Updated 4/21/25

Churchill Downs Incorporated (CHDN), best known for the Kentucky Derby, has grown into a multifaceted entertainment and gaming company with a strong presence in historical racing machines, regional casinos, and online wagering. Under the leadership of CEO Bill Carstanjen, the company has delivered steady revenue growth, expanded its property base, and raised its annual dividend for 14 consecutive years.

Despite a stock price decline from its $150 highs to near $100, the business continues to show financial strength, with over $770 million in operating cash flow and improving free cash generation. Analysts still see upside based on a consensus price target around $120, with long-term fundamentals supported by strong management, strategic reinvestment, and efficient capital use. As the company executes new growth initiatives and strengthens its core offerings, investors have reason to stay focused on its evolving value proposition.

🐎 Key Dividend Metrics

💰 Dividend Yield: 0.40%

📈 5-Year Average Yield: 0.32%

📅 Dividend Growth Streak: Positive, but not aggressive

🔁 Payout Ratio: 7.2%

📊 Annual Dividend Per Share: $0.41

📆 Ex-Dividend Date: December 6, 2024

📍 Payment Date: January 3, 2025

A Quick Look at the Business

Based in Louisville and tracing its roots back to the 1800s, Churchill Downs has evolved well beyond its origins in horse racing. Yes, the Kentucky Derby is still the crown jewel, but today’s CHDN has built a diversified model centered on regional casinos, online betting platforms, and entertainment properties.

It’s not just operating venues—it owns a lot of the land they sit on. That makes the business less vulnerable to rising rents or outside ownership pressures. In recent years, the company has expanded into new markets, financed some major developments, and created a high-margin operation that spins off reliable cash.

Recent Events

Over the past 12 months, shares have taken a hit—down over 16% year-over-year. That slide reflects more than just company performance. It’s largely tied to the broader impact of interest rates, as CHDN carries a fair amount of debt from its expansion strategy.

But peel back the price movement, and the fundamentals tell a different story. Revenue climbed 11.2% over the last year, landing at $2.73 billion. Net income came in at $426.8 million, showing a solid 15.6% profit margin. What’s even more impressive? Return on equity came in at nearly 43%. That kind of number points to strong capital efficiency, something long-term investors love to see.

Earnings per share grew to $5.68, with quarterly earnings growth coming in at 24.5%. So while the market may have cooled on the stock price, the core business is still moving in the right direction.

Dividend Overview

Let’s cut to the chase: the current yield of 0.40% isn’t going to satisfy someone hunting for high income. But this isn’t a yield play—it’s a dividend reliability story. CHDN pays $0.41 per share annually, and management hasn’t shown any signs of backing off from that.

What stands out is how easily the company covers this dividend. With a 7.2% payout ratio, the dividend represents just a fraction of the company’s net income. That leaves a lot of breathing room. Whether cash is needed for expansion, paying down debt, or navigating tougher quarters, the dividend isn’t going to be the thing that tips the balance sheet.

The most recent dividend was paid in early January, with the ex-dividend date set for December. This consistent annual schedule helps long-term investors plan their income streams, even if the amount is modest.

Dividend Growth and Safety

If you’re thinking about dividend safety, the numbers paint a comfortable picture. The company earns nearly $5.70 per share, and it’s only returning 41 cents of that to shareholders. That gives it a coverage ratio close to 14 times earnings—very healthy by any standard.

The real question is how sustainable this is in the context of the broader financials. The company generated over $770 million in operating cash flow last year, which gives it the muscle to both fund its dividend and reinvest in future growth. That said, levered free cash flow turned negative—coming in at around -$52 million. The dip came mostly from capital expenditures, not operational struggles, so it’s not something to panic about. But it does put a spotlight on how management is balancing growth ambitions with near-term cash outlays.

Where things get a bit tighter is the balance sheet. Total debt is nearly $5 billion, and the company’s current ratio is below 1—sitting at 0.56. The debt-to-equity ratio is also elevated, over 450%. That’s the tradeoff: CHDN has used borrowing to expand quickly, and while it’s managing that well today, it limits short-term flexibility.

Still, with such a low dividend commitment and strong recurring cash generation, the risk to the payout itself remains low. There hasn’t been rapid dividend growth, but the company’s strategy suggests it’s prioritizing expansion now, with room to shift gears if market conditions change. And for long-term investors, that kind of optionality is worth something.

For income-focused investors with a longer time horizon, Churchill Downs offers a unique profile. It’s not the classic dividend name that promises yield up front—but it does offer strength underneath, and more importantly, the capacity to grow that income in the years ahead.

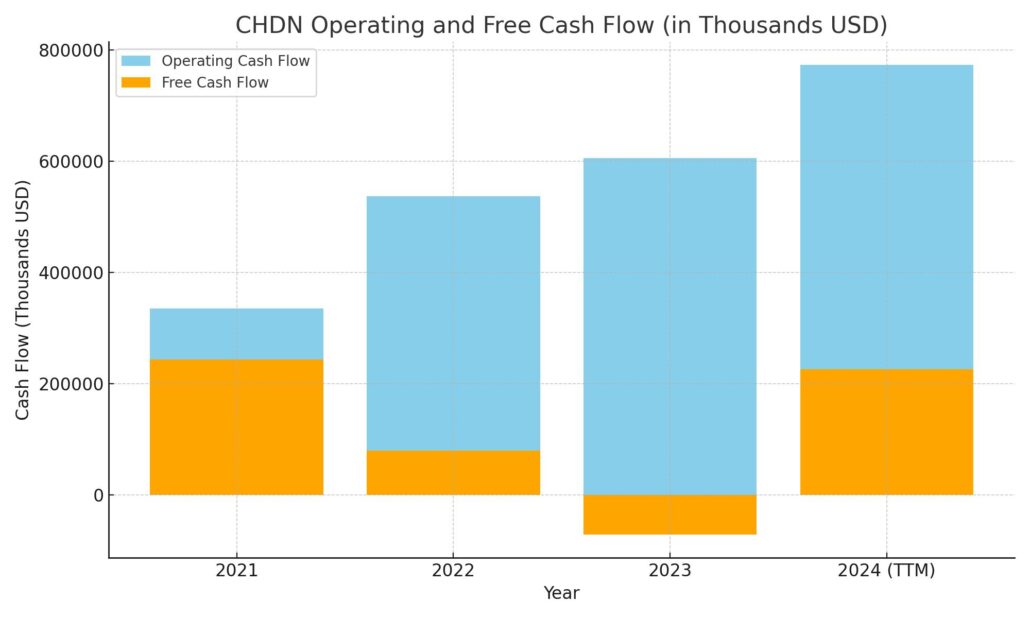

Cash Flow Statement

Churchill Downs posted trailing 12-month (TTM) operating cash flow of $772.7 million, marking a strong increase from the prior two years. That growth shows continued momentum in the core business, especially when compared to $605.8 million in 2023 and $536.8 million in 2022. Free cash flow swung back into positive territory, coming in at $225.7 million TTM—an encouraging turnaround from negative $70.7 million in 2023. This positive flow suggests that, despite heavy spending, the company is generating enough cash to cover its operational and capital needs.

On the investing side, the company remains active, with cash outflows of $545.2 million over the TTM period, mostly tied to capital expenditures which totaled $547 million. Financing cash flow turned negative again at -$196.6 million, reflecting debt repayments of $900.8 million, even as new debt issuance brought in $965.5 million. CHDN also spent $186 million repurchasing its own shares. Despite these moves, the company’s cash position rose to $252.7 million, up from $221.8 million the year before, showing it’s maintaining liquidity even amid high investment and debt activity.

Analyst Ratings

📈 In recent weeks, analysts have adjusted their outlook on Churchill Downs Incorporated (CHDN), reflecting shifts in market sentiment and company performance. Barclays initiated coverage with an “Overweight” rating and a price target of $125, indicating confidence in the company’s growth prospects. Stifel Nicolaus lowered their price target from $161 to $142, maintaining a “Buy” rating, citing concerns over near-term challenges. Wells Fargo also adjusted their target from $165 to $158, reflecting a cautious stance while still recommending an “Overweight” position. Mizuho reduced their target from $151 to $148, maintaining an “Outperform” rating, suggesting a tempered optimism. Additionally, JMP Securities reiterated a “Market Outperform” rating with a consistent target of $166, indicating sustained confidence in the company’s long-term strategy.

🔮 Despite these mixed adjustments, the consensus among analysts remains positive. The average 12-month price target for CHDN stands at approximately $153.44, suggesting a potential upside of over 50% from current levels. This consensus reflects a belief in the company’s robust fundamentals and growth trajectory, even amidst short-term market fluctuations.

Earning Report Summary

Churchill Downs closed out 2024 with solid momentum, and the numbers reflect a company that’s firing on all cylinders. Total revenue hit $2.73 billion for the year, a notable jump from the year before, and adjusted EBITDA came in strong at $1.16 billion. The fourth quarter added a big push to that performance, delivering $624.2 million in revenue and net income of $71.7 million. Per-share earnings landed at $0.95, giving shareholders another reason to feel good about the company’s direction.

Live and Historical Racing Delivers

One of the biggest highlights this quarter came from the Live and Historical Racing segment. This part of the business pulled in $275.5 million in revenue, up from $235.3 million the previous year. That growth was largely thanks to the new Rose Gaming Resort in Northern Virginia, plus solid numbers from venues in both Virginia and Kentucky. Adjusted EBITDA for the segment jumped to $101.6 million, which speaks to the strength of the company’s investment strategy in the racing and entertainment space.

Gaming Expands, But Faces Pressure

The Gaming segment also saw its top line grow, reaching $257.5 million in revenue for the quarter. The big story here was the launch of the Terre Haute Casino Resort, which gave results a boost. That said, some of the existing properties did feel the squeeze from regional competition and rising labor costs. Even with those pressures, the segment still posted $120.1 million in adjusted EBITDA—plenty of staying power there.

Wagering Business Stays Steady

Wagering Services, now operating under the new name Wagering Services and Solutions, had a more mixed quarter. Revenue was slightly down at $108 million, mostly due to a slowdown in sports betting and horse racing handle. But not all was soft. Adjusted EBITDA actually improved to $37.3 million, helped along by tighter cost control and a lift from the growing Exacta systems business.

Leadership Perspective and Looking Ahead

CEO Bill Carstanjen seemed pleased with how things played out in 2024. He pointed out that the milestone 150th Kentucky Derby was a major win for the company, both financially and operationally. He also talked about the ongoing focus on improving the Derby experience and expanding HRM facilities, especially in growth markets like Virginia and Kentucky.

Looking into 2025, Churchill Downs is planning to reinvest heavily. The company’s aiming to spend somewhere between $350 million and $400 million on capital projects—most of it geared toward building out more gaming and racing infrastructure. And for shareholders, there’s another small perk: the annual dividend was raised again, this time by 7%, now sitting at $0.409 per share. That marks the fourteenth straight year of dividend increases, which says a lot about how confident the leadership is in the long-term outlook.

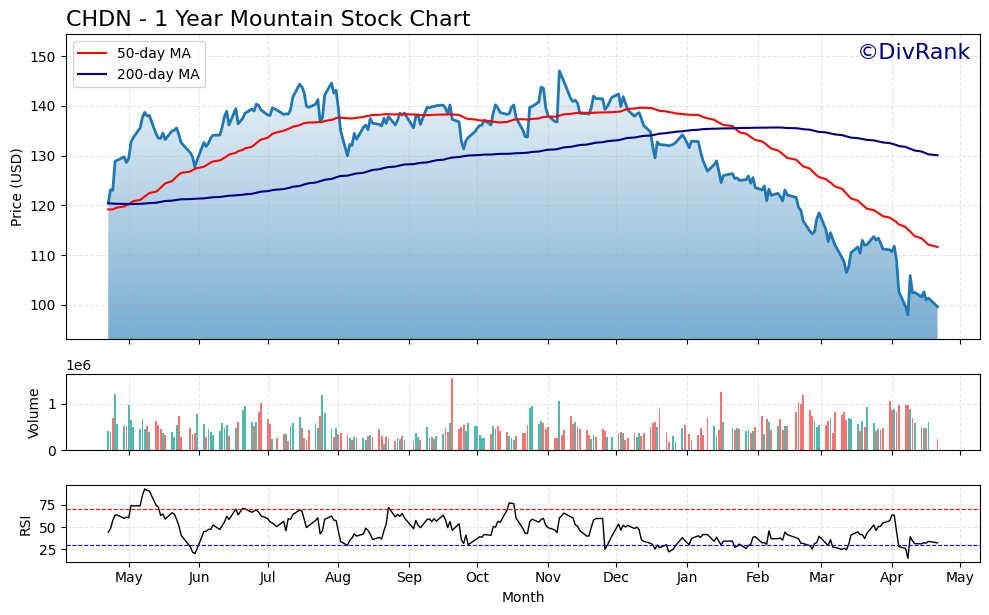

Chart Analysis

Churchill Downs Incorporated (CHDN) has had a tough twelve months, and this chart shows it clearly. After peaking near the $150 mark last summer, the stock has taken a steady decline, now sitting closer to $100. That kind of retracement, while painful in the short term, also resets the playing field for those with a long-range perspective.

Moving Averages

The 50-day moving average (red line) has been in a downtrend since late December, sharply diverging from the 200-day moving average (blue line), which has also turned downward but at a slower pace. The fact that the 50-day crossed below the 200-day months ago was one of the earlier warning signs of a sustained downtrend. This technical crossover, often referred to as a death cross, has played out over the past several months as the price failed to recover above either line. For now, the price remains significantly below both averages, signaling a bearish posture from a trend-following perspective.

Volume Trends

Trading volume has been relatively stable, though slightly elevated in the more recent decline. This tells us that the selling isn’t happening in isolation—there’s been consistent participation on the way down. However, there haven’t been many major spikes in volume, which suggests the drop hasn’t been driven by panic selling, but more of a slow bleed as buyers step aside.

RSI Levels

The RSI (Relative Strength Index) has been hanging out in oversold territory quite a bit since the beginning of the year, occasionally bouncing but mostly struggling to regain its footing. It touched the lower boundary around 30 several times, which typically signals that a stock is due for a short-term bounce. However, without follow-through in price or confirmation from other indicators, those bounces haven’t held. The RSI finally ticked upward a bit in April but still remains well under the midpoint, showing weak momentum.

Final Take

This is a chart that’s clearly broken down from a technical standpoint, but it’s also getting stretched. The stock is trading well below its long-term average, volume hasn’t capitulated dramatically, and RSI is showing exhaustion. While the trend is down, it’s also ripe for some consolidation or a potential base to start forming. What happens next will depend heavily on how the broader market treats cyclical names and whether CHDN can show operational resilience in upcoming quarters.

Management Team

Churchill Downs Incorporated is led by a seasoned executive team with deep experience across gaming, racing, and corporate strategy. At the helm is CEO William C. Carstanjen, who has been with the company since 2005 and took over the CEO role in 2014. Carstanjen has overseen the transformation of Churchill Downs from a traditional racetrack operator into a diversified entertainment and gaming business. His leadership has driven expansion into regional casinos, online wagering, and historical racing machine venues.

Supporting Carstanjen is President and COO William E. Mudd, who joined the company in 2007. Mudd’s background in operations and finance has played a key role in scaling the business efficiently while integrating new properties into the company’s portfolio. CFO Marcia A. Dall brings decades of financial expertise and is responsible for shaping financial strategy, ensuring compliance, and leading investor communications. Together, this team has helped Churchill Downs stay competitive while positioning for future growth in a highly regulated and evolving industry.

Valuation and Stock Performance

Churchill Downs stock has had a challenging stretch recently. It hit a high of $150.21 in the past year but has since pulled back to around $101. The decline has tracked closely with broader trends in the gaming sector and concerns about rising interest rates, which tend to weigh heavily on companies with larger debt loads like CHDN.

Even with the stock’s decline, many valuation models suggest it may be trading below its fair value. The current price reflects roughly a 35 percent discount to its estimated intrinsic value, based on discounted cash flow projections and peer comparisons. Analysts covering the stock have offered a range of price targets, with a consensus landing around $120, which still points to potential upside from current levels.

The company’s valuation ratios help put this in context. A trailing P/E of 17.85 and a price-to-book ratio of 6.87 suggest investors are still assigning a premium for the company’s assets and profitability, though that premium has shrunk compared to previous years. At the same time, revenue and EBITDA continue to show solid growth, providing some reassurance that the business remains fundamentally sound even if the stock price has slipped.

Risks and Considerations

There are several areas where investors may want to tread carefully. Churchill Downs carries a high level of debt—nearly $5 billion—with a debt-to-equity ratio approaching 451 percent. This level of leverage makes the company more sensitive to interest rate changes and potentially limits its flexibility if financial conditions tighten further.

Another factor to keep in mind is regulatory and competitive pressure. The gaming industry is constantly evolving, with each state and region having different rules, limits, and approval processes. Any changes to those regulations—or increased competition from other operators—can impact performance, particularly in newly entered markets where Churchill Downs is still building customer loyalty and scale.

Operationally, the racing side of the business continues to face challenges, including declining interest in live horse racing and ongoing scrutiny related to animal welfare. While Churchill Downs has made efforts to strengthen safety measures and modernize its racing venues, public perception and potential policy changes could influence attendance and wagering trends over time.

Economic conditions also present a general risk. Gaming and entertainment businesses tend to be affected when consumers cut back on discretionary spending, and while Churchill Downs has done a good job diversifying income streams, this still remains a cyclical business.

Final Thoughts

Churchill Downs isn’t just about the Derby anymore. It’s become a diversified company operating across several verticals, with a mix of legacy appeal and modern gaming strategy. The management team continues to invest in new properties and expand its reach, while also returning value to shareholders through consistent dividend growth.

Yes, the recent stock performance hasn’t been easy to watch, but it may offer a more attractive entry point for those willing to ride through some short-term uncertainty. With a solid leadership team, a history of strategic execution, and multiple levers for long-term growth, Churchill Downs remains a name worth watching closely as the broader sector evolves.