Updated 4/22/25

Cohen & Steers (NYSE: CNS) specializes in real assets, managing portfolios concentrated in REITs, preferred securities, infrastructure, and natural resources. With over $87 billion in assets under management, the firm is built around a disciplined approach to income and value investing. Leadership remains tightly aligned with shareholders—nearly half of the stock is held by insiders—and has guided the business through a variety of market cycles.

Despite recent stock price pressure driven by sector rotation and rising interest rates, CNS continues to produce solid earnings, maintain a healthy dividend, and manage risk with a conservative balance sheet. For investors focused on long-term income and consistency, the company’s steady financials, experienced management, and focus on real asset strategies offer a compelling foundation.

Recent Events

The last year has brought its share of challenges and opportunities for Cohen & Steers. As rates climbed, REIT valuations—core to CNS’s portfolio—faced pressure. At the same time, the hunger for dependable income only grew. That dynamic has kept CNS’s stock moving within a wide range, from a 52-week high of $110.67 down to a recent low of $67.09. As of late April, shares were trading just over $71, down significantly from last year’s highs.

Still, the company’s latest financials show resilience. First quarter results for 2025 came in solid, with earnings growing 17% year over year and revenue up nearly 10%. Net income over the trailing twelve months was just north of $157 million on $529 million in revenue, a strong 29.7% profit margin.

Debt remains low, with just $141 million on the books and a conservative debt-to-equity ratio of 24.55%. What’s also notable here is insider ownership. Nearly half the shares—46.1%—are held by insiders. That’s not a detail to brush off. It suggests those running the company are deeply invested in its long-term success and dividend policy.

Key Dividend Metrics

📈 Forward Dividend Yield: 3.48%

💵 Annual Dividend Rate: $2.48 per share

📅 Dividend Payout Ratio: 78.1%

📉 5-Year Average Yield: 2.79%

🧮 Trailing Dividend Yield: 3.22%

📆 Most Recent Dividend Date: March 13, 2025

⏳ Ex-Dividend Date: March 3, 2025

Dividend Overview

Right now, CNS pays a forward yield of 3.48%. That’s a healthy payout, especially in this environment, where yield hunters are turning over every rock to find income that feels dependable. At a share price just above $71, you’re getting a meaningful stream of income—more than the firm’s average yield over the past five years.

The company’s payout is based on a trailing 12-month dividend of $2.39 per share, with earnings per share coming in at $3.06. That puts the payout ratio at 78.1%. Yes, that’s a little high, but not uncomfortably so. CNS has long favored returning capital to shareholders, and the current payout still fits within its typical operating rhythm.

This isn’t a growth-at-all-costs company. It’s a dividend-first firm with a focus on high-quality real assets. The consistency of its payout reflects that mindset. Even in choppy markets, the dividend remains central to the story here.

Dividend Growth and Safety

Let’s take a look at what matters most to long-term income investors—how safe is the dividend, and where could it go from here?

CNS has a strong track record of maintaining and gradually increasing its dividend. It’s not one of those companies posting double-digit hikes year after year. Instead, think modest, deliberate growth. That approach fits well with its asset mix and income stability.

Now, a payout ratio above 78% does mean the firm is distributing a big chunk of its profits. It leaves less wiggle room for aggressive raises unless earnings push higher. But with REITs and infrastructure regaining some favor as the rate cycle stabilizes, CNS could be in a good position to continue delivering steady—or even slightly growing—dividends.

The firm’s cash position is another source of comfort. With over $309 million in cash and modest debt, CNS isn’t financially constrained. It has the liquidity to support the dividend, even if earnings were to face pressure for a couple of quarters.

That 46% insider ownership comes back into focus here, too. When management is this heavily invested alongside shareholders, the odds of dividend cuts drop sharply. There’s a clear incentive to keep distributions healthy and intact.

Short interest is worth a quick glance. At around 6.4% of the float, it shows there are skeptics—but not an overwhelming crowd betting against the stock. Much of that doubt likely stems from sector-specific concerns, not from a belief that CNS’s dividend is at risk.

When you put it all together, CNS offers a rare blend—predictable income, specialized focus, insider alignment, and a disciplined capital structure. For investors who value dividends above all, there’s a lot to like in this quiet operator.

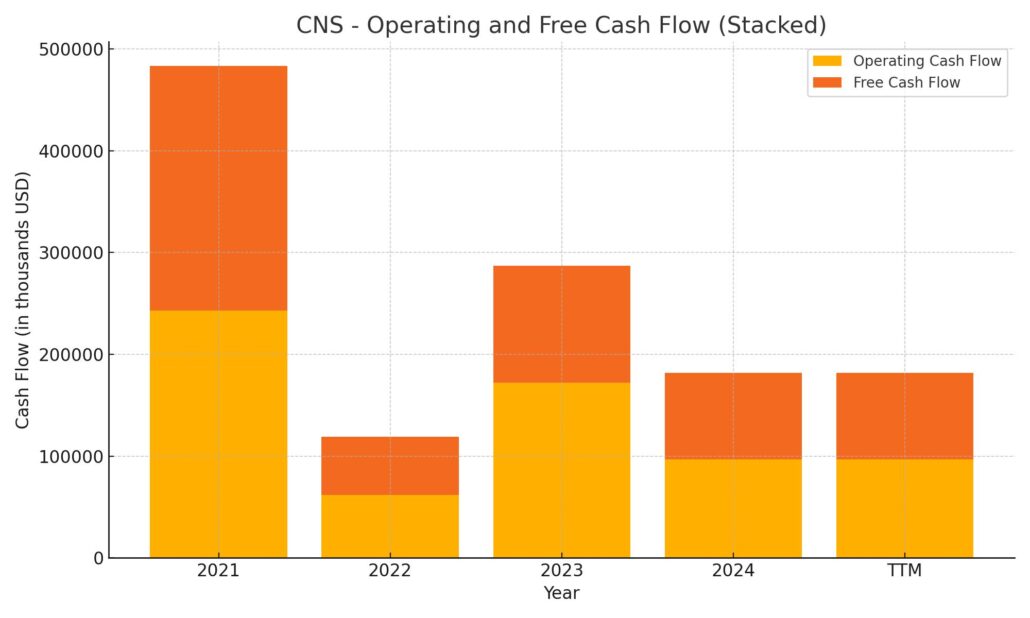

Cash Flow Statement

Cohen & Steers generated $96.7 million in operating cash flow over the trailing 12 months, a noticeable drop from $172 million in the prior year. This decline suggests a more tempered pace of inflows from its core asset management business, though the firm still produced solid positive free cash flow of $85 million. Capital expenditures totaled just under $12 million, in line with expectations for a company with a relatively asset-light model.

On the investing side, CNS spent $119.7 million—more than the previous year—highlighting an uptick in deployment of capital toward future growth or potentially opportunistic acquisitions. Financing activities swung to a positive $18.2 million, reversing last year’s outflow, thanks largely to a $68 million stock issuance that more than offset $21 million in share repurchases. The company ended the period with $183 million in cash, giving it continued flexibility while maintaining a conservative balance sheet.

Analyst Ratings

🟢 Cohen & Steers (NYSE: CNS) has recently seen a shift in analyst sentiment, with notable adjustments to its ratings and price targets. UBS upgraded the stock from a “Sell” to a “Neutral” rating, raising its price target from $63 to $102. This change reflects a more optimistic view of the company’s prospects, possibly due to improved performance or a more favorable outlook in the real assets and income-driven investing space.

🔻 On the other hand, Evercore ISI maintained its “Outperform” rating but trimmed its price target from $94 to $78. While the rating remained positive, the lower target reflects some caution, likely tied to recent earnings guidance or sector-specific pressures—particularly around the valuation compression in REITs and other yield-focused holdings.

📊 The broader consensus from analysts paints a picture of cautious optimism. The average price target across coverage sits around $85, suggesting potential upside from current levels. Still, the spread in targets shows a level of uncertainty, with some seeing recovery ahead and others wary of near-term headwinds. Overall, the sentiment leans positive but remains tempered by the dynamics of the current market environment.

Earning Report Summary

Cohen & Steers kicked off the first quarter of 2025 with a performance that was steady, even if not flashy. They reported adjusted net income of $38.4 million, which worked out to $0.75 per share—slightly down from $0.78 in the previous quarter. Revenues came in at $133.8 million, dipping from $139.9 million. That drop was mostly tied to a few factors: fewer revenue days in the quarter and slightly softer average assets under management.

The operating margin also pulled back just a touch, landing at 34.7%, compared to 35.5% last time around. Nothing alarming here—it’s more a reflection of a quarter with some natural slowdowns.

Inflows and AUM Head in the Right Direction

Even with some top-line softness, the flow story was encouraging. The firm brought in $222 million in net inflows, which is always a healthy sign, especially in a market that hasn’t been easy for anyone focusing on income-generating strategies. A lot of that came from open-end funds and continued strength in their Japan subadvisory mandates.

Assets under management rose to $87.6 billion by the end of the quarter, up from $85.8 billion. A good chunk of that increase—about $2.1 billion—was driven by market appreciation, showing that the strategies they’re running are keeping pace with broader recovery trends.

Leadership’s Take on What’s Ahead

CEO Joe Harvey struck a confident tone in discussing the results. He acknowledged that markets are still tricky, but he pointed out the depth and consistency of their investment strategies as key strengths. There’s a clear focus on sticking with what they know—real assets, infrastructure, income-producing investments—and continuing to deliver long-term value.

Looking ahead, the message from leadership is clear: stay disciplined, stay focused, and be ready to move when opportunity knocks. They see plenty of room for growth in their niche and are continuing to lean into it with conviction. In a market full of noise, that kind of consistency may be exactly what long-term investors are looking for.

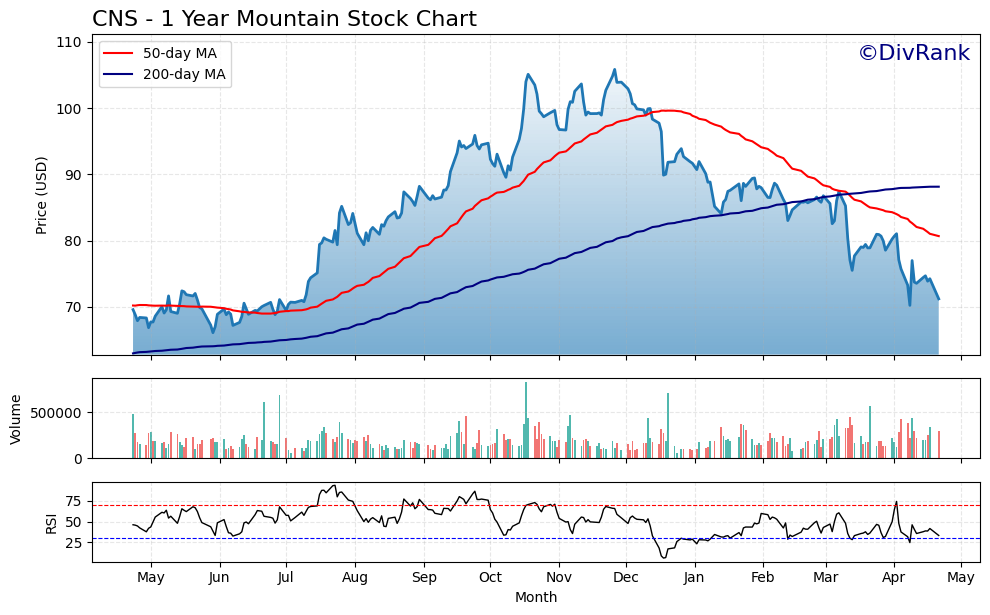

Chart Analysis

A Shift in Momentum for CNS

The past year has been a story of two very different halves for CNS. From late spring through the end of November, the stock showed clear upward momentum. Price action stayed consistently above both the 50-day and 200-day moving averages, and buyers seemed firmly in control. This uptrend peaked in early December with shares topping out just shy of $110.

Since then, the narrative has changed. The 50-day moving average rolled over sharply and has been trending downward for several months, now crossing well below the 200-day line. That’s a classic signal of a longer-term downtrend taking hold. The stock itself has followed suit, breaking below both moving averages and failing to reclaim them in multiple attempts. The last several weeks show lower highs and lower lows, with the price now pressing down into the $70 range.

Volume and Momentum Indicators Flashing Warning Signs

Volume spikes are sporadic and mostly occur on down days, hinting at distribution rather than accumulation. There hasn’t been consistent heavy buying on rallies, which suggests large holders aren’t stepping in aggressively yet. If anything, volume behavior reinforces that this drawdown is being met with indifference or quiet selling.

Looking at the RSI at the bottom of the chart, it’s been hovering below the 50 mark for most of the last few months. This signals weak relative strength, and any brief climbs above that midpoint have been short-lived. As of now, RSI is approaching the oversold region again, which could attract short-term buyers—but without volume confirmation, it’s not enough to suggest a trend change.

Where Things Stand Now

CNS is testing support levels that haven’t been seen since early last year. With both key moving averages trending lower and volume offering little conviction, the technical picture is tilted toward continued softness unless there’s a meaningful catalyst. The 200-day moving average may now act as resistance on any recovery attempts, which will make upside progress more challenging.

What’s happening on this chart reflects a broader cooling in sentiment. After a strong run in the middle of last year, the market seems to be reassessing valuation, earnings momentum, or macro sensitivity. The current downtrend is established and would need a sharp reversal in price action or a fundamental spark to break out of the current pattern. Until then, the chart tells a cautious story.

Management Team

Cohen & Steers is led by a management team with deep experience in the asset management industry. Joseph Harvey, who took over as CEO in 2021, has been with the firm since 1992. His leadership has emphasized stability, discipline, and a continued focus on the company’s long-standing core strengths in real assets. Jon Cheigh, who serves as President and Chief Investment Officer, has been instrumental in shaping investment strategies since he joined in 2005. His expertise in real estate and listed infrastructure plays a central role in the firm’s overall positioning.

Supporting them is Raja Dakkuri as Chief Financial Officer, bringing a steady approach to financial management, and Adam Derechin as Chief Operating Officer, who helps ensure operational efficiency across the business. The leadership bench combines strategic vision with long-term institutional knowledge—something that often makes a meaningful difference during market shifts and economic uncertainty.

Valuation and Stock Performance

The past year has been a tough stretch for CNS. The stock has declined from a high of $110.67 to a recent low in the mid-$60s. That pullback tracks with broader softness in income-oriented assets, particularly real estate investment trusts and preferred securities. Even with that decline, Cohen & Steers remains fundamentally sound. Revenue over the trailing twelve months is just over $529 million, with net income topping $157 million.

The stock’s beta of 1.44 reflects higher-than-average volatility, especially compared to broad market benchmarks. It’s not uncommon for sector-focused managers to exhibit wider price swings, particularly in response to interest rate moves. Still, the stock appears to be trading below consensus valuation. Analysts have pegged the fair value of CNS closer to $85, suggesting there’s room for price recovery if market sentiment stabilizes or interest rates ease.

Risks and Considerations

There are a few things investors should keep in mind with Cohen & Steers. The company’s success is closely tied to its exposure in real assets and yield-based investments. These areas can be sensitive to interest rate changes and economic cycles. A sustained period of rising rates or recessionary pressure could weigh on both asset flows and fund performance.

Another factor is regulation. Any shifts in how asset managers can structure or market products—especially in the REIT or infrastructure space—could have ripple effects. Operationally, the firm is strong, but its high insider ownership, while generally a positive for alignment, could limit outside influence on key strategic decisions. Investors looking for more agile, broadly diversified asset managers might find that level of concentration a little too narrow for their liking.

Final Thoughts

Cohen & Steers has carved out a focused and respected place in the world of real asset investing. The management team is experienced and clearly aligned with shareholder interests, especially given the high level of insider ownership. Despite recent softness in the stock price, the company continues to generate reliable earnings and pay an attractive dividend.

Its valuation today may be appealing for those who believe that rate pressures could ease or that listed real assets may find renewed favor in the market. While there are risks to consider—macro headwinds and sector sensitivity among them—the foundation of the business remains intact. For investors looking to participate in income-generating strategies through a firm with a long-term lens, CNS continues to be a name worth watching.