Updated 4/25/25

Coterra Energy Inc. (CTRA) combines oil and natural gas production across major U.S. basins with a disciplined approach to capital and shareholder returns. Formed through the merger of Cimarex Energy and Cabot Oil & Gas, the company has built a reputation around operational efficiency, strong free cash flow, and a steady dividend payout. Backed by a seasoned management team and a conservative balance sheet, Coterra has remained resilient through commodity cycles. Its valuation is modest relative to earnings and cash flow, while a flexible dividend policy and significant liquidity support long-term capital return plans. With production growth underway and improved cost efficiency from recent acquisitions, CTRA offers a mix of stability and strategic growth potential.

Recent Events

As of late April, CTRA is trading at $25.46, barely moving in pre-market. This sort of price action might seem unexciting, but that’s part of the appeal. In a sector known for volatility, Coterra has shown a steadier hand. There’s been a modest dip in market cap since the highs of late 2023, slipping from around $21 billion to $19.45 billion today. But with commodity prices cooling and the broader energy sector treading water, that drop hasn’t hurt the fundamentals.

The company continues to hold more than $2 billion in cash, giving it significant flexibility. Whether it’s returning capital to shareholders, investing back into production, or simply staying ready for whatever the market throws next, that kind of liquidity is a cushion most E&Ps would love to have.

Key Dividend Metrics

📈 Forward Yield: 3.46%

💵 Trailing Yield: 3.31%

📆 5-Year Average Yield: 4.34%

📊 Payout Ratio: 56%

📅 Next Dividend Date: March 27, 2025

🔁 Most Recent Ex-Dividend: March 13, 2025

📉 Dividend Growth YoY: Flat

💰 Cash on Hand: $2.04B

💳 Debt/Equity: 28.96%

Dividend Overview

Coterra’s forward dividend yield of 3.46% isn’t going to turn heads the way a double-digit yield might, but it’s the kind of number income investors can appreciate—dependable, modest, and sustainable. The company doesn’t tie itself to a rigid dividend structure. Instead, it runs a hybrid approach, blending a base dividend with variable components depending on how well the company performs.

The most recent dividend came through on March 27, 2025, after going ex-dividend earlier that month. This follows a fairly consistent payout rhythm, which makes it easier for investors who count on regular income.

What’s interesting is that while the trailing yield is a touch below its five-year average, that average includes periods of unusually high variable payouts. So the current numbers, while not explosive, actually reflect a much more realistic baseline. They show a company that isn’t overreaching and one that’s set up to continue paying in a variety of market conditions.

Dividend Growth and Safety

Let’s be real—CTRA hasn’t grown its dividend in the traditional sense over the past year. The base payout has stayed put, and the variable portion has been trimmed. But that’s not necessarily a red flag. It’s a signal that management is prioritizing sustainability over stretch goals. And in a world where natural gas prices have been under pressure, that’s a refreshing stance.

On the safety side, Coterra is solid. With a debt-to-equity ratio sitting comfortably under 30%, and over $2 billion in the bank, the balance sheet gives plenty of breathing room. Add to that the $2.8 billion in operating cash flow and $744 million in levered free cash flow over the last twelve months, and you’ve got a company that can easily support its dividend with room to spare.

This isn’t a high-wire act. The payout ratio is at 56%, a sign that there’s still cash left to reinvest and protect the core business. That’s the kind of margin of safety that income investors appreciate—especially when other companies in the space are stretching to maintain flashy yields.

Coterra’s natural gas-heavy portfolio might not be ideal right now, given where prices are, but that could easily swing in its favor down the road. The company’s diversified position across energy basins means it can adjust as needed, keeping the dividend steady and potentially upping it if conditions improve.

There’s also something to be said for how the stock trades. With a beta of just 0.46, CTRA tends to move more quietly than the broader market. That lower volatility adds another layer of comfort for those who rely on steady income. Institutions clearly like what they see too—over 91% of the float is institutionally owned, which helps explain the relatively low short interest and consistent daily volume.

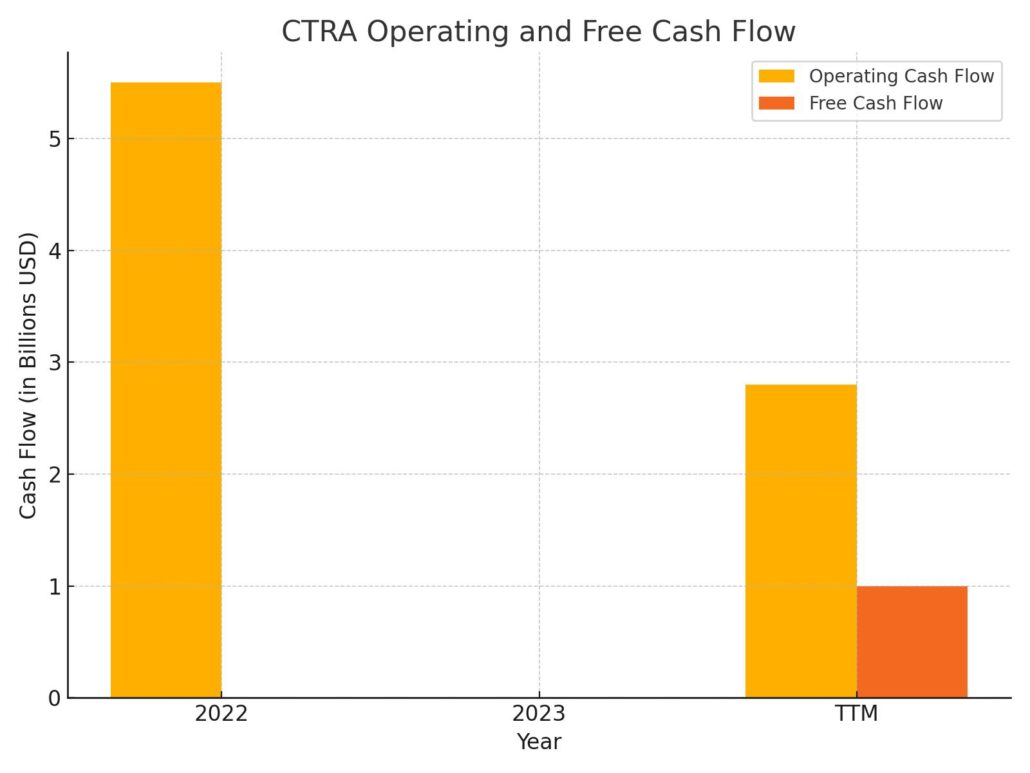

Cash Flow Statement

Coterra Energy generated $2.8 billion in operating cash flow over the trailing twelve months, a healthy figure that shows the company is still producing robust cash from its core operations despite lower energy prices. While this represents a decline from its 2022 high of $5.5 billion, it’s more in line with pre-2022 levels and still provides a solid foundation for covering dividends and reinvestment. Free cash flow came in at just over $1 billion, reflecting significant but controlled capital expenditures of $1.77 billion.

Investing cash flow was negative $1.76 billion, consistent with capital investments in production and infrastructure. On the financing side, Coterra showed a shift from heavy outflows in prior years to a positive $279 million, largely due to a $1.99 billion debt issuance that more than offset repayments. The company’s cash position has improved meaningfully, ending the period with $2.28 billion on hand, up from just $965 million a year earlier. This kind of liquidity offers flexibility moving forward and reinforces the safety of the current dividend payout.

Analyst Ratings

📊 Coterra Energy (CTRA) has recently experienced a mix of analyst updates, reflecting a cautiously optimistic view of its future potential. The current consensus price target sits at $34.00, pointing to a possible upside of roughly 33.65% from its current trading level near $25.44.

📈 Barclays recently adjusted its price target from $38 down to $37, while keeping an Overweight rating. This update reflects a shift in macro expectations, particularly assumptions around oil prices, which are now projected at $60 per barrel for 2025 and $65 for 2026.

📉 Raymond James also revised its target downward from $37 to $33, though it held firm on its Outperform rating. UBS made a similar move, lowering its target from $33 to $32 while maintaining a Buy rating. These actions reflect broader market caution more than any company-specific weakness.

💼 The main reason for these target adjustments is tied to anticipated shifts in commodity prices and the global demand landscape. Despite this, analysts continue to view Coterra’s fundamentals positively. Strong cash flow, a solid balance sheet, and operational efficiency remain key strengths that bolster its long-term investment case.

📌 While the trimmed price targets may signal short-term caution, analyst sentiment remains largely supportive. The prevailing recommendation continues to be a Moderate Buy, with most analysts betting on Coterra’s ability to navigate a volatile energy environment while maintaining shareholder returns.

Earnings Report Summary

A Solid Finish to the Year

Coterra Energy closed out 2024 on a strong note, delivering results that speak to steady operations and sharp execution. Net income came in at $297 million, or $0.40 per share, with adjusted earnings of $358 million, or $0.49 per share. Production for the quarter hit 682,000 barrels of oil equivalent per day, topping the high end of their guidance. That kind of consistency matters, especially in a volatile energy environment.

Spending Smart, Returning Cash

One thing that stood out was how tightly Coterra managed its capital. They spent $417 million in capex—right at the low end of their guidance—which helped generate $351 million in free cash flow. Out of that, $218 million was returned to shareholders through dividends and buybacks. That’s over 60% of the quarter’s free cash flow going right back to investors.

What’s more, they raised the dividend by 5%, bringing it to $0.22 per share quarterly. That bumps the annualized payout to $0.88, signaling confidence in both the business and its long-term cash generation.

Laying Out the Road Ahead

Looking into 2025, the company expects to spend between $2.1 and $2.4 billion. That’s in line with their long-term capital framework and includes some cost efficiencies they’re starting to realize—especially in the Permian Basin. They mentioned saving about $70 million in drilling and completion costs, thanks to better service pricing and integration benefits from recent acquisitions.

On the production side, Coterra is guiding for around 9% growth in total output. Oil is the real driver here, projected to jump by 47% year over year. Natural gas, on the other hand, is expected to hold steady. Recent asset additions, especially in the Delaware Basin, are giving them more room to run.

Leadership’s Take

CEO Tom Jorden shared some upbeat reflections on the quarter. He pointed to the smooth integration of new assets and called out a major 57-well development they wrapped up in Culberson County. His focus is clear—keep operations tight, allocate capital wisely, and keep delivering for shareholders.

He also laid out a refreshed three-year outlook through 2027. The plan calls for 5% or more average annual oil growth, while keeping capital spending in that $2.1 to $2.4 billion range. The goal is to stay under a 50% reinvestment rate, so they can keep generating free cash flow to support dividends, buybacks, and debt reduction.

All in all, Coterra seems to be balancing growth and discipline pretty well. The company isn’t chasing headlines but is building value quietly and methodically—something long-term investors can appreciate.

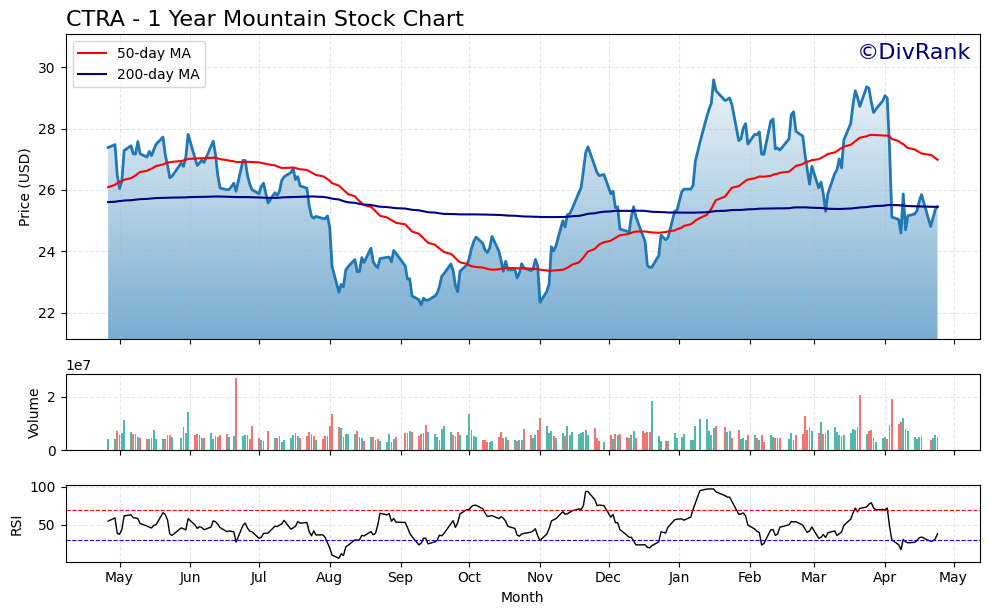

Chart Analysis

Price Action and Moving Averages

CTRA’s one-year chart paints a story of sideways movement with a few sharp pivots. The price opened last May hovering above $26 and showed early resilience, trending higher into the summer. That uptrend lost steam by late June as the stock began slipping beneath its 50-day moving average. What followed was a prolonged decline that continued into October, when the price bottomed near $22—coinciding with a significant drop below both the 50-day and 200-day moving averages.

From there, the stock began to fight its way back. By early December, it had crossed above the 50-day average again, staging a recovery that peaked in late January with a run toward $29. The 200-day moving average remained fairly stable through this period, acting as a neutral anchor.

More recently, the price slipped back below both moving averages in April. The 50-day average, now trending downward again, is showing signs of weakness. The 200-day remains mostly flat, which suggests the longer-term trend hasn’t broken decisively either way. This current behavior reflects a market in search of direction.

Volume Behavior

Volume throughout the year appears steady, with no extreme spikes outside of a few brief periods—especially in November and March—when trading activity ramped up. Those surges in volume also coincided with price volatility, suggesting some larger institutional interest or positioning changes during those times. The consistency of volume otherwise suggests steady participation without speculative froth.

Relative Strength Index (RSI)

Looking at the RSI, CTRA has spent most of the year oscillating between 40 and 70. It dipped into oversold territory in late September, right when the price hit its yearly lows, and again briefly in early April. That level around 30 acted as a support zone for momentum.

On the flip side, the RSI reached overbought conditions twice—once in early December and again in late January—lining up with the price peaks in those same periods. Since mid-April, the RSI has hovered around the 50 line, signaling indecision and a lack of strong momentum in either direction.

Overall Impression

The chart suggests that CTRA is navigating a period of consolidation after a volatile year. The broader range seems to be between $22 and $29, and price action currently sits in the lower half of that range. Neither bulls nor bears have seized full control, and the flattening of the 200-day average echoes that sentiment.

Momentum has cooled, and there’s no immediate signal of a breakout. However, the stock’s ability to hold support near $24 and avoid deeper breakdowns is a positive. While not flashing green lights for strong upside right now, the chart shows resilience, a lack of panic selling, and a steady hand in terms of investor behavior.

Management Team

Coterra Energy is steered by a seasoned leadership team with deep experience across the energy landscape. At the top is Tom Jorden, who serves as Chairman, CEO, and President. He played a key role in the formation of Coterra, having previously led Cimarex Energy. Jorden’s background in geophysics and a career that spans multiple decades in the industry help ground the company’s direction in technical understanding and long-term strategy.

Supporting him is Shane Young, the Executive Vice President and CFO. Young’s background in investment banking and previous CFO roles in upstream energy makes him a solid steward of Coterra’s financial health. His focus has remained on maintaining discipline in capital allocation and sustaining shareholder returns through the cycle.

Stephen Bell serves as Executive Vice President of Business Development and brings a strong track record of corporate growth. Andrea Alexander, as Senior Vice President and Chief Human Resources Officer, ensures the organizational culture aligns with the company’s operational goals. On the operational front, Michael DeShazer leads as SVP of Business Units, keeping production on track across the company’s basins. Meanwhile, Kevin Smith, the Chief Technology Officer, drives innovation—an increasingly important area for an industry navigating efficiency and environmental demands.

It’s a leadership team that combines strategic thinking with on-the-ground experience, and that blend has helped Coterra stay nimble yet steady in a complex energy environment.

Valuation and Stock Performance

Coterra’s valuation today suggests a company that’s trading at a discount to its intrinsic potential. Its forward P/E ratio of just under 9 reflects a stock that is still reasonably priced compared to peers, particularly given its consistent cash flow generation and lean cost structure.

The stock has been range-bound over the past year, bouncing between the low $20s and high $20s. It hasn’t been a runaway performer, but it also hasn’t broken down in the face of softer commodity prices. That kind of resilience, especially in a cyclical sector, says something about investor confidence and how the market values Coterra’s stability.

On a technical level, the stock is holding near its long-term moving averages and has avoided major sell-offs. That supports the view of a name that is consolidating rather than declining. The average analyst price target hovers in the low-to-mid $30s, suggesting room for appreciation if the company continues executing at current levels.

Meanwhile, the dividend yield sits around 3.5%, and that’s been supported by consistent free cash flow. With more than $2 billion in cash on hand, there’s a strong foundation to maintain and possibly grow that payout, particularly if natural gas prices stabilize or trend higher in the coming quarters.

Risks and Considerations

As with any company operating in the energy space, there are risks investors should weigh. Commodity prices are the most obvious. Coterra is exposed to fluctuations in both oil and natural gas, and pricing cycles can have a major impact on cash flow and profitability. The company has mitigated some of this through hedging and basin diversification, but it remains a key consideration.

Regulatory pressure is another wildcard. As environmental standards evolve, particularly around emissions and groundwater protection, compliance costs could rise. Coterra has had to address legacy issues in places like Dimock, Pennsylvania, where operations drew public and legal scrutiny. To its credit, the company has invested in infrastructure and remediation in response, and has become more proactive in community engagement.

Operational risks also exist, including weather disruptions, equipment failures, or delays in permitting. That said, Coterra’s multi-basin presence offers a measure of insulation, allowing production to shift between assets if needed.

Financially, the company is in good shape, but in a cyclical business, discipline is always key. Any prolonged downturn in commodity prices could test the limits of capital efficiency and force changes in spending or payouts. For now, the balance sheet and cost controls appear robust, but as always, conditions can shift quickly in this sector.

Final Thoughts

Coterra Energy may not always steal the spotlight, but it has built a business with staying power. The management team is experienced and focused, the operations are efficient, and the capital strategy leans toward prudence rather than flash.

Valuation remains attractive, and while the stock hasn’t broken out of its range, it also hasn’t given investors much reason for concern. It’s the kind of name that rewards patience, especially for those who prioritize stability and income over speculation.

Of course, risks remain—this is the energy sector after all—but Coterra has weathered cycles before and appears well-positioned to do so again. With strong fundamentals, a shareholder-focused approach, and leadership that understands the landscape, it’s a company that continues to quietly deliver.