Key Takeaways

💰 Dividend yield of 3.27% with steady growth and a comfortable payout ratio of 42.16%.

💵 Strong cash flow with operating cash hitting $989.5 million and ample free cash flow for dividends.

📉 Analyst consensus is cautious (“Reduce”), citing margin compression risks and slowing loan growth.

📊 Solid earnings report with net income up significantly in Q4 driven by robust loan and deposit growth.

👔 Experienced management led by CEO Phil Green emphasizes conservative growth and disciplined banking.

Updated 4/25/25

Cullen/Frost Bankers (CFR), based in San Antonio, has built a reputation on conservative growth, strong capital discipline, and a focus on relationship-based banking across Texas. With a forward dividend yield above 3 percent and a payout ratio just over 42 percent, it continues to appeal to income-focused investors seeking consistency.

The company recently reported robust fourth-quarter earnings, supported by loan and deposit growth, and a solid balance sheet with more cash than debt. Management, led by CEO Phil Green, has emphasized long-term strategic expansion into high-growth markets like Austin and Dallas. Despite some recent volatility in the stock price, CFR maintains healthy fundamentals, a well-capitalized position, and a clear path for continued dividend strength.

Recent Events

It’s been a strong stretch for Cullen/Frost. Revenue grew 7.1% year-over-year in the latest quarter, a healthy clip for a regional bank in today’s environment. Net income over the last twelve months came in at $569.63 million, and earnings per share hit $8.87. Those aren’t just good numbers — they reflect a business that’s doing a lot of the right things behind the scenes.

One of the standout figures is the 51% year-over-year jump in quarterly earnings growth. That kind of surge doesn’t happen by accident. It’s a sign that the bank has been able to handle the interest rate environment better than many of its peers.

Return on equity clocks in at 15.30%, and return on assets is at 1.13%. These numbers show that Cullen/Frost is generating strong returns without taking on excessive risk — something not every bank can claim right now.

The stock itself has been on a bit of a ride. Over the past 52 weeks, CFR shares have ranged from $94.09 to $147.64. Lately, the stock has been trading around $115, up about 8.66% over the last year, nudging out the broader market’s performance. It’s not setting the world on fire, but it’s delivering solid, steady returns — exactly what you’d want from a dividend-paying bank stock.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.27%

💰 Forward Annual Dividend Rate: $3.80 per share

🔒 Payout Ratio: 42.16%

🌿 5-Year Average Dividend Yield: 2.99%

📅 Next Dividend Date: March 14, 2025 (Ex-Dividend Date: February 28, 2025)

🧾 Trailing Annual Dividend Yield: 3.21%

Dividend Overview

If you’re looking for reliability, Cullen/Frost’s dividend delivers. With a forward yield of 3.27%, it’s offering a nice premium over the S&P 500 average yield without stretching itself thin. The current payout ratio sits at a comfortable 42.16%, suggesting there’s plenty of room for the dividend to be maintained even if earnings growth slows down.

One thing that stands out is how Cullen/Frost funds its dividend. It’s not using smoke and mirrors like share buybacks or heavy borrowing. Instead, the dividend is backed by steady, organic profits and a fortress-like balance sheet. Cash on hand totals $10.4 billion, compared to $5.02 billion in debt. That kind of cushion is rare these days, even among some of the bigger players.

The stock’s five-year beta is 0.81, meaning it tends to move less than the market overall. For dividend investors who value steady income and a smoother ride, that’s a real bonus. It points to less day-to-day drama, allowing you to focus more on the income stream and less on the market noise.

Dividend Growth and Safety

Cullen/Frost doesn’t just pay a dividend — it grows it thoughtfully.

Right now, the forward yield sits higher than its five-year average yield of 2.99%. That small detail tells a bigger story: today’s yield represents an opportunity to lock in a slightly better-than-usual income stream without taking on undue risk.

The payout ratio remains firmly in safe territory. At just over 42%, Cullen/Frost has the flexibility to continue growing its dividend in the future without having to rely on perfect market conditions or aggressive balance sheet maneuvers.

The balance sheet strength only reinforces this view. With more cash than debt, Cullen/Frost is in an enviable position. It has options — to reinvest in the business, support the dividend through rocky periods, or even step up payouts when conditions are favorable. Not every bank can say that right now, especially after a turbulent couple of years in the financial sector.

Growth-wise, while you shouldn’t expect explosive dividend hikes, steady low-to-mid single-digit annual increases seem well within reach based on earnings power and payout philosophy. For dividend investors who value sustainability and predictability over excitement, that kind of slow and steady growth can be exactly what fits into a long-term portfolio.

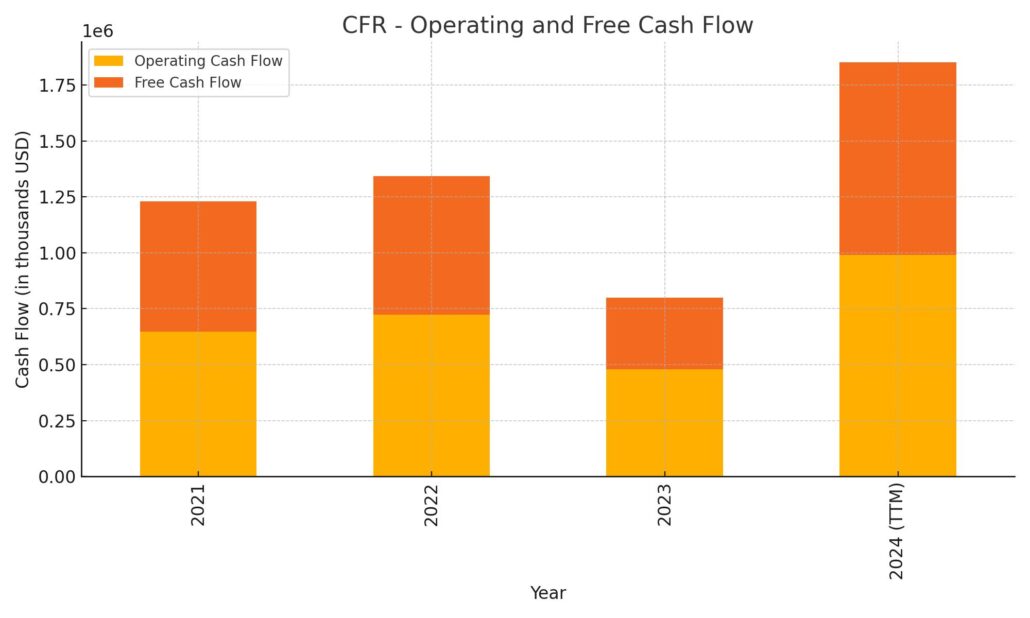

Cash Flow Statement

Cullen/Frost Bankers has posted a strong operating cash flow over the trailing twelve months, coming in at $989.5 million. This marks a sharp improvement from the $478.8 million generated in 2023, reflecting the bank’s healthier earnings environment and improved management of core banking operations. Free cash flow also showed a healthy increase, landing at $861.8 million, suggesting Cullen/Frost is retaining a significant amount of cash after covering capital expenditures, which totaled $127.8 million over the same period.

On the investing side, cash outflows were relatively modest at $180.9 million, especially compared to the much heavier investing activity in prior years. Financing activities turned positive, with $738.3 million in cash inflows, a reversal from heavy outflows in 2023. The company’s end cash position has grown to an impressive $10.23 billion, up from $8.69 billion last year. Overall, Cullen/Frost’s cash flows reflect a solid, conservative capital structure with a strong emphasis on liquidity and operational discipline.

Analyst Ratings

Cullen/Frost Bankers (CFR) has seen a shift in analyst sentiment recently. 📉 The consensus rating has moved to “Reduce,” reflecting a more cautious tone among analysts. 🧠 Out of 14 analysts, 3 have issued a sell rating, 9 are recommending holding the stock, and only 2 have suggested it as a buy. 📊 The average 12-month price target sits around $132.57, suggesting a modest upside from where the stock is currently trading.

Several factors have driven this more reserved outlook. 🏦 Analysts have pointed to concerns about net interest margin compression, which could pressure profitability if rates stabilize or decline. 📉 There’s also some worry about slowing loan growth in Cullen/Frost’s core Texas markets, where competition remains intense. 🌵 Broader economic uncertainties, including a potentially cooling economy, have added to the cautious stance. 🔍 Even though Cullen/Frost continues to deliver strong balance sheet fundamentals and reliable dividend payouts, these external factors have made analysts more hesitant to predict significant near-term stock price gains.

Earnings Report Summary

Cullen/Frost Bankers wrapped up 2024 with a strong performance that showed the bank’s steady approach is still paying off. Net income for the fourth quarter came in at $153.2 million, or $2.36 per diluted share. That’s a healthy jump from $100.9 million, or $1.55 per share, during the same period last year. A big part of that improvement came from the absence of a special FDIC surcharge that had weighed on earnings previously, so it’s a cleaner comparison this time around.

Strong Loan and Deposit Growth

One of the standout points from the quarter was the strength in net interest income, which rose by 5.8% to $433.7 million. That growth came from a 9.3% increase in average loans, reaching $20.3 billion. Deposits also moved higher, up 1.7% to $41.9 billion. These aren’t just small numbers either — they show that Frost is gaining traction in important Texas markets like Austin, Dallas, and Houston, where their expansion strategy continues to push forward.

Full-Year Performance Holds Steady

For the full year, Cullen/Frost reported net income of $575.9 million, translating to $8.87 per share. That’s a slight dip compared to 2023’s $591.3 million and $9.10 per share, but if you strip out the FDIC special assessment from last year, it’s basically a wash. Leadership was quick to point out that without that charge, earnings would have been even closer to prior year levels, painting a picture of solid underlying strength.

Leadership Comments and Future Outlook

Chairman and CEO Phil Green had plenty of positive things to say about the quarter. He credited the company’s employees for the strong results and emphasized that Cullen/Frost is now entering a phase where its long-term investments in branch expansion are really starting to bear fruit. It’s clear they believe their slow-and-steady approach will continue to pay off over the next few years.

On top of that, the board declared a first-quarter dividend of $0.95 per share and approved a fresh $150 million stock repurchase program. Capital ratios stayed strong, with a Common Equity Tier 1 ratio of 13.62%, giving the bank plenty of financial flexibility heading into 2025. Non-accrual loans ended the year at $78.9 million, which remains very manageable given the size of their loan book.

Looking ahead, CFO Dan Geddes suggested that possible interest rate cuts by the Federal Reserve could have an impact on earnings moving forward. Still, Cullen/Frost seems positioned to handle whatever comes next with the same conservative, steady approach that’s been its hallmark for decades.

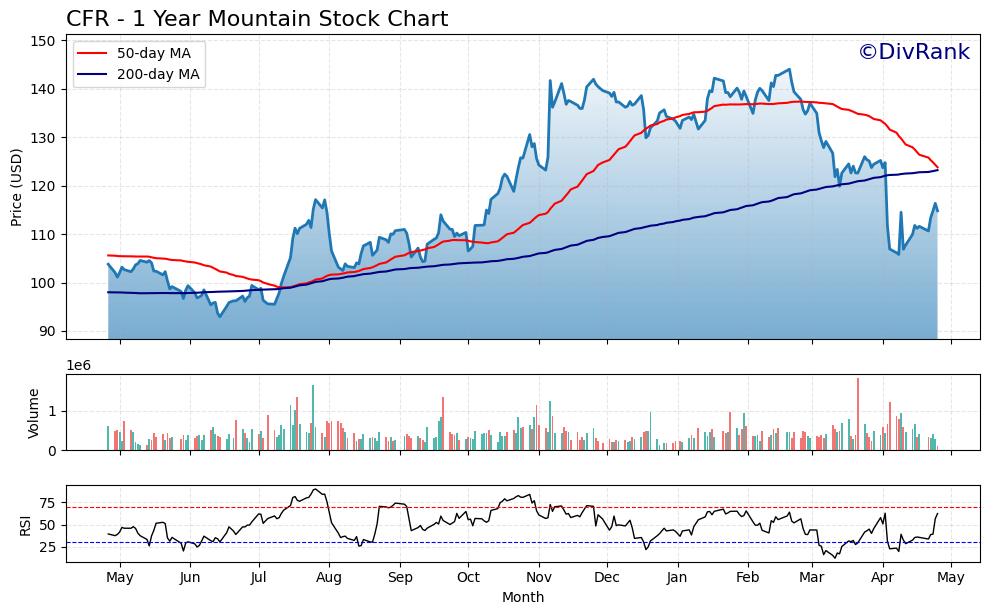

Chart Analysis

Price Movement and Trend Lines

Looking at the one-year chart for CFR, the stock experienced a steady climb from late summer through the end of the year, peaking above 140 in early March. Since then, it’s pulled back sharply, dropping below both the 50-day and 200-day moving averages before showing signs of a rebound into late April. The 50-day moving average has now turned lower and is sitting well above the price, while the 200-day is still sloping upward, though flattening.

This kind of divergence between the short-term and long-term trend lines suggests the stock recently lost some momentum, but the longer-term trend is still intact for now. What’s encouraging is the recent bounce off the 120 level and recovery toward the moving averages, which may signal early attempts to stabilize after the selloff.

Volume Activity

Volume picked up notably during the sharp drop in early April. That spike in activity usually means institutional participation, which could be either forced selling or strong hands stepping in to buy the dip. Since then, volume has tapered back to normal levels, hinting that the most intense part of the shakeout might be over for now.

RSI Indicator

The RSI dropped below 30 during the recent pullback, entering oversold territory before snapping back above 50. That sharp move off the lows could be a sign that buyers are re-entering at more attractive price levels. The fact that RSI didn’t stay oversold for long adds to the case that the worst of the downside might be in the rearview.

Overall Takeaway

CFR’s chart shows a name that recently came under pressure but is starting to find its footing again. The stock remains below its 50-day average, so there’s still work to do technically, but the upward slope in the 200-day and the firm bounce in both price and RSI offer a constructive setup for a potential recovery in the weeks ahead.

Earnings Report Summary

Cullen/Frost Bankers (CFR) wrapped up 2024 with a strong performance that showed the bank’s steady approach is still paying off. Net income for the fourth quarter came in at $153.2 million, or $2.36 per diluted share. That’s a healthy jump from $100.9 million, or $1.55 per share, during the same period last year. A big part of that improvement came from the absence of a special FDIC surcharge that had weighed on earnings previously, so it’s a cleaner comparison this time around.

Strong Loan and Deposit Growth

One of the standout points from the quarter was the strength in net interest income, which rose by 5.8% to $433.7 million. That growth came from a 9.3% increase in average loans, reaching $20.3 billion. Deposits also moved higher, up 1.7% to $41.9 billion. These aren’t just small numbers either — they show that Frost is gaining traction in important Texas markets like Austin, Dallas, and Houston, where their expansion strategy continues to push forward.

Full-Year Performance Holds Steady

For the full year, Cullen/Frost reported net income of $575.9 million, translating to $8.87 per share. That’s a slight dip compared to 2023’s $591.3 million and $9.10 per share, but if you strip out the FDIC special assessment from last year, it’s basically a wash. Leadership was quick to point out that without that charge, earnings would have been even closer to prior year levels, painting a picture of solid underlying strength.

Leadership Comments and Future Outlook

Chairman and CEO Phil Green had plenty of positive things to say about the quarter. He credited the company’s employees for the strong results and emphasized that Cullen/Frost is now entering a phase where its long-term investments in branch expansion are really starting to bear fruit. It’s clear they believe their slow-and-steady approach will continue to pay off over the next few years.

On top of that, the board declared a first-quarter dividend of $0.95 per share and approved a fresh $150 million stock repurchase program. Capital ratios stayed strong, with a Common Equity Tier 1 ratio of 13.62%, giving the bank plenty of financial flexibility heading into 2025. Non-accrual loans ended the year at $78.9 million, which remains very manageable given the size of their loan book.

Looking ahead, CFO Dan Geddes suggested that possible interest rate cuts by the Federal Reserve could have an impact on earnings moving forward. Still, Cullen/Frost seems positioned to handle whatever comes next with the same conservative, steady approach that’s been its hallmark for decades.

Management Team

Cullen/Frost Bankers is led by a group of seasoned executives who have guided the company with consistency and a measured hand. Phil Green, who serves as Chairman and CEO, has been with the bank since 1980 and brings decades of institutional knowledge. Under his leadership, the bank has maintained a conservative credit culture and built out its branch footprint across Texas, particularly in high-growth metro areas like Austin and Dallas.

Green is known for his emphasis on long-term growth over short-term gains, and that mindset filters through the rest of the leadership team. CFO Jerry Salinas, who joined Cullen/Frost in the mid-1980s, provides stability on the financial side. He has overseen the company’s disciplined capital allocation and guided it through both expansion cycles and downturns with the same conservative lens. The broader management team reflects the same stability — turnover is low, and leadership tends to rise internally, fostering a deep understanding of the bank’s culture and strategic priorities.

Cullen/Frost has also made technology investments a core part of its longer-term vision, which is being overseen by executives focused on digital transformation without sacrificing the customer-first experience that’s long defined the brand. In an industry where management missteps can quickly become costly, this team’s steady, deliberate approach is a clear strength.

Valuation and Stock Performance

As of the most recent data, CFR shares are trading near $115, down from their recent peak above $140 but still solidly above their 52-week low near $94. With a forward price-to-earnings ratio around 13 and a trailing P/E just slightly higher, valuation remains reasonable for a high-quality regional bank. The price-to-book ratio sits near 2, reflecting market confidence in the bank’s long-term return on equity and its strong balance sheet.

Over the past year, CFR has outperformed broader financial sector benchmarks in stretches, particularly during periods when investors favored more conservatively run institutions. The sharp pullback in March and April of this year, however, reflects broader concerns about regional bank exposure to shifting interest rate dynamics and deposit competition. Yet even with that drop, the long-term chart still shows an upward bias, and the recovery underway in April and early May suggests that investors may be finding value at these levels.

From a dividend yield perspective, CFR is offering more than 3 percent, which adds another layer of return for shareholders. Compared to the broader S&P 500 average yield, that payout is competitive, particularly when you factor in the bank’s history of steady dividend growth and moderate payout ratios. While share price movement has seen some turbulence recently, the underlying financial performance has held firm, which is often the foundation for longer-term recovery.

Risks and Considerations

Like any financial institution, Cullen/Frost is exposed to risks that can shift quickly depending on economic and regulatory developments. One of the primary challenges is interest rate sensitivity. As a regional bank, CFR’s core business is tied closely to net interest income, which can fluctuate based on Federal Reserve policy. The bank has benefitted from a rising rate environment in recent quarters, but if rates begin to fall, compression in net interest margins could weigh on earnings.

Deposit competition is another area to watch. Cullen/Frost has long prided itself on customer loyalty and relationship-based banking, but higher-for-longer rate policies have led many banks to offer aggressive rates to retain deposits. If customers begin moving money into higher-yielding alternatives outside the banking system, that could create added funding pressure. So far, the bank has managed to keep deposit levels stable, but this is an ongoing dynamic that could affect profitability.

Credit quality also remains a constant consideration. While Cullen/Frost has maintained low levels of non-performing assets and has avoided aggressive lending practices, any downturn in commercial real estate or regional economic activity could affect its loan book. Given its geographic concentration in Texas, any economic slowdown in that state would likely have a disproportionate impact compared to more nationally diversified peers.

On the operational side, the expansion into new markets and continued investment in technology is a balancing act. There’s potential for margin expansion and long-term growth, but execution risk always lingers, especially in an environment where customer behaviors are shifting and digital expectations continue to evolve.

Lastly, while the stock’s valuation appears reasonable, investor sentiment toward regional banks as a group remains fragile. External shocks — whether regulatory, economic, or even headline-driven — can lead to sharp selloffs that don’t always reflect the specific fundamentals of a bank like CFR. That kind of volatility can test investor patience, even when the underlying metrics remain solid.

Final Thoughts

Cullen/Frost Bankers sits in a category of its own — a regional player with the strength, consistency, and leadership typically associated with much larger institutions. The bank’s conservative approach, deep Texas roots, and disciplined expansion strategy have allowed it to grow steadily without overreaching. This measured growth has been paired with strong dividend performance and a firm commitment to shareholder returns.

Despite some recent weakness in the stock price, the company’s fundamentals have held up well. Earnings remain strong, loan and deposit growth continues, and the balance sheet reflects years of disciplined management. The pullback in shares has brought valuation metrics to levels that suggest long-term value may be emerging once again, especially for investors who prize consistent returns and capital preservation.

As with any investment in the financial sector, there are risks — interest rate pressures, deposit competition, and regional economic exposure chief among them. But Cullen/Frost has navigated past cycles by staying true to its core strengths: responsible lending, tight expense control, and a strong customer-first culture.

The road ahead may include some twists and turns, especially if broader market sentiment toward banks remains cautious. Yet for those willing to look past the short-term volatility, the story here is one of disciplined execution and a long-term commitment to both growth and income. Cullen/Frost may not be the flashiest name in the space, but its approach continues to deliver where it counts.