Last Update 4/24/25

Commerce Bancshares (NASDAQ: CBSH) offers a well-rounded profile for investors focused on steady income and consistent financial performance. With over 150 years of banking history and a strong presence across the Midwest, the company blends conservative management with a disciplined growth strategy. Its dividend track record spans more than five decades of uninterrupted increases, supported by a low payout ratio and healthy free cash flow. Recent earnings showed a rise in net income, solid loan growth, and careful cost management. The stock has climbed over 14% in the past year, and with strong capital ratios, experienced leadership, and a clear strategic direction, CBSH continues to deliver reliable returns while maintaining a robust balance sheet.

Recent Events

In its latest quarterly update, Commerce Bancshares reported net income of $540 million over the trailing twelve months and earnings per share at $4.03. Notably, earnings were up 16.8% from the previous year. That’s impressive given the tricky interest rate environment banks are dealing with right now.

Revenue also edged up to $1.64 billion, a modest 3.4% year-over-year growth. Nothing flashy there, but it’s the kind of growth that speaks to stable operations, especially for a bank that leans more conservative with its lending practices.

The company is generating strong profitability metrics—return on equity stands at 17.01%, and return on assets is 1.75%. These numbers point to a management team that’s running a tight ship. With a current P/E ratio just under 15 and a forward P/E a little over 16, the stock trades in a middle-of-the-road range, not too stretched, not overly discounted.

It’s not a growth rocket, but it’s not supposed to be. This is a business that knows its identity and doesn’t stray far from its core.

Key Dividend Metrics

📈 Dividend Yield: 1.82% (Forward)

🔁 5-Year Average Dividend Yield: 1.69%

💵 Annual Dividend Rate: $1.10 (Forward)

🧮 Payout Ratio: 26.28%

📆 Most Recent Dividend Date: March 25, 2025

❌ Ex-Dividend Date: March 7, 2025

📊 Dividend Growth: Consistent increases over the past decade

🔒 Dividend Safety: High, given low payout ratio and strong earnings

Dividend Overview

Let’s talk about what really matters to income investors—the dividend. CBSH’s forward yield sits at 1.82%, which might not catch your eye at first glance. But don’t dismiss it based on yield alone. The real story is in the low payout ratio—just over 26%. That tells you everything you need to know about the sustainability of the dividend.

Commerce isn’t stretching its resources to pay shareholders. Instead, it pays out a manageable portion of earnings while keeping the rest to strengthen its balance sheet or reinvest in operations. For conservative investors, that’s a reassuring signal.

And CBSH has been at this for a long time. It has raised its dividend for more than 50 straight years. That kind of history isn’t common. It’s a sign that the dividend isn’t just a quarterly obligation for Commerce—it’s part of the DNA.

This isn’t the kind of stock that’s going to shower you with cash in the short term, but over the years, it has delivered a growing income stream that’s weathered plenty of economic ups and downs.

Dividend Growth and Safety

Growth in the dividend has been measured—typically in the low single digits—but that consistency is a strength, not a weakness. The goal here isn’t to surprise investors with big jumps. It’s to grow the payout carefully and predictably, which Commerce has done well.

With $4.18 billion in cash on hand and $2.42 billion in debt, the company’s financial footing looks solid. There’s a comfortable cushion to keep the dividend going even if the economy slows or loan losses pick up. And with a low payout ratio, there’s room to increase the dividend if earnings continue to grow at a steady pace.

The stock also carries a low beta of 0.71, meaning it tends to be less volatile than the broader market. That’s good news if you’re looking to build a dividend-focused portfolio that won’t swing wildly with every market headline.

In the end, Commerce Bancshares isn’t trying to be something it’s not. It’s a bank that knows how to keep things steady and reward shareholders over time. For those looking for consistency and reliability in their dividend holdings, CBSH has the kind of profile that fits right in.

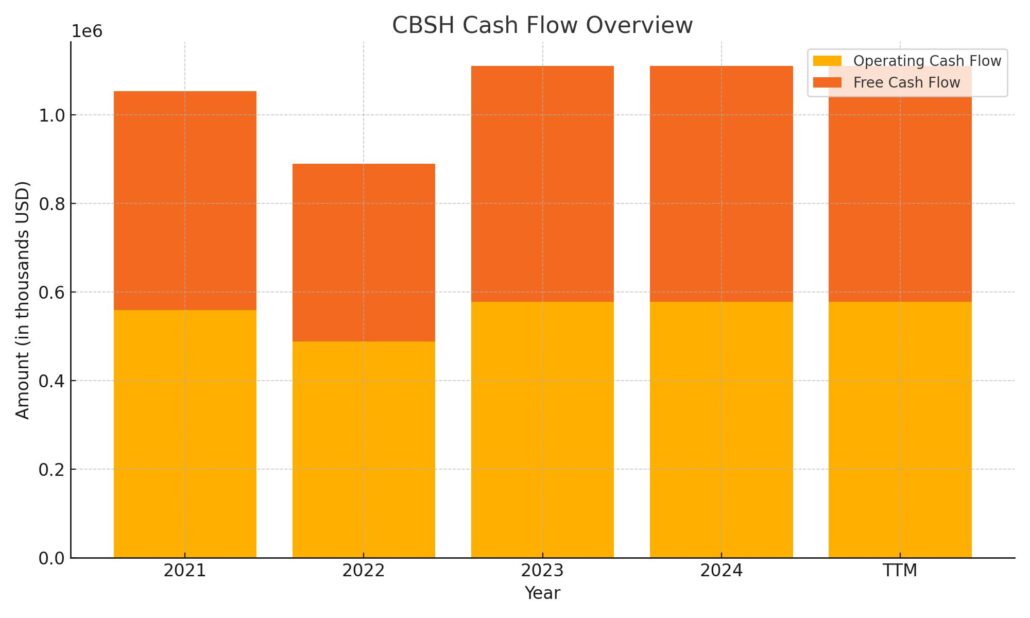

Cash Flow Statement

Commerce Bancshares generated $577.9 million in operating cash flow over the trailing twelve months, reflecting a solid core business that continues to produce reliable income. This figure marks an increase from the prior year, reinforcing the bank’s ability to generate cash from its lending and deposit activities. Free cash flow also came in strong at $531.7 million, a healthy margin above capital expenditures of $46.1 million, which shows disciplined reinvestment and ample room for dividend coverage.

On the investing side, cash inflow totaled $483.8 million, a reversal from more volatile movements in prior years, particularly 2022. Financing activities continued to show a net outflow, with $372.9 million going out—largely driven by share repurchases and dividend payments. The repurchase of capital stock alone accounted for $170.5 million, signaling confidence from management in long-term value. With an ending cash position of $3.38 billion, the company has more than enough liquidity to meet obligations and sustain its dividend policy, even in the face of higher interest payments, which grew to $453.2 million over the same period.

Analyst Ratings

Commerce Bancshares (NASDAQ: CBSH) has seen a mix of analyst actions recently, reflecting shifting perspectives on its performance and outlook. 🟡 Morgan Stanley upgraded the stock from “Underweight” to “Equal Weight” on April 7, 2025, citing a more balanced risk-reward profile. 🔽 They also adjusted their price target downward from $66 to $58, indicating tempered expectations despite the upgrade.

🔻 On the other hand, StockNews.com downgraded CBSH from a “Hold” to a “Sell” rating on April 17, 2025. This move suggests concerns about the company’s near-term performance or broader market factors weighing on its valuation.

🟠 Additional price target revisions came from Keefe, Bruyette & Woods, who lowered their target from $74 to $70, and from Wells Fargo, who brought theirs down from $70 to $60. Both firms maintained a neutral stance, signaling neither strong optimism nor deep concern.

📊 Despite the range of views, the overall consensus rating for CBSH remains a “Hold,” with analysts landing on an average price target of about $64.60. This implies the stock is expected to maintain its current trajectory without major surprises ahead.

Earning Report Summary

Commerce Bancshares kicked off 2025 with a solid performance, showing that its conservative, steady approach to banking still works well even in today’s shifting economic landscape. The company brought in net income of $131.6 million, or 98 cents per share, which was not only an improvement from last year’s $112.7 million but also a bit ahead of what analysts had expected. Revenue came in at $428.1 million, up 7.6% from the same time last year—an encouraging sign of consistent growth.

Strong Lending and Interest Income

One of the big contributors to the quarter’s performance was net interest income, which reached a record $269.1 million. The bank benefited from higher rates on its fixed-rate assets, and it managed to grow its balance sheet in the process. The yield on its interest-earning assets edged up to 3.56%, which shows that they’re making their lending dollars work harder.

Reliable Fee-Based Business

Non-interest income, which includes everything from service charges to trust fees, also held up nicely. It totaled $158.9 million this quarter, with trust and wealth management fees seeing a healthy bump of over 10% compared to a year ago. This part of the business continues to be a dependable revenue stream and adds some balance to the traditional banking model.

Keeping Costs in Check

On the expense side, Commerce showed good discipline. Non-interest expenses dropped by 3% to $238.4 million, partly because last year’s numbers included a few one-time costs that didn’t recur. That cost control helped the bank improve its efficiency ratio to 55.6%, which is a positive sign for shareholders who value operational discipline.

Credit Quality and Capital Remain Strong

Credit metrics continue to look healthy. Non-accrual loans came in at just 0.13% of total loans, and charge-offs were modest at 0.25%. They did slightly increase their loan loss reserves to $167 million, or 0.96% of total loans, a cautious move but one that reinforces their conservative posture.

From a balance sheet perspective, total assets grew to $32.4 billion. Loans were up, averaging $17.2 billion, and deposits came in strong at nearly $25.8 billion. Capital ratios also stayed in good shape, with a Tier I leverage ratio of 12.29% and tangible common equity at 10.33%.

Commerce didn’t shy away from rewarding shareholders either. The company repurchased around 855,000 shares at an average price of $64.56 and boosted its dividend to 27.5 cents a share—a 7% increase from last year. These moves reflect confidence in their long-term strategy and ongoing commitment to creating value for investors.

Looking ahead, leadership sounded cautiously optimistic. CEO John Kemper noted the strength of the bank’s business model and emphasized that Commerce is well-positioned for whatever comes next, whether that’s continued economic stability or a bumpier road. The message is clear: they’re ready either way.

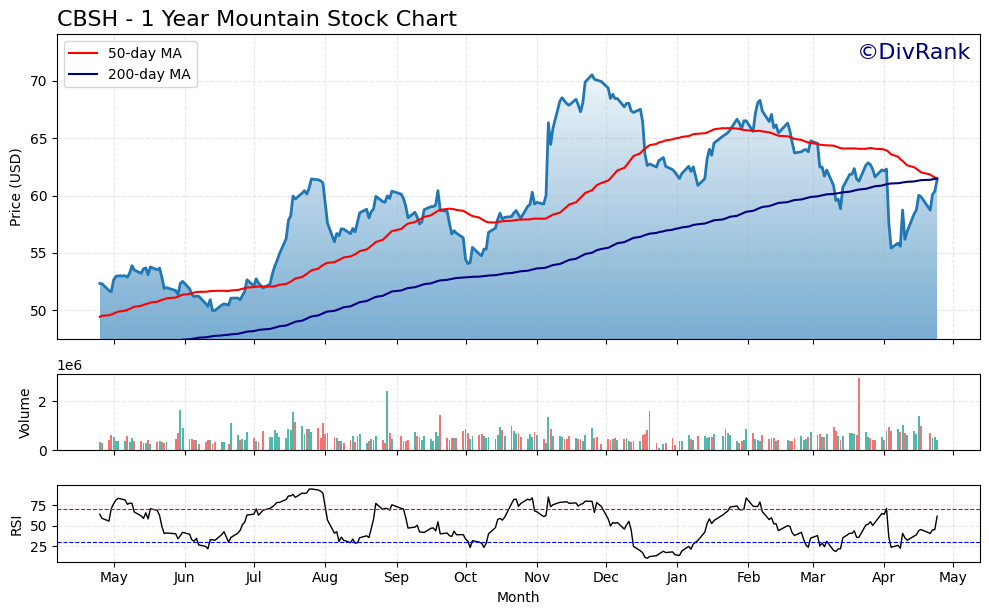

Chart Analysis

CBSH has spent the past year moving through a clear cycle of upward momentum, topping out, and then correcting. The chart reveals a lot about how sentiment and technical levels have shifted over the last twelve months.

Price Action and Moving Averages

Looking at the price trend, the stock saw a strong run-up from late May through November, climbing steadily from the low $50s to over $70. That move pulled the 50-day moving average sharply above the 200-day line, a classic sign of bullish momentum. But the peak in November was followed by a long and gradual decline, eventually pulling the 50-day back down to meet and now slightly drop below the 200-day moving average.

That crossover—often referred to as a bearish signal—suggests the stock has lost some steam and is moving into a more neutral or potentially corrective phase. Price has recently started recovering from a sharp dip in April, bouncing near the $55 level, and has now re-approached both moving averages. This is an important zone to watch, as it could either signal renewed strength if price breaks above it, or continued sideways action if it stalls here.

Volume Trends

Volume has remained relatively consistent throughout the year, with only a few spikes during periods of sharp price movement. Notably, the strong rally in November was backed by increased volume, which adds legitimacy to that move. More recently, the price recovery in April happened on slightly higher volume as well, hinting that some accumulation may be taking place after a sell-off.

The volume pattern doesn’t show any signs of panic or broad-scale distribution, which is encouraging. Most of the trading activity appears orderly, and there’s no major outlier that would suggest instability in the stock.

Relative Strength Index (RSI)

The RSI stayed mostly between 30 and 70 for the majority of the year, with a few touches above 70 during the strong run into late fall and dips below 30 during the recent correction. That’s typical of a stock moving through its cycle without extreme overbought or oversold conditions dominating.

Currently, RSI has turned higher and is approaching the mid-60s, suggesting some positive momentum is coming back into play. It’s not yet overbought, but it’s definitely showing strength after what was a weak March.

The recent rebound, paired with stabilizing volume and improving RSI, paints a picture of a stock that might be trying to find its footing again. If it can reclaim and hold above the moving averages, there’s room for the trend to turn upward once more. For now, it’s showing signs of resilience after a cooling-off period.

Management Team

Commerce Bancshares is led by a seasoned executive team with deep roots in the company and the banking industry. At the helm is John W. Kemper, who serves as President and Chief Executive Officer. Kemper joined Commerce in 2007, bringing experience from McKinsey & Company, and has held various leadership roles within the organization. He holds degrees from Stanford University, the London School of Economics, and Northwestern University’s Kellogg School of Management.

Supporting Kemper is Charles G. Kim, Executive Vice President and Chief Financial Officer. Kim has been with Commerce since 1989 and oversees all financial functions, consumer banking segments, technology, and strategic planning. His educational background includes a Bachelor of Science in business administration and an Executive MBA from Washington University in St. Louis.

The executive team also includes Kevin Barth, Executive Vice President and CEO of Commerce Bank – Kansas City, who joined the company in 1984 and oversees operations in multiple states. Other key members are John Handy, President and CEO of Commerce Trust; David L. Orf, Executive Vice President and Chief Credit Officer; and Paula Petersen, Executive Vice President overseeing consumer banking and strategic services. This leadership group brings a wealth of experience and a commitment to the company’s long-standing values and strategic direction.

Valuation and Stock Performance

As of April 24, 2025, Commerce Bancshares’ stock (NASDAQ: CBSH) closed at $61.37. Over the past 52 weeks, the stock has traded between $49.97 and $72.75, reflecting a 14.36% increase over the year. The company’s market capitalization stands at approximately $8.1 billion.

In terms of valuation, CBSH has a trailing P/E ratio of 14.98 and a forward P/E of 16.39. The price-to-book ratio is 2.32, indicating that the stock is trading at a premium to its book value, which is common for well-established banks with consistent earnings. The stock’s beta is 0.71, suggesting lower volatility compared to the broader market.

Analysts have a consensus price target of approximately $64.60 for CBSH, with a consensus rating of hold. This reflects a balanced view of the company’s steady performance and the challenges facing the regional banking sector.

Risks and Considerations

While Commerce Bancshares has demonstrated consistent performance, there are several risks and considerations to keep in mind. The banking industry is subject to economic cycles, and a downturn could impact loan demand and credit quality. Interest rate fluctuations can also affect net interest margins, a key revenue source for banks.

Regulatory changes pose another risk. New regulations or changes to existing ones can increase compliance costs and affect profitability. Additionally, the company must continually invest in technology to meet customer expectations and fend off competition from fintech firms.

Cybersecurity is an ongoing concern, as banks are prime targets for cyberattacks. Any breach could lead to financial losses and damage to the company’s reputation. Lastly, while the company’s leadership has been stable, any significant changes in the executive team could impact strategic direction and investor confidence.

Final Thoughts

Commerce Bancshares has a long history of prudent management and steady growth. The company’s experienced leadership team, solid financial metrics, and commitment to shareholder returns make it a noteworthy player in the regional banking sector. While there are risks inherent in the banking industry, Commerce’s conservative approach and strong capital position provide a buffer against potential challenges. As the financial landscape continues to evolve, the company’s adaptability and focus on core banking principles position it well for the future.