Key Takeaways

💰 EIX offers a forward dividend yield of 6.19% with a payout ratio under 50%, supported by steady annual increases and strong earnings coverage.

💵 Operating cash flow reached $5.01 billion in the trailing twelve months, while free cash flow remained negative due to ongoing infrastructure investments.

📊 Analysts maintain a moderately bullish stance with a consensus price target of $76.75, and recent upgrades reflect confidence in long-term performance despite short-term volatility.

📈 First quarter core EPS rose to $1.37, driven by a regulatory settlement, with management reaffirming full-year guidance and emphasizing grid modernization efforts.

Last Update: 5/1/25

Edison International (EIX), the parent of Southern California Edison, delivers power to over 15 million people in California and has remained a reliable income-generating utility through market shifts. With a forward dividend yield of 6.19% and a conservative payout ratio under 50%, the company continues to attract income-focused investors looking for consistent returns backed by real earnings.

Despite a challenging year marked by wildfire exposure, regulatory pressures, and a steep share price decline, Edison’s leadership has maintained steady guidance and focused execution. Long-term infrastructure investments, solid operating margins, and a supportive regulatory framework are helping to anchor its outlook.

📌 Key Dividend Metrics

💰 Forward Yield: 6.19%

📅 Dividend Payout Ratio: 45.47%

📈 5-Year Average Yield: 4.37%

🔁 Dividend Growth Rate: Modest, low single digits

📆 Last Dividend Paid: April 30, 2025

⛔ Ex-Dividend Date: April 7, 2025

📉 52-Week Price Change: -25.65%

💳 Annual Dividend: $3.31 per share

Recent Events

Edison’s stock has taken a hit. After closing at $53.51, it’s down nearly 9% in just one trading session. That’s not something you usually see with a utility company, which typically operates in a much more stable lane. But this drop doesn’t necessarily reflect a breakdown in the business itself.

The company remains profitable, with nearly $2.73 billion in net income over the past year and a healthy operating margin above 23%. That kind of margin strength is impressive, especially in a regulatory-heavy environment like California.

Debt is a concern, no question. With total debt pushing past $39 billion and a debt-to-equity ratio over 210%, Edison is definitely carrying a heavy financial load. But that’s not unusual for the industry, where long-term infrastructure spending demands capital. And despite the leverage, the company still has investment-grade strength and the cash flow to back up its dividend commitments.

There hasn’t been any indication that Edison is pulling back on shareholder returns. The most recent dividend was paid right on time at the end of April, showing a continued commitment to rewarding investors even through a tough market environment.

Dividend Overview

With the current selloff, Edison’s dividend yield has climbed north of 6%, which is well above its five-year average. This isn’t a yield spike driven by panic or a surprise dividend slash—it’s the result of a lower share price. That distinction matters.

The company raised its dividend this year from $3.21 to $3.31, continuing its slow and steady trend of annual hikes. The growth may not be aggressive, but it’s dependable. Investors counting on regular income won’t be disappointed by Edison’s track record.

Earnings coverage remains solid. A 45% payout ratio gives the company a solid cushion. There’s room to maneuver even if earnings slip a bit. And while the company’s free cash flow is negative, that’s due to aggressive investment in grid upgrades and wildfire prevention—not cash burn from operations. Edison’s $5.19 billion in operating cash flow continues to provide a strong foundation for the dividend.

Dividend Growth and Safety

EIX isn’t going to wow you with dividend growth. That’s just not the role it plays. What it offers is consistency. The annual increases are modest, but they come like clockwork, and that predictability is gold for investors who rely on dividend income.

From a safety perspective, things still look solid. Earnings are more than covering the dividend, and EBITDA of $6.41 billion gives Edison enough strength to keep making payments while servicing its debt. That kind of balance is key in a capital-intensive business like utilities.

Still, there are risks worth keeping in mind. The level of debt is significant, and the regulatory environment in California is always complicated. Wildfire-related costs and future liability are wild cards that investors can’t ignore. But this isn’t new territory for Edison. They’ve been managing these risks for years, and so far, they’ve done it without missing a dividend.

What we’re seeing right now is more about sentiment than fundamentals. The stock’s decline has pushed the yield higher, and the market seems to be pricing in worst-case scenarios that haven’t materialized. For dividend-focused investors, that disconnect between price and performance could mean opportunity.

Edison International doesn’t need to dazzle to deliver. It just needs to keep doing what it’s done for decades: provide steady income backed by essential services. In that regard, it’s still doing the job.

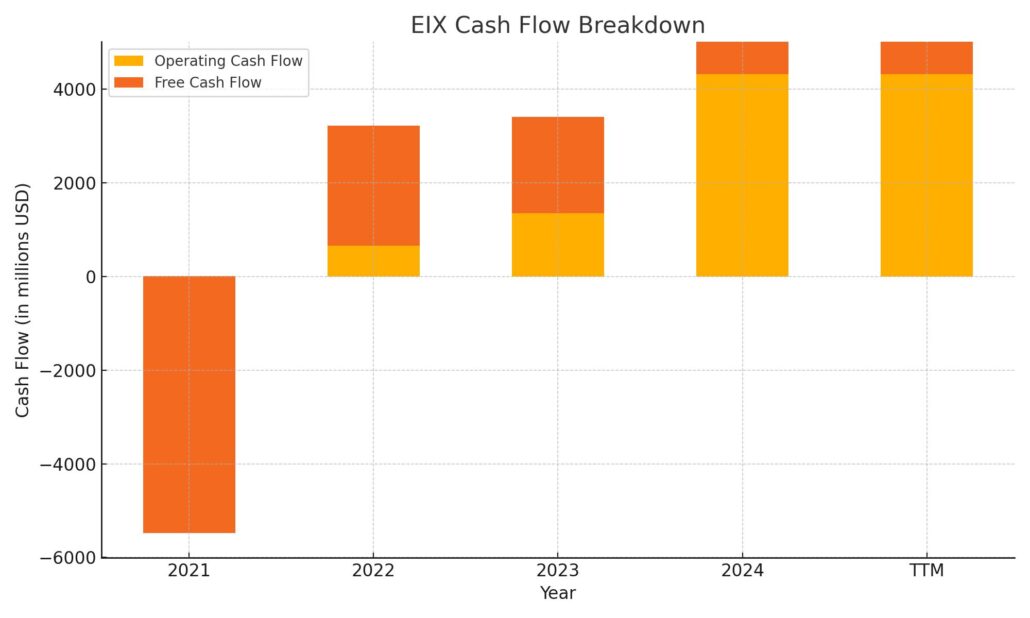

Cash Flow Statement

Edison International’s trailing twelve-month cash flow paints a picture of a capital-heavy business still generating solid operating income but feeling the weight of ongoing infrastructure investment. Operating cash flow has grown to $5.01 billion, a notable recovery from the prior year’s $3.4 billion. This uptick reflects more efficient operations and a return to more normalized earnings levels, especially when contrasted with the razor-thin $11 million reported just a few years back.

However, the company remains deep in investment mode. Capital expenditures exceeded $5.7 billion, and total investing cash flow came in at a negative $5.54 billion—typical for a regulated utility modernizing its grid. Free cash flow remains negative at -$693 million, though improved from deeper deficits in previous years. On the financing side, Edison brought in $674 million, driven by debt issuance of $5.56 billion, partially offset by repayments and a repurchase of stock. The cash position at year-end rose modestly to $684 million. All in, Edison continues to fund its capital spending through a mix of debt and operating income while managing free cash flow shortfalls within expected utility sector norms.

Analyst Ratings

Edison International has recently seen a mix of analyst sentiment, reflecting both long-term confidence and short-term caution. 📈 The consensus 12-month price target currently sits around $76.75, indicating a potential upside of over 43% from the current price of $53.51. 💹

🔵 Barclays maintained its Overweight rating as of early April, nudging its price target slightly down from $65 to $64. This signals that the firm still sees strength in Edison’s fundamentals, even as it tempers expectations amid broader utility sector weakness.

🟢 UBS showed a more optimistic shift, upgrading the stock from Neutral to Buy and setting a price target of $65. Their move suggests renewed confidence in Edison’s growth potential, possibly driven by the company’s focus on long-term infrastructure projects and stable operating cash flow.

🟠 Morgan Stanley took a more conservative stance, maintaining an Underweight rating but increasing its price target from $48 to $52. The modest bump acknowledges some underlying strength but also reflects lingering concerns—especially around debt levels and wildfire exposure.

🟡 Goldman Sachs kept its Neutral rating, trimming its target from $88 to $68. While not bearish, this adjustment reflects a more cautious outlook on near-term performance.

Overall, analysts remain moderately constructive on Edison International. With a Moderate Buy consensus and improving core earnings, the stock continues to attract income-focused investors looking past short-term turbulence.

Earning Report Summary

Solid Start to the Year

Edison International kicked off 2025 on a relatively strong note. Core earnings per share came in at $1.37, up from $1.13 a year ago. That kind of growth might not turn heads in high-growth sectors, but for a utility company navigating regulatory and environmental pressures, it’s a respectable step forward. One of the major tailwinds this quarter came from the TKM Settlement Agreement, which helped lower interest expenses and padded the bottom line.

At the same time, revenue dipped by 6.5% year over year, landing at $3.81 billion. That decline isn’t ideal, but it wasn’t unexpected. Despite the top-line weakness, Edison kept its full-year core earnings guidance steady in the range of $5.94 to $6.34 per share. Leadership also reiterated their long-term growth target of 5 to 7 percent annually through 2028. That kind of consistency is exactly what dividend-focused investors want to hear.

Leadership’s Outlook

CEO Pedro Pizarro took time to speak about Edison’s broader mission—especially its work in wildfire-prone areas like Malibu and Altadena. He talked about rebuilding these communities stronger and more resilient, not just patching things up. Grid hardening and reliability remain top priorities, and the company continues to push forward with wildfire mitigation measures.

He also made a point to emphasize collaboration with state leaders to keep California’s utility framework on solid footing. That’s crucial for Edison, given the complex regulatory environment it operates in.

Financial Clarity and Risks

CFO Maria Rigatti broke down some of the numbers behind the headline figures. She pointed out that about 30 cents of the core EPS this quarter came from the TKM settlement, which isn’t a recurring benefit. Higher interest expenses at the corporate level also weighed slightly on results, but not enough to derail the overall performance.

One risk the company acknowledged is potential exposure to the Eaton Fire. While investigations are still ongoing and nothing conclusive has been found yet, Edison is staying proactive with local and state officials. At the same time, the company is preparing to submit its 2026 Wildfire Mitigation Plan, which outlines further investments in grid safety and modernization.

Staying the Course

Despite a few bumps in the road, Edison International seems to be sticking to its long-term strategy without blinking. The earnings beat and solid guidance send a message that management is confident in how things are progressing. They’re staying committed to reinvesting in critical infrastructure, navigating California’s regulatory terrain, and keeping the dividend supported by a reliable cash flow base. For a utility stock, that’s exactly the kind of tone investors like to hear.

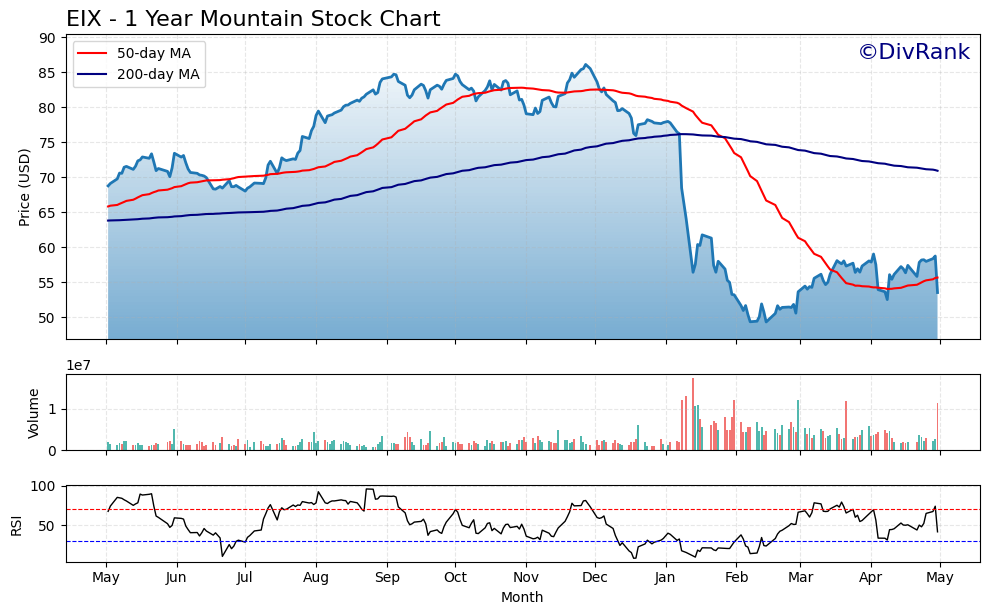

Chart Analysis

Breakdown of EIX Price Trends

EIX has had a turbulent year on the chart. From May through early December, the stock trended steadily higher, with a strong climb that peaked around mid-December just shy of $87. The 50-day moving average stayed comfortably above the 200-day for most of that run, which typically supports upward momentum.

That changed dramatically heading into January. A sharp breakdown in price caused the 50-day to plunge, crossing below the 200-day line in early February—a bearish crossover often referred to as a death cross. Since then, the price has remained well below both moving averages, although there’s been some stabilization in recent weeks.

The most recent price action shows signs of trying to bottom out. There’s a noticeable rounding pattern beginning to form from early March through April, with the price recovering slightly and testing resistance around $56. It’s not a confirmed reversal yet, but it does signal that the worst of the selling pressure may be behind for now.

Volume and Momentum Signals

Volume spiked dramatically during the January selloff, which often reflects capitulation. Since then, volume has normalized, suggesting a calmer, more orderly trading environment. There’s been a slight uptick in buying interest during April as the price tested its lows and bounced higher.

Looking at the RSI (Relative Strength Index), the stock dipped below 30 in January, indicating oversold conditions. Since then, RSI has risen steadily and is now hovering around the 60 level. That suggests improving momentum without the stock being overbought.

Moving Average Context

While the 50-day average is still below the 200-day, the recent flattening of the 50-day line could be an early signal that downward momentum is slowing. For this to flip more decisively bullish, the price would need to break above the 200-day average and hold there with follow-through volume.

Overall, the chart suggests that EIX may have passed through a period of forced selling and is now attempting to find its footing. While there’s no breakout yet, the stabilization and shift in RSI offer early signs of strength returning.

Management Team

Edison International’s leadership team is seasoned and steady, navigating a challenging operating environment with a focus on long-term infrastructure resilience and regulatory balance. CEO Pedro Pizarro has been with the company in various executive roles for nearly two decades, and his tenure at the top since 2016 has been defined by a strategic push into grid modernization and wildfire mitigation. He tends to strike a tone that blends technical precision with a broader view of public responsibility—something critical when you’re operating in California.

CFO Maria Rigatti has also been a consistent presence, bringing strong financial discipline during a time when utility finance is under the spotlight. Her visibility on earnings calls and in investor communications reflects the company’s intent to maintain transparency, particularly around issues like wildfire costs and regulatory settlements. The rest of the executive team includes professionals with deep experience in utility operations, environmental compliance, and public policy—a combination that’s crucial when working in a state known for its complexity.

The leadership’s long view is evident in its capital allocation. There’s a continuous reinvestment into the grid and safety improvements rather than aggressive expansion or risky M&A. The company’s handling of settlements, earnings visibility, and regulatory collaboration shows a team that prioritizes stability and execution.

Valuation and Stock Performance

Looking at where EIX stands today, the valuation is deeply compressed. The stock trades at a trailing P/E of just 7.57, which is well below the broader utility sector average and even further below the market’s overall multiple. Even on a forward basis, the P/E is hovering around 8.86. That kind of discount usually signals uncertainty or fear in the market—and in Edison’s case, it seems to be mostly about macro concerns and specific wildfire risk, not a breakdown in fundamentals.

The stock is down over 25 percent over the past 12 months, with a sharp decline starting in early January. That drop dragged it well below both its 50-day and 200-day moving averages. What’s notable, though, is that the price has started to stabilize, hovering in the 53 to 55 dollar range through April and into early May.

In terms of valuation multiples beyond earnings, Edison trades at 1.20 times price-to-sales and 1.37 times price-to-book. These are not lofty numbers, particularly for a regulated utility with a captive customer base and strong cash flow. On an enterprise value to EBITDA basis, the ratio sits at 7.32, which again suggests the market is pricing in more risk than the company is actually showing operationally.

The dividend yield of 6.19 percent is another piece of the puzzle. It’s well above the five-year average of 4.37 percent and stands out among peers. With a payout ratio under 50 percent, that yield appears supported by actual earnings, not financial engineering. It’s a yield that’s a result of market pessimism, not deteriorating company performance.

Risks and Considerations

Edison International does carry a few risks that long-term investors should weigh carefully. The biggest, and most well-known, is its exposure to California wildfires. The company operates in regions that are particularly vulnerable to fire-related events, and although it has made significant investments in grid safety and partnered with state programs under AB 1054, the legal and financial risk remains.

Another concern is debt. With a total debt load of 39.56 billion dollars and a debt-to-equity ratio above 210 percent, Edison is heavily leveraged. That’s not uncommon in the utility space, but it does reduce flexibility. As interest rates remain elevated, the cost of capital could rise, making future infrastructure investments more expensive or slowing dividend growth potential.

Regulatory shifts are another wildcard. While the company has worked closely with California regulators and made progress in securing settlements and approvals, that environment can change quickly. Political pressure, environmental mandates, or changing public sentiment could introduce new compliance costs or operational hurdles.

There’s also the matter of cash flow. Free cash flow remains negative, though much of that is due to planned capital expenditures. Still, the market tends to react sharply to negative FCF even when it’s tied to growth investments. If the company fails to generate visible returns from these outlays, sentiment could remain soft.

On the performance side, the stock has yet to reclaim its longer-term moving averages. While it’s encouraging to see the RSI trending upward and some stability in price, momentum hasn’t decisively turned. Investors looking for confirmation may want to see a break above 60 dollars with volume to feel more confident about the technicals.

Final Thoughts

Edison International today reflects a story of resilience more than growth. The business model is sound—regulated, essential, and backed by consistent earnings. The management team is experienced, pragmatic, and focused on the long term, steering the company through regulatory and environmental challenges with clear communication and disciplined capital allocation.

Valuation has reached levels that suggest the market is overly skeptical, particularly in light of strong operating margins, solid earnings coverage of the dividend, and strategic clarity. The yield is generous, especially when compared to both historical averages and peers, and it doesn’t come at the expense of sustainability.

The risks—wildfire exposure, high leverage, regulatory complexity—are real, but they’re also well understood and actively managed. The recent pullback may have made the stock less appealing for short-term traders, but for those willing to wait, EIX offers a combination of dependable income and potential price recovery that isn’t easy to find in today’s market.

With infrastructure still in focus and regulatory support mostly intact, Edison is positioned to continue its role as a foundational utility for the state and a consistent performer for investors who prioritize income and resilience over excitement.