Key Takeaways

🌿 Dividend yield of 0.65% backed by steady long-term dividend growth and a safe 21.9% payout ratio.

💵 Healthy cash flow generation with $4.9 billion in free cash flow supporting dividends and reinvestment.

📊 Analysts remain largely positive (16 of 20 rate “Buy”), citing growth potential in bioprocessing and genomics.

📉 Q1 earnings dipped slightly amid softness in diagnostics and life sciences, but biotechnology showed strength.

👨💼 Experienced management led by CEO Rainer Blair emphasizes operational efficiency and disciplined capital allocation.

Updated 4/25/25

Danaher Corporation (DHR) operates at the intersection of life sciences, diagnostics, and biotechnology, backed by a consistent management team and a strong operational playbook. Over the past year, the stock has declined more than 20 percent, reflecting pressure in diagnostics and life sciences, though its bioprocessing segment has shown meaningful growth. The company continues to generate healthy free cash flow, maintain lean margins, and reinvest in long-term priorities like genomics. Trading at around 26 times forward earnings with a modest 0.65 percent dividend yield, Danaher offers a balanced profile of stability, innovation, and discipline.

Recent Events

The past year hasn’t been particularly kind to Danaher’s stock. Shares have fallen about 20% over the past 12 months, a stark contrast to the broader market’s positive movement. Investors have grown concerned about slowing growth in Danaher’s life sciences and diagnostics businesses, especially after the pandemic-driven boom faded.

Quarterly numbers reflected some of these pressures. Revenue ticked down by nearly 1% year-over-year, while earnings per share dropped by over 12%. Still, not everything in the report was gloomy. Danaher managed to hold its operating margin strong at 22.49%, and free cash flow stayed solid at $4.23 billion. These are not signs of a company in trouble — more like a business navigating a short-term headwind.

Danaher continues investing in high-growth areas like bioprocessing and genomics, positioning itself for future expansion. Its management team has a long history of allocating capital wisely, balancing growth investments with shareholder returns. That track record gives some confidence that today’s challenges are more of a pause than a fundamental shift.

Key Dividend Metrics

💵 Forward Annual Dividend Rate: $1.28

📈 Forward Dividend Yield: 0.65%

🛡️ Payout Ratio: 21.90%

📅 Dividend Date: April 25, 2025

📊 5-Year Average Dividend Yield: 0.37%

🏛️ Dividend Growth (Trailing 5 Years): Steady upward trend

Dividend Overview

Danaher has never been about offering a sky-high dividend yield. With a forward yield currently at 0.65%, it’s clear that the company prioritizes steady growth and preservation of capital over handing out large cash payments today. For dividend investors who focus more on safety and long-term wealth building, that’s not a bad thing.

The company’s payout ratio of 21.9% is comfortably low, suggesting plenty of room for future dividend increases even if earnings growth stays soft for a while. It also acts as a cushion during tougher times, ensuring that the dividend isn’t under threat when revenue growth slows.

Danaher’s next dividend payment is scheduled for April 25, 2025, following the ex-dividend date on March 28, 2025. Even in a tougher earnings environment, management has stuck to its practice of consistently growing the dividend. That consistency speaks volumes about the underlying health of the business.

Interestingly, today’s yield looks a bit more attractive than usual when you glance at history. Over the past five years, Danaher’s average dividend yield has been just 0.37%. Right now, with the stock price lower, investors are getting a little bit of a bonus compared to that long-term average.

Dividend Growth and Safety

Danaher’s dividend story is all about steady, reliable growth. Over the past five years, the company has methodically raised its payout, supported by strong cash flow and disciplined management. You won’t see flashy, massive increases year after year, but what you will find is a rhythm of dependable growth.

Cash flow is the real engine behind Danaher’s dividend. In the last twelve months, operating cash flow reached $6.25 billion, and after capital expenditures, free cash flow stood at $4.23 billion. That’s a healthy margin of safety covering dividend obligations and giving the company the flexibility to reinvest in the business or pursue smart acquisitions when opportunities arise.

On the balance sheet side, things look just as solid. Danaher carries about $17.58 billion in total debt, which sounds like a big number at first, but with a debt-to-equity ratio of just 34.56% and nearly $2 billion in cash on hand, the company has plenty of financial firepower. For dividend investors, that kind of balance sheet strength matters. It means the dividend isn’t just a promise based on hope — it’s backed by real financial health.

Another point worth mentioning is Danaher’s stability compared to the broader market. With a beta of 0.89, the stock tends to move less dramatically than many others, which fits nicely with a dividend-focused strategy looking for steady returns over the long haul.

Valuation-wise, Danaher trades at about 26 times forward earnings. It’s not bargain-bin cheap, but for a company with durable earnings power and a track record of navigating economic ups and downs, the valuation seems reasonable. You’re paying up for quality, consistency, and a dividend stream that has proven it can grow through thick and thin.

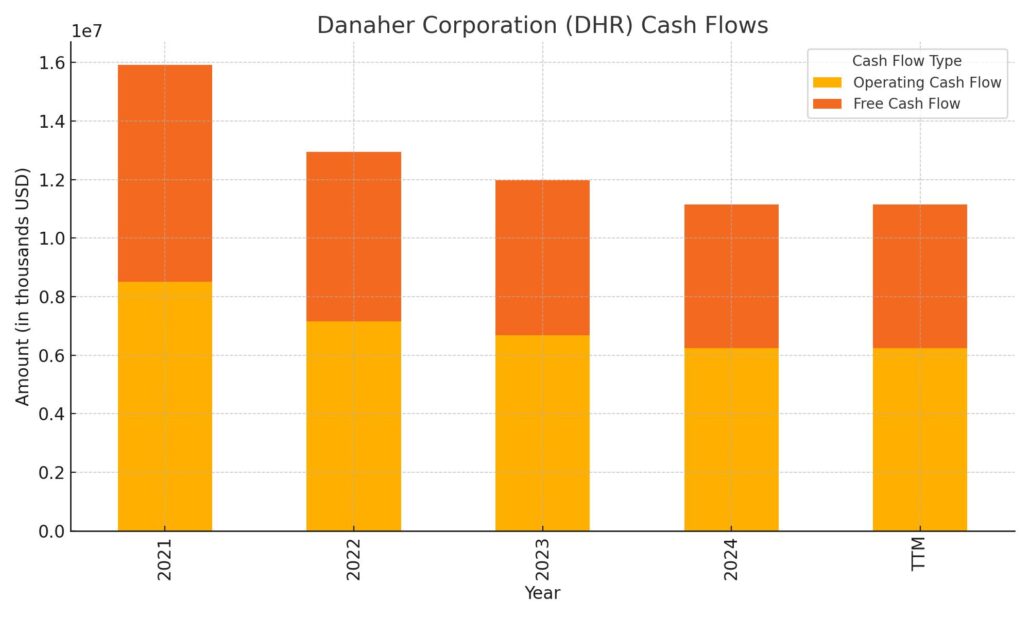

Cash Flow Statement

Danaher’s trailing twelve-month cash flow tells a story of a company leaning into operational strength while tightening its belt on spending. Operating cash flow came in at $6.25 billion, showing a decline from the previous years, though still a healthy number that more than covers the company’s capital needs. Free cash flow followed suit at $4.9 billion, reflecting the reduced operating income but still offering ample cushion for dividends, reinvestment, and debt service.

The company continued to invest in its business, with capital expenditures totaling $1.35 billion over the period. However, the most noticeable shift occurred in financing activities. Danaher spent over $9.5 billion here, driven primarily by aggressive stock buybacks totaling $7.05 billion and significant debt repayments. These moves signal a deliberate focus on returning capital to shareholders while managing leverage. The result of these actions was a noticeable drawdown in the company’s cash reserves, ending the period with $1.87 billion in cash — down from over $5.8 billion just two years prior.

Analyst Ratings

Danaher Corporation has seen a mix of analyst actions recently, reflecting cautious optimism amid evolving market conditions. 📈 Stifel Nicolaus upgraded the stock from “Hold” to “Buy,” setting a price target of $260. This upgrade was influenced by Danaher’s strategic initiatives in high-growth areas like bioprocessing and genomics, which are expected to drive future revenue streams. 📈 Similarly, Guggenheim reiterated a “Buy” rating with a $250 target, citing the company’s strong operational execution and robust cash flow generation.

📉 Conversely, some analysts have adjusted their outlooks downward. UBS Group lowered its price objective from $275 to $240, maintaining a “Buy” rating but reflecting concerns over near-term revenue pressures in the life sciences segment. 📉 Wells Fargo also reduced its target from $280 to $240, assigning an “Equal Weight” rating due to anticipated challenges in the diagnostics market.

🔍 Despite these varied perspectives, the consensus among analysts remains positive. Out of 20 analysts, 16 have issued a “Buy” rating, while 4 have recommended “Hold.” The average 12-month price target stands at $264.40, suggesting a potential upside of approximately 34.5% from the current trading price.

Earnings Report Summary

Danaher Corporation’s first quarter of 2025 showed a company that’s steadying itself through a changing market, keeping its focus sharp even with a few bumps along the way. Revenue came in at $5.74 billion, dipping slightly by about 1% compared to last year. Even with the small drop, the numbers beat Wall Street’s expectations. Earnings per share landed at $1.88, which was also a little softer than the previous year but still better than what analysts were bracing for.

Biotechnology Stands Out

One bright spot was the Biotechnology segment. It posted 6% revenue growth, with core sales climbing 7%. Demand stayed strong, especially for tools used in commercial therapies, an area that continues to see a lot of investment and excitement. Better yet, operating margins in this segment improved nicely, showing that Danaher’s earlier bets on efficiency and innovation are paying off.

Life Sciences and Diagnostics Face Challenges

Not every division had the same momentum, though. Life Sciences revenue slipped by about 3.5%, with core sales also down around 4%. Changes in foreign exchange rates and a softer market environment weighed on results. The Diagnostics segment had a similar story, seeing a 3.1% revenue drop. This was largely due to shifts in reimbursement policies and some procurement changes overseas, particularly in China.

Strong Cash Flow and Steady Margins

Even with a few cracks in the top-line numbers, Danaher continued to show financial strength where it counts. Gross margin came in at a healthy 61.2%, and while adjusted operating profit margin tightened a bit to 29.6%, the company made it clear that investments in productivity and innovation were the driving factors behind that slight squeeze. Operating cash flow reached $1.3 billion, and free cash flow came in strong at $1.06 billion, giving Danaher plenty of flexibility to invest in its future and return capital to shareholders.

Leadership Outlook

CEO Rainer Blair sounded upbeat about where the company is heading. He pointed to the strong results in Biotechnology and stressed how the Danaher Business System continues to help the company operate more effectively, even when market conditions get tricky. Looking ahead, leadership reaffirmed full-year guidance, aiming for about 3% core revenue growth and adjusted earnings per share between $7.60 and $7.75. The company expects low single-digit growth for the second quarter as well, signaling cautious but steady optimism.

All things considered, Danaher’s latest quarter shows a company that knows how to navigate a complex environment without losing sight of its long-term strategy.

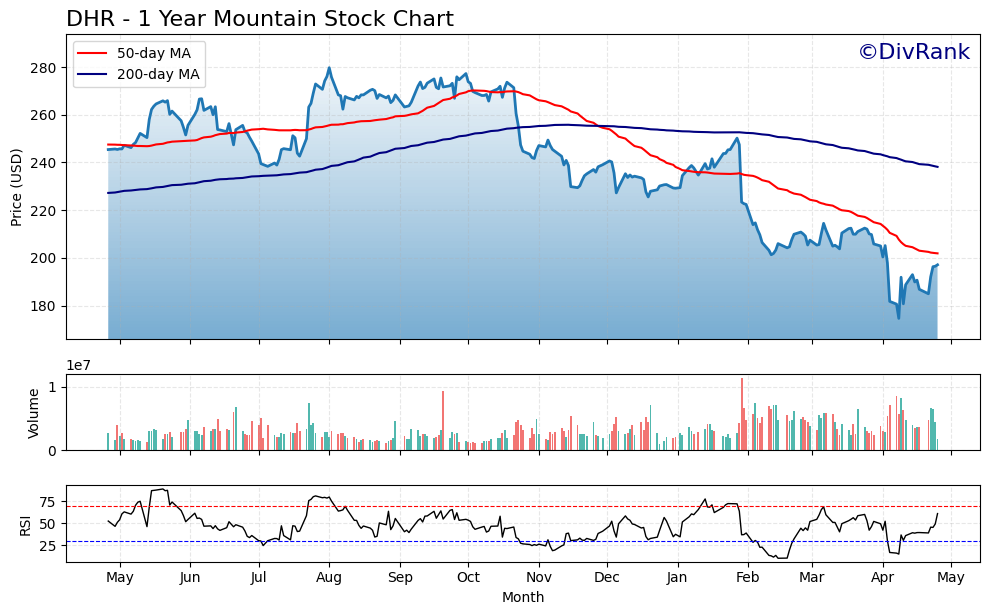

Chart Analysis

Overall Price Trend

DHR has been in a clear downtrend over the past year. After peaking around $280 last summer, the stock has steadily declined, now trading closer to the $190 range before a recent bounce. The 50-day moving average, shown in red, has consistently stayed below the 200-day moving average since early November, confirming the bearish momentum that’s been in play for several months.

This kind of pattern usually reflects broader selling pressure, and the long-term averages reinforce that the stock is still in a declining phase, although the latest uptick is worth noting. That bounce off the lows in April could indicate early signs of stabilization, but the moving averages haven’t started to flatten or reverse just yet.

Volume Behavior

Looking at the volume, there was a noticeable spike during sell-offs, especially in late January and early April. That kind of volume surge on down days typically suggests stronger conviction behind the selling. However, more recently, volume has begun to normalize even as the price has started to recover, a potential early indicator that the heavy liquidation phase may be behind us.

While there’s not yet clear accumulation behavior on volume alone, the reduction in high-volume red bars suggests that the worst of the panic selling could have passed.

RSI and Momentum

The RSI (Relative Strength Index) shows a compelling pattern. Throughout the downtrend, it repeatedly dipped near or below the 30 mark, entering oversold territory several times. Each time, the stock saw a short-term relief rally, but nothing sustained until very recently.

Over the last few weeks, RSI has pushed above the midline and is currently hovering near the 60 level, suggesting improving momentum. While it’s not yet in overbought territory, it’s a stronger reading than what we’ve seen in prior months and hints that buyers may be stepping back in with more consistency.

What Stands Out

What really stands out on this chart is how the stock seems to have found some footing around the $180 level, bouncing off it more than once. That level may now represent a short-term base. Combine that with a slowly rising RSI and decreasing downside volume, and it looks like sentiment is gradually shifting away from fear.

For those looking at the bigger picture, DHR still has some technical work to do before the longer-term trend can turn convincingly. The 50-day average needs to start curling higher, and ideally, we’d want to see the price reclaim the 200-day level to truly change the narrative. But for now, the worst of the pressure seems to be easing, and the recent chart behavior hints at some much-needed relief.

Management Team

Danaher’s leadership team has built a reputation for execution, discipline, and long-term vision. At the helm is Rainer Blair, who has served as President and CEO since 2020. Blair has been with the company for over a decade, rising through the ranks after leading various operating companies within Danaher. He’s known for his sharp operational focus and steady leadership style, especially during times of macro uncertainty.

Under Blair’s leadership, the company has continued to rely heavily on the Danaher Business System, a framework that emphasizes continuous improvement and lean operating principles. This approach isn’t just corporate jargon — it’s deeply embedded into how every part of the business operates, from the C-suite down to the factory floor. It’s also helped Danaher remain agile and profitable even when revenue growth stalls.

Beyond Blair, the executive team features a blend of operational veterans and innovation-driven leaders. Their collective experience across healthcare, diagnostics, and industrial technology gives Danaher a strong foundation as it continues to expand in high-growth sectors like bioprocessing and genomics. The company’s consistent track record of well-timed acquisitions and divestitures is a reflection of management’s ability to think long-term while executing in the near term.

Valuation and Stock Performance

DHR has had a bumpy ride over the past year. The stock is down more than 20 percent over the last 12 months, and it’s been trading well below its 200-day moving average for a good part of the year. That performance has lagged behind the broader market, which has posted modest gains during the same period. For some, that underperformance raises red flags. But for others, it starts to bring the valuation into a more reasonable zone.

Right now, Danaher is trading at around 26 times forward earnings. That’s not exactly cheap by traditional standards, but it’s notably lower than the 40-plus multiples it carried during periods of stronger growth. What investors are paying for today is a quality business with stable cash flow, a defensive profile, and a management team that has proven itself over time.

The company’s price-to-sales ratio sits just above 6, while its enterprise value to EBITDA is just under 22. These metrics, when compared to Danaher’s historical averages, suggest that the stock is closer to fair value than it has been in several years. Especially when considering its free cash flow generation — over 4.9 billion dollars in the trailing twelve months — the current valuation becomes easier to digest for investors focused on quality and durability.

Danaher also carries a relatively low beta of 0.89, which means the stock tends to be less volatile than the broader market. That kind of stability can be attractive for those looking for smoother returns in turbulent markets.

Risks and Considerations

While Danaher has a lot going for it, it’s not without risks. The company’s exposure to life sciences and diagnostics makes it sensitive to changes in government policy, healthcare reimbursement, and global research funding. Recent performance in those segments has shown just how quickly demand can shift when budgets tighten or regulatory landscapes evolve.

China is another potential pressure point. Like many multinationals, Danaher has significant exposure to Asia, and changes in procurement behavior and policy shifts in that region have already impacted the diagnostics business. Continued volatility or tightening regulation in key international markets could weigh on results moving forward.

Acquisition risk is another piece of the puzzle. Danaher has long used acquisitions as a growth lever, and while it’s generally been successful at integrating and creating value from those deals, there’s always the chance that future acquisitions don’t deliver the expected return or distract from the core operations.

There’s also the risk that the company could struggle to reignite top-line growth in a sustainable way. While cash flows and margins have remained strong, earnings growth has slowed recently, and revenue in the most recent quarter showed a slight decline. If growth doesn’t resume soon, the valuation may begin to look stretched, even if fundamentals remain strong.

On the dividend front, the yield is modest at just 0.65 percent. For investors seeking immediate income, Danaher might fall short. It’s more of a compounder than an income generator. That said, the low payout ratio provides flexibility for future dividend growth.

Final Thoughts

Danaher is the kind of company that tends to fly under the radar until you really dig into the details. Its stock may not be making headlines right now, but there’s a quiet strength to its business model that becomes clearer with time. Even during a tougher year marked by slowing growth and sector-specific headwinds, the company has continued to generate strong free cash flow, maintain healthy margins, and invest in long-term opportunities.

The leadership team remains focused and experienced, which shows in the consistency of execution. While some segments like diagnostics and life sciences have faced temporary slowdowns, other areas like biotechnology have picked up the slack. The business remains well-diversified, both geographically and across industries.

Valuation has come down to a level that many long-term investors might find attractive, especially when you consider the quality of earnings and management’s proven track record. Risks certainly exist — international exposure, sector volatility, and integration challenges among them — but they’re balanced by the company’s strengths in cash flow, efficiency, and long-term strategic thinking.

All in all, Danaher is a company that continues to do the quiet work of building value, whether the market is cheering it on or not. Its performance over the years has often spoken louder than any quarterly headline, and that’s a trait that never goes out of style.