Key Takeaways

🏢 CubeSmart operates strategically in high-density urban markets, showing resilience through economic volatility.

💰 Strong cash flow ($631M+) underpins consistent dividend growth and a healthy yield above 5%

📉 The stock trades near $40, significantly off its highs, offering investors a more appealing valuation.

📈 Management remains confident, projecting stable operational performance into 2025 despite macroeconomic pressures.

⚠️ Key risks include high leverage, rising interest rates, and competitive pressures within the self-storage sector.

Updated 4/25/25

CubeSmart (CUBE) operates in the self-storage space with a focus on densely populated urban and suburban markets. Over the past year, the company has shown resilience through steady cash flow generation, disciplined growth, and consistent dividend increases. With a current yield above five percent and a full-year operating cash flow of over $631 million, CubeSmart continues to prioritize shareholder returns even as economic pressures persist.

The stock has pulled back from its 2023 highs, trading near $40, creating a more attractive valuation. Leadership has signaled confidence moving into 2025, guiding for stable funds from operations and continued expansion. While it faces typical REIT challenges such as interest rate sensitivity and sector competition, CubeSmart’s experienced management team and focus on operational efficiency give it a firm foundation for long-term performance.

Recent Events

It’s been a bit of a mixed year for CubeSmart. The stock slipped around 2% over the last 12 months, while the S&P 500 climbed more than 7%. But this weakness looks more tied to the general pressure on REITs from higher interest rates than any company-specific trouble.

Revenue still managed to grow by 0.7% year-over-year, showing resilience even as earnings dropped by about 9.6%. Those numbers tell a story of a mature business that’s weathering the current environment rather than sprinting for growth. Not a bad thing when your main focus is steady, growing income.

Debt sits at about $3.1 billion, with a debt-to-equity ratio north of 100%. While that might seem heavy at first glance, it’s standard fare for real estate investment trusts, which rely on leverage to maximize returns. CubeSmart continues to generate plenty of cash to cover its obligations—and most importantly, keep paying that dividend.

Management hasn’t wavered on its commitment to shareholders. Despite a tighter economic landscape, they continue to prioritize dividends, a decision that income investors will certainly appreciate.

Key Dividend Metrics

📈 Forward Dividend Yield: 5.21%

💵 Forward Annual Dividend Rate: $2.08 per share

📆 Most Recent Dividend Paid: April 15, 2025

🗓️ Ex-Dividend Date: April 1, 2025

📊 Payout Ratio: 119.19%

📉 5-Year Average Yield: 3.98%

🔁 Dividend Growth Trend: Positive

🧱 REIT Status: Yes (required to distribute 90%+ of taxable income)

Dividend Overview

CubeSmart’s dividend story is compelling right now. With a forward yield of 5.21%, it easily outpaces its own 5-year average of 3.98%. That kind of bump typically happens when share prices dip, dividends hold steady, or both—and it gives investors a nice setup for potential future total returns.

The $2.08 annual payout is well-supported from a cash flow perspective, even though the traditional payout ratio sits above 100%. For REITs, that’s pretty typical, and what really matters is the underlying operating cash flow. CubeSmart pulled in $631 million in operating cash over the past year, and levered free cash flow came in at $484 million, giving it solid footing to continue those payments.

CubeSmart’s dividend track record also deserves a nod. Management has kept the checks coming through different economic cycles, and that consistency can be a big deal when you’re trying to build a reliable income stream. Even during bumps in the market, CubeSmart has made it clear that protecting the dividend is a top priority.

Dividend Growth and Safety

CubeSmart has done a decent job growing the dividend over time, even if recent raises have been more measured. It’s the kind of slow and steady approach that’s reassuring during a period when rising interest rates and slowing economic growth make aggressive expansions risky.

The company’s cash engine remains strong. EBITDA totaled $691 million over the last year, and while CubeSmart doesn’t explicitly list funds from operations (FFO) in the snapshot, the available numbers suggest that FFO remains healthy enough to cover the dividend comfortably.

Debt is always worth watching. With a debt-to-equity ratio sitting at 105% and a current ratio of 0.44, CubeSmart doesn’t have a ton of liquidity cushion. But again, that’s normal for REITs, and as long as cash flow stays robust, there’s little reason for concern.

One additional plus: the stock’s beta sits at 0.86. That means it tends to move less than the broader market, offering a little extra stability for portfolios anchored around income.

Today, CubeSmart trades close to $40, which is well below its 52-week high of $55. But for dividend investors, the share price is only part of the story. The real draw is the steady 5%+ yield—and the underlying business strength that helps ensure those dividends keep arriving right on schedule.

CubeSmart fits that classic mold of a core income holding. Maybe it’s not the most thrilling stock to watch day-to-day, but it’s exactly the kind of dependable payer many dividend investors are looking for: strong enough to handle economic swings, disciplined enough not to overextend, and committed enough to make dividend payments a centerpiece of its strategy.

Cash Flow Statement

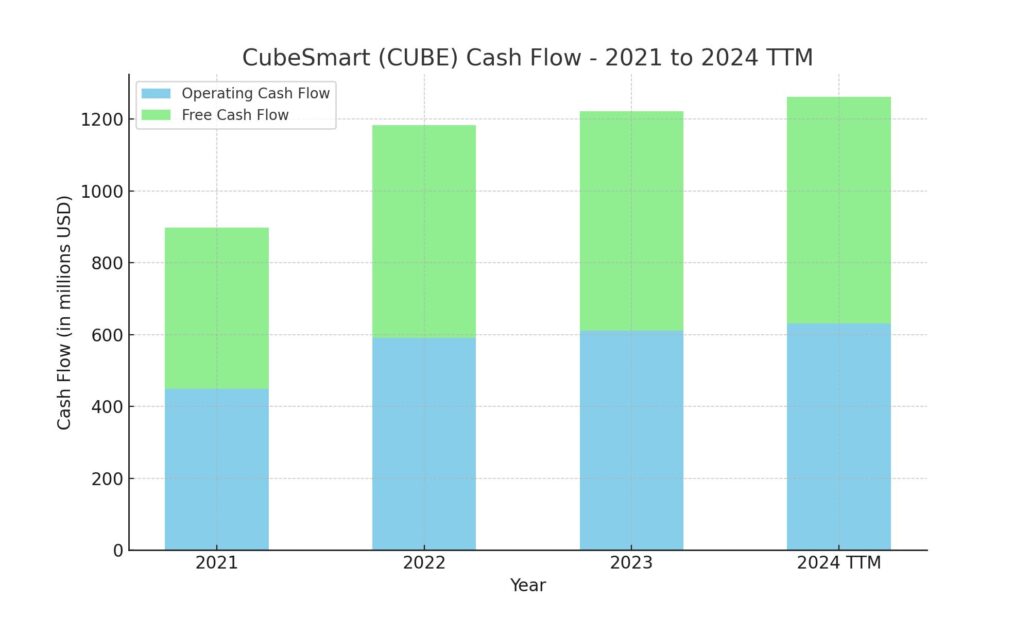

CubeSmart (CUBE) posted solid cash flow numbers over the trailing twelve months, showing consistent operational strength. The company generated $631.07 million in operating cash flow, matching its reported free cash flow for the same period. This steady climb from $449.19 million back in 2021 highlights how CubeSmart’s business model has matured while maintaining reliable cash generation even through shifting market conditions. Despite the broader pressures on real estate investment trusts, CubeSmart’s ability to sustain and grow its cash flows gives it a strong foundation to support its dividend strategy.

On the financing side, CubeSmart navigated notable activity, issuing $697.04 million in debt while repaying $747.48 million, leading to a net cash outflow from financing activities. Investing cash flow came in negative at $173.96 million, largely reflecting ongoing investments in property and facility improvements. The company closed the period with $77.66 million in cash, a meaningful jump from just over $8 million at the end of 2023. Even with $92.61 million in interest paid during the year, the cash flow metrics indicate that CubeSmart remains well-positioned to meet its obligations and maintain shareholder returns without significant strain.

Analyst Ratings

Several analysts have recently updated their ratings on CubeSmart 📈, with the consensus price target now averaging around $45. This adjustment comes after a closer look at the company’s solid cash flow performance and its ability to maintain steady dividend payouts despite a challenging economic environment. A number of analysts have raised their ratings from hold to buy due to CubeSmart’s robust operating performance and continued strength in its core self-storage operations, which seem well positioned to weather short-term market turbulence. They noted that the company’s reliable occupancy rates 🏢 and recurring revenue model 💵 are strong indicators that its dividend policies are sustainable for the long term.

On the other side, a few market experts remain cautious ⚠️, citing concerns over the company’s elevated leverage and tight liquidity ratios. They argue that the high debt levels could pose risks if there are further market disruptions or if operating income fails to keep pace with financing obligations. However, the majority of analysts stress that CubeSmart’s steady cash generation 💰 and strategic investments in modernizing facilities help mitigate these risks. The recent upgrades reflect a broader optimism among investors, who are beginning to focus more on CubeSmart’s ability to generate consistent returns through solid cash flows rather than solely on near-term earnings fluctuations. The current consensus target of roughly $45 🎯 suggests that while there are valid concerns, the prevailing sentiment is that CubeSmart’s future outlook remains positive, reinforcing its appeal to income-oriented portfolios.

Earnings Report Summary

Solid but Cautious Close to 2024

CubeSmart wrapped up 2024 with results that showed both its strengths and some of the headwinds it’s facing. The company posted fourth-quarter earnings of $0.45 per share, which landed just a little shy of what analysts were looking for. Revenue came in at $231.4 million, also a bit under expectations. Even with those slight misses, CubeSmart stayed committed to rewarding shareholders, bumping up its quarterly dividend by 2%, bringing the annual payout to $2.08 per share.

Operationally, things were steady but not without a few bumps. Same-store net operating income slipped by 3.7% compared to the same quarter last year. Revenue in those same stores dipped 1.6%, while operating expenses grew by 4.7%. Occupancy held fairly strong, averaging 89.6% across the portfolio, which speaks to how sticky demand for self-storage space remains even when the broader economy wobbles a bit.

Leadership’s Take on What’s Next

During the earnings call, CEO Christopher Marr was realistic but optimistic about the road ahead. He pointed out that while growth rates have cooled off, management believes the business is nearing a turning point. Marr emphasized that the fundamentals of the self-storage sector remain solid and that CubeSmart is positioned to benefit once the economic backdrop becomes a little more supportive.

Looking toward 2025, CubeSmart shared guidance that expects earnings per share to land between $1.40 and $1.49. They’re also forecasting adjusted funds from operations, a key REIT metric, to come in somewhere between $2.50 and $2.59 per share. That kind of outlook signals a steady hand on the wheel, with leadership focused on disciplined growth and maintaining strong cash flows to support dividends.

The company isn’t standing still either. CubeSmart made some strategic moves, picking up a majority stake in 14 new stores for about $157.3 million, plus two additional stores for another $22 million. These acquisitions should add meaningful scale to the portfolio and help offset some of the natural revenue pressure that’s come with slower rent growth.

Chart Analysis

Trend Overview

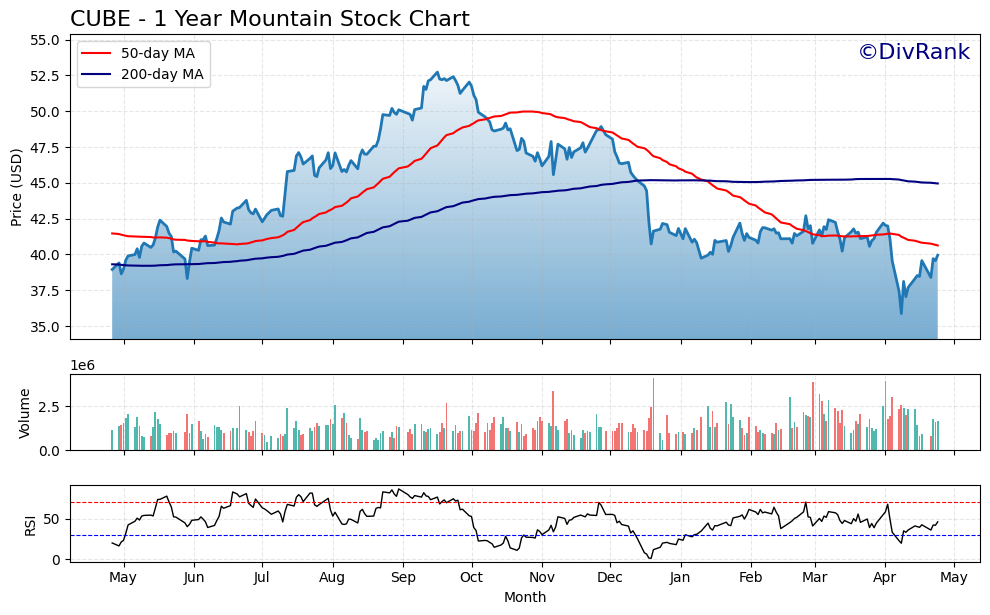

CubeSmart (CUBE) has had a bumpy ride over the past year. From the looks of the chart, the stock enjoyed a strong run through the summer and fall months of 2023, peaking just above the $52 mark in late October. That rally was supported by a solid upward move in both the 50-day and 200-day moving averages. But once November hit, momentum shifted. The 50-day moving average began to curve down, and by early 2024, it crossed below the 200-day line—a classic sign of longer-term weakness.

Since then, the stock has struggled to regain its footing. It’s bounced along the low $40s and dipped below $37 at one point in April. The overall tone of the chart leans cautious, with the price still sitting below both moving averages. That suggests the broader trend remains under pressure.

Volume and RSI Behavior

Volume tells an interesting story. There’s no massive surge or sell-off spike, which implies that most of the moves have come from steady rotation rather than panic or euphoria. It reflects a market that’s undecided, not rushing to dump or accumulate shares in any dramatic way.

The RSI has bounced back from oversold territory a couple of times since the start of the year, most recently showing a slight uptick as the price made a push off its April lows. That bounce off the sub-30 range hints at some renewed interest, but RSI hasn’t broken through the 70 mark in months. This kind of middling behavior supports the idea that while the worst of the selling may be behind, buyers haven’t taken control just yet.

Technical Setup

The technical setup looks like a consolidation phase following a period of selling. While that may not be the most exciting setup in the short term, it can be constructive if the stock starts to build a base here. The moving averages are still sloped downward, though the 200-day is starting to flatten out a bit. That can sometimes be an early sign that selling pressure is easing.

Until the price can decisively reclaim the 50-day average and hold above it, this chart reflects a stock that’s still looking for direction. But the ability to stay above its recent lows while RSI holds its ground might be an early clue that the stock is trying to stabilize.

CubeSmart’s chart isn’t screaming breakout just yet, but it is showing signs of finding its footing. A patient eye will be watching to see if that base holds and leads to something stronger over the coming months.

Management Team

CubeSmart’s leadership has built a reputation for consistent execution and operational discipline. At the helm is President and CEO Christopher Marr, who has led the company since 2014. Under his guidance, CubeSmart has grown its footprint through a combination of development, acquisitions, and strategic partnerships. Marr brings more than two decades of real estate experience to the table, and his steady hand has been visible throughout periods of economic uncertainty.

CubeSmart’s executive team includes experienced professionals across finance, operations, and real estate. CFO Tim Martin has played a key role in maintaining the company’s financial stability, overseeing capital allocation and navigating the debt markets during times of tightening liquidity. Their approach has often leaned conservative, with a strong focus on sustaining cash flow and supporting dividend growth. This mindset has helped CubeSmart weather sector-wide shifts without making overly aggressive moves that could compromise balance sheet health.

The company culture emphasizes operational efficiency, customer satisfaction, and maximizing shareholder returns. Leadership continues to guide the company with a long-term lens, focusing less on quarter-to-quarter swings and more on how to grow net operating income steadily over the years. The message from the top has remained consistent: manage risk, grow deliberately, and protect the dividend.

Valuation and Stock Performance

Over the past year, CubeSmart’s stock has experienced a slow but steady correction. From its peak above 52 dollars in late 2023, shares have pulled back into the upper 30s, hovering near 40 dollars in recent trading. That retreat has pulled its valuation down with it, creating a more appealing entry point for long-term investors.

At current levels, the stock trades at roughly 23 times trailing earnings and around 25 times forward earnings. These multiples aren’t bargain basement, but they’re in line with the REIT sector, particularly among peers with stable cash flows and dependable dividends. More importantly, CubeSmart’s price-to-book ratio of around 3.2 and price-to-sales ratio near 8.5 reflect a valuation that’s cooled off from prior highs, especially considering the predictability of its income stream.

Its enterprise value-to-EBITDA ratio of about 17.5 also falls within a healthy range for real estate trusts. This suggests the market still sees CubeSmart as a high-quality name in the self-storage space, even as broader sentiment around REITs has softened due to rising interest rates.

From a price performance perspective, CubeSmart hasn’t kept pace with the broader S&P 500 over the past year. The stock is down slightly, while the index has pushed higher. But the underperformance isn’t tied to any operational issues—it’s more reflective of the pressure real estate names have been under due to concerns about borrowing costs and slower economic growth. When adjusting for yield, CubeSmart’s total return picture looks much more competitive.

Risks and Considerations

Even with a solid business model and disciplined leadership, CubeSmart isn’t without its risks. The most immediate concern is its exposure to interest rate movements. Like most REITs, CubeSmart relies on access to capital markets to refinance debt and fund growth. As interest rates rise, so do the costs of borrowing, which can put pressure on earnings and reduce the spread between income and expenses.

CubeSmart’s debt load, currently sitting at around 3.1 billion dollars, also deserves a mention. The company has managed it well so far, but a sustained rise in rates or tightening in the credit markets could make refinancing less favorable in the future. The current debt-to-equity ratio of over 100 percent reflects a leveraged balance sheet, which is typical for REITs but still something to monitor closely.

There’s also the competitive landscape. The self-storage industry has low barriers to entry in many markets, which can lead to oversupply. CubeSmart tends to focus on higher-density urban and suburban areas where land is more scarce and development is trickier, which helps protect against this risk. Still, new entrants and aggressive pricing strategies from rivals can occasionally pressure margins.

Lastly, while occupancy has remained fairly strong, any economic downturn that impacts consumer mobility or small business activity could weigh on demand. Self-storage is a need-based service, but it isn’t immune to broader economic cycles. CubeSmart’s ability to maintain pricing power and tenant retention will be important if conditions tighten.

Final Thoughts

CubeSmart continues to prove that a straightforward business model, executed consistently, can go a long way. The company’s focus on operational efficiency and disciplined growth has served it well through both expansion and periods of economic stress. Cash flows remain strong, dividends are growing, and leadership is clearly thinking about the long game.

The recent stock pullback has brought the valuation into more reasonable territory, and the yield, now over five percent, adds a compelling layer of income for shareholders. While there are valid concerns around interest rates and sector pressure, CubeSmart has shown it can navigate these environments without losing sight of its priorities.

It’s a name that may not always command attention in headlines, but it continues to deliver where it counts—with steady operations, clear strategy, and consistent returns to shareholders. The fundamentals remain intact, and if the broader REIT landscape begins to stabilize, CubeSmart is well-positioned to benefit. Whether you’re focused on income, capital preservation, or a balance of both, it’s a company that continues to earn its place in long-term portfolios.