Key Takeaways

💰 Dividend yield at 3.4%, supported by a sustainable payout ratio and consistent dividend growth.

📈 Robust cash flow generation ($20.1 billion in operating cash), providing ample coverage for dividends and buybacks.

🎯 Analyst consensus remains positive with a $126+ price target, implying meaningful upside potential.

📉 Earnings dipped 23% amid softer energy prices, but production growth remains strong, particularly in the Permian Basin and Alaska.

👥 Experienced leadership under CEO Ryan Lance emphasizes disciplined capital allocation, strategic acquisitions, and long-term shareholder returns.

Updated 4/25/25

ConocoPhillips is a global upstream energy company with a focused strategy on oil and gas exploration and production. Operating in more than a dozen countries, it maintains a strong balance sheet, disciplined capital allocation, and a clear commitment to returning value to shareholders. With a forward dividend yield of 3.4% and a well-covered payout ratio under 40%, the company continues to appeal to income-focused investors.

Despite recent price pressure and a year-over-year earnings dip, ConocoPhillips has kept production growing, particularly in the Permian Basin and Alaska, and remains cash flow positive. A seasoned leadership team, thoughtful acquisitions like Marathon Oil, and a strategic capital budget for 2025 highlight the company’s long-term planning. Trading near its 52-week low with an average analyst price target above $125, it stands at a potential inflection point backed by solid fundamentals and a proven approach to navigating commodity cycles.

Recent Events

The past year brought a few bumps, as energy prices cooled off from their post-pandemic highs. Revenue dropped slightly by about 3.1% year-over-year, and earnings per share saw a more noticeable dip, down over 23%. Still, this comes on the heels of a very profitable run for ConocoPhillips. If anything, the softer numbers reflect a normalization rather than a sign of concern.

Management hasn’t deviated from its strategy. Instead of chasing risky growth, they’re sticking to efficient capital allocation—using cash to fund the dividend, repurchase shares, and pay down debt. That approach is reflected in the numbers. The company ended the last quarter with over $6 billion in cash and a debt-to-equity ratio under 40%. Those are solid figures, especially in the often volatile oil and gas space.

There’s also some quiet movement worth noting. ConocoPhillips has hinted it could be open to the right acquisition if the opportunity lines up. That’s something to keep in mind as consolidation continues across the industry.

Key Dividend Metrics

🟢 Forward Dividend Yield: 3.40%

📈 5-Year Average Dividend Yield: 2.67%

💵 Annual Dividend Payout: $3.12 per share

🧾 Payout Ratio: 39.95%

⏳ Next Ex-Dividend Date: February 14, 2025

📆 Next Dividend Payable: March 3, 2025

📊 Dividend Growth Streak: Rising since 2016

For dividend investors, these stats offer a pretty appealing picture. The current yield is higher than its average over the past five years, and it’s supported by a healthy payout ratio that suggests the dividend isn’t just sustainable—it has room to grow.

Dividend Overview

One thing that makes ConocoPhillips stand out among its energy peers is how it handles shareholder returns. This isn’t just about mailing out a standard quarterly dividend. The company has built a return strategy that includes regular payouts plus special distributions and aggressive buybacks when times are good. That kind of flexibility makes a lot of sense in a business where cash flow can swing with oil prices.

Right now, shareholders are enjoying a solid base dividend of $3.12 a share, which equates to a 3.40% yield. That’s comfortably ahead of the broader market average and especially attractive when viewed through the lens of a conservative, income-focused investor.

And here’s what matters most: ConocoPhillips has shown a real commitment to protecting that base dividend through thick and thin. Even when earnings pressure builds, as it did this past year, they’ve maintained the payout without hesitation. That level of consistency is key if you’re building a long-term dividend portfolio.

While other energy stocks might flash higher yields—think 7% or more in some pipeline names—those usually come with more debt and business model complexity. COP takes a more grounded approach, and the result is a dividend story that’s dependable, even if it’s not the highest headline number out there.

Dividend Growth and Safety

ConocoPhillips doesn’t just pay dividends—it grows them in a way that feels earned, not forced. Since rebooting its dividend in 2016, the company has gradually and deliberately increased the payout. What’s notable here is that growth has come alongside strong financial discipline.

The payout ratio, sitting at just under 40%, leaves a lot of breathing room. That gives COP the ability to continue paying even if oil prices stay soft for longer than expected. It also positions the company to raise the dividend when the market turns favorable.

The company’s returns are strong across the board. Return on equity is above 16%, and operating margins are north of 26%—both signs that ConocoPhillips is making solid profits on its production. These profits flow directly into free cash flow, which in turn supports the dividend.

Another tailwind is the company’s sizable stock buyback program. By reducing the number of shares outstanding, ConocoPhillips increases earnings per share and further strengthens the coverage of its dividend. Add in over $6 billion in free cash flow and you’ve got a company with the financial room to reward shareholders without cutting corners.

The company’s beta of 0.84 is also worth mentioning. It shows that COP tends to move a little less than the overall market—useful for income investors who prefer less price volatility. That kind of stability is welcome, especially when you’re counting on regular dividends to play a central role in your strategy.

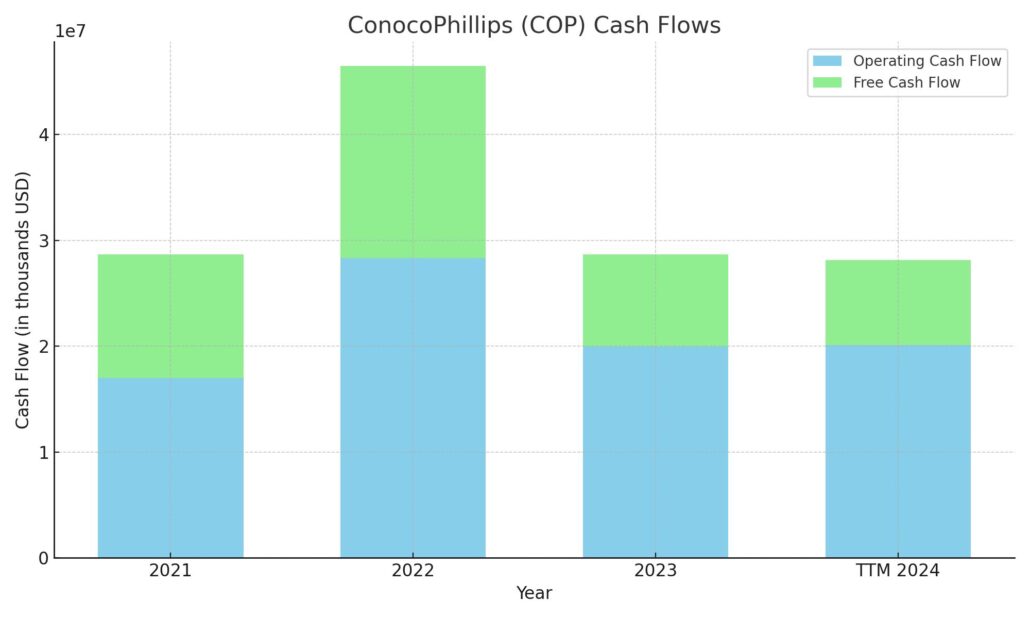

Cash Flow Statement

ConocoPhillips generated $20.1 billion in operating cash flow over the trailing twelve months, slightly above last year’s figure, showing consistent core business strength despite a softer earnings backdrop. This steady performance in cash generation reflects efficient operations and disciplined cost control. Free cash flow came in at $8 billion, down from the previous year’s $8.7 billion and significantly below the $18.1 billion seen in 2021—driven largely by higher capital expenditures and more normalized commodity prices. Still, this level of free cash flow gives the company ample flexibility to support dividends and buybacks.

On the investment side, ConocoPhillips allocated over $12.1 billion in capital expenditures, which is a step up from the prior year and suggests a continued commitment to long-term asset development. Financing activities showed a net cash outflow of $8.8 billion, reflecting ongoing debt management and capital returns. Despite the sizeable outflows, the company maintained a strong cash position, finishing with nearly $5.9 billion on the balance sheet. This stable cash level, paired with robust operating inflows, underpins ConocoPhillips’ ability to sustain shareholder distributions while investing in future production.

Analyst Ratings

Analyst sentiment toward ConocoPhillips has been active recently, with several firms adjusting their price targets in response to the company’s latest financial performance and broader market conditions. 🎯 The consensus among analysts remains positive, with an average 12-month price target of approximately $126.89. 📈 This suggests a potential upside of about 38% from the current share price.

🔻 However, some analysts have revised their outlooks. UBS reduced its price target from $116 to $111 while maintaining a “buy” rating, reflecting a more cautious stance due to recent earnings results. Wells Fargo also adjusted its target from $131 to $116, maintaining an “overweight” rating. These updates reflect tempered optimism, balancing short-term challenges like earnings compression with confidence in long-term fundamentals.

On the more optimistic side, 🟢 Mizuho raised its target from $132 to $134 and upgraded the stock to “outperform,” citing expectations for improved operational efficiency and solid free cash flow support. Overall, while opinions vary slightly, the general tone from the analyst community remains constructive. Most view ConocoPhillips as a financially sound, shareholder-friendly name in the energy sector with room to run, particularly if oil prices stabilize or rise.

Earnings Report Summary

ConocoPhillips wrapped up 2024 with a performance that showed both stability and momentum, even with some of the pressure from softer oil prices. The fourth quarter came in stronger than many were expecting, with earnings landing at $2.3 billion, or $1.90 per share. On an adjusted basis, that ticked up to $1.98 per share. Full-year profits reached $9.2 billion, with earnings per share at $7.81. Not bad, especially considering the average price they received for their oil and gas dropped by about 10% compared to the year before.

Production Driving Results

What really helped offset the pricing dip was production. Daily output hit 2.18 million barrels of oil equivalent (BOE), which is a solid jump from last year. The Permian Basin was a standout again, delivering over 830,000 BOE per day. Conoco also got a boost from Alaska, where their Nuna project started pumping out oil in December and added another layer of strength to the production numbers. Overall, more barrels flowing out of the ground helped keep the cash coming in—operating cash flow for the year was a healthy $20.1 billion.

Looking Ahead to 2025

As for where things are headed, ConocoPhillips has mapped out a capital budget of $12.9 billion for 2025. That’s going to be the peak for this cycle, with a lot of it aimed at long-term projects like their Willow development in Alaska and some LNG initiatives in Qatar. At the same time, they’re planning to dial back spending in the Lower 48 states by around 15%. Part of the broader plan also includes selling off some non-core assets—smaller producing fields that are less central to their strategy—which should bring in about $600 million. That cash will help cover the Marathon Oil acquisition they closed for $22.5 billion.

Investors had something to smile about too. ConocoPhillips raised its capital return target for 2025 to $10 billion, up from $9.1 billion in 2024. That includes $4 billion in dividends and $6 billion going toward share repurchases. For the first quarter of the new year, they locked in a dividend of $0.78 per share, payable in early March.

Leadership Commentary

CEO Ryan Lance had a lot to say about where the company’s headed. He emphasized that ConocoPhillips remains focused on generating strong returns, not just through production but also through smart capital allocation and strategic deals like the Marathon acquisition. He pointed out that they’re already on track to hit over $1 billion in synergies from the deal by year-end. On top of that, the company hit a 244% reserve replacement ratio in 2024, with a strong 123% coming from organic additions—basically showing they’re not just pumping oil, but replacing what they produce and then some.

Chart Analysis

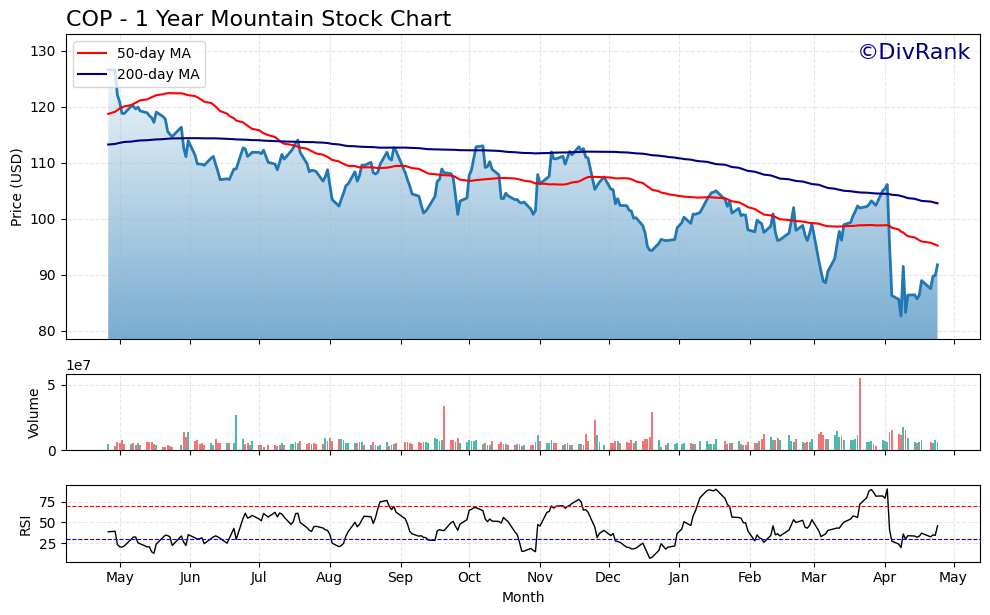

Trend and Moving Averages

Looking at the one-year chart for COP, there’s a clear downward trend that has persisted since the highs near $130 in mid-2023. The 50-day moving average (red line) has remained below the 200-day moving average (blue line) for most of the year, signaling a longer-term bearish structure. This alignment suggests sustained downward momentum, although the recent bounce in price during late April might indicate a potential shift or a short-term bottom forming.

Price Action and Support Zone

The price hovered mostly between $100 and $110 for the better part of the year before breaking down below $100 in March and early April. That dip appears to have been met with buying interest, as shown by the rebound toward the end of the chart. There’s a noticeable sharp V-shaped recovery off the low near $87, which often reflects aggressive dip buying or short-covering. However, the price remains below both key moving averages, so any upside momentum will still face resistance.

Volume Patterns

Volume spikes have been sporadic but telling. There were significant surges in trading activity during periods of sharp drops and recoveries, particularly around November, March, and mid-April. This suggests those were key moments of institutional involvement or sentiment shifts. Sustained increases in volume would be a good sign if the stock starts to trend upward again, but for now, the volume remains relatively average in recent sessions.

Relative Strength Index (RSI)

The RSI at the bottom of the chart shows multiple tests of the oversold zone below 30, especially in June, December, and April. Each time the RSI dipped, the stock attempted to recover, indicating buyers tend to step in during those extremes. More recently, the RSI bounced from below 30 and is heading upward again, which suggests that bearish pressure may be easing in the short term.

Current Outlook

The recent price action in late April shows promise. A recovery from near 52-week lows, with improving RSI and higher volume, opens the door to a potential reversion toward the 50-day average. However, both moving averages are still trending downward, and unless that changes, the broader picture remains cautious. Watching how the stock behaves around the $95 to $100 area in the coming weeks will be key to understanding whether this bounce has legs or fades back into the longer-term trend.

Management Team

ConocoPhillips is led by a highly experienced executive team with deep expertise across the energy sector. At the top is Ryan Lance, Chairman and CEO since 2012. Under his leadership, the company has prioritized operational efficiency, shareholder returns, and disciplined capital deployment. His steady hand has helped ConocoPhillips remain resilient through commodity price cycles and major industry shifts. Supporting him is Bill Bullock, the Executive Vice President and CFO, who plays a critical role in financial strategy, balance sheet strength, and capital allocation.

The rest of the management team brings diverse backgrounds in global operations, ESG strategy, and upstream development. This depth allows the company to take a forward-thinking approach without losing sight of execution. The leadership’s consistency over the years has built credibility with investors, especially those focused on long-term stability and predictable performance.

Valuation and Stock Performance

As of late April 2025, ConocoPhillips trades near $91.80 per share, well below its 52-week high of $130.77. That gap reflects the broader downturn in energy prices, but also investor hesitation amid global macro uncertainty. Still, the fundamentals haven’t deteriorated. In fact, many analysts estimate the stock’s fair value to be around $126 to $130, which signals that it may be undervalued at its current price.

The company is trading at a forward price-to-earnings ratio of roughly 11.2x and a trailing P/E of about 11.75x, both of which suggest a reasonable valuation for a large-cap producer with consistent free cash flow. While the stock has posted a one-year total return of -26.93%, it’s worth noting that the decline aligns with broader weakness across the upstream energy space.

Over the longer term, ConocoPhillips has delivered competitive returns thanks to its capital discipline and aggressive shareholder return policy. Between dividends and buybacks, it returned more than $9 billion to shareholders in 2024 and is on track for $10 billion in 2025.

Risks and Considerations

Like all companies in the energy sector, ConocoPhillips operates in a space that carries meaningful risk. Commodity price volatility remains the single biggest factor influencing profitability. Any prolonged downturn in crude oil or natural gas prices can pressure margins, reduce cash flow, and impact capital returns. On the flip side, sharp price spikes often come with geopolitical risk or demand shocks—both of which can introduce operational or regulatory challenges.

ConocoPhillips also faces the growing challenge of aligning with the global shift toward lower-carbon energy. While the company has made progress in improving its emissions profile and investing in carbon capture and storage, it still operates in a sector under growing scrutiny from regulators and environmental groups.

Another area to watch is the integration of Marathon Oil, a significant acquisition that could reshape ConocoPhillips’ asset base and cash flow profile. The deal has regulatory hurdles to clear, and integration risk always exists, even for experienced operators. Additionally, with capital expenditures expected to peak in 2025, any misstep in execution or cost overruns could put pressure on near-term financials.

Final Thoughts

ConocoPhillips remains one of the more disciplined and shareholder-friendly companies in the upstream energy space. Its leadership team has consistently made thoughtful decisions around capital allocation, and the company continues to balance growth with capital returns. While the stock has struggled in the short term, much of that decline appears tied to external forces rather than a deterioration in business fundamentals.

With a solid balance sheet, well-covered dividend, and a focus on high-return assets, the company is positioned to weather the current environment and benefit from any rebound in commodity pricing. There are risks, no doubt—some tied to the broader energy transition, others to regulatory and execution factors. But the groundwork has been laid for long-term value creation. The next phase will likely be shaped by how effectively ConocoPhillips executes on its strategic plans and manages its recent acquisition, while continuing to reward shareholders along the way.