Key Takeaways

📈 Dividend yield sits at 1.42% with steady annual growth and a low payout ratio of 35.95%, leaving room for future increases.

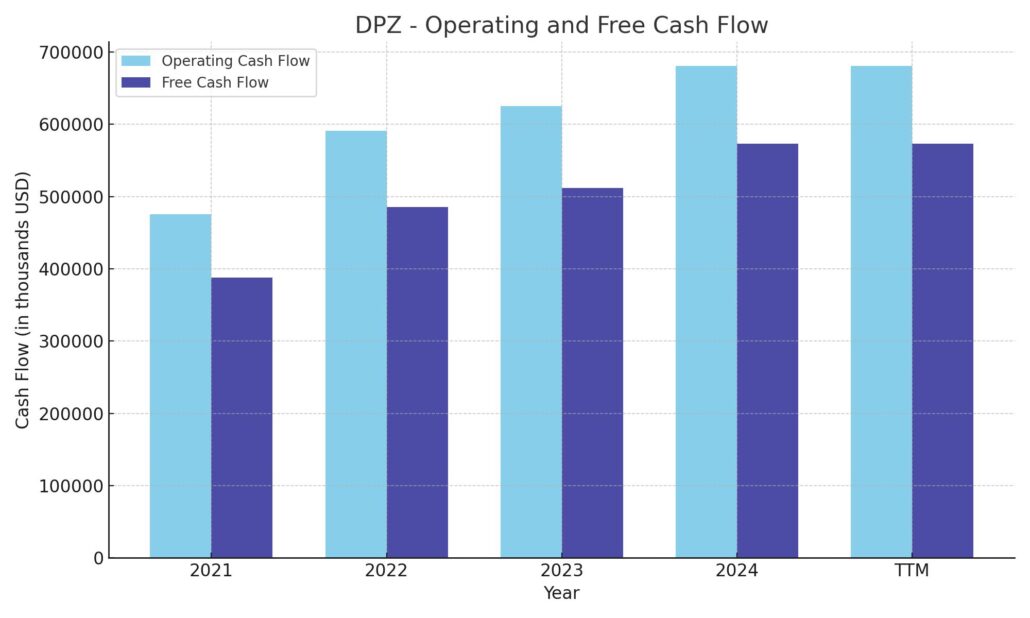

💰 Free cash flow reached $573 million in the trailing twelve months, comfortably covering dividends and supporting ongoing share buybacks.

🧐 Analyst sentiment is cautiously optimistic with a consensus price target of $498.50; recent upgrades reflect confidence in product strategy and delivery partnerships.

📊 Q1 earnings beat expectations on profit, with international growth offsetting a slight U.S. sales decline; management remains confident in full-year guidance.

Last Update: 5/1/25

Domino’s Pizza (DPZ) continues to build long-term value through consistent execution, efficient capital allocation, and disciplined growth. With over 20,000 stores globally and a heavily franchised model, the company generates strong free cash flow and maintains high returns on assets. Recent initiatives like the DoorDash partnership and new product launches reflect a focus on expanding reach while adapting to shifting consumer behavior. While U.S. same-store sales dipped slightly in the latest quarter, international performance remained solid, and management reaffirmed its full-year growth targets. Backed by a stable dividend, steady buybacks, and a seasoned leadership team, Domino’s remains focused on operational performance and shareholder returns.

Recent Events

The past few quarters have been steady for Domino’s. The company isn’t blowing the doors off in terms of revenue growth, but it’s quietly putting up strong earnings numbers. Most recently, earnings jumped over 21% year-over-year, while revenue nudged up just above 3%. That kind of bottom-line strength tells you Domino’s knows how to control costs and keep margins healthy—even when inflation or supply chain disruptions come knocking.

Tech continues to be a major part of the strategy. Domino’s has leaned into digital ordering, GPS tracking, and delivery optimization, all of which keep it ahead of the curve in a fiercely competitive space. Add to that its recent partnership expansions with third-party delivery platforms, and you’ve got a business adapting well to a shifting consumer landscape.

Shares have climbed back from a 52-week low near $396 to hover around the $490 mark. Even with macro pressure, Domino’s has found a way to stay relevant and deliver results. The only real shadow on the balance sheet is the debt load, which stands at over $5.3 billion. With a current ratio of 0.60, liquidity isn’t ideal. But Domino’s has a knack for managing this structure, and its capital-light franchising approach gives it room to maneuver.

Key Dividend Metrics

🍕 Forward Dividend Yield: 1.42%

💵 Forward Dividend Rate: $6.96

📈 5-Year Average Yield: 1.06%

🔁 Dividend Growth (TTM): Up from $6.27

🧮 Payout Ratio: 35.95%

📆 Next Ex-Dividend Date: June 13, 2025

💰 Last Dividend Payment: March 28, 2025

Dividend Overview

Let’s get this out of the way: Domino’s isn’t yielding 4 or 5 percent. The forward yield sits at 1.42%, which isn’t huge by traditional dividend standards. But this isn’t a stock you chase for income alone—it’s about the quality and consistency behind those payouts.

What’s impressive is how the dividend has grown. It was $6.27 last year and has now been bumped up to $6.96. That kind of steady, upward movement is what long-term investors like to see. The payout ratio is conservative too—just under 36%. That means Domino’s isn’t stretching itself to fund these distributions. There’s plenty of room left over to handle debt, reinvest in the business, or continue growing the dividend over time.

The company’s free cash flow situation backs this up. With nearly $474 million in levered free cash flow over the trailing twelve months, there’s a solid cushion beneath the payout. The dividend doesn’t feel forced. It feels intentional, and more importantly, sustainable.

Dividend Growth and Safety

Growth has been the name of the game since Domino’s initiated its dividend in 2013. Every single year since then, the company has raised the payout. That’s the kind of track record that doesn’t come by accident. It’s the result of a business model built for stability and a leadership team that sticks to its capital return playbook.

The heavy franchising model plays a huge role here. With minimal company-owned stores, Domino’s keeps costs down and margins high. Return on assets sits above 30%, and operating margins remain healthy. All of this feeds into a robust cash flow engine that can comfortably fund dividend increases.

Debt does sit high on the balance sheet, and some might raise an eyebrow at a book value per share of negative $112.88. But context is key. Domino’s uses leverage as part of a calculated financial strategy—it’s not recklessly piling on obligations. The company has consistently managed its debt in line with its cash generation, and as long as those free cash flows keep rolling in, there’s little reason to worry.

Most importantly, the dividend is covered. Not just by earnings, but by actual cash. That’s what matters for long-term investors looking to avoid surprises. And with quarterly payments that line up well across the calendar, Domino’s delivers consistency both in product and in payouts.

Domino’s won’t be the highest yielder in your portfolio, but it might end up being one of the most consistent contributors over time. For those who value reliable growth and a management team that knows how to balance ambition with discipline, this pizza chain offers more than just a meal—it offers a steady stream of income with room to rise.

Cash Flow Statement

Domino’s continues to demonstrate strong and stable cash generation. Over the trailing twelve months (TTM), the company produced $680 million in operating cash flow, marking its highest result in the past five years and reflecting the durability of its franchised model. After capital expenditures of $107 million, Domino’s free cash flow reached $573 million—again, its strongest figure in that stretch. This healthy cash flow positions the company well to support ongoing dividends, manage debt obligations, and pursue strategic investments without needing to stretch the balance sheet.

Financing activities remain heavily tilted toward shareholder returns. Over the TTM period, Domino’s spent $354 million on share repurchases while limiting debt repayments to just under $5 million. The combination of aggressive buybacks and minimal new debt issuance signals confidence in long-term cash flow strength. Cash from investing activities was modestly negative, a positive sign suggesting restraint and efficiency. As a result, Domino’s ended the period with a growing cash position of $575 million, giving it financial flexibility while still maintaining its capital return commitments.

Analyst Ratings

Domino’s Pizza (DPZ) has been in the spotlight following its latest quarterly earnings, and analysts have responded with a mix of optimism and caution. While U.S. same-store sales showed a slight decline of 0.5%, the international business delivered a more upbeat tone with a 3.7% gain. That split performance has fueled a range of reactions from the analyst community.

📈 Bank of America kept its Buy rating and nudged the price target upward from $520 to $549. Their outlook is driven by faith in Domino’s growth strategy—especially moves like the partnership with DoorDash and the ongoing rollout of menu innovations like stuffed crust offerings. RBC Capital is also in the bullish camp, lifting its target from $500 to $550, pointing to solid international traction and the potential for a stronger second half in the U.S. market.

📉 On the other hand, Barclays took a more cautious stance, trimming its target from $425 to $420 and maintaining an Underweight rating. They expressed skepticism around the company’s ability to hit its full-year guidance and voiced concerns that the domestic business may be approaching saturation.

💰 Across the board, the average price target among analysts currently sits around $498.50. Price targets range from a low of $420 to a high of $612, signaling a generally positive, if slightly reserved, consensus about Domino’s future upside.

Earning Report Summary

Domino’s just wrapped up its first quarter of 2025, and the results were a little mixed—but not without some bright spots. The company reported earnings per share of $4.33, which beat expectations. Revenue, on the other hand, landed at $1.11 billion, just a hair below what analysts were looking for. Still, the focus from leadership was less about hitting every number and more about the bigger picture.

U.S. Sales See a Slight Dip

On the domestic front, same-store sales in the U.S. slipped by 0.5%. It’s not a huge drop, but it was noticeable. The takeaway from the company’s side? They’re well aware of the macro pressures that are affecting consumer habits, from inflation to shifting dining preferences. That said, leadership emphasized that Domino’s is still gaining market share, which is no small feat in a competitive food space.

CEO Russell Weiner pointed to product innovation as a key driver, calling out the recent launch of the Parmesan Stuffed Crust Pizza as one of their most impactful additions. It’s part of a bigger push to keep the menu fresh and interesting. And there’s more on the horizon, including a major expansion in delivery options.

International Growth and a Big Move with DoorDash

Internationally, it was a much different story. Same-store sales outside the U.S. rose 3.7% (excluding currency shifts), showing that the brand still has strong momentum abroad. Domino’s has been making steady inroads in various global markets, and that traction seems to be paying off.

One of the more anticipated changes coming soon is the rollout of their DoorDash partnership. Starting in May, customers will be able to order Domino’s through the DoorDash app, which opens up a new delivery channel and introduces the brand to potential new customers who might not have otherwise used Domino’s own platforms. It’s a pretty strategic play, especially given how competitive the delivery space has become.

Looking Ahead with Confidence

CFO Sandeep Reddy gave some color on the company’s financial outlook, mentioning that income from operations grew by 1.4%, and would have been higher if not for one-time severance costs. He stood by the company’s full-year guidance, expecting 3% U.S. same-store sales growth and forecasting stronger performance in the back half of the year.

There’s also a lot of attention on expansion. Domino’s plans to open around 175 new U.S. stores in 2025. That’s a clear sign they’re not hitting the brakes on growth anytime soon, despite rising costs and economic uncertainty. They’re keeping their foot on the gas and betting on long-term demand staying strong.

All in all, while Q1 wasn’t a slam dunk across every metric, Domino’s continues to show it knows how to navigate challenges while staying focused on innovation and growth.

Chart Analysis

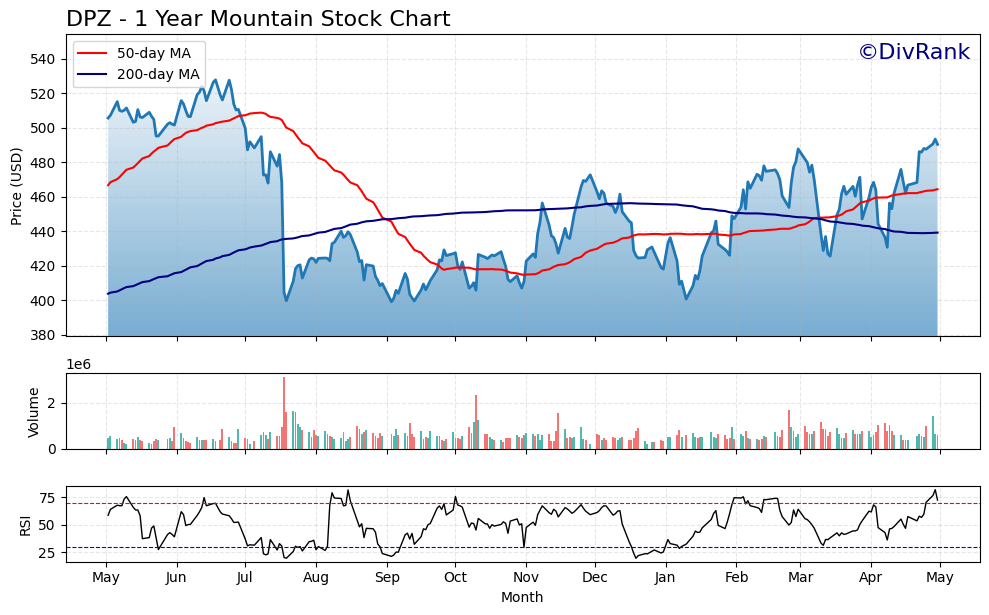

Price Action and Moving Averages

DPZ has put together a strong recovery over the past few months. After peaking early last summer above $520, the stock saw a sharp decline, bottoming around $400 in late July. That drop cut through the 50-day moving average, and for several months, the price stayed below both the 50-day and 200-day averages. It was a sluggish stretch through much of the fall, with lower highs and lower lows that reflected cautious sentiment.

But something shifted in early 2024. The price began carving out a series of higher lows, and by March, it crossed back above the 50-day moving average with conviction. It’s now trading comfortably above both the 50-day (red line) and 200-day (blue line) moving averages—a sign of positive momentum. What’s encouraging is how the 50-day average is now curling upward, hinting that the trend may be turning back in the stock’s favor.

Volume and Participation

Volume has been relatively stable throughout the year, but a few spikes—especially around earnings releases and breakout points—stand out. The recent move higher in April was accompanied by a slight pickup in volume, suggesting some renewed interest from larger market participants. That’s often a sign that the move isn’t just noise; there’s some conviction behind it.

Relative Strength Index (RSI)

The RSI, sitting just above 70, has entered overbought territory. That doesn’t mean a reversal is imminent, but it does suggest that the stock may be due for a pause or slight pullback in the near term. Previous trips into this zone have often led to short-term consolidation rather than sharp declines, especially when supported by improving price structure.

Overall Takeaway

DPZ has transitioned from a downtrend into a healthier, more constructive chart setup. The recent crossover of the 50-day moving average above the 200-day (a golden cross) and a stair-step pattern of higher lows show a technical environment that favors continuation rather than breakdown. It’s been a patient turnaround, but the last few weeks of price action support the case for strength building under the surface.

Management Team

Domino’s has built its success on more than just a popular product—it’s the people steering the ship that have kept the business moving forward through both opportunity and adversity. Russell Weiner, who stepped into the CEO role in 2022, brings continuity and insight from his prior position as COO and President of Domino’s U.S. business. He knows the brand inside and out and has long been a champion of the company’s strategic evolution, from fortressing its store footprint to embracing a tech-driven delivery model.

Under his leadership, the company has sharpened its focus on improving customer access, operational efficiency, and menu innovation. He’s been clear about Domino’s long-term vision, especially when it comes to growing digital ordering channels and partnering with third-party platforms like DoorDash without compromising the company’s identity. CFO Sandeep Reddy also plays a crucial role, particularly in maintaining capital discipline. With prior experience at Guess and Six Flags, he’s taken a pragmatic approach to debt management and shareholder returns, including maintaining a well-covered dividend and a consistent stock buyback program.

Overall, the management team balances tradition and innovation well. They continue to prioritize franchisee relationships and store-level economics, which has been key to the company’s long-term franchise growth. It’s a team that doesn’t chase headlines but steadily works on building shareholder value over time.

Valuation and Stock Performance

DPZ has been on a bit of a ride over the past year, trading in a wide range between roughly 396 and 538. The stock hit its lows in late summer 2024 before grinding its way back to the higher end of that range in the first quarter of 2025. At around 490, it’s now comfortably above both the 50- and 200-day moving averages, which signals renewed investor interest and improved technical momentum.

Looking at valuation, Domino’s trades at a trailing P/E of around 28 and a forward P/E near 28.4. While that might look rich at first glance, context matters. This is a company with a proven, capital-light model, strong brand equity, and resilient earnings. Compared to its QSR peers, Domino’s sits in the middle-to-upper range in terms of multiples, but the consistency of its cash flows and ability to return capital justify the premium. Its price-to-sales ratio sits around 3.6, while the enterprise value to EBITDA ratio is just under 21. These figures aren’t bargain-basement, but they reflect a business with stable fundamentals and modest top-line growth.

The stock also boasts strong return metrics. Return on assets is over 30 percent, which is unusually high for a company in this space. That speaks to just how efficient the business is, thanks in part to its franchise-heavy structure and low capital intensity.

Institutional ownership is strong, with nearly 96.5 percent of the float held by large investors, while insider ownership remains around 7.4 percent. That combination signals a balance of long-term oversight and internal alignment. Even with some volatility, the stock has a tendency to bounce back quickly when investor confidence improves.

Risks and Considerations

As with any company, Domino’s isn’t without its risks. One of the more pressing concerns is its balance sheet. With 5.3 billion in total debt and no reported equity, the company’s capital structure is highly leveraged. While management has managed that debt effectively so far, any major disruption in cash flows could put pressure on its flexibility.

Labor costs and food inflation also remain ongoing challenges. While the company’s scale helps mitigate some of the pressure, cost inputs have a direct impact on franchisee profitability, and any sustained squeeze on margins could weigh on store expansion plans. Delivery dynamics are also evolving. While Domino’s has historically resisted partnering with aggregators, its recent pivot toward DoorDash reflects the competitive need to meet consumers where they are. Execution will be key, as margins are thinner on third-party orders.

Another consideration is saturation in the U.S. market. Domino’s has been aggressively fortressing key metro areas, which improves delivery times and operational efficiency, but it can also lead to cannibalization if not managed carefully. International markets offer runway for growth, but they come with their own set of political and economic risks that could impact performance abroad.

And finally, valuation itself is a double-edged sword. At nearly 28 times forward earnings, expectations are baked in. Any earnings miss or slowdown in same-store sales could lead to multiple compression. Investors will want to monitor whether the recent performance improvement is sustainable or just a bounce from last year’s low base.

Final Thoughts

Domino’s Pizza has quietly carved out a place as one of the most resilient and disciplined names in the restaurant space. The company’s commitment to operational excellence, digital innovation, and shareholder returns has helped it weather economic cycles and shifting consumer behavior. It’s a name that doesn’t rely on hype but instead builds long-term value through consistency and strategic clarity.

The dividend isn’t flashy, but it’s reliable and growing. Management continues to return capital through both dividends and buybacks, supported by a free cash flow engine that remains strong even during tougher quarters. And while the company’s leverage is something to keep an eye on, it’s balanced by predictable revenue and an asset-light structure that makes its debt more manageable than it might appear at first glance.

From leadership to performance and capital allocation, Domino’s continues to operate with discipline. It’s not chasing growth for the sake of it, but it’s not standing still either. The next phase will be shaped by how well it executes on its tech partnerships, manages store growth, and adapts to a more competitive delivery landscape. If the past year is any indication, this is a company that knows how to navigate change without losing its core identity.