Key Takeaways

📈 Dividend yield of 2.48% backed by 18 consecutive years of steady dividend growth.

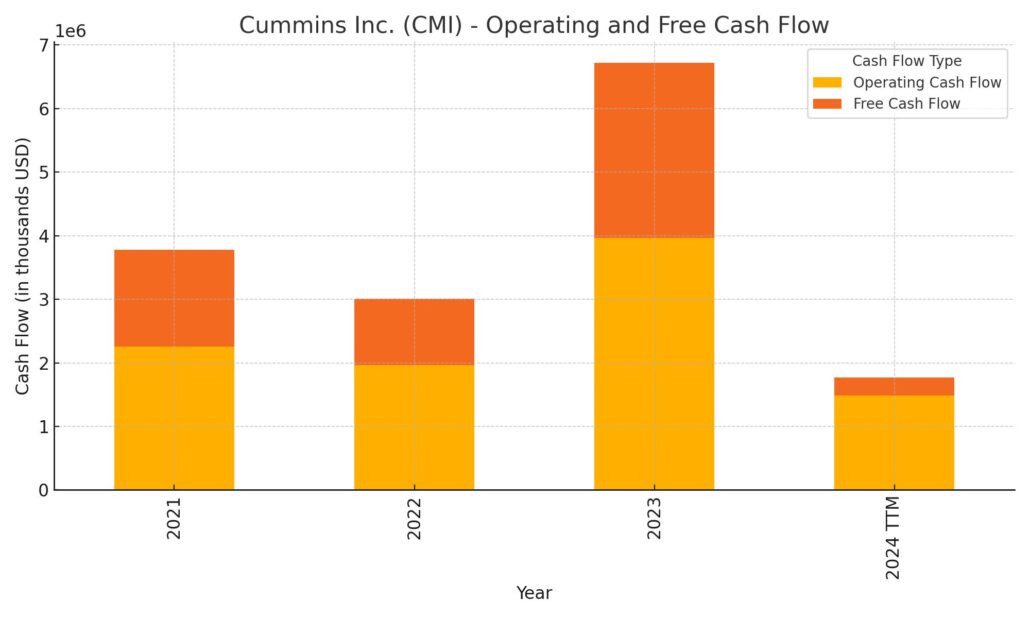

💰 Solid cash flow generation of $1.49 billion supports ongoing dividends despite recent declines.

📊 Analyst ratings have turned cautious, citing economic headwinds, but still indicate modest upside potential.

🗓️ Cummins reported robust earnings of $34.1 billion in revenue, navigating market softness with disciplined cost management.

👥 Experienced management under CEO Jennifer Rumsey focuses on core operations while strategically investing in clean energy.

Updated 4/25/25

Cummins Inc. (CMI) stands out for its consistent financial performance, disciplined management, and long track record of shareholder returns. With nearly two decades of uninterrupted dividend growth, the company continues to deliver income and long-term value. In 2024, Cummins reported $34.1 billion in revenue and $3.9 billion in net income, even as it navigated softer truck market demand and restructured parts of its clean energy division. The forward dividend yield sits at 2.48%, backed by a low payout ratio and strong cash flow.

Management, led by CEO Jennifer Rumsey, remains focused on balancing core engine operations with investments in low-emission technologies. While shares have pulled back from recent highs, the company’s fundamentals and valuation offer a grounded outlook supported by institutional confidence and a clear strategic direction.

Recent Events

Cummins Inc. has been quietly making moves this year, steering through a tricky economic backdrop without much drama. While a lot of companies have been tossed around by global slowdowns, Cummins kept its head down and did what it does best — delivering solid results.

Profit margins are holding strong at 11.6%, and the company is sitting on over $2.2 billion in cash. That strong cash position matters because it gives Cummins flexibility, whether the economy gets better or worse from here. Sure, revenue dipped a little, down 1.1% year-over-year, but given the broader industrial slowdown, it’s far from a reason to panic.

One thing to keep an eye on: valuation. The forward price-to-earnings ratio has moved up to about 14.4, higher than the trailing P/E of 10.4. That shift suggests that Wall Street is being a bit more cautious about future earnings. Again, not necessarily bad news — just a realistic adjustment for a company that has lived through its fair share of cycles.

Through all of it, Cummins kept the dividend checks coming. The latest payout in March kept its long track record intact, offering investors that sense of reliability that’s getting harder to find these days.

Key Dividend Metrics

📈 Forward Yield: 2.48%

💵 Forward Annual Dividend: $7.28 per share

🔁 5-Year Average Yield: 2.49%

🧮 Payout Ratio: 24.67%

📅 Last Dividend Paid: March 6, 2025

🔔 Ex-Dividend Date: February 21, 2025

🪙 Dividend Growth Streak: 18 years

Dividend Overview

If you’re an investor who values steady income, Cummins fits like a well-worn glove. The yield today sits at 2.48%, and over the last five years, the average yield has barely budged, holding around 2.49%. That tells you a lot: Cummins isn’t just a one-hit wonder. The market has consistently recognized its dividend strength without needing dramatic swings in valuation.

The real comfort comes from the payout ratio. At just about 25%, it leaves the company plenty of breathing room to keep growing the dividend or support it if earnings take a breather. There’s no stretch here, no signs of Cummins straining to meet its obligations. It’s the kind of discipline that quietly builds wealth over time.

Another little nugget worth mentioning: Cummins hasn’t split its stock since 2008. With the price hanging around the $290 mark, another split could eventually happen. While stock splits don’t affect dividends directly, they sometimes stir up fresh interest from individual investors. That could, down the road, help support valuations.

Dividend Growth and Safety

Cummins doesn’t just pay dividends — it grows them, year after year. For 18 straight years, through thick and thin, this company has increased its payout. That covers some pretty rough periods: the 2008 financial crash, the oil collapse, even the chaos of 2020. And yet, the dividend kept marching higher.

Looking at the numbers today, there’s good reason to expect that discipline to continue. EPS for the past twelve months came in at $28.37, while total dividends paid were just $7.00 per share. That’s a lot of cushion. It means even if earnings waver a bit, Cummins isn’t at risk of having to yank the dividend.

Debt is manageable too. Total debt clocks in at around $7.7 billion, and the company’s debt-to-equity ratio sits at about 68%. Not trivial, but absolutely reasonable for a heavy industrial business that deals in large equipment and major projects. Add to that the $2.2 billion in cash on hand, and the dividend looks well-supported from a balance sheet standpoint.

Some investors might raise an eyebrow at the negative levered free cash flow reported lately, sitting around -$79 million. But dig a little deeper and it becomes clear this was driven more by capital investments than a fundamental cash flow problem. Operating cash flow still topped $1.49 billion. This isn’t a case of a company burning cash to stay alive — it’s a company investing to stay competitive.

Lastly, you have to like the ownership profile. Over 86% of Cummins shares are held by institutions. That kind of ownership usually means management gets held to a high standard when it comes to protecting shareholder interests, including dividends. Cummins’ board and executives clearly know their investor base and understand the expectations that come with it.

Cash Flow Statement

Over the trailing twelve months, Cummins generated $1.49 billion in operating cash flow, a sharp drop from the nearly $4 billion it posted the year prior. The decline highlights the tighter margins and perhaps more cautious spending behavior seen across industrials in the current environment. Despite the drop, the company still managed to produce positive free cash flow of $279 million, which remains sufficient to support its dividend, though with less room than in previous years.

On the investing side, Cummins spent $1.78 billion, largely directed toward capital expenditures totaling $1.21 billion. These investments reflect a commitment to future growth, even amid near-term softness. Financing activities showed a net outflow of $173 million. The company issued $2.72 billion in debt but paid back $1.57 billion over the same period. Notably, there were no reported repurchases of capital stock this year. The end cash position decreased to $1.67 billion, down from over $2.1 billion the year before. It’s a slimmer margin, but the overall financial posture still appears measured and deliberate rather than reactive.

Analyst Ratings

Cummins Inc. has recently experienced a noticeable shift in analyst sentiment, with a few firms turning more cautious. 🛑 UBS downgraded the stock from a buy to a sell, slashing their price target from $400 to $240. This move was mainly driven by rising concerns over economic headwinds and the belief that Cummins’ current valuation might not fully reflect the potential slowdown in earnings growth.

Other firms have followed with adjustments of their own. 🏦 Morgan Stanley trimmed its price target from $425 to $340 but chose to stick with an overweight rating, signaling they still see longer-term value. JPMorgan also pulled back, lowering its target from $375 to $308, while Baird cut its view from $407 to $315, both maintaining neutral outlooks. These moves suggest that while Cummins remains fundamentally strong, analysts are dialing back their near-term expectations.

Not every voice in the room is cautious, though. 🚀 Evercore ISI boosted its price target to $451 from $408 and maintained an outperform rating, showing some analysts still have confidence in the company’s longer-term prospects. On balance, the average consensus price target for Cummins now sits around $346, hinting at modest upside potential from where the stock is trading today.

Earning Report Summary

Cummins closed out 2024 with a solid showing, even though it wasn’t all smooth sailing. The company reported fourth-quarter revenues of $8.4 billion and net income of $418 million, working out to $3.02 per diluted share. Those numbers came after absorbing a $312 million restructuring charge tied to its Accelera business, which focuses on zero-emissions technologies. When you strip out that one-time hit, adjusted earnings per share landed at $5.14, beating what many were expecting.

Full-Year Performance

For the full year, Cummins hit a new high with $34.1 billion in revenues. Net income for the year came in at $3.9 billion, translating to $28.37 per share. The company also pulled off a big move by completing the separation of Atmus Filtration Technologies, booking a tidy $1.3 billion gain from that transaction. Even with revenues mostly flat year-over-year, Cummins didn’t pull back on rewarding its shareholders. They bumped up the dividend for the fifteenth straight year and returned almost $1 billion through dividends and share repurchases.

Leadership’s Outlook

Jennifer Rumsey, Cummins’ CEO, had a straightforward message about where things are headed. She acknowledged that the North American truck market could see some softness, especially early in the year, but pointed to strength in other parts of the business that should help even things out. The forecast for 2025 calls for revenues to be somewhere between down 2% to up 3%, with EBITDA margins expected to land between 16.2% and 17.2%. In short, while the year might start with a few bumps, Cummins feels confident it can stay profitable and keep cash flowing steadily.

Chart Analysis

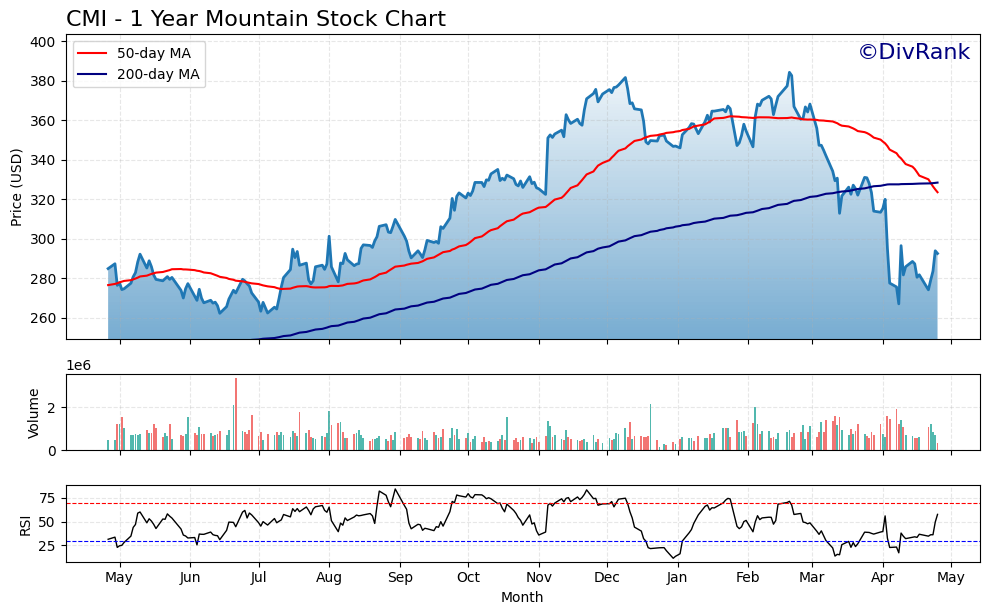

Price Trend and Moving Averages

CMI has had a volatile but clear story over the past year. From a gradual climb in the second half of last spring and through the fall, the price action shows a strong upward move that peaked near the start of the year. That rise was supported by the 50-day moving average (in red), which stayed well above the 200-day moving average (in blue) until just recently.

What’s more important now is the shift in trend. The 50-day MA has sharply turned lower and just crossed below the 200-day MA — a technical signal that often reflects a transition from strength to caution. The price dipped significantly in March and early April, bouncing off the lows but still sitting below both key moving averages. This pattern is often a sign of changing sentiment.

Volume and Momentum

Looking at volume, there isn’t a consistent surge tied to either the rise or fall, but there were a few spikes during sell-offs. That suggests more of a reactionary exit from positions rather than accumulation on weakness. The RSI, now recovering and approaching neutral territory near 50, indicates the stock was recently oversold, having dipped under 30 twice in March and early April. The recovery in RSI shows buyers are beginning to step back in.

Overall Market Behavior

Zooming out, the chart shows a classic top structure forming between January and March. That period of sideways action at higher prices followed by the current drop aligns with a transition from a markup phase into a distribution or markdown stage. The price failing to hold above $320 and the aggressive drop toward $260 in April confirms that sellers have been in control lately.

Despite the rebound attempt, the short-term pressure remains to the downside, as long as the price stays below the declining 50-day moving average. Until the stock reclaims and holds above that moving average, this remains a cautious technical setup with potential for more consolidation.

Management Team

Cummins has built a reputation over the years for having a steady and pragmatic leadership team. At the forefront is CEO Jennifer Rumsey, who has emphasized a mix of operational discipline, engineering excellence, and a forward-looking approach to technology. Her style leans into transparency and level-headed decision-making, and that’s reflected in how the company has handled both challenges and opportunities.

The rest of the executive team brings deep expertise in global manufacturing, finance, and innovation. Their approach isn’t flashy, but it’s highly effective. Decisions like restructuring parts of the business that aren’t meeting expectations—such as the Accelera unit—show a willingness to make difficult calls when needed. There’s a focus on balancing long-term strategy with short-term performance, and it shows up in how Cummins continues to grow its dividend, maintain margins, and invest in future technologies without overextending.

Valuation and Stock Performance

CMI shares have had a rough stretch after peaking near $390. The price has since pulled back toward the $290 level, but this isn’t necessarily a sign of weakness in the company. In fact, the pullback has brought valuation metrics into a more attractive zone. The forward price-to-earnings ratio sits at about 14.4, which is below the broader market average. Even the trailing P/E is just over 10, a number that reflects the strength of Cummins’ recent earnings and its ability to generate solid profits.

From a fundamental standpoint, the stock doesn’t look stretched. Price-to-sales and price-to-book ratios remain within normal ranges, and the dividend yield—currently around 2.5 percent—is sitting comfortably near its five-year average. That means investors are getting a steady income stream at a price that reflects recent volatility, not deteriorating fundamentals.

Technically, the trend has turned more cautious. The 50-day moving average has fallen below the 200-day average, often a sign of broader sentiment shifting. The stock’s decline since March suggests it’s moved into a consolidation phase, which may continue in the short term. But for investors with a longer time horizon, the fundamentals provide a solid foundation that could support a more constructive outlook as market conditions stabilize.

Risks and Considerations

Like any company operating in cyclical industries, Cummins faces a number of challenges that could affect future performance. One of the biggest is its dependence on global commercial vehicle demand. If there’s a slowdown in trucking or off-highway equipment markets—especially in North America—revenues could take a hit. These are not risks unique to Cummins, but they do introduce some earnings volatility.

The company is also investing heavily in clean energy technologies through its Accelera division. While the strategy is promising, adoption has been slower in some regions. That delay forced Cummins to restructure parts of the business and take a one-time charge. If that trend continues, the payback period for these investments could stretch out longer than expected.

Other concerns include inflationary pressures, lingering supply chain issues, and foreign exchange swings, all of which can impact costs and margins. Although Cummins has done a solid job managing these factors in the past, they remain relevant risks. The company also holds over seven billion dollars in debt, which means higher interest rates could have an effect on financing costs or capital allocation decisions.

Final Thoughts

Cummins is navigating its current environment with the same steady hand it has shown for decades. Management’s cautious but confident tone, combined with its long history of disciplined execution, gives the company a solid foundation. Even as the market recalibrates around growth expectations and industrial demand, Cummins continues to return capital to shareholders and position itself for the next cycle.

The stock’s recent correction has brought valuations back in line with historical norms, and the dividend remains well-covered and consistent. The mix of legacy engine businesses and investments in new technologies makes the company more adaptable than many of its peers. And while short-term risks are real, especially with slower truck sales and international uncertainty, Cummins has a track record of playing the long game successfully.

There’s no single catalyst likely to send the stock soaring overnight, but that’s not what this company is about. It’s a business built on scale, execution, and resilience. Whether the market rebounds quickly or continues to churn, Cummins looks prepared to keep delivering value through whatever comes next.