Last Update 4/24/25

Community Healthcare Trust (CHCT) is a healthcare-focused real estate investment trust with a portfolio concentrated in outpatient medical properties, rehabilitation centers, and treatment facilities, primarily in non-urban areas. With a current yield nearing 12% and a consistent dividend history, it continues to draw interest from income-focused investors.

Over the past year, the stock has faced pressure from rising interest rates and declining investor sentiment, leading to a significant drop in price. Despite this, CHCT has remained active with new property acquisitions, expanded its credit facility, and maintained steady operating cash flow. The management team, led by CEO Dave Dupuy, has leaned on disciplined capital allocation and strategic growth to navigate a more volatile environment. As CHCT trades near the lower end of its 52-week range, investors are weighing the risks of tenant concentration and interest rate sensitivity against the company’s long-term focus and dependable cash generation.

Recent Events

It’s been a rough patch for CHCT lately. The stock is down more than 38% over the past year, sliding from a high of $27.62 to just around $15.71 today. That’s a steep drop for a REIT, especially one in the relatively defensive healthcare sector. But part of that is the broader pressure on real estate investment trusts, as rising interest rates have made investors more cautious.

The latest earnings haven’t helped the case either. Revenue barely grew, up just 0.6% year-over-year, and net income took a big hit. CHCT posted a net loss of nearly $6 million over the trailing twelve months, and earnings growth declined almost 60%. That’s the kind of financial slowdown that makes the market nervous, especially when debt is involved.

Despite that, the stock saw a small lift in after-hours trading, up over 3%, which might suggest some investors are starting to see value at these levels. But make no mistake—this is a business facing some headwinds right now.

Key Dividend Metrics

📈 Forward Dividend Yield: 11.84%

💵 Forward Annual Dividend: $1.87 per share

🧾 Trailing Dividend Yield: 11.75%

📊 5-Year Average Dividend Yield: 5.50%

📉 Payout Ratio: 288.10% (based on GAAP EPS)

📅 Ex-Dividend Date: February 24, 2025

💰 Dividend Date: March 5, 2025

Dividend Overview

The standout here is clearly the yield. With CHCT offering a forward yield north of 11%, it’s going to catch the eye of anyone building a portfolio for income. It’s a level of yield that’s hard to ignore, especially in a world where most traditional income options are yielding much less.

But when a yield climbs that high, it’s usually a sign the market is skeptical about how sustainable it really is. And in CHCT’s case, there’s some reason for that concern. The payout ratio is sitting at nearly 288% if you go by earnings, which on the surface looks way too high. But this is a REIT, and traditional earnings aren’t the best way to judge its ability to pay dividends.

Instead, we look at cash flow. CHCT’s operating cash flow is around $59 million annually, which helps ease some of those worries. Cash flow is solid, but it’s not exactly booming. And with higher interest rates pushing up borrowing costs, that cushion isn’t as comfortable as it once was.

Right now, the dividend appears to be covered from operations, but it doesn’t leave a lot of room for error. For investors relying on income, this is the kind of setup where you keep an eye on quarterly reports to make sure the numbers hold up.

Dividend Growth and Safety

One thing CHCT has done well since it came onto the scene is steadily increase its dividend. It hasn’t been dramatic, but the company has made small, regular hikes that add up over time. That’s a pattern dividend investors love—consistent raises that don’t grab headlines but make a big difference to long-term income.

Lately, though, that growth has slowed down. The most recent increases have been modest at best. That could be a signal that management is being cautious, choosing to hold steady instead of stretching to grow the payout further in a tight financial environment.

The REIT’s debt load is a big reason for that caution. Total debt is just under $490 million, and the debt-to-equity ratio is well over 100%. It’s not an emergency, but it does mean CHCT is operating with a decent amount of leverage. In a rising rate environment, that matters more than ever.

That said, the balance sheet does have some strengths. The current ratio is over 5, which means CHCT has enough short-term assets to handle its obligations. That kind of liquidity gives some breathing room, and it supports the short-term stability of the dividend.

One other thing working in CHCT’s favor is its low beta—just 0.63. That tells you this stock doesn’t tend to move wildly with the market, which is great for investors who want to collect dividends without dealing with constant price swings. Also worth noting: over 87% of the shares are held by institutions. That’s usually a sign of long-term confidence in the business model.

All told, CHCT offers an attractive income stream that comes with some real risks. The payout is high, but it’s being supported by cash flow, not earnings. There’s not much wiggle room if conditions tighten further, but for now, the dividend remains intact—and that’s something income-focused investors will want to keep tabs on.

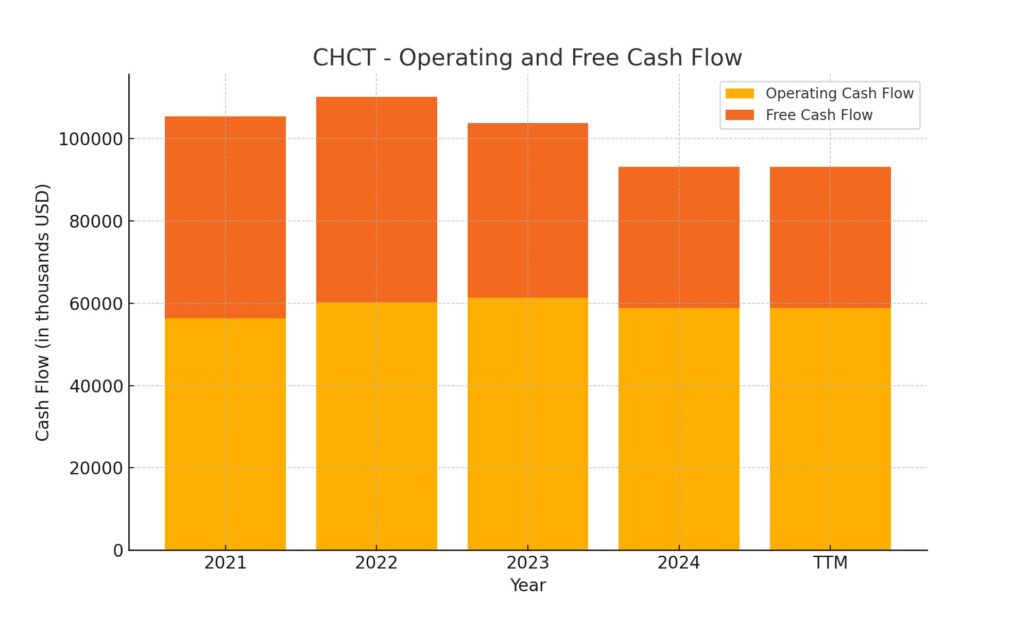

Cash Flow Statement

Community Healthcare Trust’s trailing twelve months (TTM) cash flow profile shows a company that continues to generate consistent cash from operations while navigating the capital demands of a real estate-heavy business. Operating cash flow came in at $58.9 million, which reflects steady performance compared to prior years, where figures have hovered around the $60 million mark. This consistency is a positive sign, especially in an environment where revenue growth has slowed. Free cash flow for the same period was $34.2 million, down from the prior year’s $42.4 million, suggesting a tighter margin after necessary capital expenditures.

Investing activity remains aggressive, with CHCT deploying over $92 million—largely toward property acquisitions and improvements, in line with its strategy to expand its healthcare footprint. On the financing side, the company raised $162 million through debt issuance but paid back nearly $80 million, leaving it with a net inflow from financing. This balance between borrowing and repayment is crucial given the interest expense climbed to $23 million for the year. Despite the heavy investing, CHCT ended the period with $4.4 million in cash, showing that while cash balances are lean, liquidity remains intact for now.

Analyst Ratings

Community Healthcare Trust Incorporated (CHCT) currently holds a consensus rating of “Hold” among analysts. 🟡 This reflects a cautious stance, with a mix of opinions: some suggest maintaining existing positions, while others see modest upside potential.

The average 12-month price target for CHCT stands at $21.25, hinting at a possible 34% upside from its current trading level. 📈 Targets among analysts range from a low of $18.00 to a high of $25.00, showing a wide span of sentiment across the board.

One notable shift came from Piper Sandler, which downgraded CHCT from “Overweight” to “Neutral” in early May 2024. 🪂 This move came with a lowered price target of $19.00 and was driven largely by growing caution over the company’s pace of acquisitions and its exposure to rising interest rates, which can strain capital-heavy business models like REITs.

On the other hand, Truist Securities offered a more upbeat take, maintaining a “Buy” rating while nudging their target up from $22.00 to $23.00 back in December 2024. 💬 That boost was based on confidence in CHCT’s long-term strategy and the belief that its healthcare-focused property portfolio can offer durability, even amid economic headwinds.

Analyst sentiment seems to mirror CHCT’s current reality—solid fundamentals but limited room for error. It’s a wait-and-watch name for now, where every earnings update and rate shift could tip the balance.

Earnings Report Summary

Steady Quarter with a Focus on Fundamentals

Community Healthcare Trust closed out the fourth quarter of 2024 with results that were generally steady, showing a company focused on the long game rather than short-term surprises. Net income landed at $1.8 million, or about $0.04 per diluted share. While those numbers aren’t going to turn heads, they’re consistent with CHCT’s strategy of slow, stable growth in essential real estate.

The more meaningful figure for investors was the company’s FFO—funds from operations—at $0.48 per share. Even more telling was the adjusted FFO at $0.55 per share, reflecting solid ongoing performance from its property portfolio. These figures haven’t moved much quarter-over-quarter, but that consistency is part of what makes CHCT attractive to long-term income investors.

Portfolio Expansion Continues

In line with its usual pace, the company made several acquisitions during the quarter. Three fully leased properties totaling roughly 38,000 square feet were added to the portfolio for just over $8 million. Management expects around a 9.4% return from those deals, which fits with their targeted yield range. That wasn’t all—CHCT also signed agreements to acquire a residential treatment facility along with seven other healthcare properties, projecting returns of around 9.1% to 9.75%. These aren’t splashy purchases, but they reinforce the company’s commitment to disciplined growth in secondary markets.

Financial Moves for Flexibility

On the financial side, CHCT took steps to strengthen its balance sheet flexibility. It expanded its revolving credit facility to $400 million and extended the maturity date out to late 2029. That kind of runway gives the company room to act when acquisition opportunities arise without needing to scramble for funding.

As expected, CHCT continued its tradition of paying out a reliable dividend, with a quarterly payout of $0.4675 per share. This keeps the yield very attractive, especially at current price levels.

Operational Notes

Revenue came in at $29.3 million, which is just a hair under the previous quarter. Operating expenses were trimmed slightly, and general and administrative costs also edged down. However, interest expenses did tick up to $6.4 million, a reflection of increased borrowings to support new investments.

Occupancy slipped a bit to 90.9%, and the average lease term dropped to 6.7 years. While these are minor changes, they’re worth watching as indicators of tenant stability and the overall health of the property base.

Looking Ahead

Leadership struck a cautious but confident tone about the road ahead. They’re keeping the focus on acquiring the right properties at the right prices, especially in a market where timing can be tricky. There’s no rush to load up on new deals, but management made it clear that CHCT is positioned to act when conditions are right. With a strong capital position and a clear strategy, the company is sticking to what it knows best—reliable healthcare real estate in underserved markets.

Chart Analysis

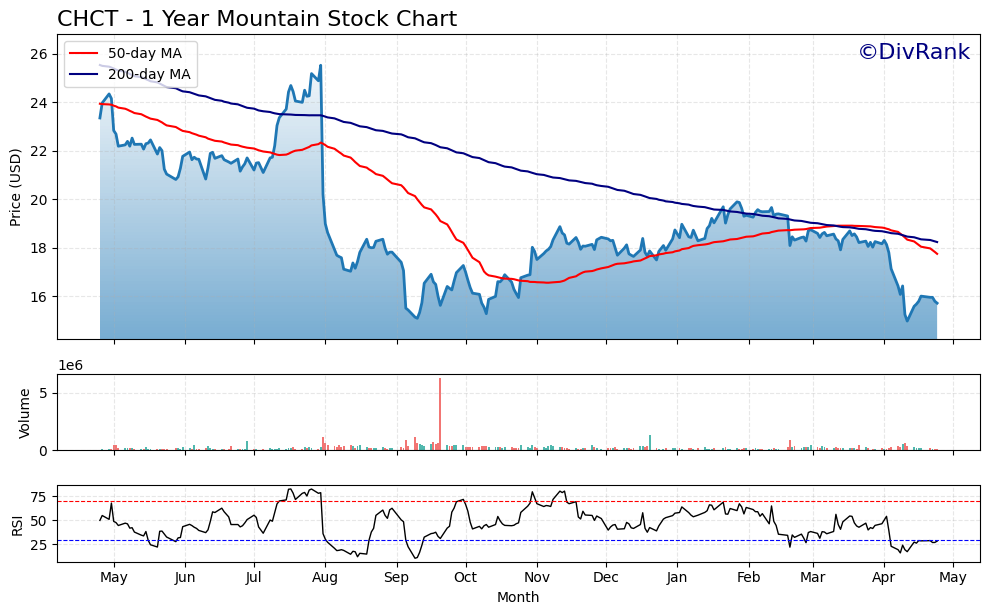

Downward Momentum and Key Averages

The past year hasn’t been kind to CHCT. After peaking above $26, the stock has steadily trended downward, breaking below its 50-day moving average in late summer and staying there since. The 50-day moving average itself has been declining sharply and is now well under the 200-day moving average—a textbook sign of sustained weakness. The long-term 200-day average is also trending lower, reinforcing the idea that this isn’t just a short-term dip, but a longer correction still in progress.

The crossover of the 50-day moving average beneath the 200-day average in September signaled a shift in momentum. Since then, every attempt to rally has been met with resistance, and the stock has consistently failed to reclaim prior highs. Most of the price action since January has been beneath both moving averages, which keeps pressure on any short-term rebounds from turning into something more meaningful.

Volume and Sentiment

Volume remains relatively subdued except for a brief spike in early September, suggesting that most recent selling pressure hasn’t come with panic—but rather a steady outflow. This isn’t necessarily a bad thing. The lack of high-volume breakdowns could indicate there’s no rush for the exits, just a rebalancing as the stock reprices in line with changing fundamentals.

What’s more interesting is that the most recent bounce off the lows hasn’t come with increased buying interest, which may suggest skepticism is still lingering. Until volume supports a breakout above resistance levels near $18–$19, the trend remains in a holding pattern.

RSI and Potential Exhaustion

Looking at the Relative Strength Index (RSI), CHCT has dipped into oversold territory multiple times over the past six months, including a stretch in April where it dropped below 30. These kinds of moves often precede short-term reversals, and that’s exactly what played out, with a mild rally that followed.

However, the RSI hasn’t broken into overbought territory since early January, and most of the action has hovered around neutral levels. This reflects the lack of strong momentum in either direction. The recent RSI low may suggest some downside exhaustion, but it doesn’t yet confirm a shift back to sustained strength.

Overall Technical Picture

What this chart reveals is a prolonged markdown phase with occasional pauses and weak bounce attempts. There’s no clear sign of accumulation forming just yet, as the price continues to struggle beneath long-term moving averages. That said, the RSI’s oversold signal paired with the volume profile might point to a stabilization phase starting to form. For now, it’s still too early to say the trend has reversed, but the worst of the selling pressure may be easing.

Management Team

Community Healthcare Trust (NYSE: CHCT) is led by a team with a strong background in healthcare real estate and financial strategy. At the center is Dave Dupuy, who took over as President and CEO in 2023. His previous work in healthcare investment banking gives him a deep understanding of the sector’s complexities, especially when it comes to mergers, acquisitions, and long-term capital deployment.

Supporting him is Bill Monroe, the Chief Financial Officer, who brings solid financial oversight and helps guide the company’s broader strategic decisions. The executive leadership has remained fairly consistent over the past few years, which lends a sense of continuity and direction that’s especially important in uncertain market cycles. Their collective experience is a cornerstone of CHCT’s ability to navigate both growth opportunities and operational challenges.

Valuation and Stock Performance

CHCT hasn’t had an easy run in the market lately. Over the past year, the stock has seen a steep decline, dropping from a 52-week high of $27.62 down to recent lows around $15. It’s been under pressure from rising interest rates and investor concerns around its growth outlook, which has led to underperformance relative to many of its REIT peers.

On a valuation basis, CHCT trades at a price-to-sales ratio of about 3.9 times, which is still a bit higher than many in its space. That could mean investors are expecting a degree of stability or a rebound, but it also raises questions about whether the stock is still a little pricey given its recent earnings softness.

Analyst estimates put the average 12-month price target around $17, suggesting some modest upside from current levels. The one thing that continues to stand out is the dividend. With a forward yield close to 12%, it’s one of the more attractive yields in the sector, which could make it appealing for those focused on income.

Risks and Considerations

There are a few areas of risk that are worth highlighting. One of the biggest is interest rate exposure. CHCT’s model depends heavily on external financing to fund its acquisitions, and with borrowing costs on the rise, its margins and future deal flow could feel the pressure. The recent uptick in interest expense reflects that dynamic already playing out.

Another factor is tenant concentration. If any of the larger tenants were to default or fail to renew leases, the financial impact could be material. CHCT operates in a focused sector, which offers some insulation, but also means limited diversification.

There are also broader market risks tied to healthcare regulations and reimbursement structures. These can affect tenant operations, which in turn, affect occupancy rates and rental income. Lastly, the company needs to continue meeting REIT distribution requirements to maintain its favorable tax status. Any disruption in that flow—whether from cash constraints or operational hiccups—could impact investor confidence.

Final Thoughts

Community Healthcare Trust has built a unique position in the healthcare real estate space, focused on essential services in non-urban areas. The management team brings the right mix of strategy and experience to keep the business steady, even during more volatile periods.

While the stock has pulled back sharply, the dividend remains high and supported for now by operating cash flow. Investors willing to look through the near-term volatility may find value in its long-term model, but the road ahead likely includes challenges tied to rates, tenant performance, and acquisition execution.

CHCT isn’t a growth story at this moment—it’s about preserving value, maintaining income streams, and making the most of well-timed real estate decisions. The next few quarters will be telling as the company either stabilizes and rebuilds investor confidence or continues to feel the weight of a tough macro environment.