Key Takeaways

📈 EBMT offers a forward dividend yield of 3.28% with a consistent payout ratio under 46%, reflecting a sustainable and shareholder-friendly approach to dividend growth over time.

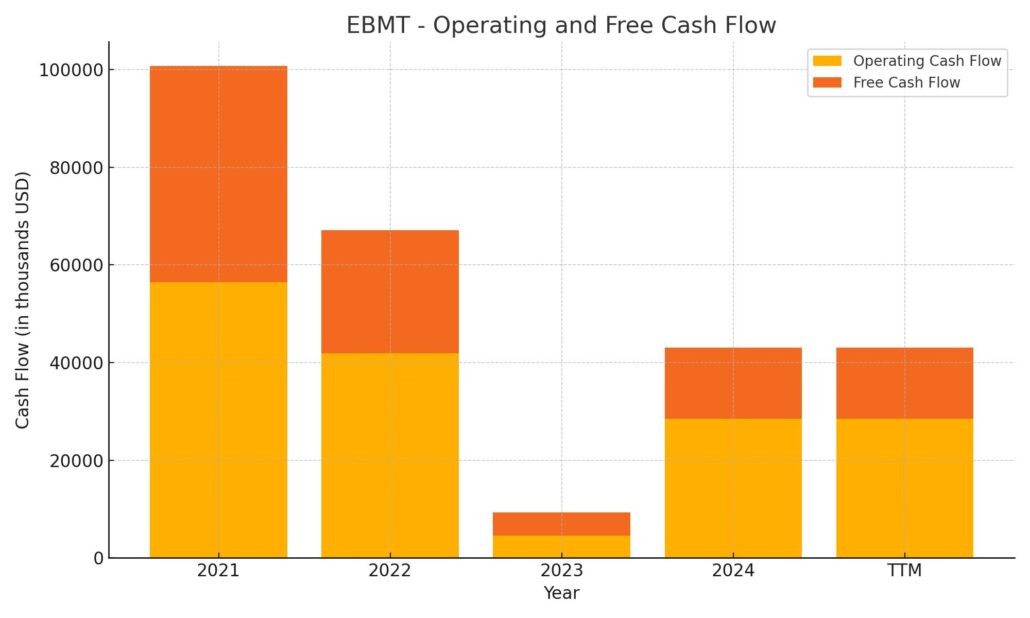

💵 Trailing twelve-month operating cash flow reached $28.5 million, with free cash flow at $14.5 million, marking a significant recovery from the prior year’s negative figure.

🟡 Analysts currently maintain a consensus “Hold” rating with a price target of $17.00, citing steady performance and limited short-term upside following recent share price appreciation.

📊 First-quarter earnings rose 70.7% year-over-year, supported by a stronger net interest margin, disciplined expense control, and solid loan and deposit growth.

Last Update: 5/1/25

Eagle Bancorp Montana (NASDAQ: EBMT) is a regional bank headquartered in Helena, Montana, operating through its subsidiary, Opportunity Bank of Montana. With a focus on community banking, the company has grown through disciplined lending, targeted acquisitions, and a commitment to returning value to shareholders. Over the past year, EBMT has delivered solid financial performance, with net income rising over 70% year-over-year in the most recent quarter and consistent growth in both deposits and loans.

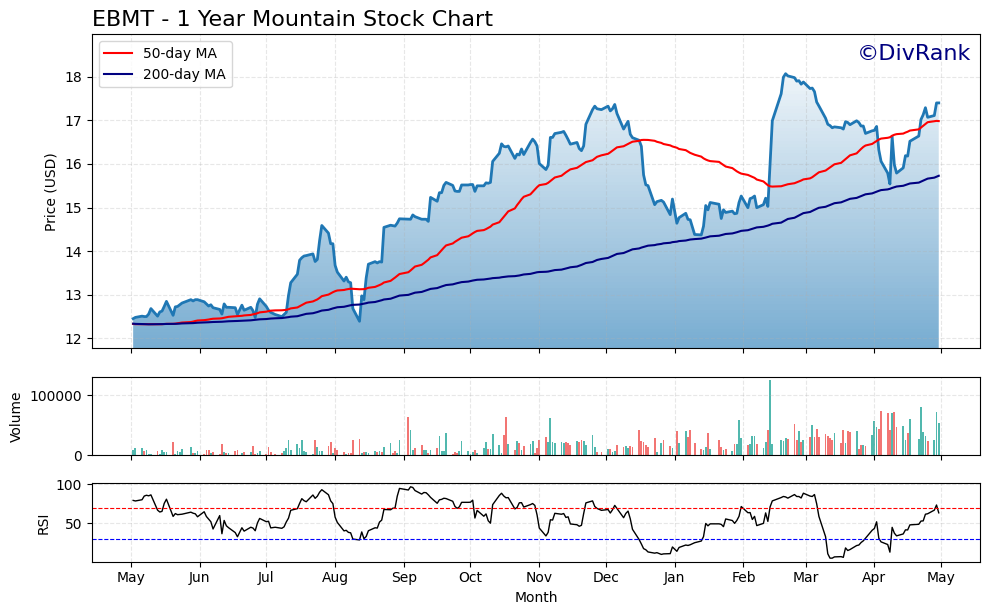

The stock has appreciated more than 34% in the past 12 months and continues to offer a forward dividend yield above 3%, supported by a conservative payout ratio of 45%. Trading below book value and well-supported by both 50-day and 200-day moving averages, the stock has shown technical strength alongside operational consistency. Leadership remains focused on stable expansion, cost control, and maintaining strong asset quality across its Montana markets.

🕒 Recent Events

EBMT reported strong earnings for the final quarter of 2024, with net income at $9.78 million and revenue reaching $80.7 million. That marked a solid 58.6% year-over-year jump in earnings. It wasn’t just a fluke, either—there’s clear evidence of momentum. Revenue saw a modest but respectable 3.2% gain from the previous year, reflecting the bank’s disciplined loan growth and controlled expenses.

Return on equity came in at 5.68%, and return on assets landed at 0.47%. These figures won’t knock your socks off, but they reflect a careful, methodical approach to banking. Operating margin, meanwhile, was a solid 20.22%, suggesting that even with modest top-line growth, the bank is keeping a tight grip on its costs.

From a market standpoint, EBMT’s stock has been climbing, gaining over 34% in the past year. That’s more than triple the performance of the S&P 500 during the same stretch. While it recently dipped slightly in pre-market trading, it remains well above its 50- and 200-day moving averages, showing solid technical support.

And perhaps most important for income investors: EBMT’s dividend is comfortably covered by its earnings, with a payout ratio of just under 46%. That cushion gives management breathing room to continue rewarding shareholders without putting pressure on the balance sheet.

📊 Key Dividend Metrics

💰 Forward Annual Dividend Rate: $0.57

📈 Forward Dividend Yield: 3.28%

📉 5-Year Average Yield: 2.93%

🔒 Payout Ratio: 45.56%

📅 Next Ex-Dividend Date: May 16, 2025

📆 Last Dividend Paid: March 7, 2025

🌱 Dividend Growth Trend: Slow and steady

🔄 Last Split: 19:5 in April 2010

💸 Dividend Overview

EBMT’s dividend yield currently sits at 3.28%, slightly above its five-year average. That tells you a couple of things: the payout is steady, and the stock hasn’t been under heavy selling pressure. That’s a good sign, especially when some banks are cutting or pausing dividends due to tighter credit conditions.

The dividend isn’t enormous, but it is well-supported. The company has clearly made shareholder returns a priority, even while managing acquisitions and staying conservative with its capital. In this environment, that kind of approach can be refreshing.

What’s more, the current payout ratio of 45.56% leaves plenty of room for flexibility. It’s not so low that the dividend feels meaningless, but it’s far from dangerous territory. The earnings base is solid enough to handle the current dividend and even support modest increases down the line.

🌿 Dividend Growth and Safety

This isn’t the kind of dividend stock that’s going to wow you with high single-digit annual raises. EBMT’s style is more modest. There’s a pattern of small increases over time, usually in tandem with stronger earnings years. The growth may not be flashy, but it’s measured, and that predictability can be a major plus for income-oriented portfolios.

The big jump in earnings last quarter gives the company more headroom to keep the dividend stable or even nudge it up. Net income is on the rise, and management has shown they aren’t inclined to overextend just to boost yield. That adds to the sense of dividend safety here.

With $31.7 million in cash and over $4 per share in liquidity, EBMT is also sitting on a comfortable cushion. Total debt is $201 million, which isn’t light, but the company’s conservative operations and balance sheet give it the bandwidth to handle obligations without jeopardizing the dividend.

One other thing to note is the low beta—just 0.39. This tells us the stock tends to move less than the broader market, which is attractive when you’re looking for income with less drama. It doesn’t hurt that the ex-dividend date is coming up on May 16, 2025, either, offering a near-term catalyst for income seekers.

In short, EBMT continues to behave like a steady, no-nonsense dividend name that’s just doing its job—paying shareholders consistently while keeping risk in check.

Cash Flow Statement

Eagle Bancorp Montana’s trailing twelve-month cash flow profile highlights strong operational footing with $28.5 million in operating cash flow, a sharp improvement over the previous year’s $9.3 million. This return to form brings the company closer to its 2021 levels and signals a healthy core business. Free cash flow came in at $14.5 million, reversing last year’s negative figure and showing EBMT is once again generating cash beyond its capital needs.

On the investing side, outflows continue to be heavy, with $27.8 million spent, primarily tied to securities and loan growth. Financing activities added $6.3 million in cash, supported by $135 million in debt issuance, partially offset by $62 million in repayments. The company also repurchased a modest $419,000 in stock. Despite aggressive investment and financing actions, EBMT grew its cash position to $31.6 million. Overall, cash flows reflect a bank that’s actively managing its balance sheet while keeping cash generation stable.

Analyst Ratings

Eagle Bancorp Montana (NASDAQ: EBMT) has seen a shift in analyst sentiment over the past year. In late 2022, several analysts adjusted their stance on the stock, moving from more optimistic ratings to a more neutral position. The reasoning centered around valuation concerns and a more cautious outlook for regional banks overall, especially as rising interest rates began pressuring net interest margins and loan demand.

As of now, the consensus among analysts stands at a cautious but steady “Hold” rating. 🟡 The average price target sits at $17.00, which is right around current trading levels. This suggests that analysts aren’t expecting major upside or downside in the near term. Instead, they seem to be looking for more visibility into how the company manages its loan book and funding costs through a still-volatile rate environment.

The adjustments in ratings weren’t based on any red flags in the company’s operations. 🏦 Rather, they reflected a broader recalibration in expectations for the sector. Analysts acknowledged EBMT’s consistent execution, but also flagged that most of the near-term upside may already be priced in following the stock’s strong run over the past year. For now, it seems the market is in a wait-and-see mode with EBMT.

Earning Report Summary

Strong Start to the Year

Eagle Bancorp Montana kicked off 2025 on solid footing, reporting net income of $3.2 million for the first quarter, which works out to $0.41 per diluted share. That’s a sizable jump compared to the $1.9 million, or $0.24 per share, it posted this time last year. While it’s a slight dip from the previous quarter’s $3.4 million, the year-over-year improvement is the headline here.

A key part of this strength came from its net interest margin, which expanded to 3.74% from 3.59% last quarter and 3.33% a year ago. That’s a healthy move in the right direction, driven by better yields on loans and investments, while the bank also made progress in trimming its funding costs. Net interest income edged up to $16.9 million, marking steady progress both quarterly and annually.

Deposit and Loan Growth Holding Steady

Deposits grew to $1.69 billion, a 3.3% increase from a year ago, while total loans reached $1.52 billion. Loan growth was more modest, but in the current rate environment, stability is a win. Credit quality remained solid too—nonperforming loans dropped to $5.3 million from $7.2 million, and the allowance for credit losses held firm at 1.10% of total loans. That reserve now covers more than 300% of problem loans, which gives the bank some cushion.

Some Pressure on Noninterest Income

Noninterest income landed at $4 million, which is down from the previous quarter’s $4.6 million. The drop mainly came from lower mortgage-related activity, which has been a common trend across the industry. On the expense side, the bank managed to cut costs by nearly 4% from last quarter, bringing noninterest expenses to $17 million. A big part of that improvement came from lower data processing expenses.

Leadership’s View and Looking Ahead

CEO Laura Clark called the quarter a solid one and pointed to the bank’s growth in deposits, margin expansion, and tighter control over expenses. She also highlighted the broader vision of strengthening the bank’s position across Montana and serving communities with a balanced loan portfolio and reliable deposit base.

On the financial side, CFO Miranda Spaulding noted the impact of improved yields and declining funding costs on margin expansion. She sounded optimistic that this trend could continue, especially with the current rate outlook from the Fed providing some tailwinds.

Book value per share increased to $22.26, and tangible book value rose to $17.38, both showing steady long-term progress. The board also declared a quarterly dividend of $0.1425 per share, set to be paid in early June, which remains in line with the bank’s long-standing commitment to shareholder returns.

Chart Analysis

Steady Long-Term Climb

The chart for EBMT over the past year tells the story of a stock that’s been building higher ground in a consistent, methodical way. Starting just above $12 last May, the price has steadily climbed, recently touching $17.50 before pulling back slightly. The blue-shaded price area shows a clean trend of higher highs and higher lows with only a few periods of sideways movement or temporary corrections.

The 200-day moving average, shown in navy, has kept a steady upward slope the entire time—often a reflection of strong underlying support. Meanwhile, the 50-day moving average (red) crossed above the 200-day back in August, a signal of medium-term strength. Despite a dip in early March when the price fell below the 50-day, buyers stepped in quickly and lifted the stock again. Since then, the shorter moving average has curled higher, and the price is now reclaiming levels near its recent highs.

Volume and Momentum Clues

Volume stayed relatively low through much of last summer but began picking up as the stock climbed past $14 in late September. A few spikes in volume can be seen in early February and April, possibly tied to earnings or dividend activity. These increases didn’t coincide with any meaningful breakdowns in price, suggesting accumulation rather than distribution.

The RSI (Relative Strength Index) at the bottom of the chart shows a few distinct periods of overbought and oversold conditions. Most of the dips below the 30 level—like in late December and February—were followed by sharp recoveries, indicating strong buying interest on weakness. Currently, RSI has moved toward the 70 line again, hinting at renewed upward momentum, but not quite overheated yet.

Altogether, EBMT has carved out a reliable upward channel with healthy pullbacks, increasing volume on strength, and consistent support from long-term trend lines. This type of structure often reflects investor confidence that’s building quietly but meaningfully over time.

Management Team

Eagle Bancorp Montana is guided by a leadership team that combines regional banking experience with a focus on measured, long-term growth. Laura Clark, currently serving as President and CEO, took over the role in 2022 after holding senior positions within the bank, including CFO and COO. Her leadership style emphasizes consistency, risk management, and building on the bank’s local relationships. With decades of banking experience in Montana, Clark brings both institutional knowledge and a steady hand.

Miranda Spaulding, the company’s CFO, has been with Eagle Bancorp since 2013 and brings strong financial expertise to the table. Her work in financial planning and regulatory compliance has been essential as the bank has navigated changes in interest rate environments and economic cycles. The broader executive team, including long-time credit and lending leaders, is deeply familiar with the bank’s markets and clients. They’ve helped position the company for steady expansion without overreaching.

This leadership team’s approach is best described as thoughtful and responsive. They don’t chase trends. They manage risk, maintain clean credit books, and look for smart opportunities to grow—especially through community-based lending and careful acquisition.

Valuation and Stock Performance

Eagle Bancorp Montana has had a quietly strong run over the past year. The stock is up over 34 percent from where it stood a year ago, reflecting a healthy balance of operational progress and investor confidence. The gains have come steadily, without the sharp ups and downs often seen in the sector, which speaks to the stability of the underlying business.

From a valuation standpoint, the numbers paint a picture of a bank that’s still attractively priced. The price-to-earnings ratio sits just above 12, while the forward P/E is even lower. Price-to-book is hovering around 0.78, suggesting that the stock is trading below the value of its net assets. For investors who value consistency and margin of safety, these are metrics worth noting.

The 200-day moving average has been steadily climbing, and the stock continues to hold above that level. Technical trends support the narrative of a company in a solid long-term uptrend. While the consensus analyst price target is around $17, which is right near its current range, the modest upside doesn’t fully capture the return potential when the dividend yield is included.

EBMT doesn’t make headlines, but it also doesn’t deliver surprises. And for many investors, that’s the point.

Risks and Considerations

Like any financial institution, Eagle Bancorp Montana faces risks tied to both internal operations and the broader economic environment. One recent concern came from the disclosure of a material weakness in internal control related to how certain borrowings were reported in the cash flow statement. While this didn’t affect net income or the balance sheet, it’s a reminder that even well-managed banks need strong systems in place to support transparency and reporting accuracy.

The bank’s geographic concentration in Montana is another consideration. It benefits from strong community ties and local market knowledge, but this also means it’s more exposed to regional economic shifts. Agricultural cycles, real estate activity, and small business health in Montana will all continue to play a role in shaping future earnings.

There’s also the interest rate environment to consider. While EBMT has managed to expand its net interest margin in recent quarters, shifts in Fed policy or competitive deposit pressures could change that. A rapid decline in rates could compress margins, while another round of increases might impact borrowing demand or asset quality.

That said, the bank’s balance sheet is in good shape, credit losses remain low, and leadership has been proactive about managing these risks. The track record suggests they’re aware of the pressures and are taking appropriate steps to mitigate them.

Final Thoughts

Eagle Bancorp Montana offers a quiet kind of consistency that appeals to those who value steady performance over flash. It’s not a high-growth play, and it’s not trying to be. Instead, it’s a well-run regional bank with a history of disciplined lending, careful expansion, and a commitment to returning value to shareholders.

The stock has climbed steadily over the past year, and it still trades at a valuation that suggests there’s room for continued upside when you factor in the dividend. Management has shown a deep understanding of the markets they serve and a steady hand in navigating both growth and risk.

While there are always challenges—from internal controls to regional concentration—the overall picture remains stable. The fundamentals are solid, the leadership is experienced, and the focus on long-term stability remains front and center. For those looking for a grounded, reliable financial name, Eagle Bancorp Montana continues to stand out in a quiet but meaningful way.