Updated 4/25/25

Key Takeaways

✅ CSWI delivered strong FY2024 results with $792.8M revenue and $109.1M adjusted net income.

📈 Recent quarterly earnings surged 192%, reflecting improved operational efficiency.

💰 Conservative dividend policy with a 0.34% yield and ultra-low 10.2% payout ratio.

🚀 Stock up over 30% in the past year but trades at a premium valuation (forward P/E above 40).

👔 CEO Joseph Armes leads a shareholder-aligned management team focused on sustainable growth.

CSW Industrials (NASDAQ: CSWI) is a diversified industrial company operating across HVAC, plumbing, construction, and energy markets. With a strategy built around disciplined acquisitions, margin expansion, and steady cash flow, it has consistently delivered strong financial results. In fiscal 2024, the company posted $792.8 million in revenue and $109.1 million in adjusted net income, while free cash flow hit $146.8 million.

Its management team, led by CEO Joseph Armes, emphasizes long-term growth and capital efficiency, supported by meaningful insider ownership. Though the dividend yield remains modest, a low payout ratio and consistent increases highlight its long-term potential. Trading near $310 with a forward P/E above 40, CSWI has seen its stock climb over 30 percent in the past year. The company’s combination of financial strength, smart leadership, and operational focus has positioned it as a consistent performer with a clear growth trajectory.

Recent Events

In the latest quarter ending December 31, 2024, CSWI kept its momentum rolling. Revenue for the trailing twelve months came in at $858.61 million, reflecting a healthy 10.7% increase compared to the prior year. But the real eyebrow-raiser was earnings growth, which surged by a staggering 192.2% year-over-year. That kind of profit spike doesn’t just happen by accident — it shows that the company is squeezing more value from each dollar of sales.

Operating margins stood at a strong 15.28%, and net margins were even a hair higher at 15.53%. In a world where margin compression is an everyday risk, those numbers are worth paying attention to.

On the balance sheet, CSWI continues to play it safe and smart. With $213.75 million in cash and only $68.7 million in total debt, the company has more than enough flexibility to weather any bumps in the road. The current ratio of 4.18 underlines the strength of its liquidity position, while a debt-to-equity ratio of just 6.46% shows a commitment to staying financially nimble.

Investors have noticed. CSWI’s stock price has climbed 31.5% over the past year, handily outperforming the broader market. The stock’s beta sits at 0.88, which suggests it tends to be less volatile than the S&P 500 — a trait dividend investors looking for stability will likely appreciate.

Key Dividend Metrics

📈 Forward Dividend Yield: 0.34%

💰 Forward Annual Dividend Rate: $1.08

🛡️ Payout Ratio: 10.2%

🚀 5-Year Average Dividend Yield: 0.46%

📅 Next Dividend Date: May 9, 2025

🔔 Ex-Dividend Date: April 25, 2025

Dividend Overview

If you’re searching for high-yield income, CSWI probably won’t make your shortlist. The forward dividend yield is a modest 0.34%, and even over the past five years, the average has hovered around 0.46%. That’s significantly below sectors like utilities or telecoms, where yields often stretch past 4% or 5%.

But to focus on yield alone would be missing the bigger picture. CSWI’s payout ratio is a mere 10.2%, signaling that management is paying out just a sliver of its earnings. That leaves an enormous margin of safety and plenty of room for reinvestment and future dividend growth.

While some companies pump up their dividends to prop up share prices, CSWI has taken a much more disciplined approach. It quietly returns capital to shareholders without compromising its ability to grow the business. This kind of low-payout, high-flexibility model is often where the best dividend growth stories begin.

Notably, CSWI has shown no signs of dividend cuts, even during challenging market environments. Instead, it’s steadily nudged its dividend higher in tandem with its growing earnings base. Investors who can look beyond today’s small checks and focus on tomorrow’s larger ones could be well-rewarded over time.

Dividend Growth and Safety

Under the hood, CSWI’s dividend story gets even better. While the starting yield may feel underwhelming, the company’s history and financial muscle suggest that bigger payouts are on the horizon.

Operating cash flow over the trailing twelve months clocked in at $163.49 million, and levered free cash flow hit $108.52 million. Those figures leave plenty of breathing room after dividend payments. Put simply, CSWI is generating a lot more cash than it’s handing out, and that surplus fuels growth, acquisitions, and future dividend hikes.

Its fortress balance sheet only adds to the dividend’s safety. With more than three times as much cash as debt, and an ultra-low payout ratio, CSWI could easily afford to double the dividend if it wanted to. But if history is any guide, management will continue taking a slow, sustainable path, favoring consistency over flash.

It’s also worth noting that CSWI isn’t a high-beta stock. With a five-year beta of 0.88, it tends to move less than the broader market — a feature that offers a little extra comfort when volatility rears its head.

One area that could make some investors pause is valuation. The forward P/E ratio sits at 42.55, and the PEG ratio is 2.84. Those numbers suggest investors are already pricing in a lot of future growth. But when you marry a strong, cash-rich business model with a long runway for expansion, sometimes paying a little extra upfront can be worth it in the end.

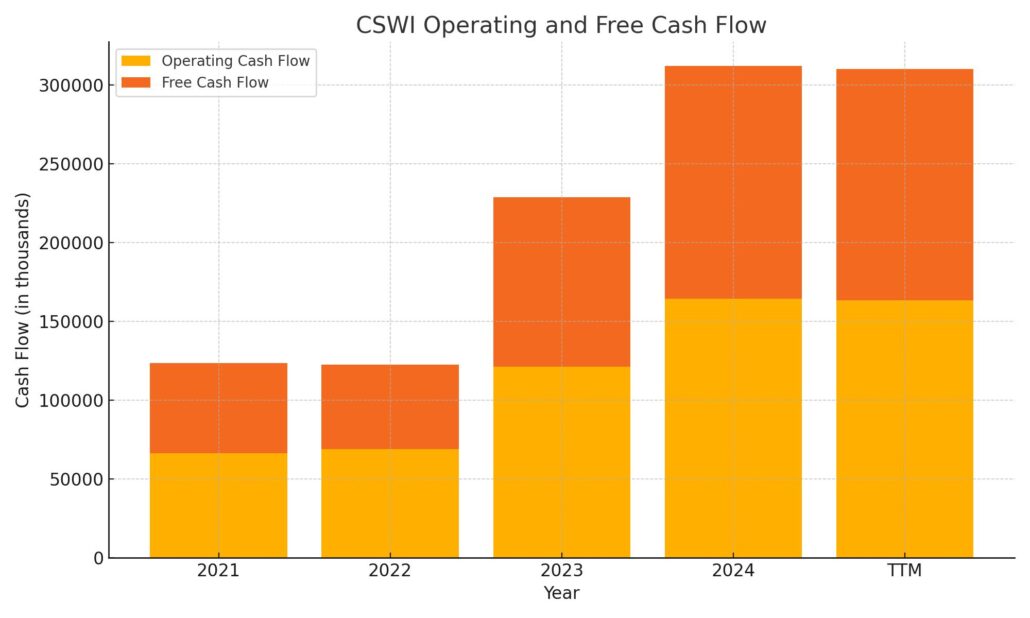

Cash Flow Statement

Over the trailing twelve months, CSW Industrials generated $163.5 million in operating cash flow, maintaining a strong level almost identical to the previous year’s $164.3 million. This steady cash generation highlights the consistency of the company’s core operations. Free cash flow also remained robust at $146.8 million, reflecting disciplined capital spending with just $16.6 million allocated toward capital expenditures.

On the investing side, the company spent $128.9 million, significantly higher than in prior years, suggesting more aggressive investment activity, possibly related to acquisitions or expansion efforts. Financing activities swung positive at $155.3 million, reversing last year’s large cash outflow. This was driven by new debt issuance of $72.7 million, though repayments of $225.7 million and continued share repurchases kept financial management tight. The end cash position surged to $214.9 million, providing a comfortable liquidity cushion compared to just $22.2 million a year ago.

Analyst Ratings

📈 In recent months, CSW Industrials (CSWI) has seen several adjustments in analyst coverage, reflecting a more cautious stance amid evolving market conditions. 🏛️ Wells Fargo maintained its “Equal Weight” rating but lowered the price target from $350 to $295, citing concerns about valuation and potential headwinds in the industrial sector. 🏢 Similarly, Citigroup reiterated a “Neutral” rating while reducing its target from $364 to $313, pointing to a more tempered growth outlook.

🎯 Despite these revisions, the consensus among analysts remains a “Hold,” with an average price target of approximately $342.50. 📊 This suggests a modest upside from current levels, indicating that while CSWI’s fundamentals are solid, the stock may be fairly valued in the near term. 🧠 Analysts appear to be balancing the company’s strong operational performance with broader market uncertainties, leading to a more neutral outlook.

Earnings Report Summary

CSW Industrials closed out fiscal 2024 with a solid performance, putting up some of the best numbers in the company’s history. Revenue for the fourth quarter came in at $210.9 million, which was a healthy 7.8% jump over the same time last year. Most of that growth came from the company’s core operations, while the rest was boosted by smart acquisitions like Dust Free. Net income wasn’t far behind, rising 17.4% to $31.8 million, and earnings per share landed at $2.04, up 16.9% from the previous year. EBITDA grew 13%, and margins widened to a strong 26.5%, showing that CSWI isn’t just growing — it’s getting more profitable too.

Full-Year Highlights

For the full fiscal year, CSWI reported $792.8 million in revenue, a 4.6% improvement compared to the year before. Adjusted net income came in at $109.1 million, up 13.2%, while adjusted earnings per share reached $7.01, a 12.9% lift. Cash generation was another bright spot. Operating cash flow hit $164.3 million, rising by more than 35% year over year. The company didn’t just sit on that cash either. It invested $32.7 million into acquisitions, spent $16.6 million on capital improvements, and returned $22.3 million to shareholders through stock buybacks and dividends.

Leadership’s Take

CEO Joseph Armes sounded genuinely pleased with how things turned out. He pointed to the company’s smart acquisition strategy and strong organic growth as major reasons for the record-setting year. Armes also made it clear that CSWI’s margin expansion and free cash flow performance are a big part of the playbook going forward. Looking into fiscal 2025, he expects more revenue growth while keeping those healthy margins intact. Armes took a moment to highlight CSWI’s culture too, mentioning that employees collectively own over 5% of the company’s shares, tying the team’s success directly to shareholders’ interests.

Segment Performance

Breaking it down by segments, Contractor Solutions remained the workhorse, delivering $141.2 million in revenue, a 5.4% increase helped by Dust Free’s contribution. Specialized Reliability Solutions also moved higher, posting an 8% gain to $41.6 million. Engineered Building Solutions stole a bit of the spotlight with a 20.4% surge in revenue, totaling $30.1 million. Across the board, each part of the business pulled its weight, showing that CSWI’s growth story isn’t tied to just one market or product line.

Chart Analysis

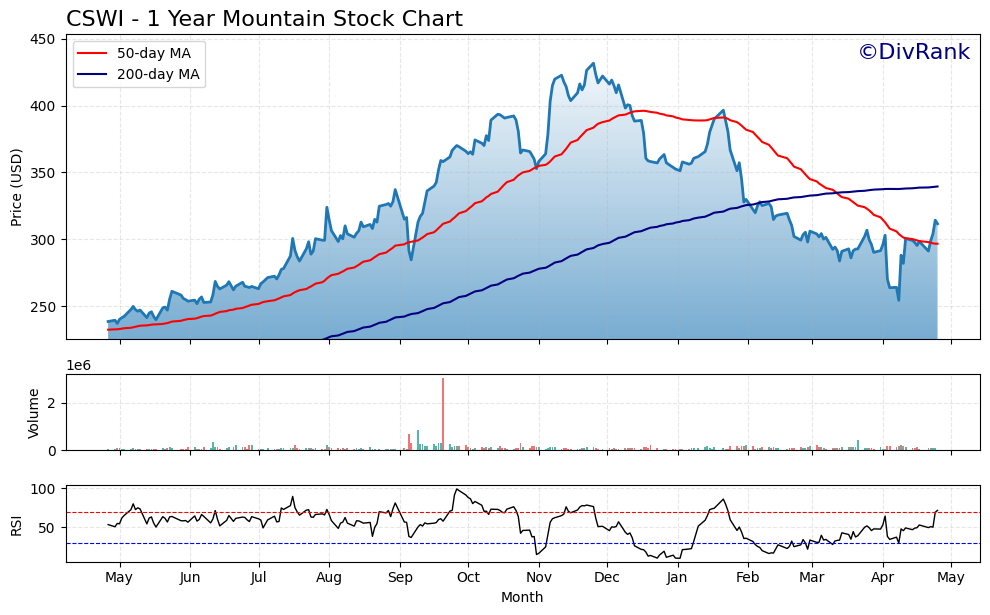

Price Action and Moving Averages

The chart for CSWI over the past year tells a story of strong early momentum followed by a clear reversal and recent attempts at recovery. The stock surged impressively through the summer and into the late fall, pushing well above the $400 mark before rolling over in the winter months. The red 50-day moving average clearly shows this shift, peaking and then turning downward around January, reflecting a loss of short-term momentum.

Meanwhile, the blue 200-day moving average continued to rise into early spring, lagging the price action as expected but now showing signs of flattening out. The downward cross of the 50-day over the 200-day earlier this year—a classic technical warning sign known as a death cross—coincided with a sustained downtrend that bottomed out near the $280 range in April.

What’s notable now is the sharp bounce at the tail end of the chart. Price has jumped above the 50-day average, closing the gap toward the longer-term moving average, suggesting buyers may be stepping back in. Whether this bounce can be sustained or not will depend on what happens as the price approaches that 200-day resistance zone.

Volume and RSI

Volume mostly remained steady throughout the year, with a few standout spikes—particularly around earnings or market-moving events. These bursts in volume, especially the large green spike in the fall, tend to validate the moves they accompany. Recently, the pickup in volume near the bottom could indicate accumulation, especially given the follow-through on price.

Looking at the Relative Strength Index (RSI) on the lower part of the chart, CSWI was clearly overbought during its fall peak, brushing near the 70 line multiple times. It has since spent a good stretch below the midline, showing a period of sustained weakness. But lately, the RSI has pushed up from those low 30s into the upper 60s. This rebound signals increasing strength and positive momentum—though it’s brushing close to overbought territory again.

Current Setup and Technical Outlook

Technically, CSWI has shown resilience by defending its recent lows and staging a quick move higher. The fact that it’s challenging the 50-day moving average from below and closing in on the 200-day is encouraging. If the price can decisively break above and hold that 200-day level, it could mark a shift back toward a more bullish trend after months of downward pressure.

Until that happens, though, the setup remains neutral. There’s promise in the bounce, but still a lot of ground to recover from the peak. Watching how the stock behaves around the long-term moving average, combined with any volume confirmation, will provide a clearer picture of whether this move is the start of a longer-term trend or just a short-lived recovery bounce.

Management Team

CSW Industrials has quietly assembled a management team that tends to fly under the radar but consistently delivers. At the helm is Joseph Armes, who serves as Chairman, CEO, and President. His leadership has been a major factor in shaping the company’s disciplined acquisition strategy and strong capital allocation framework. Under Armes, CSWI has built a reputation for staying focused on profitability rather than chasing top-line growth for its own sake. That mindset is reflected in the company’s lean balance sheet, expanding margins, and cash-generative operations.

What stands out about CSWI’s executive bench is its commitment to long-term planning over short-term optics. The company avoids splashy headlines, instead focusing on building value through operational execution. The leadership team includes a mix of industry veterans and financial experts who have demonstrated they know how to integrate acquisitions efficiently and extract value from them quickly. Another notable trait is the level of insider ownership. Employees, including senior leaders, hold a significant stake in the company. That kind of alignment matters. When leadership has skin in the game, decisions tend to reflect a shareholder-first mindset. It helps explain the company’s steady improvement in free cash flow, rising dividend, and careful balance between growth and capital returns.

Valuation and Stock Performance

CSWI’s stock performance over the past year has been a mix of strength and recalibration. After an impressive run in 2023, the stock pushed toward the 430 mark before cooling off. That pullback has since settled into a more modest trajectory, with the shares recently rebounding from lows around 280. The current price recovery brings CSWI back near the 310 range, reflecting renewed buying interest after a steep correction.

Despite the drawdown, CSWI is still up roughly 30 percent over the past 12 months, which significantly outpaces the broader market. This performance is tied to consistently strong earnings growth, a rock-solid balance sheet, and rising investor confidence in the company’s strategy. With a beta under 1, the stock tends to move less sharply than the overall market — a feature that can be appealing in choppier market conditions.

Valuation, however, isn’t cheap. The stock is trading at a forward price-to-earnings ratio above 40 and a PEG ratio approaching 3. Those numbers reflect a premium multiple, suggesting that the market is pricing in a high degree of confidence in the company’s continued growth. That said, CSWI has historically justified its valuation with consistent earnings beats, expanding margins, and a high return on equity. The question going forward is whether those growth rates can be maintained as the company matures and faces tougher year-over-year comparisons.

Another component of valuation worth watching is the price-to-sales ratio, which remains elevated relative to industrial peers. Investors appear to be paying a premium for quality, reliability, and management’s track record. That premium may narrow if growth slows, but for now, it seems to be supported by operational performance and disciplined execution.

Risks and Considerations

No company is without risk, and CSWI is no exception. While the business is well-diversified across segments and end markets, it’s still closely tied to broader industrial and construction cycles. If demand in those sectors slows, even temporarily, CSWI’s top line could see pressure. Higher interest rates could also play a role in dampening customer activity, particularly in construction-related end markets where financing is key.

Another risk to monitor is integration. The company has made a number of strategic acquisitions in recent years. While it’s done a good job folding those businesses into its broader structure, there’s always the possibility that future deals could take longer to integrate or fail to deliver expected synergies. Given that a portion of CSWI’s recent growth has come from acquisitions, any disruption in execution could impact margins or cash flow.

Input costs also remain a wildcard. Although CSWI has shown strong margin control, volatility in raw material pricing or supply chain disruptions could create temporary setbacks. The company has managed these issues well in the past, but no industrial player is entirely insulated from rising costs or delays.

Finally, valuation is a double-edged sword. The market has rewarded CSWI with a premium multiple, but that comes with expectations. If earnings growth slows or misses estimates, the stock could be vulnerable to sharp corrections. This isn’t a risk unique to CSWI, but it’s worth noting given where the current valuation stands.

Final Thoughts

CSWI isn’t a company that chases headlines, but that’s part of what makes it compelling. It’s carved out a dependable, profitable niche in the industrial space and continues to grow without sacrificing quality. The management team has remained consistent in its strategy — reinvest in the business, acquire selectively, maintain financial discipline, and return capital to shareholders without overextending.

The most recent earnings report points to a company that’s still executing at a high level, generating strong free cash flow, and expanding margins even in a mixed economic environment. Cash generation is being used smartly — funding acquisitions, maintaining a healthy dividend, and providing optionality for future opportunities.

From a valuation standpoint, it’s not a bargain, but high-quality businesses rarely are. CSWI trades at a premium because it’s earned investor trust through performance, not promises. Risks exist, particularly around macro sensitivity and continued integration of new businesses, but the company has shown it can navigate complexity and still come out ahead.

The balance sheet is strong, leadership is aligned with shareholders, and the business model has proven resilient across different cycles. For those focused on long-term durability, consistent cash flow, and solid management execution, CSWI continues to be a company that delivers.