Updated 4/25/25

CRA International, Inc. (CRAI) is a consulting firm with deep expertise across litigation, regulatory economics, and strategic advisory services. With a market cap of around $1.1 billion, it has quietly built a track record of consistent growth, strong cash flow, and shareholder-friendly capital allocation. Over the past year, CRAI has delivered steady revenue gains, solid margins, and a healthy balance between reinvestment and returning capital through dividends and share repurchases. Its leadership team, anchored by CEO Paul Maleh, has guided the company through varied market environments while maintaining focus on sustainable growth. CRAI’s dividend is modest in yield but backed by conservative payout ratios and reliable free cash flow. The stock’s long-term performance reflects disciplined execution, and analysts see continued upside potential supported by recent upgrades and an improving business mix. For long-term investors, CRAI presents a well-run, stable business with consistent financial delivery.

Recent Events

CRA’s latest performance shows why it continues to draw interest from long-term investors. Quarterly revenue jumped over 9% year-over-year, and earnings followed suit with a 30% increase. Those are not small numbers for a consulting business, especially one that relies on high-level advisory contracts.

Net income now stands at around $46.5 million on a trailing twelve-month basis, with earnings per share at $6.74. Profit margins remain healthy at nearly 7%, while operating margins hover above 12%. These margins reflect the premium services CRAI provides—clients come to them not for volume, but for precision.

CRA’s enterprise value has grown from just over $800 million a year ago to nearly $1.2 billion. That expansion mirrors the rising demand for their services and the solid cash flows behind it. On the balance sheet side, there’s a moderate debt load at $103 million, paired with $26.7 million in cash. The current ratio sits just above 1, which isn’t extravagant, but it’s adequate for the type of business they run.

Meanwhile, shares have moved up modestly over the past year, gaining just over 8%. That may not seem like a major leap, but it’s a stable return in a market that’s been anything but predictable.

Key Dividend Metrics

📈 Forward Yield: 1.21%

💰 Annual Dividend: $1.96 per share

🔁 5-Year Average Yield: 1.35%

🧮 Payout Ratio: 25.96%

📅 Most Recent Dividend: March 14, 2025

⏰ Ex-Dividend Date: March 4, 2025

📊 Dividend Growth: Steady and reliable

Dividend Overview

If you’re chasing high yields, CRAI won’t scratch that itch. But if you’re looking for stability, this is where things get interesting. At 1.21%, the yield doesn’t look exciting at first glance. Still, it’s more than just a number—it’s backed by strong earnings and a conservative approach to payouts.

The dividend comes with a low payout ratio of just under 26%. That means there’s plenty of room to keep paying and even increase the dividend over time without cutting into growth or operational needs. CRAI is careful with how it distributes profits, which is exactly what you want in a company operating in a specialized, somewhat cyclical industry.

Even better, the company has maintained a consistent pattern of returning cash to shareholders. It doesn’t chase headlines with massive hikes or one-time specials. Instead, it sticks to a slow-and-steady approach that signals a long-term mindset.

Dividend Growth and Safety

When you zoom out over the past few years, CRAI has gradually bumped its dividend up in step with earnings growth. No flash, just consistency. It’s not the kind of stock you buy for explosive dividend gains, but rather for reliable income that grows at a pace you can count on.

The real highlight here is how safe that dividend looks. The company’s free cash flow came in around $47 million over the past year, more than enough to cover its dividend commitments and leave room for reinvestment or debt reduction. CRAI isn’t running on thin margins or issuing debt to fund shareholder returns. It’s doing it the right way—earning the cash, then paying it out responsibly.

Add to that a business model that’s less tied to traditional economic swings—because litigation and regulatory consulting don’t go out of style when markets dip—and you’ve got a very sturdy foundation for ongoing dividends.

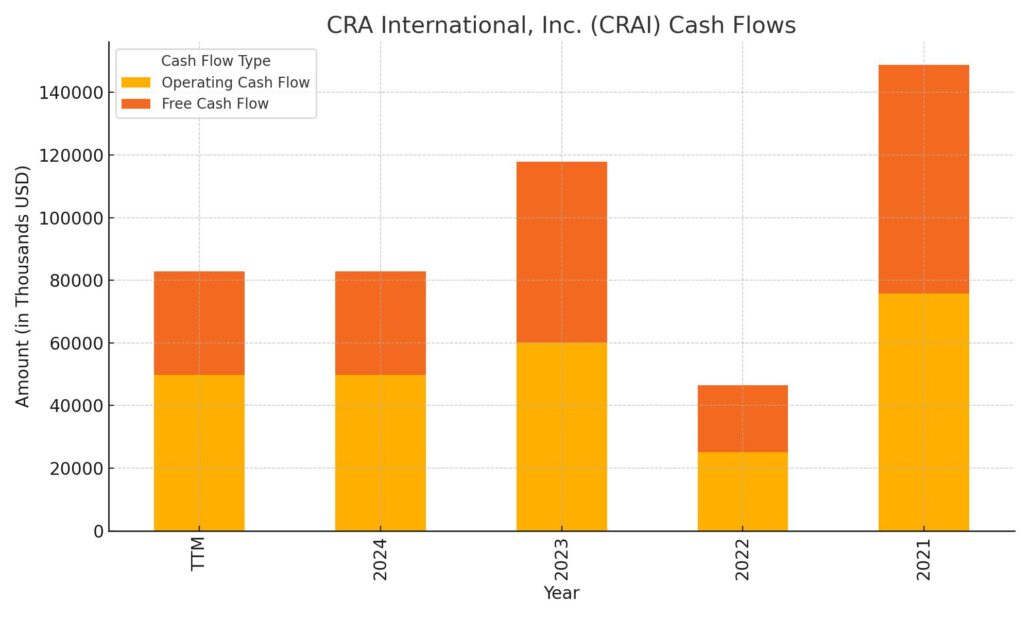

Cash Flow Statement

CRA International’s cash flow profile over the trailing twelve months highlights steady internal cash generation with a focus on maintaining operational strength. Operating cash flow came in at $49.7 million, reflecting consistent profitability and efficient working capital management. While this figure marks a dip from the prior year’s $60 million, it remains comfortably above pre-2022 levels, signaling operational health. Free cash flow for the same period was $33.1 million, which covers the dividend and leaves room for strategic flexibility.

On the investing side, the company spent $18.1 million, mostly on capital expenditures, which is notably higher than the prior year. This suggests a renewed focus on infrastructure or expansion. Financing activity resulted in a $48.9 million outflow, tied largely to dividend payments and share repurchases, keeping in line with a shareholder-friendly approach. The balance of debt issuance and repayment was flat, with $102 million both borrowed and repaid. Ending cash stood at $26.7 million—lower than previous years, but not alarming given the company’s moderate leverage and positive cash generation. Overall, the cash flows show a firm that’s deploying capital responsibly while maintaining its ability to reward shareholders.

Analyst Ratings

📈 CRA International, Inc. (CRAI) has recently received a fresh wave of optimism from analysts, with a notable price target upgrade reflecting growing confidence in the firm’s performance. One research firm moved its target from $212 up to $224 while maintaining an “Outperform” rating. This shift signals not just approval of CRAI’s financial consistency, but also recognition of its strength in carving out profitable niches within the consulting world.

💡 The consensus price target now sits at $224, which suggests analysts see more room for upside from current levels. This isn’t just about technicals or valuation multiples—it’s tied to solid earnings momentum, increasing demand for the company’s litigation and regulatory consulting services, and CRAI’s ability to keep margins healthy in a competitive environment.

📊 What’s helping drive the bullish view is CRAI’s mix of steady revenue growth, disciplined cost control, and a pipeline of client engagements that continues to grow. Their focus on high-value, complex work gives them pricing power and shields them somewhat from cyclical pressures. With these strengths, analysts are signaling that CRAI has more room to run—not with flash, but with firm, calculated steps.

Earning Report Summary

CRA International wrapped up its fiscal year with a solid fourth quarter, showing the kind of steady growth and operational consistency that investors have come to expect from this niche consulting firm. The numbers tell a pretty upbeat story—revenue came in at $176.4 million, up a healthy 9.2% compared to the same quarter last year.

Strong Performance Across Key Areas

A big part of that growth came from strong demand in several of their key service areas. Energy, Finance, and Intellectual Property were standout performers, each putting up double-digit revenue increases. Other segments like Antitrust & Competition Economics, Labor & Employment, and Life Sciences chipped in with gains as well, keeping things balanced across the board.

It wasn’t just one region carrying the weight, either. Both North America and international operations posted growth—7.8% and 15.7%, respectively. That kind of geographic spread helps reduce risk and adds some nice stability to the top line.

Profitability Moves in the Right Direction

Net income rose 30.8% year-over-year to $15 million for the quarter, which works out to $2.18 per diluted share. On an adjusted basis, earnings per share came in at $2.03. EBITDA, which is a good measure of how efficiently the business is running, was up as well—28.4% higher, reaching $24.4 million. That made up nearly 14% of quarterly revenue, showing that margins are holding strong.

Full-Year Results Reflect Momentum

Zooming out to the full year, revenue totaled $687.4 million, which was a 10.2% jump from the prior year. Net income for the year rose to $46.7 million, or $6.74 per diluted share, and adjusted earnings landed at $7.60 per share. EBITDA for the full year was $90.4 million, representing over 13% of total revenue.

That kind of earnings power gives the company a lot of room to maneuver, and they’re putting it to good use. CRAI returned $12.3 million to shareholders through dividends and also bought back about 206,000 shares, spending $33.3 million on the repurchase program.

Looking Ahead

Management laid out revenue guidance for fiscal 2025 in the range of $715 million to $735 million. They’re also targeting an EBITDA margin between 12% and 13%, which suggests they’re aiming to keep performance tight while continuing to invest in growth. Leadership made it clear they see plenty of opportunity ahead, but they’re also aware of the broader economic backdrop and are positioning accordingly.

Overall, the tone from the top was confident but measured—acknowledging challenges, but clearly optimistic about where the company is headed next.

Chart Analysis

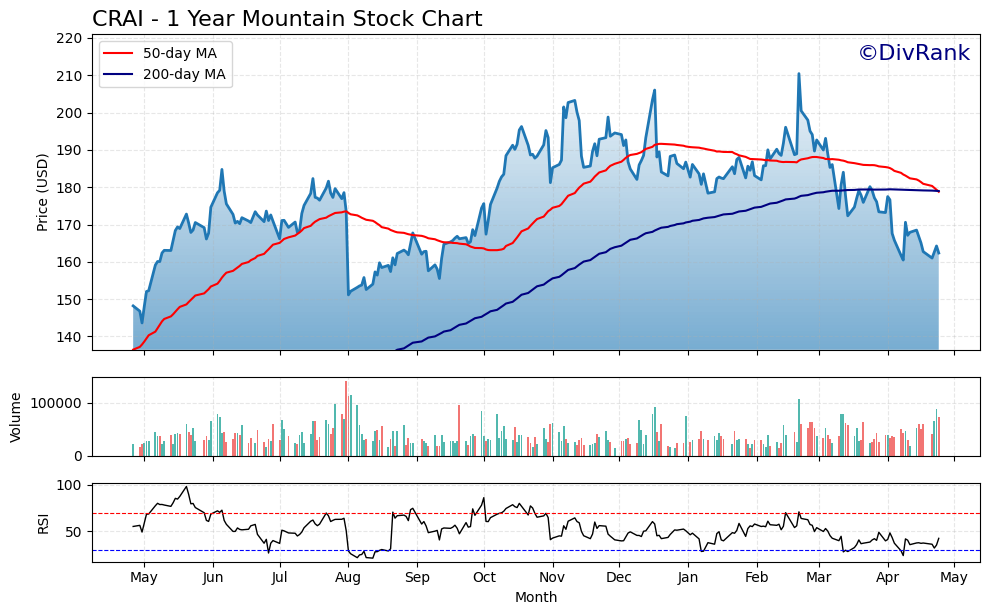

Price Movement and Trend Shifts

CRAI has had a fairly dynamic year, starting from around the $140 level and climbing steadily through the summer, peaking near $210 toward the end of 2023. From there, the trend shifted. The 50-day moving average began flattening in late January and is now in a clear downward slope. Meanwhile, the 200-day moving average, which had been steadily rising, is starting to level off. This crossover of the faster average moving down toward the slower one is a technical sign of momentum fading over the medium term.

Over the past two months, the price has consistently traded below both the 50-day and 200-day averages. That’s often interpreted as a sign of bearish pressure, particularly when the drop is accompanied by a declining trend in volume, as seen in April. The price action shows lower highs and lower lows, suggesting a loss of strength after last year’s rally.

Volume and Participation

Volume has been relatively stable, though noticeably thinner through much of April. A spike in volume tends to confirm strong moves, and the absence of that in recent selloffs points more to a slow drift down than panic selling. The heavier volume in late summer and again in early January corresponds with some of the more volatile price moves, and those higher participation days were largely on green candles, reflecting prior accumulation.

Now, with price pulling back and volume drying up a bit, the chart is showing signs of indecision rather than urgency. This might be part of a broader consolidation phase or a pause before a further leg lower.

RSI and Momentum

The RSI is hovering near the oversold zone at the bottom of the chart. It dipped below 30 in late April and is now trying to claw back above that level. When RSI is this low, it can often suggest the stock is technically oversold and due for a bounce, but that alone isn’t enough to signal a reversal. Instead, it shows momentum has cooled significantly.

Earlier in the year, RSI stayed mostly in the mid-to-high range, often approaching overbought during upward stretches. The shift downward reinforces what we’re seeing in the price action and moving averages: a transition from strength to weakness.

Current Position

The most recent candles are testing support near the $160 range with a few long lower wicks, indicating some buying interest at those levels. Still, these candles are small, showing uncertainty and lack of conviction from buyers. Without a change in trend or a spike in volume, the current setup doesn’t yet show a strong push back toward previous highs. Instead, this looks like a stock that is cooling off after a solid run and may be entering a reset phase.

Management Team

CRA International is led by Paul Maleh, who has been with the company for over three decades and has served as CEO and Chairman since 2009. Under his leadership, CRAI has evolved into a highly regarded consulting firm with a strong presence in areas like antitrust, energy, and financial services. Maleh has been instrumental in guiding the company through various economic cycles, maintaining focus on long-term value creation and operational discipline.

Supporting him is a leadership team with deep experience in both consulting and corporate strategy. Executives such as Chad Holmes, who holds a key role in corporate development, help drive strategic initiatives and expand client relationships. The continuity within CRAI’s senior management has provided a stable foundation, which is often reflected in the company’s ability to deliver consistent earnings and maintain a strong client base. The leadership approach here leans conservative, focused more on measured growth and sustainable profitability than chasing trends.

Valuation and Stock Performance

CRAI shares are currently trading around the $164 level, which places them closer to the lower end of their 52-week range. That said, the long-term view shows meaningful appreciation, with the stock having delivered a cumulative return of nearly 300% over the past five years. This performance has been fueled by expanding revenue streams, consistent cash flow, and operational efficiency.

From a valuation standpoint, the stock isn’t overpriced. The trailing price-to-earnings ratio sits in the mid-20s, and forward P/E is lower, suggesting expectations for future earnings growth. The PEG ratio—factoring in expected growth—is moderate, implying the market isn’t being overly optimistic but does recognize the steady track record CRAI has built. Compared to other professional services firms, the valuation feels balanced. Not cheap, but certainly not stretched either.

The stock’s beta is under 1, which speaks to relatively modest volatility. That fits the profile of a business rooted in long-term contracts and specialized services. While not immune to broader market swings, CRAI tends to move with a bit more stability than companies tied to more cyclical sectors.

Risks and Considerations

Like any company in the professional services space, CRAI faces its share of risks. Chief among them is talent retention. The firm’s core value lies in its human capital—its ability to deliver specialized insights depends heavily on attracting and keeping top-tier consultants. In an increasingly competitive market for skilled professionals, that’s not always easy.

Another consideration is economic sensitivity. While consulting isn’t as cyclical as industries like manufacturing or retail, it isn’t completely insulated either. During slower economic periods, clients may pull back on discretionary spending, including advisory services. That could weigh on project volume or pricing.

International exposure adds opportunity but also complexity. Currency fluctuations, regulatory differences, and geopolitical tensions can all affect project outcomes and profitability. The firm will need to continue managing these elements carefully as it grows its global footprint.

Also worth noting is the fragmented nature of the consulting industry. While CRAI has carved out a strong niche, it’s operating alongside many regional and global players. Staying differentiated and ahead of client needs will be key to long-term growth.

Final Thoughts

CRA International continues to stand out for its consistent performance and measured approach to growth. The company doesn’t try to be all things to all clients—it focuses on areas where it can deliver value, and that strategy has worked well. The leadership team brings stability and a long-term mindset, which is reflected in how the business allocates capital and returns value to shareholders.

The stock has held up relatively well in a volatile market, and while it may not shoot higher overnight, it’s shown that slow, steady progress can lead to meaningful long-term returns. As with any investment, there are variables to keep an eye on, but CRAI has shown a reliable ability to manage through them.

For investors looking at companies that prioritize sustainable operations and thoughtful capital management, CRA International offers a compelling example of what steady execution looks like.