Updated 4/25/25

Corteva, Inc. (CTVA) has quietly built a strong reputation in the agricultural sector, balancing steady growth with disciplined financial management. Formed from the DowDuPont spin-off, the company operates two core businesses: Seed and Crop Protection, both of which have shown resilient performance even in challenging market conditions. With a forward-thinking leadership team and a focus on innovation, Corteva continues to invest in product development while maintaining solid free cash flow and a clean balance sheet. Its dividend is supported by healthy payout ratios and consistent earnings, offering long-term reliability for investors.

Recent Events

Corteva, Inc. (CTVA) has been carving out a solid niche in the agricultural sector since its spin-off from DowDuPont. As a company focused on seeds and crop protection, Corteva is directly tied to the rhythms of the global farming economy. Lately, things have been picking up. Revenue grew 7.3% year over year in the most recent quarter, which shows that demand is holding up even in a complicated environment.

The company is turning the corner after a stretch where rising costs and tight margins were front and center. Now, it’s managing to grow while keeping expenses in check, and that’s starting to show in its numbers. Profit margins remain modest, with a net margin around 5.36% and operating margin at 4.6%. Still, where Corteva shines is in how it handles its balance sheet and cash.

With about $3.17 billion in cash and only $3.18 billion in debt, Corteva is walking a fine financial line—and doing it well. The stock itself has been steady, up around 12% over the last 12 months. It’s currently sitting just under its recent high of $66.24, which gives investors a sense of confidence that it’s not just drifting aimlessly. Beta sits at 0.73, which suggests the stock doesn’t get knocked around as much as the overall market. That matters for investors looking for stability along with their dividends.

Key Dividend Metrics

🌱 Forward Dividend Yield: 1.10%

💸 Annual Dividend Rate: $0.68 per share

📈 5-Year Average Dividend Yield: 1.19%

🛡️ Payout Ratio: 54.10%

📅 Most Recent Dividend Date: March 17, 2025

🚫 Split History: No splits recorded

Dividend Overview

If you’re looking for a flashy, high-yield dividend stock, Corteva probably won’t be your first pick. But for investors who value consistency, this one has some appeal. The yield sits at 1.10%, and while that doesn’t turn heads, it’s backed by a measured, sustainable approach.

The payout ratio tells part of the story—at just over 54%, Corteva isn’t overextending itself. It’s paying out a meaningful slice of earnings but leaving enough room for reinvestment. That’s critical in an industry where innovation and long-term R&D spending play a big role in future growth.

Unlike companies that make big dividend announcements to drum up excitement, Corteva opts for the quiet, steady path. It has been gradually raising its dividend since it began paying one, without fanfare. That low-key approach is actually a good sign. It signals that management is thinking long-term and not trying to buy investor loyalty with an aggressive yield.

Valuation-wise, Corteva isn’t in bargain-bin territory, but it’s not overpriced either. The forward P/E is around 21.19, and the PEG ratio is at 1.36—fair numbers that suggest the dividend is not coming at the cost of overpaying for the stock.

Dividend Growth and Safety

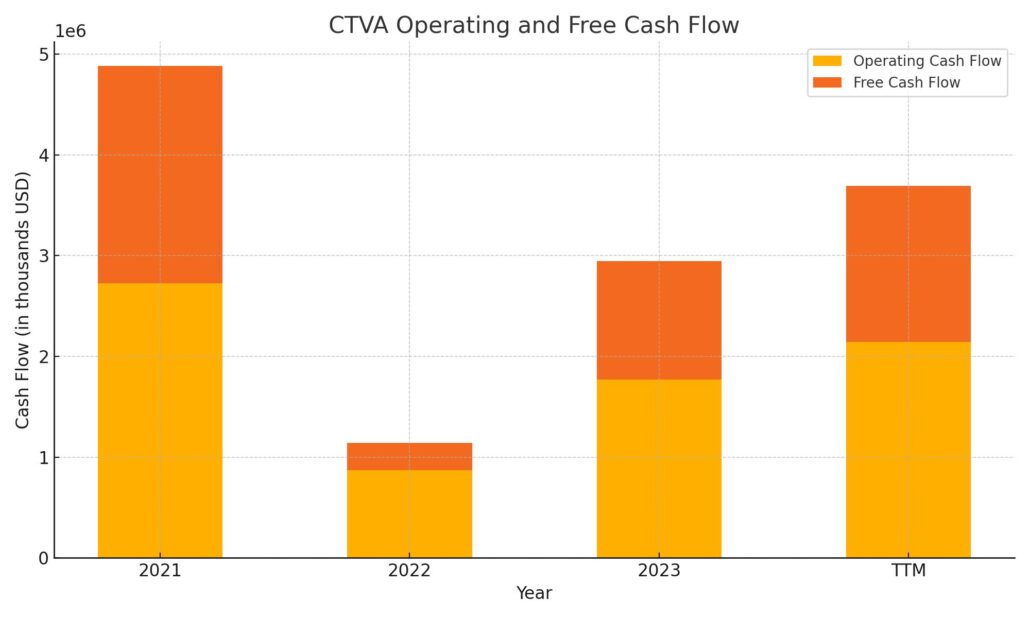

Here’s where Corteva stands out a bit more. Safety. The company pulled in $2.14 billion in operating cash flow and $2.78 billion in levered free cash flow over the last twelve months. That more than covers its dividend payments, which come out to around $464 million annually. That kind of cash flow cushion gives shareholders peace of mind.

From a growth perspective, Corteva is taking the slow and steady route. No massive jumps in payouts, but no freezes or cuts either. That kind of consistency is what a lot of long-term investors actually prefer. It’s a dividend policy built for staying power, not headlines.

Another vote of confidence comes from the shareholder base. Institutions hold over 89% of the float, which speaks to the company’s credibility among large investors. While insider ownership is minimal at 0.09%, that’s pretty typical for a spin-off like Corteva.

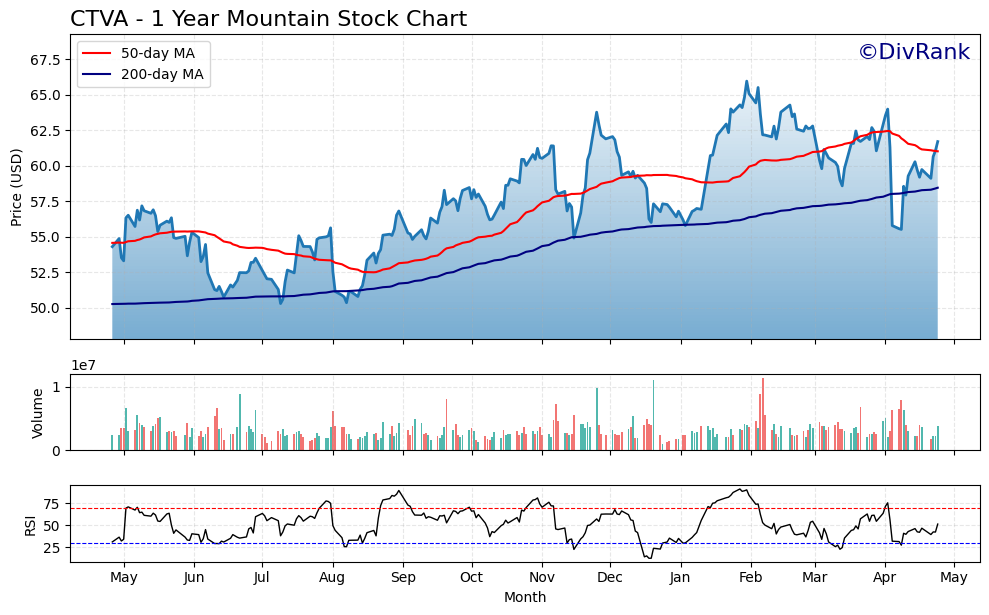

Technically, the stock’s been hugging its moving averages, which speaks to its overall stability. The 50-day sits at $61.07 and the 200-day at $58.70. That alignment often indicates a name that’s found its footing and is trading in a healthy, consistent pattern.

Importantly, Corteva isn’t weighed down by debt. With debt and cash essentially equal, and a current ratio of 1.45, there’s no liquidity pressure that would put the dividend at risk. That’s one of the key things income investors want to see—reliable payments backed by strong financial footing.

Cash Flow Statement

Corteva’s trailing 12-month cash flow statement shows a healthy operational engine, with $2.15 billion in operating cash flow—up significantly from $1.77 billion the year before. This jump reflects improving core profitability and tighter cost management. Free cash flow over the same period hit $1.55 billion, giving the company ample flexibility to support its dividend, invest in growth, and maintain a conservative capital structure.

On the investment side, capital expenditures were steady at $597 million, indicating ongoing but disciplined reinvestment in operations. Financing activity remained largely negative at -$1.2 billion, as the company continued reducing debt and returning capital. It paid down $2.89 billion in debt while issuing $3.07 billion, suggesting active debt management rather than a shift in leverage. The year ended with $3.42 billion in cash—more than enough to provide cushion and optionality heading into upcoming quarters.

Analyst Ratings

Corteva has recently seen a wave of analyst activity, with several firms adjusting their outlooks based on the company’s performance and broader market conditions. The general tone is leaning optimistic, with analysts maintaining a “Moderate Buy” stance—a reflection of steady confidence in the company’s strategic direction and financial positioning.

📊 The average 12-month price target sits at $68.13, which suggests a potential upside of about 10.4% from where the stock currently trades. 🎯 Price targets range from a more conservative $55.00 to a high-end estimate of $74.00, showing that while views may vary, the sentiment is generally positive.

📈 Recent upgrades have stemmed from Corteva’s consistent cash generation and disciplined approach to debt and capital. Analysts have pointed to the company’s ability to handle industry headwinds while keeping its financial footing solid. That kind of balance—stable operations with room to maneuver—is exactly what investors like to see when assessing long-term viability.

🔧 Several firms have nudged their price targets higher, acknowledging Corteva’s smart capital allocation and ability to deliver in a tough operating environment. The combination of operational strength and prudent strategy has led many to revisit and raise their valuation models.

🧭 All in all, the analyst community continues to view Corteva as a dependable player in its sector, backed by real earnings power and clear strategic intent. With a reasonable path toward further appreciation, analysts are signaling that Corteva’s current level might not fully reflect its potential.

Earning Report Summary

Corteva wrapped up its most recent quarter with a solid performance that showed strength in all the right places, especially considering the headwinds facing the agriculture sector right now. While the full-year numbers showed a slight dip overall, the fourth quarter delivered some encouraging signs that have both investors and leadership feeling optimistic about what’s ahead.

Seed Segment Holds Steady

Sales in the Seed business came in at $1.8 billion for the quarter, an 8% increase compared to the same time last year. Volume growth did a lot of the heavy lifting here, jumping 19%, particularly thanks to the expansion of Safrinha corn planting in Brazil. Pricing was a little soft, down 3%, and foreign exchange took a bit of a bite with an 8% negative impact, but the overall performance was still strong.

This part of the business continues to be a pillar for Corteva. The company’s continued focus on product innovation and regional strategy is keeping it competitive and providing a good foundation for steady revenue even when market dynamics shift.

Crop Protection Sees Strong Demand

Crop Protection also pulled its weight. The segment brought in $2.2 billion in net sales, up 6% from the previous year. What stood out here was the 16% growth in volume, mostly driven by strong demand in Latin America. Some pricing pressure showed up with a 5% decline, but that didn’t stop the segment from delivering a big jump in earnings. Operating EBITDA surged 73% to $461 million, thanks to solid cost management and continued demand for newer products like spinosyns and biologicals.

Corteva’s portfolio strength is clearly showing up here, and it looks like the company is well-positioned to keep riding that wave of demand for newer, more advanced crop protection solutions.

Full-Year Picture and Cash Flow

Looking at the bigger picture, full-year net sales were slightly down at $16.9 billion, a 2% decrease from 2023. Still, organic sales ticked up by 1%, which helps paint a clearer picture of how the core business is doing without the noise of currency shifts and other external factors. Operating EBITDA came in at $3.4 billion, and EPS for the year landed at $2.57—down a bit, but not surprising given the environment.

What really stood out was Corteva’s cash flow. Operating cash flow for the year hit $2.3 billion, up 27%, while free cash flow came in at $1.7 billion, a 40% jump. That kind of performance gave the company enough flexibility to return $1.5 billion to shareholders through dividends and share repurchases.

Looking Ahead

For 2025, Corteva is setting its sights on net sales between $17.2 billion and $17.6 billion, with earnings per share expected in the $2.70 to $2.95 range. The company also plans to buy back about $1 billion in stock over the next year.

Leadership’s tone is clearly upbeat. CEO Chuck Magro pointed to improving conditions in the ag markets and emphasized how the company’s disciplined execution is helping it stay on course. After a quarter like this, it’s easy to see why they’re feeling confident heading into the rest of the year.

Chart Analysis

Price and Moving Averages

CTVA has displayed a solid upward trend over the past year, climbing steadily from the $50 range to above $60. What stands out is how the price has consistently respected the 200-day moving average, particularly through the mid-year stretch. This longer-term support line has gradually trended higher, reflecting the stock’s broader strength. The 50-day moving average has been more dynamic, at times pulling away during rallies and dipping closer during corrections. Recently, the stock dipped below both moving averages in early April but quickly snapped back above the 200-day and is now flirting with the 50-day line again. That kind of bounce shows resilience and suggests the longer-term trend remains intact.

Volume Behavior

Volume has remained relatively balanced, with no extreme surges or sell-offs outside of a few isolated spikes—particularly one noticeable burst in February. The overall pattern doesn’t suggest distribution or panic selling. Instead, volume tends to rise during positive price action, hinting that buyers are stepping in on strength. That’s often a sign of healthy accumulation rather than speculation.

RSI Momentum

The Relative Strength Index (RSI) has hovered mostly between 40 and 70, with occasional pushes into overbought territory around key peaks, especially in September and February. Lows in the RSI didn’t dip far below 30, showing that the stock rarely fell into oversold conditions. Right now, RSI is on the upswing again but not yet near overbought levels, which leaves room for further momentum if current buying interest continues.

Overall Impression

The chart for CTVA shows a steady, upward-sloping structure with well-supported price levels and measured volatility. This kind of setup reflects a stock with a strong foundation, where buyers are consistently stepping in during pullbacks. The interplay between the price and moving averages, combined with supportive RSI and stable volume, paints the picture of a company being gradually accumulated over time—not chased.

Management Team

Corteva is led by CEO Chuck Magro, who stepped into the role in 2021. With prior leadership experience at Nutrien and Agrium, he brings deep industry knowledge and a strong track record in agricultural business strategy. Since taking over, Magro has emphasized operational discipline and innovation, working to sharpen Corteva’s edge in both the Seed and Crop Protection segments. His leadership has also focused on cost control, targeted R&D investment, and long-term value creation for shareholders.

Supporting Magro is a seasoned executive team. David Johnson, serving as CFO, has kept Corteva’s financials tight, ensuring capital is allocated efficiently and debt levels remain well-controlled. Sam Eathington, who leads the technology side, has pushed forward with Corteva’s digital initiatives and biological advancements. Judd O’Connor, President of the Seed division, brings a strong commercial background that’s helped drive growth in global markets. Collectively, this group brings a good balance of science, finance, and strategy—core traits for navigating a cyclical and regulation-heavy industry like agriculture.

Valuation and Stock Performance

Corteva’s stock has shown reliable upward movement, closing at $61.71 on April 24. Over the past year, it has gained roughly 13%, quietly outperforming broader benchmarks. That kind of slow and steady climb may not make headlines, but it speaks to confidence from investors who value fundamentals and predictable performance.

Right now, the average analyst price target is around $68.24, suggesting a bit more upside from current levels. The valuation doesn’t scream “cheap,” but it’s grounded. The forward price-to-earnings ratio sits at 21.19, which is reasonable for a company delivering steady growth. The PEG ratio of 1.36 also reinforces that growth expectations are baked in, but not stretched.

What supports that valuation is Corteva’s clean financial profile. With cash and debt nearly equal at just over $3 billion each, there’s no overhang. Free cash flow generation continues to improve, which gives the company plenty of flexibility—whether that’s increasing dividends, buying back shares, or investing in innovation. This balanced approach is exactly what long-term investors typically like to see.

Risks and Considerations

While Corteva’s long-term outlook is strong, the business doesn’t operate without risk. The agricultural sector is heavily influenced by weather patterns, commodity price shifts, and geopolitical disruptions that can affect planting decisions and overall demand. These are factors largely out of management’s control, but they remain real sources of volatility.

Another area worth watching is regulation. Corteva continues to navigate challenges tied to crop protection products, including evolving safety standards and legal disputes related to chemical use. These issues can be costly and time-consuming, even if the science and approvals were in place years earlier. Environmental concerns also remain front of mind for both regulators and the public, and any missteps could damage brand reputation or impact product sales.

Currency fluctuations and supply chain costs are other considerations, particularly for a company with a large global footprint. Corteva has done a decent job managing through these, but they can still weigh on margins and top-line growth when conditions shift rapidly.

Final Thoughts

Corteva sits in a position of quiet strength. The leadership team is steady, experienced, and appears focused on sustainable growth rather than short-term gains. Operationally, the company is doing what it needs to: maintaining profitability, generating consistent free cash flow, and returning value to shareholders—all while continuing to invest in the future.

Its valuation looks fair given the business quality, and stock performance has matched the company’s deliberate pace. Risks are present, as they are in any ag-related investment, but Corteva has shown the ability to manage those well.

Looking ahead, the company’s focus on innovation, efficiency, and strategic growth should continue to resonate with investors seeking steady, long-term exposure to global agriculture.