toward higher-margin, more resilient end markets. This isn’t a management team chasing headlines or aggressive growth stories. They’ve focused instead on thoughtful portfolio reshaping, operational execution, and smart capital deployment.

Eric Vaillancourt, who took on the CEO role in 2021, has been at the center of that shift. Under his leadership, Enpro has completed divestitures that removed cyclical, lower-margin segments and leaned into more stable, technology-driven applications. His tone in earnings calls is consistently focused on long-term value, not short-term moves. There’s a deliberate calmness to the company’s strategy, and that has translated into predictable execution in both operations and capital allocation.

The broader management team seems well-aligned with this vision. They’ve prioritized cash flow, kept debt manageable, and steadily increased shareholder returns through regular dividend raises. The CFO team has shown a clear focus on maintaining flexibility, which has become increasingly important in today’s uncertain macro backdrop. While the company doesn’t carry the flash of more tech-oriented names, its leadership has proven it knows how to quietly build shareholder value over time.

Valuation and Stock Performance

Enpro isn’t a household name, and that’s reflected in its valuation. As of the most recent trading levels around $149, the stock is well below its 52-week high of $214.58. The pullback in price has been notable, especially considering the stock was trading at a premium just a few months ago. That decline has brought valuations back down to more reasonable levels. The forward P/E now sits just above 20, with EV/EBITDA near 15. These aren’t bargain-bin numbers, but they suggest the stock is no longer priced for perfection either.

Looking over the past year, performance has been mixed. The early part of the year brought a surge in buying interest, driven in part by broader industrial strength and Enpro’s own consistent earnings. But after peaking in early 2024, the stock started to retreat as markets reassessed growth expectations and sentiment shifted more defensively. The recent dip into the $140s brings the stock closer to its 200-day moving average, which could act as a technical floor if buyers step back in.

Despite the pullback, total returns have held up reasonably well over the multi-year view, especially when factoring in the growing dividend. The company doesn’t carry excessive valuation risk at these levels, and while upside might be slower than high-growth peers, it still appears supported by fundamentals. From a pricing perspective, Enpro seems to be settling into a range where patient investors might find the risk/reward profile more balanced than it has been in the recent past.

Risks and Considerations

While Enpro offers a lot of things that long-term investors like—steady cash flow, a growing dividend, and a focused management team—it’s not without its risks. The first is cyclicality. Despite its move into more stable, tech-heavy markets, Enpro still carries some industrial exposure. If macro conditions weaken more broadly or if end markets like semiconductors and aerospace see slowing demand, that could pressure margins and earnings.

Another consideration is debt. Although leverage is under control, with a debt-to-equity ratio below 50 percent, the company has close to 700 million dollars in total debt. That’s not excessive, but it does require attention, especially in a rising-rate environment. The good news is that Enpro’s strong free cash flow generation provides a buffer, but any meaningful drop in cash flow could shift that balance.

There’s also the challenge of scale. Enpro is a mid-cap player in markets often dominated by larger, better-resourced peers. It has carved out a niche, but growth will require continued strategic execution, smart acquisitions, or organic expansion in high-growth categories. Missteps in execution, particularly around integration or capital allocation, could have outsized effects given the company’s size.

Finally, investor perception remains a bit underwhelmed. Enpro doesn’t get the same attention as larger or flashier names, and that can lead to lower trading volumes and more muted reactions—even to strong results. For investors, that means this isn’t likely to be a momentum-driven stock. It’s a grinder, not a sprinter, and that requires some patience.

Final Thoughts

Enpro may not be on everyone’s radar, but the company has built a compelling story that’s grounded in discipline, focus, and steady execution. The dividend isn’t massive, but it’s reliable and backed by consistent free cash flow. The management team has shown a clear commitment to long-term value creation, and the recent pullback in the stock has reset expectations to a more realistic level.

There are still questions to watch—especially around how the business weathers any future macro softness—but the foundation seems solid. With lean operations, targeted market exposure, and a cautious capital strategy, Enpro appears well-positioned to keep delivering over time.

The chart reflects a stock that surged too far ahead of itself earlier in the year and is now recalibrating. If the company stays on its current track, continues improving margins, and maintains its balance sheet strength, it could gradually regain investor interest—especially among those who prioritize consistency and long-term value over flash and volatility.

It’s the kind of business that doesn’t demand attention, but quietly earns it.