Key Takeaways

🌱 Dividend yield of 0.53% supported by steady growth, a low payout ratio (27%), and periodic special dividends.

💵 Robust free cash flow of $6.93 billion comfortably covers dividends and supports continued expansion.

📊 Analysts remain positive, giving Costco an average price target of $1,024, citing strong sales momentum and operational reliability.

📈 Recent quarterly earnings solid, with net sales up over 9%, driven by strong U.S. comps and surging e-commerce growth.

👔 CEO Ron Vachris leads a seasoned management team emphasizing disciplined expansion, efficiency, and long-term member loyalty.

Updated 4/25/25

Costco Wholesale Corporation (COST) has steadily built a reputation as one of the most reliable names in retail, with a business model rooted in volume, efficiency, and customer loyalty. Over the past year, the stock has gained nearly 34%, supported by strong financial performance, consistent earnings, and a disciplined approach to expansion.

Revenue in the most recent quarter reached $62.53 billion, driven by robust U.S. sales and a 20% jump in e-commerce. The company’s low payout ratio, healthy free cash flow of $6.93 billion, and a growing cash position reinforce its dividend stability. With CEO Ron Vachris now leading a seasoned management team, Costco continues to focus on long-term growth and operational consistency. While valuation remains elevated, analyst sentiment reflects confidence in its future trajectory, especially with new store openings and a strong membership base fueling continued momentum.

Recent Events

Costco just keeps doing what it does best—running an efficient, high-volume retail business. In the most recent quarter, revenue came in at a staggering $264 billion over the trailing twelve months. That’s no small feat, especially in today’s cost-conscious consumer landscape. Even with inflationary pressures, Costco kept its profit margin steady at 2.89% and its operating margin at 3.63%.

Diluted earnings per share now sit at $17.17, with a modest 2.6% increase from the same period last year. It’s not jaw-dropping growth, but it’s consistent, and that’s what matters to income-focused investors.

Financially, the company is in a great place. With a market cap around $432 billion and cash on hand totaling over $13 billion, there’s plenty of dry powder available. Debt is managed responsibly, sitting at $8 billion with a debt-to-equity ratio under 32%. In other words, this is a financially healthy company with all the right ingredients to keep paying and potentially increasing its dividend.

Key Dividend Metrics

🪙 Forward Annual Dividend Rate: $5.20

📉 Forward Yield: 0.53%

📈 5-Year Average Yield: 0.66%

📅 Next Dividend Date: May 16, 2025

🔻 Ex-Dividend Date: May 2, 2025

🧾 Payout Ratio: 27.09%

📊 Trailing 12-Month Dividend Rate: $4.50

⚖️ Dividend Growth Trend: Steady with special dividends

💰 Cash on Hand: $13.16B

🔐 Debt Management: Strong and conservative

Dividend Overview

Costco’s dividend isn’t about grabbing attention with a high yield—it’s about staying power. The current yield sits at just over half a percent, but don’t let that discourage you. This is a company that pays what it can afford to, and it does so with discipline.

Right now, the annual dividend sits at $5.20 per share, and it’s well-covered by earnings. With a payout ratio hovering around 27%, Costco has plenty of room to maintain—and even increase—its dividend regardless of what the market throws its way.

Another reason dividend investors stick with Costco? Special dividends. Every few years, the company surprises shareholders with a one-time, oversized payout. These aren’t guaranteed, but they’ve happened enough times over the past decade that long-term investors have come to view them as part of the Costco experience.

And it makes sense. Costco’s business throws off a ton of cash. With over $5.6 billion in free cash flow and $12 billion in operating cash flow, they have the flexibility to reward shareholders without straining the balance sheet.

Dividend Growth and Safety

When it comes to dividend safety, Costco is about as dependable as they come. This is a company that thrives on routine and efficiency. Its core membership model provides a reliable revenue stream, and people keep renewing because they get value out of it. That recurring income helps smooth out the ups and downs of the broader retail environment.

The dividend itself has grown steadily over the years. It’s not the kind of double-digit annual hike you might see from smaller companies trying to catch investor attention, but it’s consistent. Costco raises the dividend each year in a slow and deliberate way, which is exactly the approach many income investors prefer.

With low debt levels, a conservative payout ratio, and billions in available cash, the dividend is in no danger. Even in tougher economic climates, Costco’s fundamentals provide a strong buffer.

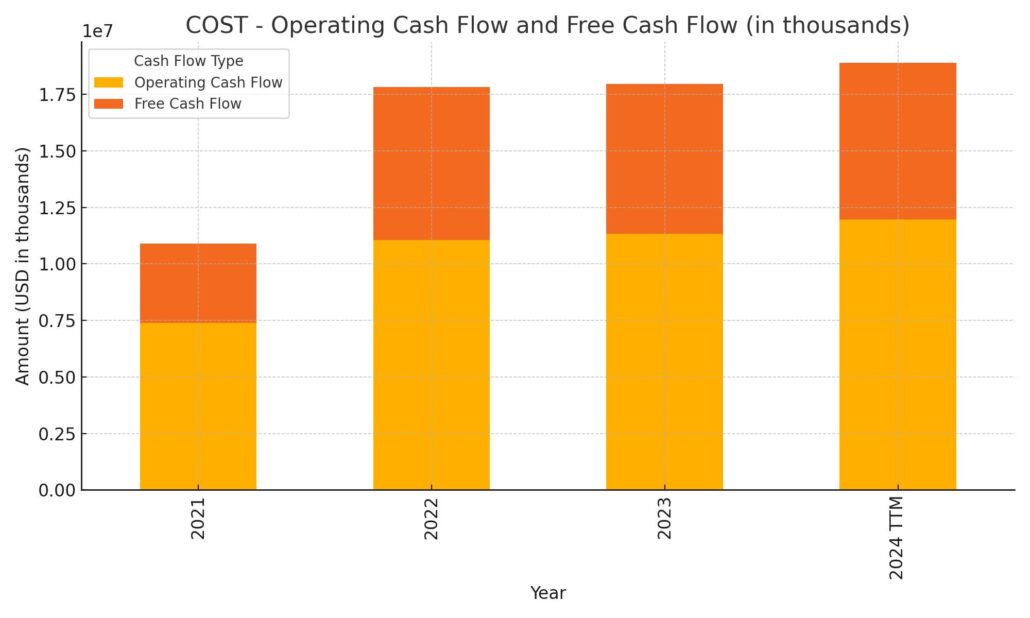

Cash Flow Statement

Costco’s trailing 12-month cash flow statement shows the strength of its core operations, generating $11.97 billion in operating cash flow—its highest level yet. This marks continued growth from previous years, reflecting solid topline performance and efficient cost management. Despite ongoing capital investments totaling $5.04 billion, the company still produced a healthy $6.93 billion in free cash flow. These figures suggest Costco is comfortably funding its expansion while still maintaining a strong cash cushion.

On the financing side, outflows totaled $3.95 billion, much lighter than the prior year’s $10.76 billion, which included larger one-time payments. Debt repayment exceeded new borrowing, aligning with Costco’s cautious approach to leverage. The company ended the period with $12.45 billion in cash on hand, a noticeable bump from last year’s $9.91 billion. This growing cash position provides added flexibility for dividends, special distributions, or reinvestment without strain.

Analyst Ratings

📈 Costco’s stock has recently seen a mix of analyst activity, reflecting both confidence in its fundamentals and caution around valuation. 🎯 The consensus 12-month price target now stands at approximately $1,024, suggesting a modest upside from current levels. This average comes from a spread of estimates, with the highest target reaching $1,205 and the lowest around $890.

📊 In early April, one major firm initiated coverage with a neutral rating and a $975 price target, which matched the stock’s trading range at that point. Another firm, known for its cautious stance, adjusted its price target down from $1,150 to $1,045, although it maintained a buy rating. A third research group lowered its target slightly to $1,035 from $1,075, pointing to valuation pressures even as the company continues to perform well operationally.

💼 On the bullish side, one of the big Wall Street banks held firm on its overweight rating, highlighting strong March sales numbers and Costco’s ongoing gains in market share. Another global institution backed this view, citing the retailer’s proven ability to navigate through macroeconomic uncertainty and its consistent resilience in various retail environments.

🔍 Overall, analysts remain largely supportive of Costco’s business model and execution. The stock continues to attract long-term confidence, though its lofty valuation is something being watched closely.

Earnings Report Summary

Strong Sales Across the Board

Costco had another solid quarter, showing why it continues to earn the trust of both shoppers and investors. In the second fiscal quarter of 2025, the company pulled in $62.53 billion in net sales, a jump of over 9% from the same period last year. That kind of growth isn’t easy to come by in retail these days, but Costco’s focus on value and efficiency continues to pay off.

Net income came in at $1.79 billion, or $4.02 per share, up from $3.92 a year ago. These gains were driven by steady performance across its warehouses, with comparable store sales rising 6.8% overall. In the U.S. alone, comps were even stronger at 8.3%. One standout was online shopping, which surged by more than 20% compared to last year—a clear sign that Costco’s digital strategy is gaining traction.

Leadership’s Take and Looking Ahead

During the earnings call, CFO Gary Millerchip shared that customer behavior hasn’t shifted much—members are still seeking value, and they’re showing loyalty to the Costco brand. He pointed out that inflationary pressures are being managed well and that core categories continue to show strength.

CEO Ron Vachris also chimed in, addressing some of the broader challenges like tariffs and supply chain volatility. Despite those hurdles, he sounded optimistic. Certain areas like electronics and premium meat were highlighted as strong performers, even as parts of the retail industry remain under pressure. The message was clear: Costco isn’t just surviving—it’s adapting and finding ways to grow.

The company also announced plans to open 28 new locations this fiscal year, one of which will be its 900th store. That milestone isn’t just a number—it shows how committed Costco is to reaching new markets and expanding its membership base. With steady financials and continued growth plans, Costco’s leadership seems confident about the road ahead.

Chart Analysis

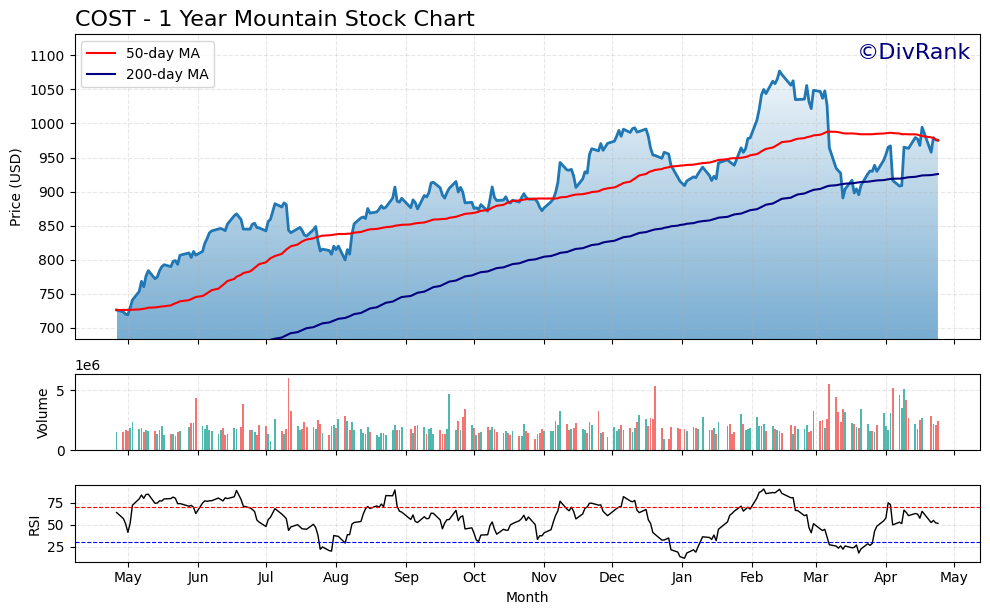

Price Movement and Trend Structure

COST has demonstrated a steady and impressive climb over the past year, moving from just under $720 to peaking above $1100 before pulling back. The stock has shown a consistent pattern of higher highs and higher lows, which is typical of a healthy long-term uptrend. What stands out is the consistent respect shown to the 50-day moving average (red line), especially from May through February. This moving average acted as dynamic support for months, with only brief periods of violation.

In recent months, however, there’s been some shifting behavior. The price pulled back sharply in March, breaking below both the 50-day and 200-day moving averages for a short stretch. It’s since bounced back above the 200-day and is now flirting with the 50-day once again. This suggests a possible consolidation phase where the stock is recalibrating after a strong run.

Volume and Participation

Volume spikes in March coincide with the price dip, showing that sellers briefly gained control. That said, volume has normalized since, and buyers seem to have stepped in around the 880–900 level. This kind of volume reaction supports the idea that the recent correction wasn’t a breakdown, but rather a pause or breather in a longer-term move.

The steadiness of the volume through the year—with only occasional surges—indicates controlled institutional activity rather than panic-driven movement. This kind of trading activity adds confidence in the underlying strength of the trend.

RSI and Momentum Shift

Looking at the RSI (Relative Strength Index) in the lower section, it stayed mostly above 50 through the second half of last year, which aligned with the strong upward price momentum. In March, the RSI dropped sharply, hitting the oversold zone briefly. But just as quickly, it reversed and moved back toward the midpoint, signaling a shift in momentum.

At present, the RSI is hovering close to neutral, suggesting there’s no immediate overbought or oversold pressure. That supports the idea that the stock might be forming a base around current levels. It also tells us that short-term sentiment is more balanced now after the sharp volatility earlier in the year.

Overall Technical Behavior

COST appears to be transitioning out of a strong markup phase into a period of consolidation. This is not unusual after such an extended run. The way it has held above the 200-day moving average, despite recent volatility, shows underlying strength. The bounce from March lows has been measured, with higher lows now forming again, which could be a foundation for the next leg higher.

The stock is holding key support levels and resetting momentum, which is a healthy technical setup for names that have already experienced a big move. The current action suggests patience and watchfulness are key at this stage, especially with the 50-day moving average acting as a battleground.

Management Team

Costco’s leadership continues to be one of its strongest assets. At the helm is Ron Vachris, who became CEO in early 2024. His rise through the ranks—from a forklift driver at Price Club to the top job—is a story that mirrors Costco’s own commitment to internal development and operational discipline. Vachris knows the business inside and out, and his approach reflects continuity rather than change. Under his guidance, the company has maintained its focus on growth, value, and operational consistency.

Working closely with him is CFO Gary Millerchip, who brings a steady hand to Costco’s financial strategy. He’s been instrumental in managing the balance between shareholder returns and reinvestment, especially during periods of cost inflation and global uncertainty. What sets this management team apart is how in tune they are with the company’s core identity—keeping prices low, treating employees well, and scaling sustainably. There’s a real sense of alignment from top to bottom, which is rare in a company of this size.

Valuation and Stock Performance

Costco’s stock isn’t cheap—and hasn’t been for a while. It currently trades at a trailing price-to-earnings ratio near 57 and a forward P/E around 54. These aren’t bargain-basement levels, but they reflect the premium investors are willing to pay for reliability and predictable growth. The stock has appreciated nearly 34 percent over the last year, outpacing the broader market by a wide margin. Even with a recent pullback from its all-time highs, Costco’s valuation remains elevated compared to historical norms.

Market capitalization now sits north of $430 billion, and enterprise value isn’t far behind. Analysts have pegged the average 12-month price target at just over $1,020, which suggests room for moderate upside. Some have higher targets closer to $1,200, while others remain more conservative given the valuation. Still, even at these levels, investor sentiment remains positive. Costco’s ability to generate consistent cash flow and its track record of measured expansion support the case for its premium pricing.

Costco’s long-term performance on the chart mirrors its business model—steady, deliberate, and largely resilient to short-term noise. It doesn’t offer the kind of volatility or rapid upside you might find in high-growth tech, but it also doesn’t tend to suffer from wide drawdowns unless the broader market is in distress.

Risks and Considerations

Even companies with Costco’s reputation and track record carry risk. One of the biggest is its valuation. When a stock trades at a premium, expectations are high—and any misstep can lead to a disproportionate reaction. While Costco has handled that pressure well so far, it’s something worth keeping in mind.

There’s also the macroeconomic picture. Slower consumer spending, especially in discretionary areas, could weigh on growth. While Costco is known for essentials, it’s not immune to a pullback in overall household spending. Inflation, interest rates, and changing employment dynamics all feed into that picture.

Another area to watch is competition. While Costco holds a unique spot in the retail space, it still contends with other warehouse clubs, grocery chains, and an increasingly aggressive online market. It has made strides in e-commerce, but digital retail isn’t its primary strength—and that could become more important in the years ahead.

Supply chain issues are a lingering concern too. Global disruptions have improved somewhat, but any flare-ups could strain Costco’s pricing model. Tariffs, logistics bottlenecks, or international unrest can all impact costs, and while Costco is good at managing those, they aren’t entirely avoidable.

Final Thoughts

Costco continues to stand out as a business that simply gets the fundamentals right. Its leadership team understands what makes the company successful and isn’t trying to reinvent the wheel. Instead, they’re focused on refining the model, expanding carefully, and keeping the member experience consistent.

The stock trades at a premium, and rightfully so, given its performance and financial health. Risks exist, as they do with any equity, but Costco’s history of managing through cycles gives it a level of credibility most retailers don’t have. For investors looking at a business with discipline, longevity, and a clearly defined mission, it remains one of the more compelling names in its category.