Updated 4/21/25

Citizens Financial Services, Inc. (CZFS) has steadily built a strong reputation for disciplined banking, consistent performance, and shareholder-friendly policies. With a footprint rooted in Pennsylvania and strategic expansion through acquisitions like HV Bancorp, the bank blends conservative growth with reliable execution.

Over the past year, CZFS delivered rising earnings, improved margins, and solid cash flow—backed by a management team focused on long-term value. Trading near $52.82, the stock carries a forward yield of 3.54%, a payout ratio of just over 33%, and is priced below book value. These fundamentals, along with healthy capital reserves and a stable loan portfolio, have helped CZFS weather recent market shifts while maintaining steady returns. For investors focused on dependable income and sound financials, the story here is about sustainability, not speculation.

Recent Events

Citizens Financial Services, Inc. (CZFS) may not be grabbing headlines, but for investors who value consistent dividend income, it’s a name worth getting familiar with. This is a regional bank with deep roots, headquartered in Mansfield, Pennsylvania. It’s been serving smaller communities for over a century through its wholly owned subsidiary, First Citizens Community Bank.

Lately, the stock has experienced a notable pullback—down over 5% in recent trading to around $52.82. That’s a sharp move, especially considering it’s still up nearly 27% over the past year. Shares have ranged from $38.52 to $75.40 during that time, and while recent price action has been choppy, the business behind the stock remains stable.

Earnings have been quietly strong. Net income over the last twelve months totaled $27.82 million, with quarterly earnings showing 5.9% growth compared to the prior year. Revenue has climbed by a modest 4.2%, signaling steady growth even in a higher-rate environment. Profit margins remain solid with a 38.34% operating margin, and return on equity sits just under 10%. These aren’t eye-popping numbers, but for a bank of this size, they’re reassuring. It’s a story of slow, deliberate progress rather than dramatic swings—something many income-focused investors will appreciate.

Key Dividend Metrics

📈 Forward Yield: 3.54%

💰 Forward Annual Dividend: $1.98 per share

🔁 5-Year Average Yield: 3.23%

🧮 Payout Ratio: 33.42%

📆 Ex-Dividend Date: March 14, 2025

📅 Dividend Payment Date: March 28, 2025

📊 Recent Dividend: $1.95 per share (trailing)

💸 Dividend Growth: Steady and dependable

📚 Price-to-Book Ratio: 0.89

Dividend Overview

At a 3.54% forward yield, CZFS offers a solid return in the current environment, particularly when that yield is backed by conservative financial management. The bank has shown a clear commitment to rewarding shareholders, but they’ve done so responsibly. With a payout ratio just over 33%, they’re distributing a third of their profits back to shareholders while keeping the rest to support the business.

It’s this kind of balance that gives the dividend durability. They’re not overextending, and the business fundamentals appear strong enough to support the current rate. In fact, even if earnings were to plateau, there’s enough cushion here to keep those payments flowing.

Cash reserves total $56.39 million, and while the company carries over $300 million in debt, that’s fairly typical for a bank. What matters more is how well that debt is managed and whether the balance sheet is healthy—and here, Citizens Financial seems to check out.

Another signal that management has an eye on shareholder value is the recent 101-for-100 stock split. It’s a minor detail on the surface, but it helps keep shares affordable and accessible, especially for retail investors who might be looking to build or add to a position.

Dividend Growth and Safety

One of the more appealing aspects of CZFS for dividend investors is the sense of reliability. This isn’t a company trying to chase rapid expansion or aggressive dividend hikes. Instead, the growth in dividends has been gradual and thoughtful. They’ve built a track record of regular increases—nothing extreme, but consistent and well-supported by earnings.

The earnings payout ratio of 33.42% is well below industry thresholds where you start to worry. It gives the company flexibility to weather slower quarters or reinvest where needed. More importantly, it reflects a long-term strategy that doesn’t depend on stretching to meet dividend commitments.

Book value per share is currently $62.97, which is actually higher than the current stock price. That could point to some undervaluation, but more importantly, it shows that the company has a solid capital foundation.

The current return on equity of 9.6% isn’t leading the pack, but in this context, it signals prudent use of shareholder capital. There’s no need for this bank to take big swings. Instead, they’re building shareholder value quietly, with a focus on local banking and community ties—things that often translate to stable long-term performance.

Shares are tightly held too, with just under 7% owned by insiders and nearly 30% held by institutions. That tells us management has skin in the game, and larger investors see enough value to stay invested.

Altogether, the dividend looks safe. There’s enough financial strength, conservative management, and consistent earnings to make that 3.5% yield look reliable. And when it comes to income investing, that kind of reliability often ends up being the most important metric of all.

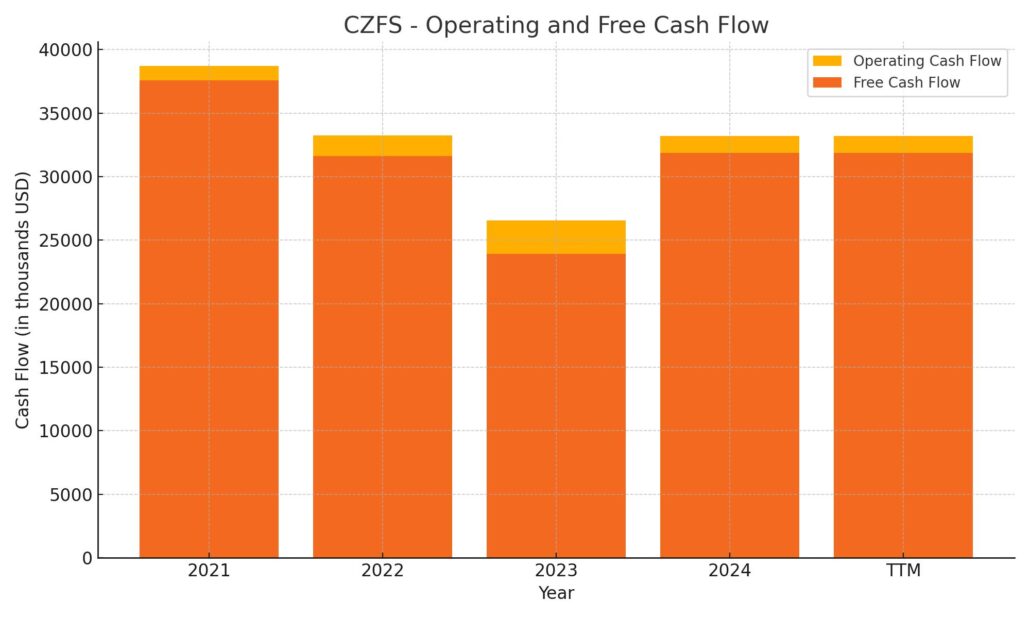

Cash Flow Statement

Over the trailing twelve months, Citizens Financial Services, Inc. generated $33.18 million in operating cash flow, reflecting continued stability in its core banking operations. That figure is a step up from the previous year, showing the business remains healthy in its ability to convert earnings into actual cash. Free cash flow followed closely at $31.87 million, indicating that after capital expenditures, the company retained most of what it brought in. Capital investment was modest at just $1.31 million, suggesting a restrained, efficiency-focused approach to spending.

On the investing side, the bank reported a cash outflow of $69.07 million, reversing the prior year’s inflow. That swing was largely driven by shifts in the bank’s securities and loan activity, which is typical in an environment where rates and liquidity needs fluctuate. Financing activities provided a net inflow of $25.28 million, reflecting active balance sheet management—particularly in debt repayment, where $35 million was retired. Despite these movements, the company ended the period with $42.2 million in cash, a solid cushion that helps ensure ongoing operational flexibility and support for its dividend commitments.

Analyst Ratings

📈 In late April 2024, Citizens Financial Services, Inc. (CZFS) was upgraded by Janney Montgomery Scott, moving from a “Neutral” to a “Buy” rating. This shift came as analysts took note of the bank’s steady earnings performance and an appealing valuation compared to similar regional banks. The firm pointed out CZFS’s conservative lending practices and strong capital reserves as reasons for increased confidence in the stock.

🎯 The consensus 12-month price target for CZFS now stands at $71.40, with projections ranging from $70.70 to $73.50. That range signals a solid upside from where the stock is currently trading, and reflects optimism that the company can continue delivering consistent results. Analysts seem encouraged by the bank’s low payout ratio, growing free cash flow, and long-term focus on shareholder value. With a measured approach to risk and a clear dividend strategy, CZFS has earned a more favorable outlook from the investment community.

Earning Report Summary

Citizens Financial Services wrapped up 2024 on a strong note, with earnings that showed both resilience and solid execution. The fourth quarter brought in $8 million in net income, which was a step up from the same period the year before. Earnings per share landed at $1.68, slightly better than the $1.59 posted in Q4 of 2023. When you zoom out and look at the full year, the results were even more impressive—net income climbed to $27.8 million, up over 56% year-over-year.

Core Business Still Growing

A big part of that growth came from improved core performance and the fact that 2023 results had been weighed down by one-time merger-related costs and credit loss provisions from the HV Bancorp acquisition. With those off the books in 2024, the underlying earnings power came through more clearly. Net interest income for the fourth quarter rose to $22.9 million, and the net interest margin nudged higher to 3.26%, which shows the bank is managing its lending and deposit mix well, even in a challenging rate environment.

Strategic Moves Paying Off

The company also benefited from its earlier decision to sell the Braavo division’s remaining loans, which added to non-interest income and cleared some assets off the books. For the full year, non-interest income came in at $15.4 million, up from $11.6 million the year before. At the same time, non-interest expenses ticked up to $65.6 million, mostly because of higher salary costs tied to the HV Bancorp acquisition. But even with that increase, the earnings gains more than covered it.

Strong Balance Sheet and Dividend Bump

From a balance sheet perspective, things look healthy. Total assets stood at just over $3 billion at year-end, with net loans sitting at $2.29 billion. Deposits continued to grow, reaching $2.38 billion, and shareholder equity edged up to nearly $300 million. Credit quality remains solid, with $21.7 million set aside for potential loan losses, which equals 0.94% of total loans.

On the dividend front, shareholders saw a slight bump, with the company increasing its quarterly payout to $0.49 per share. That’s a modest increase, but still meaningful—especially when paired with the earlier 1% stock dividend declared in June. The cash dividend was paid out in late December to holders of record earlier that month.

Leadership’s Take

Management seemed pleased with how the year wrapped up. They highlighted the successful integration of HV Bancorp and how the sale of the Braavo assets helped refocus the business. They also pointed out that the company’s balance sheet and earnings strength give it a solid foundation for whatever comes next—whether that’s more organic growth or new opportunities down the road. All in all, 2024 looked like a year where steady execution and strategic cleanup set the stage for continued progress.

Chart Analysis

CZFS has had an interesting ride over the past year, showing both solid upward momentum and a more recent cooling off that deserves some attention. What stands out most is how the stock steadily climbed from late spring into winter, peaking just above $70 in December before gradually easing back down. This kind of action suggests a strong wave of optimism followed by a stretch of consolidation and perhaps some profit-taking.

Moving Averages

The 50-day moving average (red line) moved sharply higher during the second half of the year, following the stock’s climb through summer and fall. But recently, it has flattened and begun to roll over. Meanwhile, the 200-day moving average (blue line) has quietly crept up, reflecting a longer-term uptrend that’s still intact despite recent weakness. The two lines are now converging, which can be a pivotal point. A crossover here—if the 50-day dips below the 200-day—might indicate a potential trend shift, though nothing is confirmed yet.

Volume Activity

Looking at the volume, there were several spikes during the summer months and again in November, likely reflecting news-driven buying interest. More recently, volume has been lighter and somewhat mixed, which often points to indecision among market participants. It doesn’t look like there’s a rush for the exits, but the momentum has clearly faded compared to last year’s rally.

RSI Trend

The RSI in the bottom panel tells a more cautious story. The indicator has drifted below the midpoint level of 50 and is hovering closer to oversold territory than overbought. It hasn’t dipped under 30 yet, but the pattern over the last few months shows waning buying pressure. Back in late summer and early fall, RSI consistently bumped into overbought levels, confirming the strength of the uptrend at the time. That’s no longer the case, and momentum now feels more neutral to weak.

Overall Pattern

The visual peak in late December followed by a gentle but steady decline into April paints the picture of a cooling trend after a strong run. While there hasn’t been a major breakdown, the chart reflects a more cautious tone in recent weeks. The price remains above the 200-day moving average, but the gap has narrowed. If the current weakness continues, it could challenge that longer-term support level.

From a broader perspective, the overall structure still leans bullish when you step back, but short-term signals are mixed. This is a name that had strong tailwinds in the second half of last year but is now searching for its next catalyst.

Management Team

Citizens Financial Services, Inc. (CZFS) is led by a leadership team that brings a steady hand to both strategy and day-to-day operations. They’ve consistently focused on strengthening the bank’s presence in its core markets while maintaining a conservative approach to lending and balance sheet management. This combination has allowed them to grow the business without overextending.

The acquisition of HV Bancorp was a clear example of that mindset—expanding market share while preserving the company’s identity as a community-focused institution. The board of directors complements the executive team with a broad range of experience, particularly in banking, regulatory compliance, and enterprise risk management. Their oversight has helped the bank navigate an increasingly complex operating environment while keeping long-term goals front and center.

Valuation and Stock Performance

As of now, CZFS is trading around $52.82. With a trailing P/E of 9.56 and a price-to-book ratio of 0.89, the stock appears to be undervalued by most traditional measures. For investors focused on quality at a reasonable price, those metrics offer a potentially attractive entry point, especially considering the bank’s solid return on equity and consistent dividend history.

The stock has had its swings over the past year—ranging from a low near $38 to a peak above $75—but the broader pattern has been one of resilience. The sharp rise in the second half of last year gave way to some cooling off, and now shares are trading below both the 50- and 200-day moving averages. This doesn’t necessarily signal weakness in the business but reflects a market that’s recalibrating expectations after a strong run.

What helps support the valuation case is the consistency in underlying performance. Revenue and earnings have been steadily climbing, and there’s been no sign of balance sheet stress. Paired with a dividend yield above 3.5%, the total return picture remains appealing, even if price appreciation takes a pause in the near term.

Risks and Considerations

Even with a solid foundation, no bank is immune to external risks. Interest rates remain one of the biggest variables for CZFS. A flattening or inverted yield curve could put pressure on net interest margins. In that environment, banks need to be highly efficient to maintain profitability.

There’s also credit risk to think about. If the economy softens and defaults rise, the bank could face higher provisions for loan losses. So far, the portfolio has held up well, but the risk is always present in a lending-based business. Operational risk, particularly around cybersecurity, is another area the bank needs to continue investing in. As systems get more digitized, the threat landscape expands.

Regulatory changes can also impact margins and growth plans. The bank has managed this well historically, but any shift in federal or state banking policy could introduce new headwinds. While these are manageable, they are part of the landscape and worth factoring in for any long-term holder.

Final Thoughts

Citizens Financial Services has built a business on measured growth, strong fundamentals, and disciplined leadership. The recent pullback in the stock doesn’t appear to reflect any material weakness in operations. Instead, it feels more like a pause after a strong stretch, creating a potential opportunity for investors who value consistency and income.

Leadership has shown they know how to balance risk and reward. Their acquisition strategy has been purposeful, and their commitment to maintaining a healthy payout ratio signals confidence in future earnings. Risks exist, as they do with any financial institution, but the track record here suggests a management team that is both aware of them and proactive in response.

With a solid dividend, steady earnings, and a business model rooted in community-focused banking, CZFS remains a name that deserves attention from those looking for reliability and thoughtful capital management. The current valuation offers room for upside if earnings momentum continues, and even in a slower environment, the fundamentals appear sound.