Key Takeaways

💰 DLB offers a 1.72% forward dividend yield with a history of consistent annual increases and a payout ratio under 46%, supported by strong free cash flow.

💵 The company generated $425.6 million in operating cash flow over the trailing twelve months, with free cash flow at $394.9 million and minimal capital expenditures.

📊 Analysts maintain a “Buy” consensus with a 12-month price target of $100, reflecting confidence in Dolby’s business model and future revenue growth.

📈 First-quarter earnings showed 13% year-over-year revenue growth, with licensing revenue up and leadership highlighting strong adoption across devices and platforms.

Last Update: 5/1/25

Dolby Laboratories doesn’t often make headlines, but for investors focused on building reliable, income-generating portfolios, it deserves a closer look. With deep roots in audio innovation and a business model that relies on high-margin licensing, Dolby has built a foundation that supports steady cash flows and shareholder returns—even if it doesn’t come with the drama of more volatile tech names.

Founded in 1965 and publicly traded since 2005, Dolby’s fingerprint is everywhere—from movie theaters to smartphones to streaming platforms. You’ve probably heard of Dolby Atmos or Dolby Vision, whether you realized it or not. Rather than selling products directly, Dolby licenses its technology to manufacturers and service providers, which translates into strong margins and consistent revenue.

This is the kind of business that can quietly reward patient investors. Let’s break down what’s been happening lately and what that means for dividend-focused portfolios.

Recent Events

Dolby recently posted its quarterly results, and while the numbers didn’t light the world on fire, they pointed to steady, dependable progress. Revenue rose 13% compared to last year, while earnings ticked up just over 1%. Not exciting? Maybe. But dependable? Absolutely.

The company remains in a very comfortable financial position. It’s sitting on more than $520 million in cash, with just $44 million in debt. That’s a net cash position most companies would envy, and it puts Dolby in an excellent spot to weather any turbulence, invest in R&D, or return more to shareholders.

Interestingly, Dolby is set to report earnings again after the bell today. Shares were already showing some life pre-market, up more than 4%, which suggests the market might be expecting solid guidance or progress in key areas like streaming, spatial audio, or device adoption.

Key Dividend Metrics

📈 Forward Dividend Yield: 1.72%

💵 Annual Dividend Rate: $1.32

🧮 Payout Ratio: 45.56%

📅 Most Recent Ex-Dividend Date: February 11, 2025

📊 5-Year Average Dividend Yield: 1.27%

📆 Next Dividend Payment Date: February 19, 2025

Dividend Overview

Dolby isn’t known for eye-popping yield, and that’s just fine. The dividend sits comfortably at a 1.72% forward yield. That’s modest, sure—but it’s stable, sustainable, and growing. And when you look under the hood, there’s a lot to like.

Over the past year, Dolby generated over $425 million in operating cash flow and nearly $300 million in levered free cash flow. That gives the company more than enough firepower to support its current dividend and keep increasing it without blinking.

The dividend itself has been inching upward for several years now. It’s not flashy, but it’s consistent. For long-term investors, those quiet, steady raises often work out better than chasing high yield and risking cuts. Dolby doesn’t chase yield to impress anyone—it just keeps delivering.

And the payout ratio, sitting under 46%, tells the same story: Dolby is paying what it can afford, not stretching itself thin. That kind of discipline is refreshing, especially in a market where companies sometimes overcommit to buybacks or dividends just to keep investors happy in the short term.

Dividend Growth and Safety

Dolby’s dividend growth history may not earn it a spot among elite dividend royalty, but it’s been moving in the right direction every year. Over the past five years, the average yield has hovered around 1.27%, so today’s 1.72% looks pretty attractive in comparison. That recent bump isn’t from a dividend increase alone—it also reflects some weakness in the share price, which might be an opportunity for investors looking to lock in a higher yield.

What really stands out, though, is how safe that dividend is. Dolby has nearly $9 per share in net cash and a current ratio close to 3. Debt is a non-issue here. This gives the company serious flexibility. It can raise the dividend, buy back shares, invest in new technologies, or make acquisitions without skipping a beat.

Add to that a beta of just 0.94, and you’ve got a stock that tends to be less volatile than the broader market. For income-focused investors, that means you’re less likely to get whipsawed while collecting those quarterly checks.

Dolby’s management team has shown it understands the long game. It reinvests where it needs to and returns excess cash where it makes sense. That balance is what keeps the dividend growing—and what keeps investors sleeping soundly at night.

While the current yield won’t dazzle, it fits a certain type of investor perfectly: someone who values consistency, safety, and long-term compounding. Dolby is a quiet operator with a strong core business, and its dividend is a reflection of that.

It might not be the loudest voice in the room, but in the world of dividends, sometimes that’s exactly what you want.

Cash Flow Statement

Dolby Laboratories has generated strong operating cash flow over the trailing twelve months, bringing in $425.6 million. This is a meaningful increase compared to the prior fiscal year’s $327.3 million and indicates steady top-line growth translating well into cash earnings. The company’s free cash flow came in at $394.9 million, demonstrating its ability to turn a high percentage of its operating income into cash that can be deployed back to shareholders or reinvested in the business. Capital expenditures remained relatively low at just under $31 million, showing disciplined spending on physical assets.

On the investing side, Dolby recorded a cash outflow of $295.1 million TTM, mostly in line with the previous year. Financing cash flow was also negative at $220.2 million, largely driven by share repurchases totaling nearly $132 million. Dolby has not taken on or repaid any debt, staying consistent with its strategy of maintaining a clean balance sheet. As a result of this cash flow discipline, the company ended the period with $619 million in cash, up from $578 million the year before. Despite significant shareholder returns, Dolby continues to operate from a position of financial strength.

Analyst Ratings

📈 Dolby Laboratories (DLB) has recently caught a fresh wave of optimism from analysts. Barrington Research reiterated its “Outperform” stance earlier this year, accompanied by a price target of $100. Not long after, Rosenblatt Securities also kept its “Buy” rating intact, echoing the same $100 price target. These calls underscore a growing consensus that Dolby is navigating its market with steady hands, thanks to its dominant position in premium audio-visual technologies.

💬 The average analyst consensus comes in at a solid “Buy,” with the 12-month price target holding steady around the $100 mark. That suggests nearly 30% upside from where shares are currently trading. What’s driving this confidence? A few things stand out. First, Dolby’s licensing business continues to generate high-margin recurring revenue, offering stability even during broader tech volatility. Second, adoption of its technology in streaming, cinema, and consumer electronics remains on an upward trend.

🔍 Analysts are also pointing to the company’s exceptionally clean balance sheet and disciplined capital allocation as reasons for the favorable outlook. With consistent free cash flow and minimal debt, Dolby has room to invest in innovation while rewarding shareholders. The upgrades and reaffirmations seem to reflect more than just short-term sentiment—they signal long-term belief in the brand’s place at the intersection of entertainment and technology.

Earning Report Summary

Strong Start to Fiscal 2025

Dolby Laboratories kicked off fiscal 2025 with a solid performance, showing that its core business continues to gain traction across multiple sectors. For the first quarter, revenue climbed to $357 million, up 13% from the same time last year. That growth was mostly driven by steady demand in its licensing business, which brought in $330 million—about a 12.5% increase. Meanwhile, revenue from products and services rose 22%, coming in at just over $26 million.

On the bottom line, Dolby reported GAAP net income of $68 million, or 70 cents per share. Adjusted earnings came in at $1.14 per share, which was up 13% year-over-year. That level of growth, while not explosive, shows consistency and strong execution in a competitive space.

Comments from Leadership

CEO Kevin Yeaman emphasized the growing adoption of Dolby Atmos and Dolby Vision across a wide range of devices and platforms. At CES, several major brands like Samsung, Amazon, Hisense, and TCL unveiled new Dolby-enabled TVs and soundbars. Even in the auto space, Dolby’s footprint is expanding, with more than 60 car models from 20 different automakers now featuring Dolby Atmos. Mercedes-Benz alone is offering Atmos in over 15 of its models.

The cinema market also remains a stronghold. According to the company, over 80% of the domestic box office revenue this year came from movies released in Dolby formats, and globally that figure was close to 70%. It’s clear that studios and filmmakers are sticking with Dolby’s premium experience.

Outlook and Guidance

Looking ahead to the second quarter, Dolby expects revenue to come in between $355 million and $385 million. Licensing revenue is projected to be in the $330 to $360 million range. The company anticipates gross margins of around 89% on a GAAP basis and 91% on a non-GAAP basis, showing just how profitable their licensing model can be. Operating expenses are expected to stay controlled, ranging between $230 and $240 million GAAP.

For the full fiscal year, Dolby sees total revenue landing somewhere between $1.33 billion and $1.39 billion. Licensing will likely make up the bulk of that, forecasted at $1.22 to $1.28 billion. Diluted earnings per share are projected to range from $2.39 to $2.54 on a GAAP basis and $3.99 to $4.14 non-GAAP.

Capital Return

The company continues to return capital to shareholders in a measured way. Dolby declared a dividend of 33 cents per share for both Class A and Class B shares, payable in mid-February. It also bought back around 186,000 shares during the quarter, spending about $15 million. There’s still $387 million left under the current repurchase plan, giving Dolby flexibility to keep rewarding shareholders while investing in growth.

Chart Analysis

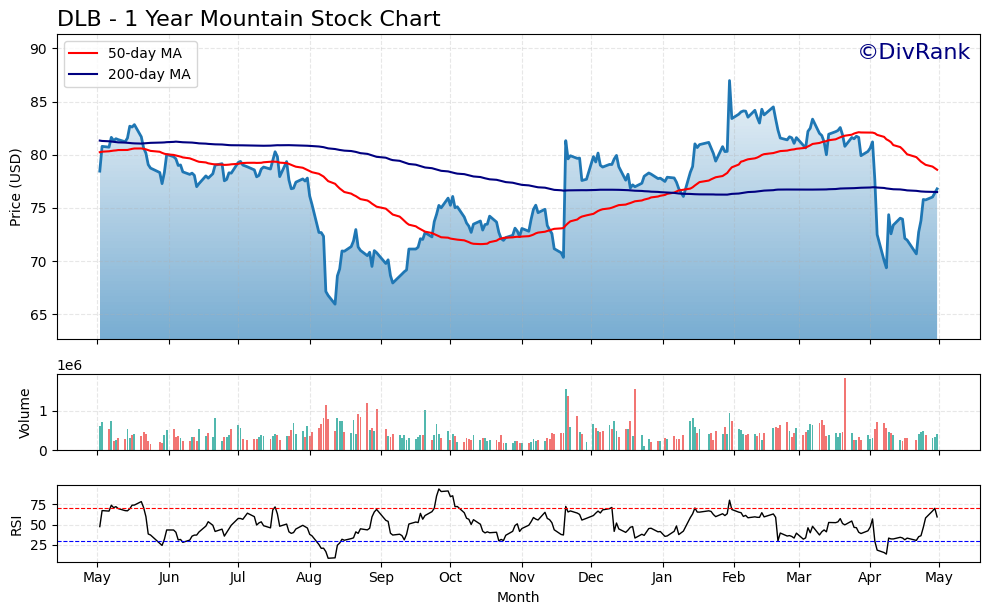

Price Movement and Moving Averages

DLB has spent the past year bouncing between roughly $66 and $89, with a fairly clear shift in momentum midway through the chart. From May through late October, the price trended lower and consistently stayed under both the 50-day and 200-day moving averages. That stretch suggested pressure from sellers, with the 50-day moving average acting as resistance throughout much of the summer.

By early November, though, the tone changed. The stock crossed back above both moving averages and held that level through the first quarter of the following year. The 50-day average even moved above the 200-day briefly, which typically signals a healthier technical setup. However, that strength began to unwind in March, as the stock dipped back below both moving averages, and the 50-day rolled over once again.

What stands out now is the sharp recovery in the final days of April. DLB rallied back toward the $77 mark and is testing the underside of the 200-day average. Whether it can push through and sustain that level will be something to watch in the weeks ahead.

Volume and RSI

Volume has remained fairly consistent, though a few spikes pop up around major moves, especially during early November and mid-April. These bursts often hint at institutional interest or reaction to earnings and guidance.

Looking at the RSI, the stock dipped below the 30 line (oversold) a few times, particularly in late August and mid-April. Each time, it reversed direction shortly after. As of now, the RSI is sitting just under 70, which is the edge of overbought territory. This suggests the stock has seen a strong short-term rebound but may need to consolidate before extending higher.

General Takeaway

The recent bounce and recovery from April lows is encouraging, especially with volume supporting the move. But there’s still work to be done technically. A break above the 200-day moving average and follow-through with steady volume could open the door for a more extended uptrend. Until then, the stock remains in a neutral zone, showing signs of stabilization but not yet in full control by buyers.

Management Team

Dolby Laboratories is led by a steady, experienced leadership group that has maintained a clear and focused strategy over the years. Kevin Yeaman, who has been CEO since 2009, has overseen the company’s transformation from a theater-focused audio company to a broader player across home entertainment, streaming, and automotive. Under his direction, Dolby hasn’t tried to be everything to everyone—it has doubled down on immersive sound and visual technologies and expanded that footprint gradually but deliberately.

The executive bench brings solid industry expertise, especially in areas like licensing, R&D, and intellectual property. This is critical, since the heart of Dolby’s model lies in monetizing its technology through partnerships and agreements rather than selling hardware. They’ve struck a balance between reinvesting in innovation and returning cash to shareholders, without chasing flashy acquisitions or taking on unnecessary risk.

Dolby’s management has also proven its ability to execute during different economic environments. Strong margins, stable revenue, and almost no debt show the kind of operational consistency that doesn’t depend on market cycles. The team’s discipline is apparent in how it manages expenses and pursues growth that’s durable rather than speculative.

Valuation and Stock Performance

From a valuation standpoint, Dolby trades at a forward price-to-earnings ratio in the high teens, which reflects expectations for modest but stable earnings growth. Its price-to-sales multiple sits around 5.7, which is not unusual for companies with high-margin licensing businesses and strong recurring revenue streams. While the stock isn’t cheap in a traditional sense, it doesn’t carry the inflated multiples of high-flying growth names either.

Looking back at the stock’s performance over the past year, it’s been relatively range-bound. Shares have moved between roughly 66 and 89 dollars, rarely breaking out in either direction. What stands out is its resilience. Even during periods of market volatility, the stock has bounced back quickly after dips. The recent recovery in April after a steep drop is a good example of how DLB tends to rebound when sentiment shifts.

Dolby’s market cap is backed by a solid financial base. It has over half a billion dollars in cash and virtually no debt. That gives the company flexibility, not just to weather any near-term bumps, but to opportunistically return capital or invest further in innovation. Share buybacks have continued steadily, with 15 million dollars spent last quarter and over 380 million dollars still authorized.

That approach, paired with a modest dividend, speaks to a company that rewards shareholders thoughtfully without overextending itself. Dolby may not deliver massive short-term returns, but it offers a measured, long-term story built on consistency and underlying financial strength.

Risks and Considerations

While Dolby’s business model offers attractive margins, it’s not without its sensitivities. The company depends heavily on the success and adoption rates of partner devices—TVs, smartphones, sound systems, and more. If hardware makers delay product launches or shift away from Dolby’s formats, revenue could take a hit. These risks tend to show up in short-term licensing fluctuations, even if the broader trend remains positive.

Another key area to watch is streaming. Dolby is well integrated into major platforms, but as more media companies invest in proprietary technologies or alternative delivery methods, Dolby could face competition for placement. Maintaining its edge means staying ahead with features like Dolby Vision and Atmos, which require ongoing R&D and collaboration with content creators.

The competitive field is always evolving. While Dolby is widely seen as a premium option, companies like DTS and emerging spatial audio technologies pose a challenge. It’s not just about audio quality—it’s also about licensing flexibility, cost, and ease of integration. Dolby’s reputation and ecosystem are strong, but staying at the forefront requires constant effort.

There’s also the international exposure to consider. A large part of Dolby’s business comes from overseas, including China and other emerging markets. That means the company isn’t immune to geopolitical tensions, trade regulations, or shifting intellectual property enforcement standards.

None of these risks are dealbreakers, but they do highlight the need for Dolby to continue executing well and adapting to shifts in how content is consumed and delivered.

Final Thoughts

Dolby Laboratories operates in a space where technology meets entertainment, and it’s managed to carve out a niche that has stood the test of time. The company has grown beyond its roots in cinema and now plays a meaningful role in how content is experienced across homes, cars, and mobile devices. It has done so without straying too far from its strengths.

The valuation reflects a balanced view—moderate growth expectations, supported by a steady stream of licensing revenue and healthy margins. It’s not priced like a hyper-growth name, but it also doesn’t behave like one. The stock tends to trade with less volatility than peers, and the financials suggest a company that’s more focused on stability than making headlines.

Leadership has kept a tight ship, steering the business with care and investing where it matters. Shareholder returns come through both dividends and buybacks, while the balance sheet stays clean. Even in a competitive and rapidly changing industry, Dolby has held its ground by sticking to what it does best.

It’s a story of consistency, not flash—a company that continues to deliver quietly in the background while the rest of the entertainment world races ahead in louder ways. Sometimes that kind of discipline turns out to be the most rewarding in the long run.