Key Takeaways

🍻 Dividend yield of 2.18%, maintained steadily despite share price pressure, with modest but consistent growth.

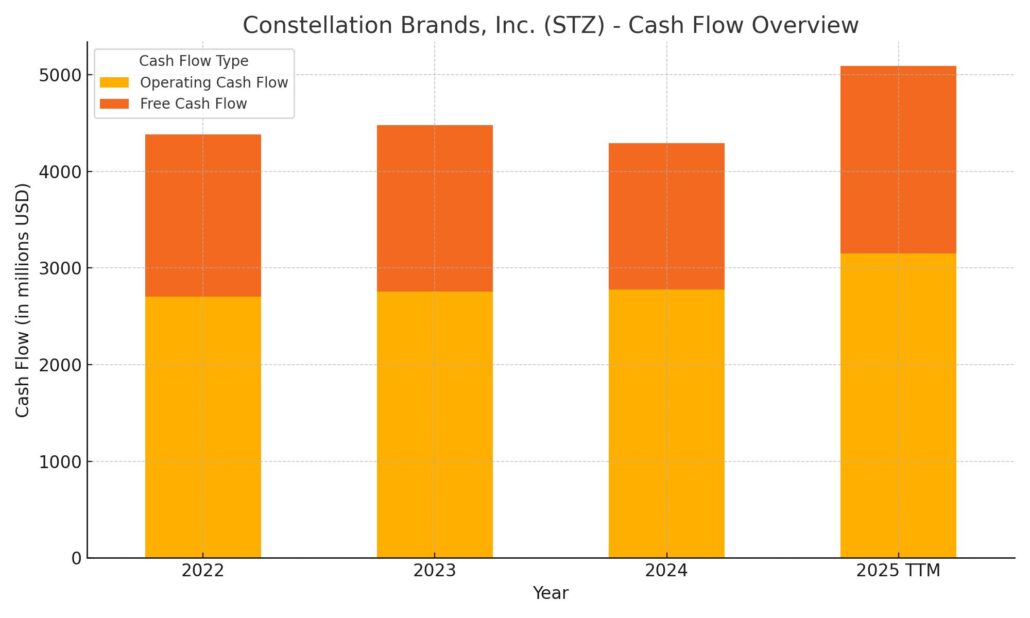

💰 Strong cash flow generation ($3.15 billion operating cash), providing ample support for dividends and debt management.

📉 Analyst sentiment cautious but optimistic overall, average price target around $229, implying ~22% upside potential.

📊 Mixed earnings report—solid revenue growth driven by beer segment, but profitability hit by one-time impairment charges.

👥 Experienced management under CEO Bill Newlands, actively streamlining operations and emphasizing premium brand growth.

Updated 4/25/25

Constellation Brands (NYSE: STZ) is a leading player in the U.S. beverage alcohol industry, known for powerhouse beer brands like Modelo and Corona, as well as a premium-focused wine and spirits portfolio. Over the past year, the company has faced a challenging stretch, with its stock down nearly 28% and new tariffs adding cost pressure to its imported beer operations. Despite the headwinds, it continues to generate strong cash flow, maintain a growing dividend, and invest in long-term brand equity. Leadership has taken steps to streamline operations, reduce exposure to underperforming segments, and focus on high-margin growth. The company remains financially sound, with a commitment to capital returns and disciplined strategy execution.

Recent Events

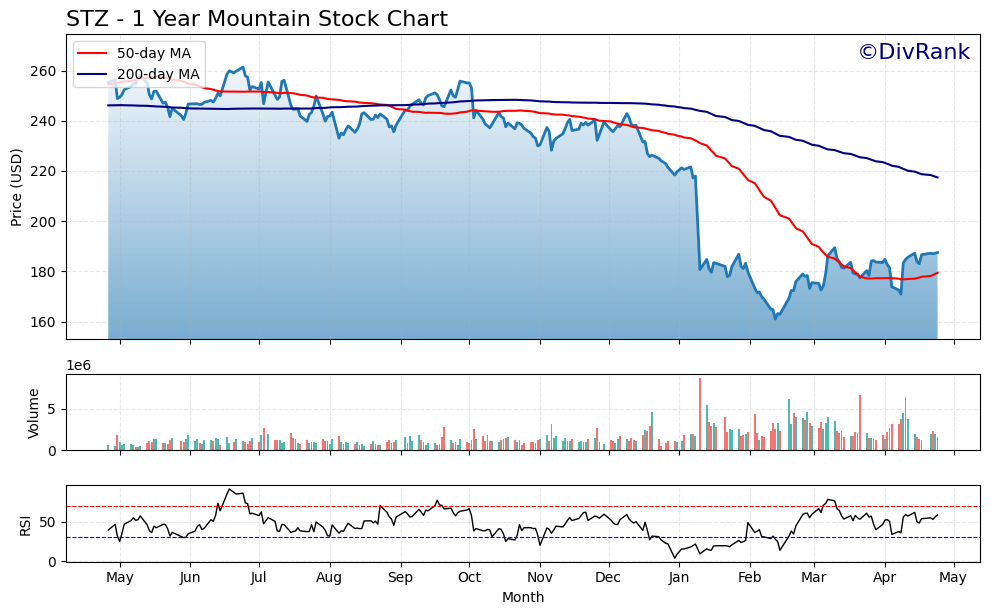

The past year has been rocky for STZ’s share price. Over the last 12 months, the stock has lost nearly 28% of its value while the broader S&P 500 moved up. Not exactly what you’d want to see on paper—but sometimes the market and fundamentals don’t move in sync.

Modelo, one of the company’s flagship beer brands, continues to crush it at retail. It’s actually the top-selling beer in the U.S. by dollar sales. Yet the market hasn’t rewarded that performance, mostly due to broader economic jitters and some one-off accounting issues.

Speaking of the balance sheet, Constellation still carries a sizable chunk of debt—over $12 billion to be exact. That gives it a high debt-to-equity ratio of around 170%. It’s something income-focused investors should keep an eye on, but it’s not necessarily a red flag if the company continues generating strong cash flow.

The earnings story is more complicated. On the surface, the company posted a diluted EPS of negative $0.45 recently, thanks to impairment charges. But the core business is still healthy, turning out nearly $4 billion in EBITDA on more than $10 billion in revenue. And with $3.15 billion in operating cash flow and $1.08 billion in levered free cash flow, it’s the cash—not the accounting net income—that keeps the dividend machine running.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.18%

💵 Forward Annual Dividend Rate: $4.08

🧮 Payout Ratio: 104.53%

📅 Ex-Dividend Date: April 29, 2025

📊 5-Year Average Dividend Yield: 1.46%

🧾 Dividend Payment Date: May 15, 2025

Dividend Overview

At the current price, Constellation’s dividend yield sits at 2.18%. That’s a decent payout, and notably above its five-year average yield of 1.46%. But here’s the kicker—this yield spike isn’t because of a big dividend hike. It’s the share price that’s come down, boosting the yield naturally. For value-minded dividend investors, that’s an interesting twist.

Now, the payout ratio might look a little alarming at first glance. It’s over 100%, which suggests Constellation paid out more in dividends than it earned in profit. But context matters. The negative earnings were due to non-recurring charges—not a sign of the company burning through cash. In reality, Constellation is still generating strong free cash flow, and that’s what really pays the dividend.

Importantly, the company has kept the dividend steady throughout market turbulence and internal restructuring. That kind of stability is what long-term investors count on. The dividend hasn’t wavered or been slashed—it’s been held in place while the company continues to invest and optimize.

In short, the dividend is not just being maintained—it’s being respected. Management clearly views the payout as a key part of shareholder return.

Dividend Growth and Safety

Constellation doesn’t have the kind of multi-decade dividend streak that some income investors chase, but what it does have is consistency. Since initiating its dividend, the company has gradually increased it over time. The growth rate has been modest, but steady—more marathon than sprint.

The real test of a dividend’s reliability is whether it’s backed by real cash. And here, STZ checks the box. Operating cash flow of over $3 billion means there’s plenty of room to cover the dividend, even with other financial obligations in play. Levered free cash flow still comes in over a billion, which keeps the payout well-supported.

Yes, the debt load is sizable. Over $12 billion is no small amount. But Constellation has shown it can manage this debt with consistent refinancing and strong interest coverage. It hasn’t been issuing new shares to plug holes, either—another quiet positive for current shareholders.

Volatility-wise, the stock’s beta is just 0.79. That means STZ tends to move less dramatically than the market overall, which is something income investors typically appreciate. Less drama means less chance of dividend cuts in stormy weather.

Cash Flow Statement

Constellation Brands generated $3.15 billion in operating cash flow over the trailing twelve months, reflecting strong performance from its core business segments. That’s an uptick from the prior year and continues a trend of steady growth in cash generation, which has remained north of $2.7 billion annually for the past three years. Capital expenditures during the same period were $1.21 billion, leading to free cash flow of approximately $1.94 billion—an impressive figure that underpins the company’s ability to fund dividends and manage debt.

On the financing side, the company saw a significant outflow of $2.26 billion, largely due to debt repayments and shareholder returns. No new debt or equity was issued in the last year, signaling a focus on deleveraging rather than leveraging the balance sheet. Investing activities resulted in just under $1 billion in outflows, showing some pullback from the higher levels seen in previous years. By the end of the period, Constellation’s cash position stood at $68.1 million—a drop from the prior year but still reflective of a company managing its liquidity carefully while continuing to invest and return capital to shareholders.

Analyst Ratings

📉 Constellation Brands (NYSE: STZ) has seen a wave of analyst rating changes recently, pointing to shifting sentiment around the company’s near-term performance. One of the more prominent downgrades came from Citigroup, which moved its rating from Buy to Neutral while lowering the price target from $260 to $190. This change was driven by concerns around slowing beer sales—an area that’s historically been a major strength for the company.

🔻 Evercore ISI followed with a trim to its outlook as well, cutting its price target from $250 to $225 but holding onto its Outperform rating. The reasoning here centered on a notable drop in sales volumes. In the fourth fiscal quarter, tracked channel volumes dipped 2.1%, a sharp contrast to the 5.7% increase seen in the prior quarter. Analyst commentary also pointed to the possibility that political dynamics could be influencing Hispanic consumer behavior—a key demographic for Constellation’s product portfolio.

🍻 Still, not every analyst is pulling back. RBC Capital maintained its Outperform rating and adjusted its price target to $233, citing strength in the company’s premium brand lineup and long-term strategy. Barclays also held firm on a Buy rating, even nudging its target up slightly from $203 to $207, signaling some underlying confidence in Constellation’s game plan.

📊 Currently, the average 12-month price target for STZ sits around $229.37. Analyst projections vary, with the lowest estimate at $190 and the most optimistic reaching $306. That implies a potential upside of just over 22% from where the stock is currently trading.

Earning Report Summary

Solid Top-Line, But a Tough Bottom Line

Constellation Brands closed out its fiscal year with a bit of a mixed bag. On the surface, the numbers looked decent—adjusted earnings came in at $2.63 per share, beating what analysts were expecting. Revenue also nudged ahead of estimates, landing at $2.16 billion. But peel back the layers, and there were a few issues that caught investors’ attention.

Most notably, the company posted a net loss of $375 million for the quarter. That loss wasn’t due to poor operations but was mostly the result of a hefty goodwill impairment charge tied to its wine and spirits business. It’s not the kind of thing that happens every quarter, but it was enough to take a bite out of the bottom line.

Beer Keeps Carrying the Load

The beer segment once again pulled its weight—and then some. It made up nearly 80% of total revenue. Flagship brands like Modelo and Corona continued to hold strong in the market, especially among Hispanic consumers, a key demographic for the company. CEO Bill Newlands spoke confidently about the loyalty Constellation’s beer brands enjoy and how they continue to lead in their categories.

Still, there’s a potential cloud on the horizon. New tariffs on imported canned beer could eat into margins, and the company isn’t brushing that off. Leadership acknowledged the concern and hinted it may affect how aggressively they can grow in the near term.

Trimming the Fat in Wine and Spirits

Things aren’t quite as rosy in the wine and spirits side of the business. That’s where the company took the biggest hit this past quarter. In response, Constellation is planning to offload some of the underperforming brands in that segment. They’re doubling down on the higher-end offerings—think wines and spirits priced over $15 a bottle. The idea is to stay aligned with what consumers want right now, which is quality over quantity.

This pivot also means dialing back on spending. The company is looking to cut capital expenditures significantly—down about 40% by fiscal 2027 and another 35% by 2028. It’s a more cautious stance that signals a desire to preserve cash and prioritize what’s working best.

Looking Ahead: A Bit More Cautious

As for the road ahead, the outlook has been tempered a bit. For fiscal 2026, Constellation is guiding for adjusted earnings in the range of $12.60 to $12.90 per share, a step down from $13.78 in the prior year. They’re also forecasting modest sales growth between 2% and 4% over the next couple of years.

While the tone may be more measured, leadership isn’t backing away from the long-term strategy. The focus remains on core strengths—especially the beer portfolio—and making sure the business is positioned for steady, sustainable growth. Newlands stressed that the underlying demand for their products remains strong, and with the right adjustments, the company is looking to stay on track.

Chart Analysis

Price Movement and Trend Overview

STZ has seen a steady downtrend over the past year, with the price slipping from the $250 range early in the chart to the mid-$180s by April. The steepest decline occurred between December and February, where price action broke below the 200-day moving average and stayed there. This kind of breakdown usually signals a shift in momentum, and the chart confirms that STZ hasn’t yet reclaimed its longer-term trend line.

The 50-day moving average continues to slope downward, although in the last few weeks, the price has started to flatten out and move slightly upward. It’s now hovering just below the 50-day MA, hinting at a possible early-stage stabilization. However, the distance from the 200-day MA remains wide, and that longer-term line is still trending lower, so the overall trend is still under pressure.

Volume Behavior

Volume hasn’t spiked dramatically, but there’s been a noticeable uptick in activity during the price trough in January and February. That may have been the point of capitulation, where weaker hands exited and value-focused buyers began stepping in. Since then, volume has settled into a steadier rhythm, suggesting a more balanced tug-of-war between buyers and sellers.

RSI Momentum

The RSI at the bottom tells an interesting story. For most of the past year, STZ has hovered in the lower half of the RSI range, dipping below 30 briefly during its heaviest sell-off. That marked an oversold condition and was followed by a rebound. Recently, RSI has been hovering just under the 60 level, which points to improving momentum but not yet full conviction from the market.

Overall, the technical picture shows a stock that has taken a hit but may be in the early stages of finding its footing. The sharp drop has cooled off, and there are signs of tentative recovery, though the longer-term trend still requires work to rebuild.

Management Team

Constellation Brands is guided by CEO Bill Newlands, who took over leadership in 2018. He brings a strong background in consumer goods and beverages, having held previous roles at Beam Inc. and LVMH. Under his leadership, the company has shifted further toward premium products and streamlined its portfolio to focus on core strengths.

Supporting him is an experienced executive team. Garth Hankinson, the CFO, plays a critical role in overseeing financial planning and capital deployment. Jim Sabia heads up the Beer Division, which has been the company’s most consistent performer, while Sam Glaetzer leads the Wine & Spirits segment. Mallika Monteiro, Managing Director of Beer Brands, also contributes heavily to strategic brand development and marketing. Together, this team has navigated an evolving landscape while emphasizing brand strength and margin growth.

Valuation and Stock Performance

As of the end of April 2025, shares of STZ are trading around $187.50, well off their 52-week high of $265.70. Over the past year, the stock has dropped close to 28 percent, underperforming broader market benchmarks. While that’s a tough stretch, it’s also pulled valuation multiples down to levels that may attract more value-focused investors.

Currently, the forward price-to-earnings ratio stands at 14.33, which appears reasonable given the company’s brand portfolio and earnings power. Price-to-sales sits at 3.33, and price-to-book is 4.85—both on the lower side relative to recent history. Analyst sentiment remains cautiously optimistic, with a consensus price target around $229. That implies there could still be meaningful upside from current levels if the company delivers on its operational plans.

Risks and Considerations

There are a few key risks to keep in mind. First, the recently enacted 25 percent tariff on imported canned beer could be a headwind. Constellation relies heavily on imported production for brands like Corona and Modelo, so this adds pressure to either absorb the costs or raise prices, neither of which is ideal.

Then there’s the ongoing shift in consumer behavior. Younger drinkers are leaning more toward ready-to-drink options, craft spirits, and other alternatives. That trend has weighed on the wine and spirits segment, prompting the company to divest some lower-end brands and focus more on high-end offerings. While that strategy aligns with premiumization trends, it’s not guaranteed to pay off immediately and requires careful execution.

The company’s balance sheet is another area that warrants attention. With a debt-to-equity ratio close to 170 percent, Constellation is highly leveraged. While it has strong cash flow, any significant rise in borrowing costs or downturn in sales could stress that financial position. Legal overhang from shareholder-related lawsuits adds another variable to the mix, though it hasn’t materially impacted operations yet.

Final Thoughts

Constellation Brands is working through a period of transition. The beer business remains a powerhouse, driven by strong brand loyalty and dominant shelf presence, especially among Hispanic consumers. However, the wine and spirits segment has struggled, and broader market conditions have weighed on the stock.

Management has responded with a clear strategy: double down on what’s working, cut underperformers, and manage costs. While the market hasn’t rewarded those moves yet, there’s a case to be made for patience. If Constellation can navigate the external pressures—from tariffs to evolving tastes—it may emerge leaner, more focused, and in a stronger competitive position over time.