Updated 4/21/25

City Holding Company isn’t going to grab national headlines or dominate the front page of financial news. But for investors who value a stable, income-producing stock, this quiet regional bank from West Virginia has a lot to offer. It’s not trying to disrupt banking or reinvent the wheel—it simply sticks to fundamentals and does them well.

With a footprint across West Virginia and neighboring states, CHCO focuses on traditional banking. It’s not chasing aggressive growth or throwing capital at the latest trend. Instead, it’s built a model around efficiency, solid returns, and a reliable dividend. In a world full of market noise, that kind of discipline has its own appeal.

The company has around $6 billion in assets and a market cap of roughly $1.67 billion. What it lacks in size, it makes up for in performance. Investors who’ve held on through the past year have been rewarded, with the stock climbing nearly 10%—comfortably outpacing the broader market.

Recent Events

City Holding’s most recent quarter didn’t bring any fireworks, but that’s part of the charm. Net income hit $116 million over the past twelve months, with earnings per share coming in at $7.89. These results continue a streak of dependable performance.

Quarterly revenue rose 3.2% year-over-year. Not huge, but in this environment, slow and steady growth is a plus. The real eye-opener lies in profitability. A net margin of over 40% and operating margin just under 50% show this bank runs a very tight ship. When nearly half of your revenue turns into operating profit, it signals a company that knows what it’s doing.

Return on equity is also impressive, sitting at 16.64%. It’s not just growing—it’s making that growth count. And with low volatility (beta of just 0.47), the stock tends to hold its ground when the broader market gets bumpy.

Key Dividend Metrics

📈 Forward Dividend Yield: 2.78%

💵 Forward Dividend Rate: $3.16

📊 Trailing Dividend Yield: 2.65%

📆 Next Dividend Date: April 30, 2025

🔁 Ex-Dividend Date: April 15, 2025

💸 Payout Ratio: 37.2%

📉 5-Year Average Dividend Yield: 2.87%

CHCO’s dividend yield isn’t the highest you’ll find, but it’s one of the most dependable. With a payout ratio below 40%, there’s plenty of cushion built in. Management isn’t overextending the company just to support the dividend—this is coming from a position of strength.

Dividend Overview

Investors looking for dividend reliability will find a lot to like here. CHCO has been steadily returning cash to shareholders quarter after quarter. The upcoming dividend of $3.16 per share isn’t just a placeholder—it’s backed by real earnings and a thoughtful capital strategy.

While many banks were forced to slash or pause their dividends during economic stress, City Holding quietly kept paying. That track record builds trust, and it’s a strong signal of how the business is run.

Compared to its peer group, CHCO’s yield sits in a sweet spot. It’s not stretching to offer a sky-high dividend that might be unsustainable. Instead, it delivers a yield that’s competitive and covered by healthy financials. And for long-term investors, that steady income stream starts to look better with each passing quarter.

Dividend Growth and Safety

This is where CHCO really builds its case as a dividend stock worth watching. The current yield is solid, but what makes it special is the consistency of growth. Over the past decade, dividend increases have been a regular feature. They’re not massive hikes, but they’re dependable—usually enough to keep up with inflation and then some.

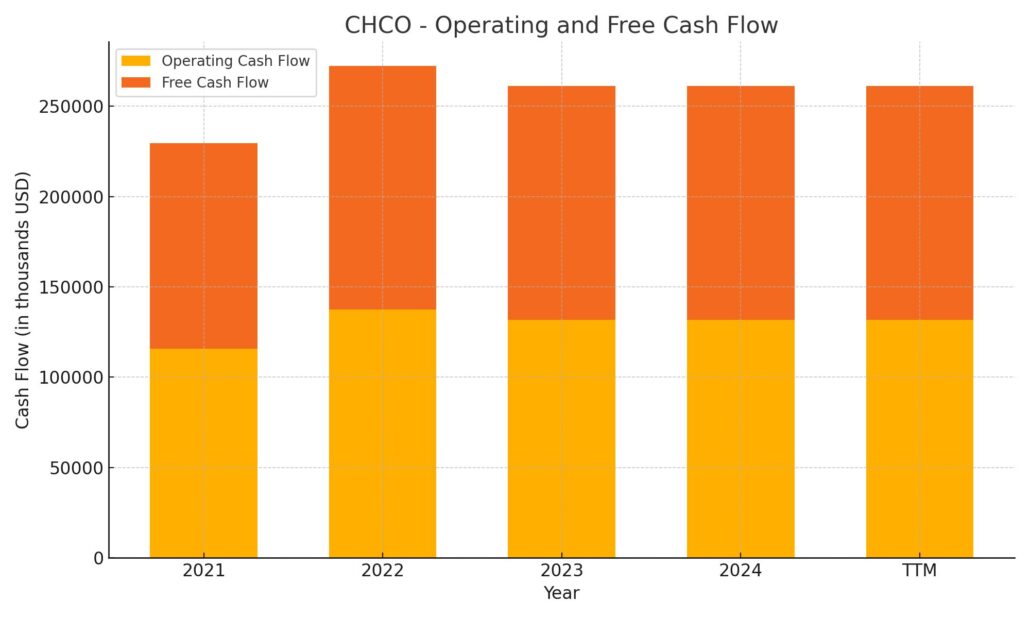

The low payout ratio is key. At just 37.2%, there’s a lot of breathing room. That means even if earnings take a short-term dip, the dividend has a strong chance of staying intact. The company also holds over $280 million in cash, with solid operating cash flow to back it up.

Debt is manageable, and leverage doesn’t appear to be a risk factor here. The financials suggest CHCO could absorb economic pressure without jeopardizing its dividend. That’s exactly what you want to see if your goal is to build a portfolio that generates reliable income over time.

CHCO isn’t the flashiest stock, and that’s perfectly fine. For dividend investors, the appeal lies in its predictability, discipline, and quiet strength. With a well-funded dividend, careful growth, and a business model that puts stability first, City Holding looks like it’s built to keep delivering for income-focused portfolios year after year.

Cash Flow Statement

City Holding Company generated $131.9 million in operating cash flow over the trailing twelve months, a solid figure that underscores the strength of its core banking operations. This level of cash generation aligns closely with its reported net income, reinforcing that the bank’s earnings are supported by actual cash inflows rather than accounting adjustments. Free cash flow came in at $129.2 million, indicating that CHCO isn’t heavily burdened by capital expenditures, which totaled just $2.7 million. This leaves the company with plenty of flexibility to maintain and potentially grow its dividend while supporting other corporate initiatives.

On the investing side, the company saw an outflow of $252.3 million, largely reflecting investment activity that likely includes securities and lending, which is typical for banks during periods of liquidity management. Financing cash flow swung positive at $189.5 million, a reversal from the prior year, helped by $50 million in debt issuance. While CHCO also continued to return capital to shareholders through $17.9 million in stock repurchases, the overall increase in financing cash flow suggests a careful balancing act between capital returns and funding needs. The cash position at year-end stood at $225.4 million, providing a comfortable cushion for both stability and optionality moving forward.

Analyst Ratings

City Holding Company (CHCO) has seen a mix of sentiment from analysts lately. 🧐 Piper Sandler recently adjusted their stance by lowering the stock’s price target from $135 to $125, while maintaining a neutral rating. This move likely reflects a more cautious approach due to current market conditions and the stock’s valuation, suggesting that while CHCO remains fundamentally sound, upside may be limited in the short term.

On the other hand, Keefe, Bruyette & Woods took a slightly more optimistic angle, bumping their price target from $120 to $130. 🔼 They also kept a market perform rating in place, signaling continued confidence in CHCO’s operational stability and consistent performance, especially considering its solid returns and conservative capital management.

The broader analyst consensus for CHCO currently leans toward a “Hold” rating, with the average 12-month price target sitting at $116.75. 🎯 The range of estimates stretches from a low of $99 to a high of $130, pointing to a fairly balanced outlook among those covering the stock. There’s no major swing in sentiment, but the steady hand shown by CHCO in its financials continues to earn it quiet respect in the analyst community.

Earning Report Summary

City Holding Company wrapped up 2024 on a high note, delivering its strongest financial performance to date. The bank reported net income of $117.1 million for the year, with diluted earnings per share landing at $7.89. It wasn’t just a solid year overall—the fourth quarter also held its own, contributing $28.7 million to the bottom line and pushing quarterly EPS to $1.94.

Steady Core Performance

One of the standout features this year was the consistent strength in net interest income, which came in at $220.2 million. That’s a small bump from the year before, showing that CHCO continues to manage its lending and deposit activities efficiently, even in a tougher rate environment. That said, the net interest margin did slip a little, down to 3.86%, mostly due to rising interest costs on liabilities. Still, the bank was able to hold its ground.

Non-interest income added a nice lift as well, climbing to $73.3 million. That came largely from higher trust and investment management fees, along with a boost from service charges. It’s a good sign that CHCO isn’t relying solely on interest income and has other levers to pull.

Keeping Costs in Check

On the expense side, there was a bit of upward pressure—salaries went up and health insurance costs edged higher. But even with those increases, the bank managed to keep its efficiency ratio below 50%, coming in at 48.8%. That’s a strong indicator of discipline and smart spending, especially in an environment where a lot of banks are struggling to contain overhead.

What also stood out was the company’s strong balance sheet. Asset quality remained high, and the capital base is in great shape. The tangible equity to tangible assets ratio ended the year at 9.06%, which offers a nice cushion heading into 2025.

Looking Ahead

Management sounded upbeat about the road ahead. They highlighted the strength of their customer relationships, the dedication of their team, and the cost structure that allows CHCO to stay competitive without overreaching. Loan and deposit growth were both solid, and there’s a clear focus on steady, sustainable expansion rather than chasing aggressive numbers.

In short, CHCO is entering the new year with momentum. It’s not a flashy business, but it’s proving once again that consistent execution and a strong foundation can deliver results—and keep shareholders happy in the process.

Chart Analysis

City Holding Company (CHCO) has had a dynamic twelve months, with clear shifts in momentum and investor sentiment playing out on the chart. The stock has moved through periods of steady gains, consolidation, and a more recent decline, all visible in the chart’s structure.

Price Movement and Moving Averages

The chart shows a strong uptrend from May through November, marked by a steady climb above both the 50-day (red) and 200-day (blue) moving averages. Around November, CHCO peaked near the $135 mark before beginning a broader pullback. Since then, the 50-day moving average has turned lower and recently crossed below the 200-day moving average—a technical signal often seen as a shift in trend momentum.

Despite the correction, CHCO has found support around the $110 level, bouncing back slightly in April. The price has yet to reclaim the 50-day average decisively, which suggests the stock may still be in a phase of resetting expectations following its earlier highs.

Volume and RSI Behavior

Volume has been generally muted, with only a few spikes, mostly on down days. This lighter volume suggests the selling has not been panic-driven, but rather a steady rotation out. The relative strength index (RSI) dropped near the oversold level (around 30) several times in March and April, hinting at possible exhaustion in selling pressure.

More recently, the RSI has begun to climb but remains below the overbought zone, which could leave room for further price recovery if momentum holds. There’s no clear divergence, but the lows in RSI during the past few months were not accompanied by drastically lower price lows, signaling some underlying resilience.

Current Trend Context

What stands out now is the convergence of the price with the long-term moving average. The stock is hovering right around the 200-day line, a spot that often acts as a decision point. Buyers who focus on stability may find interest here if the price can stabilize and reclaim the shorter-term moving average.

Over the past year, CHCO has weathered both enthusiasm and pullbacks, typical of a well-established regional bank. While it may not currently be in a breakout phase, the technicals reflect a stock that is digesting gains and recalibrating. If it can maintain support above the 200-day average and regain some upward momentum, that could mark the start of a new phase in its price cycle.

Management Team

City Holding Company is led by Charles R. Hageboeck, who has served as President and CEO since 2005. With a Ph.D. in Economics, Hageboeck brings a measured, analytical approach to running the bank, guiding it through various interest rate environments and broader economic shifts. His long-standing leadership provides a sense of stability that’s increasingly rare in the banking world.

He’s supported by David L. Bumgarner, the Executive Vice President and CFO, who also joined in 2005. With a background in public accounting and a CPA designation, Bumgarner plays a key role in overseeing financial discipline and managing the company’s capital. Other senior leaders, like Jeffrey Dale Legge, the Chief Information Officer, and John A. DeRito, EVP of Commercial Banking, have decades of experience at the company, which speaks to a culture that values continuity and long-term vision.

This kind of leadership structure tends to support consistent decision-making. The team is clearly focused on maintaining a conservative risk profile and keeping the bank’s strategy rooted in what it does well—traditional community banking with a strong emphasis on efficiency and shareholder return.

Valuation and Stock Performance

As of April 2025, CHCO shares are trading around $113.13, with a market cap of roughly $1.67 billion. The past 12 months have shown a fair bit of movement, with the stock hitting a high of $137.28 and dipping as low as $99.63. That range reflects both investor optimism and the impact of broader macroeconomic uncertainty. Despite this, CHCO has managed to outperform broader market averages over the same period.

In terms of valuation, the stock has a trailing price-to-earnings ratio of 14.42 and a forward P/E of 16.42. These are not stretched by any means and suggest the stock is priced for modest growth, which aligns with the company’s steady financial performance. The price-to-book ratio sits at 2.29, showing that investors are willing to pay a bit of a premium for the company’s proven track record and consistent returns.

The dividend yield is currently 2.78%, and the payout ratio stands at 37.2%. That’s a healthy combination—yield that’s competitive and a payout level that doesn’t jeopardize the company’s ability to reinvest or manage through tougher cycles. Over the past five years, the average yield has hovered around 2.87%, suggesting the dividend has been relatively stable even as the market has moved around it.

Risks and Considerations

While City Holding has a lot going for it, there are risks to keep in mind. One of the main concerns is loan exposure to industries that can be sensitive to economic swings, such as hospitality and commercial real estate. If the broader economy slows down more than expected, credit quality could be pressured, even though current indicators suggest asset quality remains strong.

Another consideration is the pace of interest rate changes. The bank has historically performed well in varying rate environments, but rapid shifts—especially declines—could narrow margins and dampen earnings. On the expense side, rising wage and benefit costs could pressure efficiency metrics, especially if revenue growth slows.

There’s also a growing awareness among investors around ESG issues. City Holding has room to grow here, particularly in its disclosures and policies related to environmental and social responsibility. While this may not affect the near-term financials, it could influence institutional investor interest down the road.

Final Thoughts

City Holding Company has built its reputation on consistent execution, conservative management, and a focus on returning value to shareholders. Its leadership team is seasoned and aligned with the long-term interests of the business. The stock’s valuation reflects confidence in this steady performance, and its dividend adds a layer of predictability that many investors find appealing.

That said, the company isn’t immune to broader economic risks. The sectors it lends to and the impact of rising operating costs are worth watching. But overall, CHCO continues to show that a slow-and-steady approach, backed by disciplined leadership, can hold its own even in a complex market.